Oracle Corporation Japan (Price Discovery)

Buy

Profile

The Japanese subsidiary of Oracle Corporation manages and supports the sales of Oracle Corporation’s products and services in Japan. It sells and operates software, applications, and database management systems. Established in 1982. Sales by division (% OPM): Cloud & License 84 (39), Hardware Systems 7 (4), Services 9 (21) (FY5/2024)

| Securities Code |

| TYO:4716 |

| Market Capitalization |

| 1,939,171 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Companies and governments are in solid demand for DX. Oracle Japan has a strong presence as a cloud vendor.

Oracle Corporation Japan is the Japanese subsidiary of Oracle Corporation (USA). It is a leader in database management software helpful for big data analysis. It also handles cloud infrastructure and ERP, and its cloud services are currently performing well for companies and local governments working on DX.

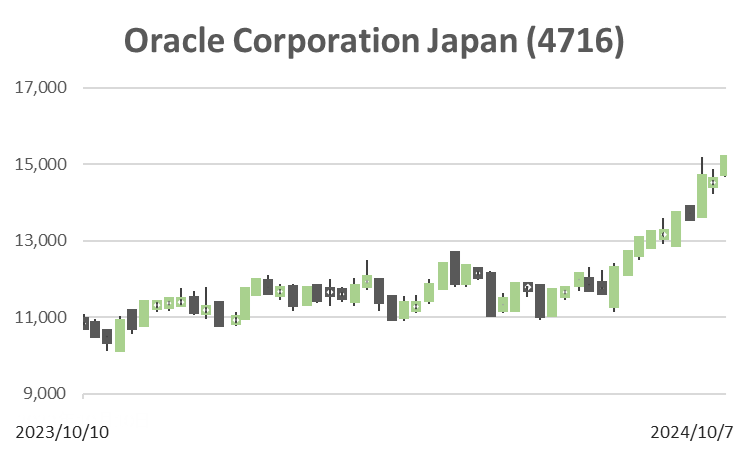

For FY5/2025, the company has only disclosed a net sales increase of 5-9% YoY and net income per share of 445-460 yen. In contrast, the company’s 1Q (June to August) results, announced earlier, showed an 11.4% increase in revenue and a 20.2% increase in operating profit, double-digit increases and greatly exceeding market expectations.

The government of Japan selected the company in October 2022 to provide government cloud services. In recent years, its brand recognition as a cloud vendor has been growing, with companies such as Nomura Research Institute and Fujitsu expanding their services using the company’s cloud infrastructure platform ‘Oracle Alloy.’ The increase in customers has increased confidence in the growth of the company’s cloud services, which generate recurring revenue. From the second quarter onwards, the company is also expected to see the benefits of the price revision (price increase) that came into effect in September.

Investor’s View

BUY. An equity yield of slightly above 4% is reasonable. The company is in the midst of a cloud boom and is expected to achieve solid results. The business is low risk compared to Oracle in the US.

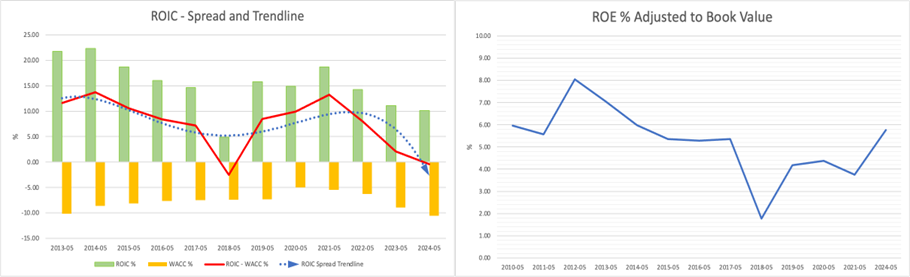

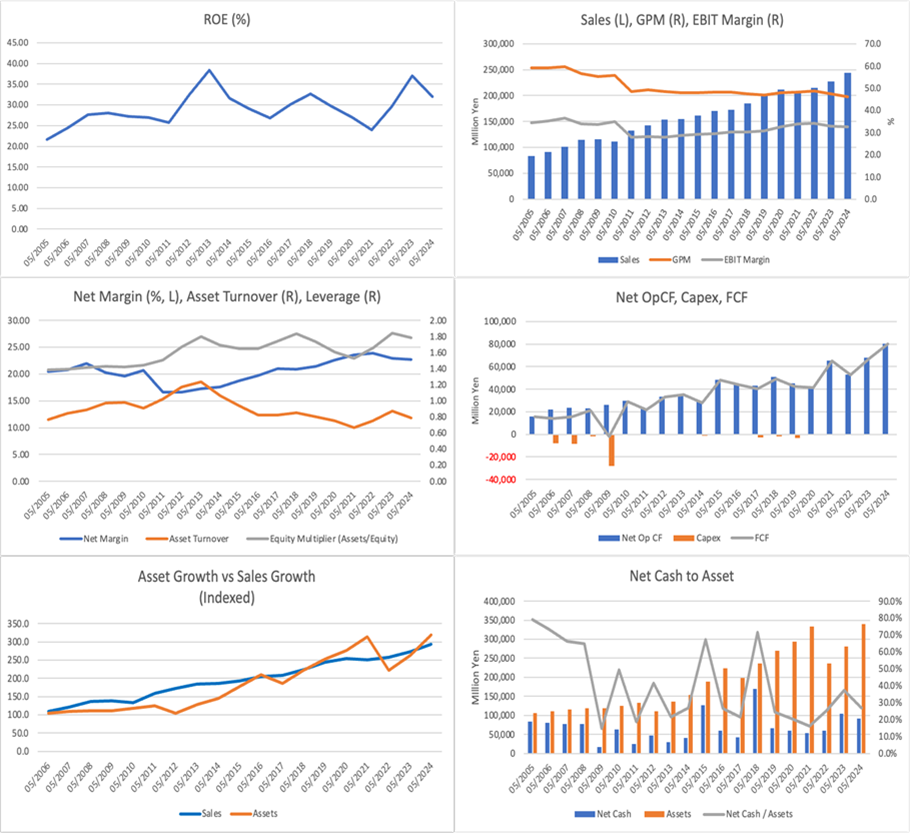

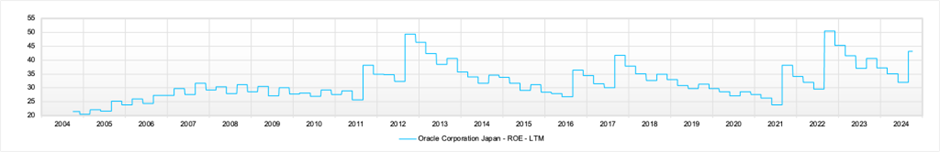

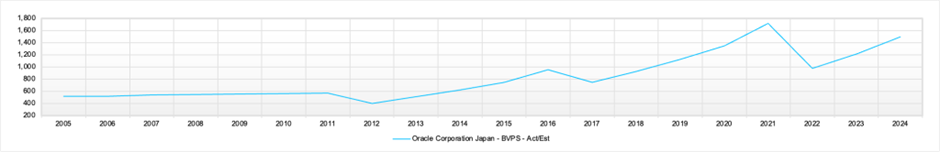

There is no doubt that Oracle Japan is an excellent business. With an overwhelming profit margin, its most recent ROE is over 30%, and it is also creating good economic value. While it is steadily generating a high level of cash, it is also successfully controlling its balance sheet through flexible dividends and M&A. This is because Oracle Corporation, the 52.49% shareholder, is a rational manager.

Oracle’s products and services have a strong presence in mission-critical systems and applications in various major industries in Japan. As Stock Hunter points out, demand for cloud computing is strong, and the company is in the midst of a boom. Management is confident that the pipeline for the future is rich.

The question is how to evaluate a stock price that has risen by over 30% since the beginning of the year, with a PBR of 15 times and a PER of 30 times. The equity yield indicated by the ROE adjusted for PBR is mideocre. However, considering that the company, which has a significant presence in cloud infrastructure, is in the middle of an industrial boom and its earnings momentum is high, that there is a continued expectation for generous shareholder returns, and that it offers a low beta in a stock market with increased volatility, it is a stock to hold for the next 8-10 months.

Price

PBR (LTM)

PER (LTM)

ROE

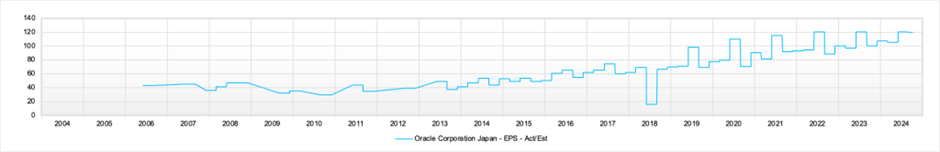

EPS

BPS

In contrast to Oracle Corporation in the US, investment in Oracle Corporation Japan’s shares is limited to the Japanese market. Still, is provides exposure to cloud vendors with lower risk. US Oracle delivers an ROE of over 200%. This is because they are actively taking on debt to maximise investment and M&A while at the same time squeezing shareholder equity through share buybacks. The fall in US interest rates will be positive for the ROIC spread. Nevertheless, US Oracle is prioritising top-line growth at the expense of economic value creation. In contrast to the aggressive stance of US Oracle, Oracle Corporation Japan, which manages the sales of Oracle products and services in Japan, does not need to be as aggressive as its parent company. It depends on the parent’s innovation, but the business risk is much lower.

| Profitability | Oracle Japan | ORCL |

| Net Margin % | 22.7 | 19.9 |

| Leverage | 1.79 | 28.16 |

| Asset Turn | 0.79 | 0.38 |

| ROE % | 31.2 | 214.1 |

| ROE % Adjusted to Book Value | 4.30 | 5.77 |

| Growth | ||

| Sales Growth – 5Yr CAGR% | 3.9 | 12.2 |

| EPS – 5Yr CAGR% | 5.1 | 10.7 |

| BPS – 5Yr CAGR% | 3.6 | -6.7 |

| Share Price | ||

| YTD Share Price Performance % | +33.85 | +62.06 |

| Market Cap (Trillion yen) | 1.86 | 67.86 |

| Beta – 3 Yr | 0.67 | 1.07 |

| PBR | 15.4 | 43.8 |

| PER (LTM) | 32.1 | 44,1 |

(Omega Investment, Factset)

Oracle Corp. Japan (4716)

Oracle Corporation (ORCL)