BR 31 Ice Cream (Price Discovery)

Speculative Buy

Profile

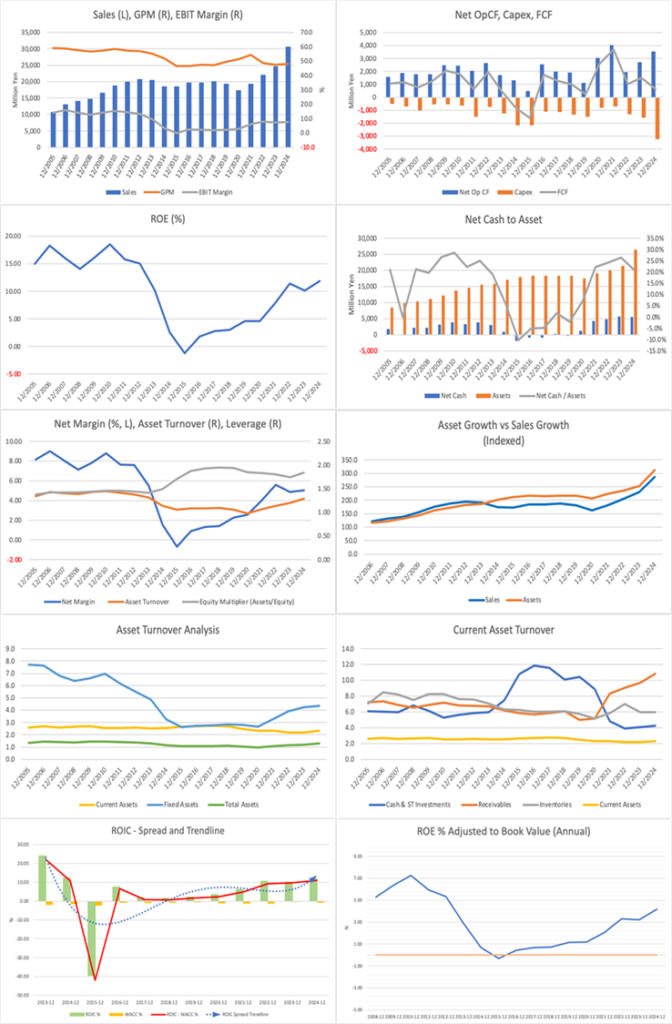

BR 31 Ice Cream Co., Ltd. (hereinafter “BR31”) is the largest ice cream chain operator in Japan, established as a joint venture with U.S.-based Baskin-Robbins, and conducts manufacturing, import/export, and sales in an integrated manner. Domestically, it has built a network of over 1,000 stores and has achieved continuous growth, including 43 consecutive months in which same-store sales exceeded those of the same month in the previous year. In FY12/2024, net sales exceeded 30 billion yen, a record high. Amid forecasts of another hot summer in 2025, sales growth and margin improvement are expected to continue. In the first quarter, the company posted net sales of 6.585 billion yen (YoY +18.4%) and operating profit of 420 million yen (YoY +54.0%), making a strong start. The full-year forecast for FY2025 is net sales of 32.86 billion yen (YoY +7.1%) and operating profit of 2.43 billion yen (+2.8%). The forecast PER is 26.1x, PBR is 2.98x, and the projected ROE is 11.4%.

Breakdown of sales by business segment (%): Manufacturing and sales of ice cream products 100% <FY12/2024>

| Securities Code |

| TYO:2268 |

| Market Capitalization |

| 40,266 million yen |

| Industry |

| Foodstuff |

Stock Hunter’s View

Strong start in 1Q. Expectation of increased demand again this summer due to high temperatures.

The Japan Meteorological Agency released its three-month forecast, increasing attention on BR 31 Ice Cream. From June to August, nationwide average temperatures are expected to be high, with projections indicating another hot summer.

The company manufactures, imports/exports, and sells ice cream and operates the Thirty-One Ice Cream franchise. It has 7,600 stores in countries and regions around the world.

The already-announced first quarter (January–March) results for the current fiscal year ending December showed net sales of 6.585 billion yen (up 18.4% YoY) and operating profit of 420 million yen (up 54% YoY). Net sales marked a record high for the first quarter for the third consecutive year, and operating profit also exceeded the January–March (standalone) result from ten years ago, setting a new all-time high. Compared to the same period of the previous year, progress was favourable, exceeding by about 2 points for net sales and about 6 points for operating profit, and with the added effect of heat forecasts, the outlook has incorporated potential for upward revisions.

The company is currently achieving a record-breaking 43 consecutive months of growth in same-store sales across all Baskin-Robbins locations worldwide. The impact of rising raw material costs has been absorbed by expanded sales, with the gross profit margin improving by 2.5 points from last year.

Collaborative campaigns with popular characters, seasonal promotions, and the success of a new product category—ice cream cakes under the “31 Patisserie” brand—have contributed to the expansion of takeout demand.

Investor’s View

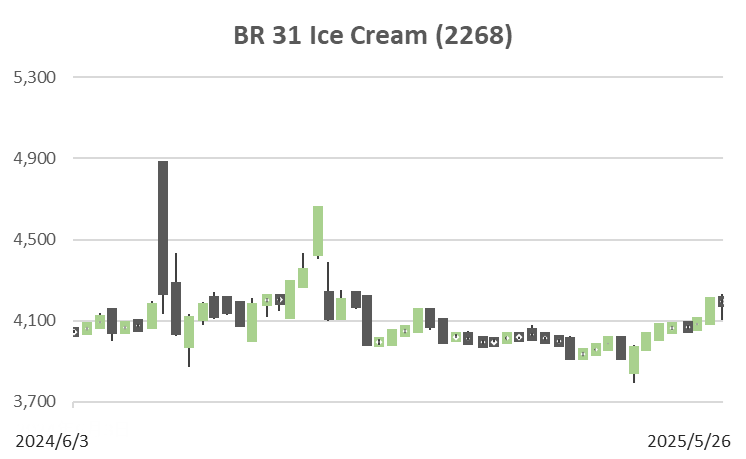

Speculative Buy. The stock price has remained flat for many years, and neither profit growth nor economic value creation has been reflected in the share price. Behind this lies the dominance by major shareholders Fujiya and U.S.-based Baskin-Robbins, as well as the low liquidity of shares in the market. BR 31 began as a joint venture with Fujiya, and even now, it remains under the influence of both companies. If Fujiya were to carry out a TOB and make it a wholly owned subsidiary, it would attract attention as a development that contributes to establishing management control and a growth strategy.

The stock price has remained flat for nearly 10 years, reminiscent of bank stocks in the old days. The market has not appreciated the expansion of the top line, accompanied by improved profit margins and the creation of solid economic value. This is likely because Fujiya and U.S.-based Baskin-Robbins hold 75% of the shares, resulting in limited free float.

Baskin-Robbins is one of the world’s largest ice cream specialty chains, originating in the United States, and is now a brand under U.S.-based Inspire Brands. “BR 31 Ice Cream Co., Ltd.,” operating in Japan, was initially established as a joint venture with Fujiya. These related companies have sold off part of their shareholdings, and by the end of December 2025, the company is expected to maintain the listing criteria of the Standard Market. However, the overwhelming ownership by insider shareholders will likely remain unchanged.

Strategic investments using cash on hand and shareholder returns are indeed promising possibilities, but the biggest opportunity for minority shareholders lies in Fujiya’s potential TOB. Full consolidation would be a positive for Fujiya and also a positive for Yamazaki Baking, which owns 54% of Fujiya. The significance of a TOB by Fujiya lies in the establishment of management control and the enhancement of synergies as part of a renewed growth strategy, and it is expected that cash on hand will be effectively used for the benefit of shareholders.

The company continues to update record-high performance, and growth is now on track in line with the long-term management plan “31 in ’31.”

In the first quarter of FY12/2025, BR 31 Ice Cream recorded net sales of 6.585 billion yen (+18.4% YoY) and operating profit of 420 million yen (+54.0% YoY), achieving record-high levels. In particular, the product strategy that captured takeout demand proved effective, with ice cream cakes and collaboration products performing strongly. In addition, the gross profit margin improved by 2.5 points compared to the same period of the previous year, absorbing the rise in raw material costs.

For the full year of FY12/2025, the company forecasts net sales of 32.86 billion yen, operating profit of 2.43 billion yen, and net profit attributable to owners of the parent of 1.55 billion yen, all expected to exceed the previous year’s results. While the forecast PER is 26.1 times, PBR 2.98 times, and ROE 11.4%, suggesting a certain level of valuation premium, the quality and stability of growth support continued investment appeal.

In the medium term, under the long-term management plan titled “31 in ’31,” the company aims to achieve 3.1 billion yen in pre-tax profit by 2031. With four strategic pillars—enhancing brand strength, digital shift, smart store operations, and expansion of sales locations—the company envisions expanding to over 1,100 domestic stores and full-scale development of overseas operations.

On the other hand, the most significant challenge is the shareholder structure and compliance with listing maintenance standards. As of the end of 2024, the ratio of tradable shares was 20.43%, falling short of the required standard, but this improved to approximately 22.93% as of March 2025 through off-market share distribution by related companies. Achievement of the 25% threshold for continued listing on the Standard Market is now within sight.

Management challenges include persistently high labour and raw material costs, changes in consumption structure due to demographic trends, and high dependence on character collaborations and seasonal products. Continued growth hinges on approaches to new customer segments such as mobile ordering, the 31Club app, and ToGo specialty stores.

A Fujiya-led TOB could significantly impact the share price. Strong brand, loyal customer base, and digital investments support steady growth.

Given the constraints of the shareholder structure, expansion of the free float is likely to be limited, and Fujiya’s materialisation of a TOB remains the most significant event. Depending on how this unfolds, the company’s valuation may shift considerably.

The company’s greatest strength lies in its “brand power.” It has succeeded in delivering value beyond price through the monthly release of new flavours responding to diversified visit motives, collaborations with popular characters, and the patisserie-style evolution of ice cream cakes. New store designs such as “F1 (Flavor First)” and “MOMENTS” have also proved effective, and 33 stores have recently completed full renovations. These initiatives have improved customer satisfaction, leading to higher spending per customer and continued same-store sales growth.

In addition, the “31Club” membership app has exceeded 9 million registered users and now accounts for more than 40% of total sales, further strengthening its role as a base of repeat customers. Mobile ordering and the introduction of digital signage have also contributed to sales growth due to digital investment.

The shareholder structure is dominated by the two major shareholders, Fujiya and Inspire Brands, holding 75.96% of the shares together.

As of the end of May 2025, the ownership ratio of the total number of issued shares is as follows:

- Fujiya Co., Ltd.: 37.98% (3,663 thousand shares)

- Inspire Brands, Inc.: 37.98% (3,663 thousand shares)

- Causeway Capital Management LLC: 0.49% (48 thousand shares)

- Columbia Multi Manager International Equity Strategies Fund: 0.49% (48 thousand shares)

- BR31 Employee Shareholding Association: 0.33% (32 thousand shares)

- Fuji Nihon Corp.: 0.26% (25 thousand shares)

- Yorozu Express Co., Ltd.: 0.25% (24 thousand shares)

The top seven shareholders account for 78.78%, meaning that the number of shares effectively in circulation is limited. As of the end of March 2025, the tradable share ratio stood at 22.93%, which is close to the Standard Market’s continued listing requirement of 25%. Further measures are required to comply with the listing standard.

The rigidity of the shareholder structure remains a constraint on market valuation. Still, changes in capital policy through a TOB or adjustments to shareholding ratios could serve as opportunities for revaluation in the medium to long term.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)