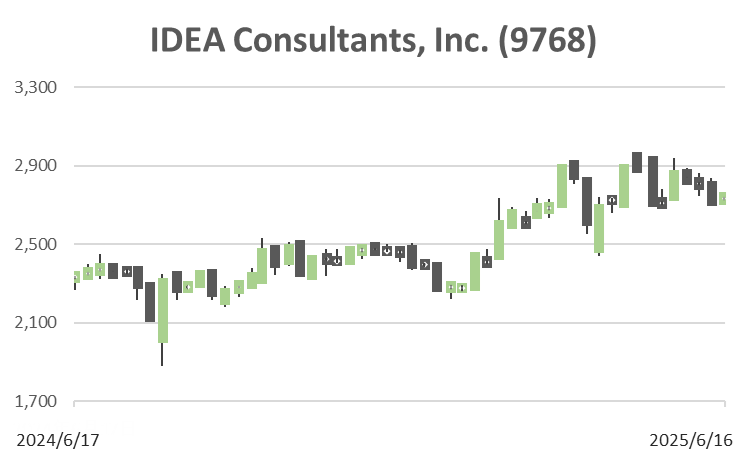

IDEA Consultants (Price Discovery)

Buy

Valuation remains undemanding, with a fairly high fee float and high-quality earnings. Given a time horizon of 18–24 months, the stock appears attractive with high visibility of return potential.

Profile

A high-margin, technical consulting firm specialising in construction, environment, and IT, underpinned by stable public-sector demand.

Founded in 1953 and headquartered in Setagaya, Tokyo, IDEA Consultants, Inc. operates across three primary business domains: environmental consulting, infrastructure consulting, and information systems. As of FY12/2024, the company employed 1,098 staff on a consolidated basis and held 28.7 billion yen in capital. Its operations span five segments: Environmental Consulting, Infrastructure Consulting, Information Systems, Overseas Operations, and Real Estate.

The Environmental Consulting segment, accounting for 65% of total sales, provides end-to-end expertise in environmental impact assessments, renewable energy project support, ecosystem studies, and numerical analysis. IDEA ranks tenth in total revenues among domestic infrastructure consultants but holds the top position in the “construction-environment” sub-sector. Approximately 85.6% of revenue is from public-sector clients, primarily the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), the Ministry of the Environment, and local governments.

The company operates specialised research laboratories across Japan, covering life sciences, marine ecosystems, chemical and food analysis, and infrastructure maintenance. These facilities support a vertically integrated service model covering surveys, planning, and regulatory reporting.

IDEA is actively expanding in strategic areas such as offshore infrastructure inspection using AUVs (Autonomous Underwater Vehicles), in-house digital transformation (DX), and sustainability-related consulting in line with Japan’s decarbonisation and national security policies.

Revenue breakdown and OPM by segment (FY12/2024):

Environmental Consulting 65% (13%), Infrastructure Consulting 30% (15%), Information Systems 2% (10%), Overseas 2% (0%), Real Estate 1% (55%)

| Securities Code |

| TYO:9768 |

| Market Capitalization |

| 20,562 million yen |

| Industry |

| Service |

Stock Hunter’s View

A stable earnings base in environmental infrastructure consulting, underpinned by public-sector demand. Differentiation through next-generation AUV technology in marine projects.

IDEA’s core business is construction-related environmental surveys funded by large government budgets. The company holds a leading position in the environmental segment within the infrastructure consulting industry. Over 80% of its revenue comes from government ministries and local authorities, where it specialises in high-margin contract types such as proposal-based and discretionary agreements.

In 1Q FY12/2025 (January–March), sales rose 0.6% YoY to 6.62 billion yen, while operating profit fell 5.6% YoY to 1.175 billion yen, a slightly soft start but in line with expectations. The Environmental Consulting segment maintained solid performance, driven by renewable energy assessments and AUV-related services such as design, production, and operational support.

The company is positioning its proprietary hovering-type AUV “YOUZAN” for offshore wind facility inspections. In December 2023, IDEA and three partners (Toda Corporation, Tokyo University of Marine Science and Technology, and Kyushu Institute of Technology) were selected for a government-sponsored proof-of-concept project in this area.

Investor’s View

Buy. Dividend-led shareholder return policy is the primary share price driver. Management views sub-1.0x PBR as a structural issue and appears committed to using dividends to address it.

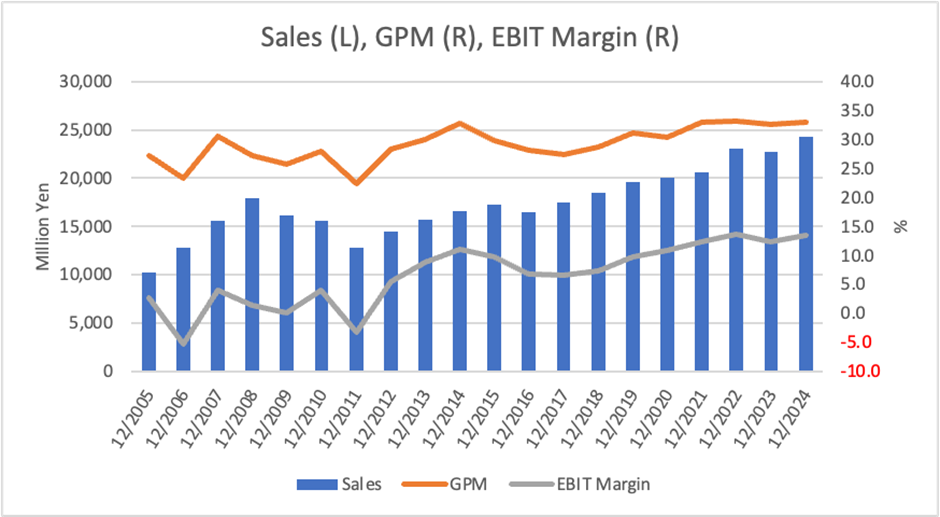

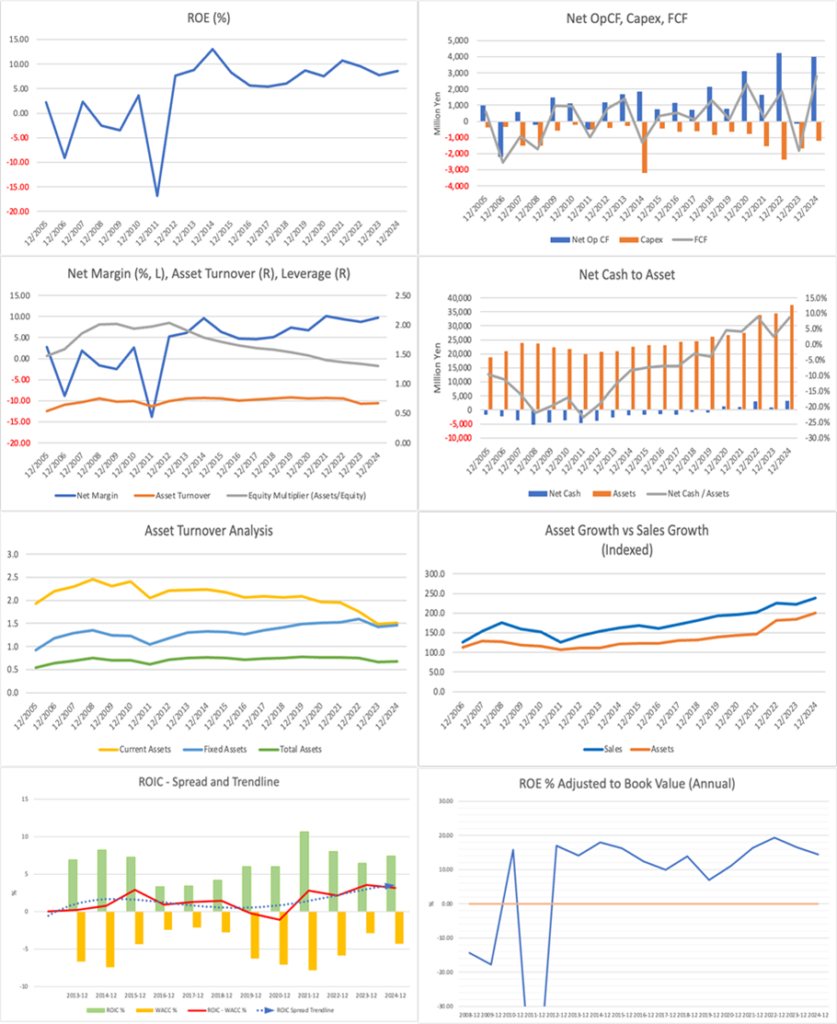

IDEA has maintained steady profit growth and a robust financial base, supported by resilient public-sector environmental and infrastructure consulting demand. The company maintains solid fundamentals with an operating margin of around 13%, ROE in the 8–10% range, and a return to positive free cash flow.

The share price remained flat from 2020 to 2023 but rose by 60% over two years after two consecutive significant dividend hikes. In February 2024, the FY2023 year-end dividend forecast was raised by 30%, from 50 to 65 yen (+44% YoY). In February 2025, the FY2024 forecast was again raised, from 90 to 100 yen (+54% YoY). The FY2025 company forecast is 118 yen, implying a dividend yield of 4.33%.

This sequence of increases has clearly communicated the company’s commitment to shareholder returns, which continues to underpin market expectations and share price support.

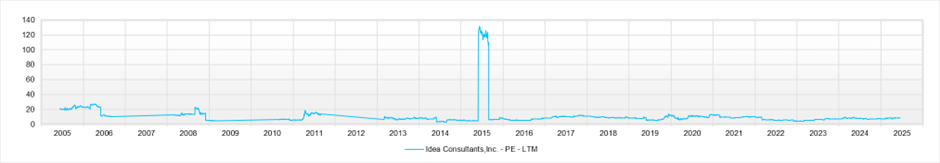

The current PBR is 0.67x, and PER is 8.5x. Based on these multiples, the implied ROE is approximately 7.9%, which is consistent with the company’s recent ROE performance. Net profit margins have remained around 10%, and FY2025 guidance suggests continued profit margin stability. As such, the current share price appears cautiously priced but broadly fair.

With a free float of 57.8% and institutional holdings limited to just 0.5%, retail investors primarily drive share price formation. As a result, market reactions to news flow tend to be amplified.

Management’s future stance on dividend growth remains a point to watch. However, given their stated focus on correcting sub-1.0x PBR, continued dividend-led shareholder returns appear likely in the near term. With an equity yield (ROE adjusted for PBR) exceeding 10% and recent share price consolidation, the stock offers a relatively defensive opportunity for investors with an 18–24-month horizon.

Financial Performance and Capital Structure

Sales and profits reached record highs in FY2024, with an equity ratio of 76.7% and a sharp rebound in operating cash flow.

In FY12/2024, the company posted record results: net sales rose 3.0% YoY to 24.32 billion yen, operating profit rose 10.9% to 3.25 billion yen, and net income attributable to shareholders of the parent company rose 17.3% to 2.38 billion yen.

The Environmental Consulting segment generated 65% of sales with a 13% operating margin (OPM), followed by Infrastructure Consulting at 30% (15%). Other segments included Information Systems (2%, OPM 10%), Overseas (2%, OPM 0%), and Real Estate (1%, OPM 55%).

The equity ratio stood at 76.7% at the end of FY2024, highlighting a highly sturdy balance sheet. The company holds approximately 3.8 billion yen in cash and deposits, and interest-bearing debt is modest at around 0.5 billion yen. Non-core assets, including strategic shareholdings and real estate, represent a meaningful portion of total assets, suggesting potential for improved capital efficiency.

Operating cash flow turned positive in FY2024 at 3.66 billion yen, compared to a negative figure in FY2023. This was driven by profit growth and improved receivables collection. Annual capital expenditures hover around 1.0–1.5 billion yen, mainly for laboratory equipment, IT systems, and internal R&D.

ROE has consistently remained within the 8–10% range, and ROIC reached 7.4% in FY2024, exceeding the company’s estimated cost of capital. With an asset-light model, IDEA demonstrates stable and relatively high capital productivity.

Mid-Term Strategy and Business Portfolio

The 6th Mid-Term Management Plan focuses on value creation through DX and co-creation, with increased allocation to high-impact social and environmental fields.

Launched in 2025, IDEA’s 6th Mid-Term Management Plan sets out five strategic pillars: Business Strategy, DX Strategy, HR Strategy, Financial Strategy, and Sustainability Strategy. The overarching theme is transformation through digital innovation and cross-sectoral collaboration.

In Business Strategy, the company is expanding into growth areas aligned with national policy agendas, such as renewable energy, biodiversity, carbon neutrality, and disaster resilience. The AUV-enabled inspection business for offshore infrastructure, including wind power, is a key growth driver. The company’s proprietary hovering-type AUV, YOUZAN, has entered the practical implementation stage.

The DX Strategy includes AI-powered analytics, productivity tools, and internal digital infrastructure upgrades. Initiatives range from laboratory digitalisation to unified HR information management.

The business portfolio remains anchored in Environmental Consulting (65%) and Infrastructure Consulting (30%). The company is reallocating resources to high-value-added domains such as nature capital, regional circular economy, and infrastructure aging mitigation within these segments.

While overseas and real estate operations contribute only modestly to total revenues (under 5% combined), overseas businesses have generated consistent ODA-linked orders and are exploring expansion into commercial projects.

Overall, the strategy aligns with megatrends in climate policy, national resilience, and social infrastructure renewal, underpinned by the company’s broad technical capabilities and decentralised R&D network.

Shareholder Returns and Capital Policy

Two consecutive years of substantial dividend increases suggest an explicit focus on correcting the sub-1.0x PBR. However, the lack of a formalised return policy and limited use of capital measures highlight the need for greater clarity.

Since FY2023, IDEA has implemented two successive significant dividend increases. For FY2024, the dividend was raised by 54% YoY to 100 yen. For FY2025, the company plans to raise it again to 118 yen, marking an 18% increase. The implied dividend yield exceeds 4%, reinforcing the perception of strong shareholder returns, especially considering the company’s PBR of 0.67x.

Historically, the company maintained a dividend payout ratio of around 30%. Based on FY2025 forecasts, this is expected to exceed 35%, indicating a shift toward prioritising shareholder distribution. However, these increases appear discretionary rather than guided by a clearly stated dividend policy or total return framework.

To date, share buybacks or other proactive capital measures have been used little, making IDEA’s overall capital policy appear conservative compared to peers. While the company holds ample cash reserves, its capital efficiency metrics (e.g., ROE and ROIC) suggest room to optimise the capital structure.

The recent dividend actions have sent a positive message to investors, and the market has responded favourably. Yet, whether this momentum can be sustained will depend on the consistency and transparency of shareholder return practices going forward. From a valuation standpoint, the stock trades at a double-digit earnings yield and continues to offer income appeal. Still, additional clarity on capital allocation priorities would likely be required to support a re-rating.

Ownership and Market Liquidity

With minimal institutional ownership, over 40% of shares are held by insiders and affiliated parties. The relatively high free float supports liquidity, but the shareholder structure limits external influence.

IDEA has 7,499,025 shares outstanding. Of these, insiders and related entities collectively hold approximately 42.2%. The largest shareholder is the IDEA Employee Shareholding Association (10.31%), followed by individuals and associated companies, including Hideo Tabata (4.15%), Life Care Service (4.79%), and Sumitomo Mitsui Finance & Leasing (4.69%).

Institutional ownership is negligible as of March 2025, indicating only 0.5% held by institutions. The free float stands at 57.8%, which is relatively high and provides a degree of liquidity. However, the high proportion of shares held by insiders suggests that the stock is insulated from external pressure, such as shareholder proposals or unsolicited takeovers.

There is no indication of a specific target for improving float or liquidity. While not explicitly defined, policy-oriented cross-shareholdings and affiliated corporate stakes suggest that a portion of the float may be less than fully liquid. Nonetheless, retail participation dominates trading activity, contributing to relatively high volatility in response to news.

Improving investor engagement and enhancing transparency around capital policy and shareholder returns may help broaden the investor base and promote more stable price formation.

Valuation and Investment View

IDEA trades at a modest valuation with a PER of 8.5x and a PBR of 0.67x. The gap between implied and actual ROE suggests potential for re-rating, while the equity yield above 10% enhances investor appeal.

IDEA’s valuation multiples remain low by market standards. At a forecast PER of 8.5x and PBR of 0.67x, the implied ROE is approximately 7.9%, which aligns with the company’s historical ROE performance of 8–10%. Net profit margins also remain stable at around 10%, and the company’s FY2025 guidance points to continued earnings resilience.

ROIC stood at 7.4% in FY2024, exceeding the estimated cost of capital and highlighting strong capital productivity in an asset-light model. Nonetheless, market perception appears cautious, likely reflecting concerns around capital policy execution and limited institutional participation.

Dividend yield currently exceeds 4%, and the earnings yield is over 10%, positioning the stock as attractive for income-focused investors. However, the absence of a formal capital return framework and minimal use of tools such as share buybacks leave room for improvement in investor communication.

While the current valuation appears broadly fair based on fundamentals, the possibility of a re-rating remains. The gap between current valuation and intrinsic value could narrow if the company demonstrates consistency in shareholder return policy and makes more explicit commitments to capital efficiency.

For medium-term investors with an 18–24 month horizon, IDEA offers a compelling risk-reward profile supported by stable earnings, income visibility, and the potential for improved capital market recognition.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)