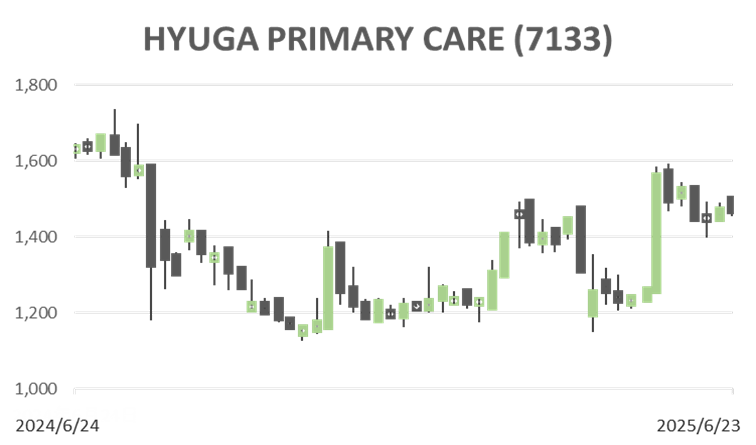

HYUGA PRIMARY CARE (Price Discovery)

Wait and See

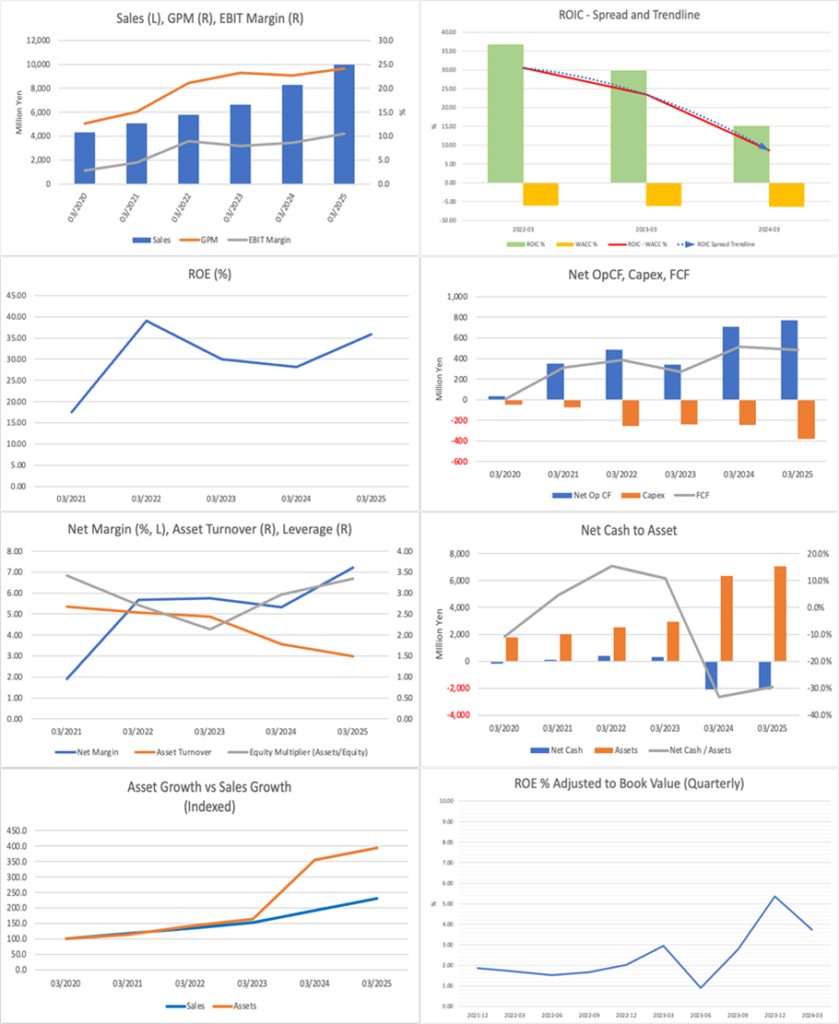

While the company maintains high ROE and top-line growth, the sharp decline in ROIC and uncertain future profitability warrant a cautious investment stance.

Profile

HYUGA PRIMARY CARE builds its business on home-visit pharmacy operations (Kirari Pharmacy) and, with equity backing from M3 Group, also runs pharmacy support services (Kirari Prime) and private residential care facilities (Primary Care Homes). The company offers a multi-tiered service portfolio by integrating 365-day pharmacist home visits with An emerging company developing multi-layered services in home healthcare and elderly care.

facility operations and IT support. In FY3/2025, it recorded net sales of 9.98 billion yen (+20.5% YoY) and operating profit of 1.05 billion yen (+48.0% YoY). Breakdown of segment sales (with operating margin): Home-visit Pharmacy 71% (9%), Kirari Prime 13% (61%), Primary Care Homes 16% (12%), Other 0% (-744%).

| Securities Code |

| TYO:7133 |

| Market Capitalization |

| 10,705 million yen |

| Industry |

| Retail trade |

Stock Hunter’s View

Comprehensive community care adapted to the era of home healthcare and elderly services. Pharmacy visits and operations support remain strong.

HYUGA PRIMARY CARE, an equity-method affiliate of M3, Inc. (2413), provides home-visit pharmacy services. Based on its Kirari Pharmacy locations, pharmacists visit patients’ homes or care facilities to deliver prescribed medication and offer guidance. The company consists of: the Home-visit Pharmacy Business (including 365-day delivery and online consultations), the Kirari Prime Business (supporting small and medium-sized pharmacies with know-how and systems), and the Primary Care Homes Business (operating residential care facilities with 24-hour nursing and caregiving services). In FY3/2025, Kirari Prime became the most significant contributor to profit for the first time, overtaking the Home-visit Pharmacy segment. Acquiring consulting contracts for facility construction and operation (“Region Prime” projects) pushed Kirari Prime’s quarterly sales and profits to record highs.

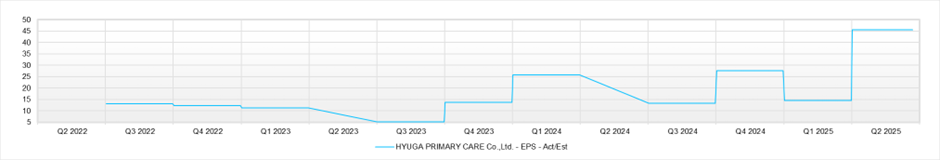

The FY3/2026 plan projects net sales of 12.19 billion yen (+22.1% YoY) and operating profit of 1.31 billion yen (+25.0% YoY), marking a second consecutive year of double-digit growth following a +20% rise in sales and +48% gain in operating profit in FY3/2025. Revenue from the Primary Care Homes segment is expected to expand sharply in the second half due to increased facility count. Kirari Prime may experience a temporary adjustment after its strong performance in the prior year, but operating profits are expected to remain high due to enhanced value-added services.

Investor’s View

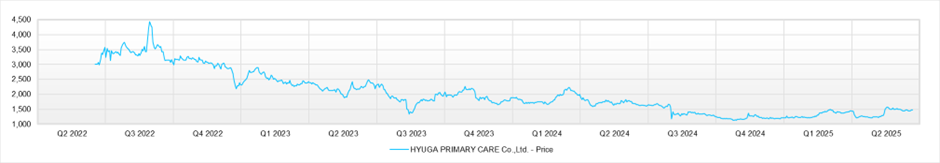

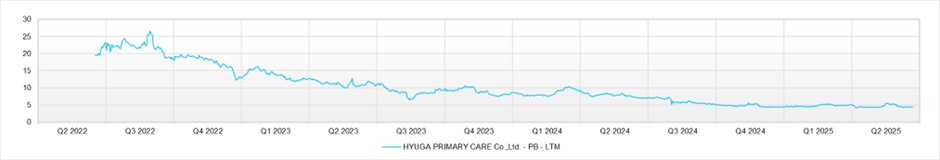

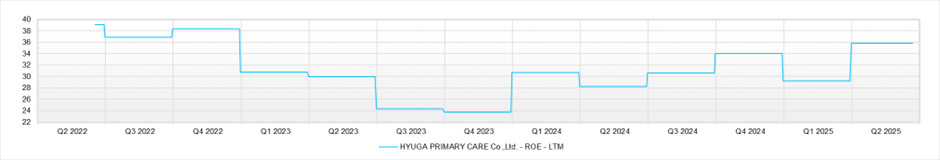

While HYUGA PRIMARY boasts high ROE and top-line growth, the rapid decline in ROIC is weighing on its stock valuation.

The company’s forecasted PER is 12.2x and PBR is 4.44x, with a projected ROE of 37.1%. The implied EPS growth rate priced in by the market remains at just +0.7%, suggesting that investor sentiment is dominated by a cautious view of the company’s medium- to long-term growth potential.

This divergence stems from a contradiction: strong near-term earnings momentum versus a steep decline in ROIC, signifying a deterioration in capital efficiency. Aggressive investment in the Primary Care Homes business, primarily through debt-financed asset acquisitions, has expanded invested capital and significantly reduced total asset turnover, from 2.4x to 1.3x. The drop in ROIC margin implies a loss of economic value, and the market appears wary of management’s rapid commitment to this segment.

The outlook for profitability in the Primary Care Homes business remains uncertain, and expanding invested capital presents a risk of diluted returns in the future. While short-term profit growth is attractive, management will face increasing scrutiny over how they balance ROIC with top-line expansion over the medium to long term.

Earnings momentum remains strong, but deteriorating capital efficiency is dragging on valuation.

In FY3/2025, HYUGA PRIMARY posted 20.5% YoY growth in revenue and 48.0% YoY growth in operating profit, with all three core segments contributing to profit expansion. Kirari Prime, while representing just 13% of sales, achieved a 61% operating margin and became the main earnings driver. The Primary Care Homes segment turned profitable with the launch of its third facility, delivering strong growth in both revenue and profit.

On the other hand, rapid capital investment has reduced capital efficiency. Total assets increased by 6.96 billion yen to 7.05 billion yen YoY, but total asset turnover declined sharply. ROIC also fell. This indicates that rising invested capital from debt-funded facility acquisitions has outpaced profit growth and failed to exceed the cost of capital.

While the FY3/2026 plan targets 12.19 billion yen in sales (+22.1%) and 1.31 billion yen in operating profit (+25.0%), growth in Kirari Prime is slowing, and uncertainty around the profitability of the Primary Care Homes business persists. Questions remain about the investment’s effectiveness.

Shareholder Structure: Stable control maintained by the founder and M3 Group; limited public float.

The largest shareholder is founder Tetsushi Kuroki (31.15%, including shares held through his asset management company), followed by CUC (11.55%), M3, Inc. (9.61%), and M3 Career, Inc. (6.87%). Including management and related parties, the combined shareholding reaches approximately 60–65%, and when including treasury shares (2.02%), the effective float is estimated to be below 20%.

Aside from Asset Management One (4.42%), institutional ownership is fragmented and minor, implying a limited role in governance and market liquidity.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

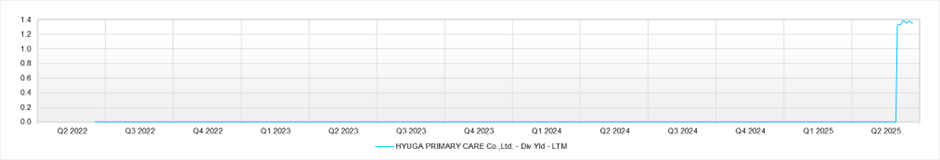

Dividend Yield (LTM)