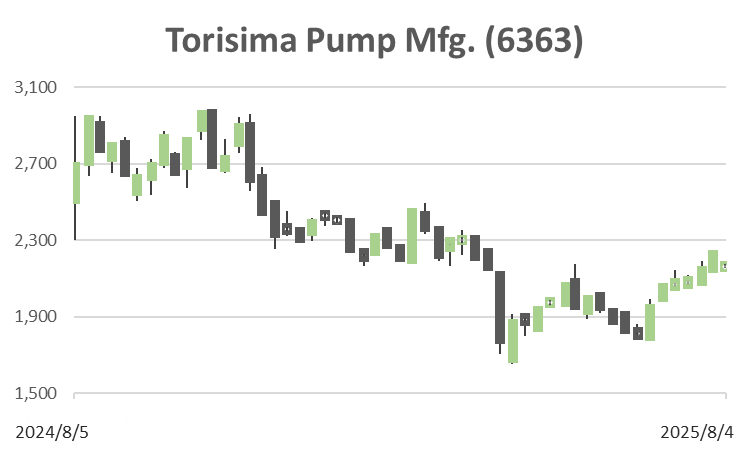

Torisima Pump Mfg. (Price Discovery)

High-risk Long-term Buy

Conclusion

Robust Middle Eastern demand and niche global leadership in desalination pumps position the stock for a potential re-rating on renewed earnings momentum.

Profile

A long-established specialist manufacturer with a global share in large and high-pressure pumps.

Founded in 1919, Torishima Pump Manufacturing Co., Ltd. is a dedicated pump manufacturer specialising in large-scale and high-pressure pumps used in water and sewage facilities, power plants, and desalination plants. The company derives 99% of its revenue from pumps and 1% from other businesses; the overseas sales ratio stands at 62% as of FY3/2025. Its strength lies in desalination projects, particularly those in the Middle East. The company operates across four segments: High-Tech Pumps, Projects (EPC), Services, and New Energy & Environment. Notably, in the Projects segment, which handles large-scale plant orders, it has in-house EPC capabilities. In recent years, it has also accelerated the development of next-generation energy-related pumps, including models for hydrogen and ammonia applications, and “super eco” pumps.

| Securities Code |

| TYO:6363 |

| Market Capitalization |

| 63,000 million yen |

| Industry |

| Machinery |

Stock Hunter’s View

Growing demand in MENA; developments in new energy technologies warrant attention.

Torishima is a long-standing, dedicated pump manufacturer. It operates in four business segments: High-Tech Pumps (for power plants, desalination plants, and general industrial use); Projects (EPC for water and sewerage and irrigation facilities); Services (maintenance and support); and New Energy & Environment (including large-scale pumps for nuclear and desalination use). The company holds the world’s leading share in large desalination plant pumps, with overseas sales comprising around 60% of total revenue.

Pump demand in emerging economies and expectations for mid-term growth in the environmental field continue to rise. As infrastructure for industrialisation and water access expands—particularly in high-population regions such as the Middle East and North Africa—demand for desalination plant pumps is increasing. In the environmental segment, the company is advancing R&D on hydrogen and ammonia-compatible pump technology, including those used in ammonia co-firing demonstration tests at thermal power plants.

For the current fiscal year ending March 2026, the company forecasts revenue of 89.0 billion yen (+2.9% YoY) and operating profit of 6.7 billion yen (+23.0% YoY). With the acquisition of Korea’s Juneung—previously a subcontracted machine processor—now complete, internalising this process is expected to improve profitability.

Investor’s View

High-Risk Long-Term Buy: A niche quality stock well suited for gaining exposure to long-term infrastructure development in the Middle East and emerging markets. Potential for renewed earnings momentum and improved capital efficiency could support a share price re-rating.

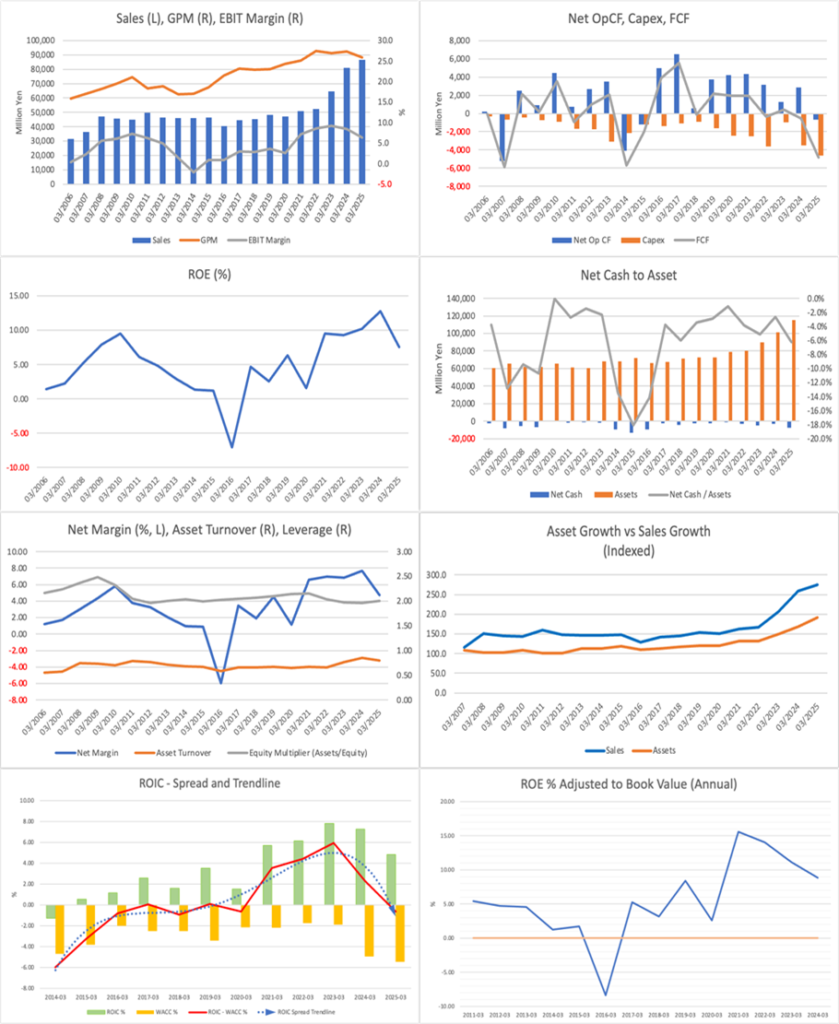

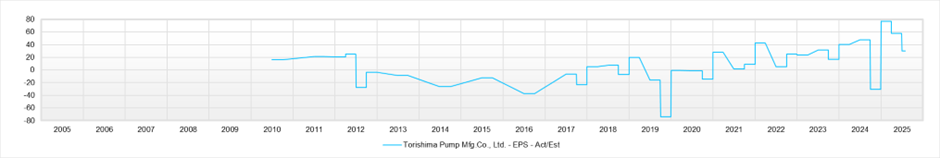

In the plant-related business domain, forecasting earnings is inherently difficult. Design revisions and cost overruns are routine within the industry, making profit margins and cash flow highly unpredictable. While earnings volatility at Torishima Pump appears relatively modest, this may simply reflect a “quiet phase” resulting from the composition of past projects. As the share of overseas orders and EPC-based businesses increases, the risk of heightened volatility should not be discounted.

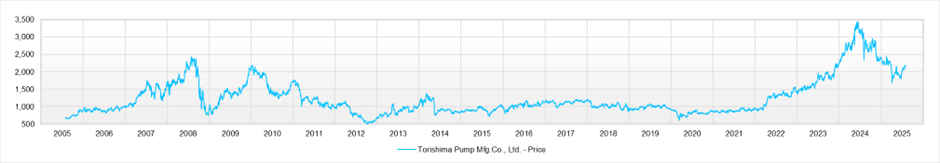

That said, demand for desalination plants in the Middle East and North Africa is expected to remain structurally strong over the medium to long term, and the company’s globally niche positioning in this field warrants recognition. The share price rally from 2021 to 2023 can likely be attributed to order momentum and earnings uplift centred on this region.

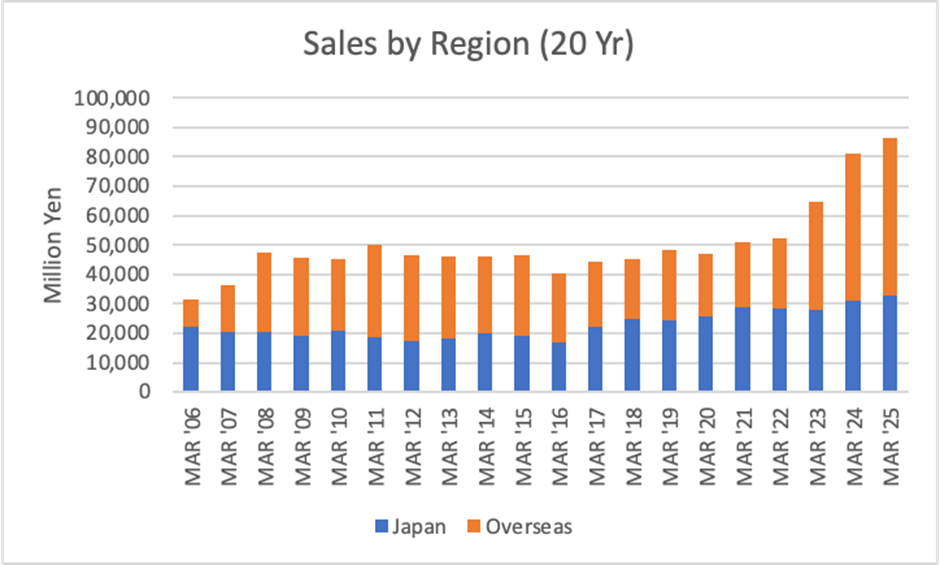

Over the past five years, overseas revenue has recorded a CAGR of +20%, raising the overseas share of total revenue to 62%. While the Japanese domestic market grew by only +5% over the same period, this divergence highlights the company’s structural transition. In FY3/2025, the company posted record-high revenue of 86.5 billion yen and operating profit of 5.45 billion yen. For FY3/2026, it is forecasting 89.0 billion yen in revenue and 6.7 billion yen in operating profit, though the achievability of these targets remains uncertain.

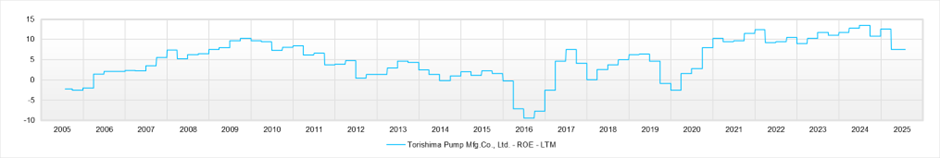

The medium-term management plan “Beyond110” sets forth targets of 100 billion yen in revenue, a 10% operating margin, and ROE of over 10% by FY2029. However, the market appears cautious in accepting these figures at face value, and their credibility hinges on the company’s capital policy and its ability to stabilise the earnings structure. Encouragingly, Torishima maintains a progressive dividend policy based on a DOE of 3% and a payout ratio of 35%, with an annual dividend of 62 yen planned for FY3/2026. A 1 billion yen share buyback programme is also underway, indicating a certain degree of shareholder awareness.

On the other hand, ESG considerations warrant attention. Desalination plants are highly energy-intensive, and growing scrutiny may be placed on their connection to renewable energy sources and associated CO₂ emissions. In certain markets, decarbonisation trends could pose headwinds rather than tailwinds.

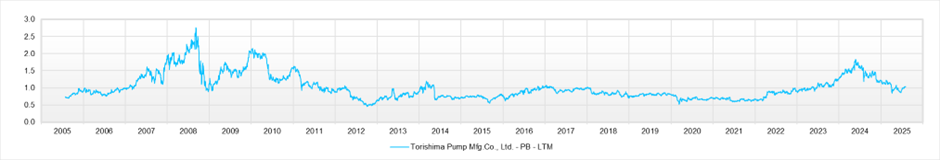

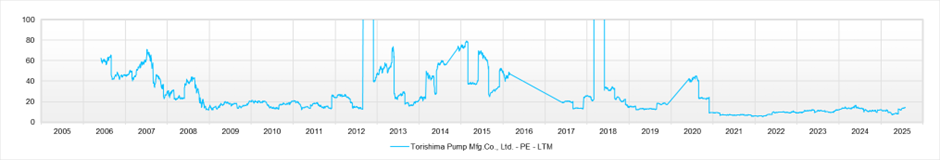

From a valuation perspective, a PBR of 1.03x and PER of 14.8x do not represent a clear undervaluation. Nevertheless, should signs of improving ROE and renewed earnings momentum emerge, a re-rating phase could follow. Even absent a dramatic shift in valuation multiples, the stock may be reassessed in light of stable revenue streams in the service and maintenance segments, as well as the longer-term impact of process in-sourcing via the acquisition of Korean machining partner Juneung.

Taking into account both the structural strength of overseas demand and the room for improvement in capital efficiency and portfolio composition, the stock may be regarded as a value reconstruction play centred on Middle Eastern infrastructure exposure, offering long-term appeal to investors anticipating a recovery in earnings momentum.

Although earnings are inherently difficult to forecast, demand for desalination infrastructure in the MENA region remains structurally strong.

FY3/2025 results posted record-high revenue of 86.5 billion yen (+6.7% YoY) and operating profit of 5.45 billion yen (–20.1% YoY), supported by continued overseas demand. Overseas revenue accounted for 62%, with a five-year CAGR of +20% versus +5% in Japan, highlighting an apparent structural shift.

For FY3/2026, the company guides for revenue of 89.0 billion yen and operating profit of 6.7 billion yen. However, given the inherent unpredictability of the plant business, especially in EPC projects involving cost overruns or design revisions, profitability and cash flows remain difficult to project with precision.

Nonetheless, the continued wave of infrastructure investment in emerging markets, particularly in desalination-related fields where Torishima has strong positioning, provides a credible backdrop for renewed earnings momentum. Should this materialise, the share price could once again respond in advance of the fundamentals.

The company’s mid-term plan “Beyond110” targets revenue of 100 billion yen, an operating margin above 10%, and ROE exceeding 10% by FY2029. While market confidence in these targets remains guarded, the company has committed to a progressive dividend policy anchored by a DOE of 3% and a payout ratio of 35%. For FY3/2026, the planned dividend is 62 yen, supplemented by a 1 billion yen share buyback programme.

With PBR hovering near 1.0x and PER around 15x, current valuation levels are not especially supportive. Still, structural overseas demand and the potential for a profit cycle resurgence offer sufficient grounds for re-rating potential in the mid to long term.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)