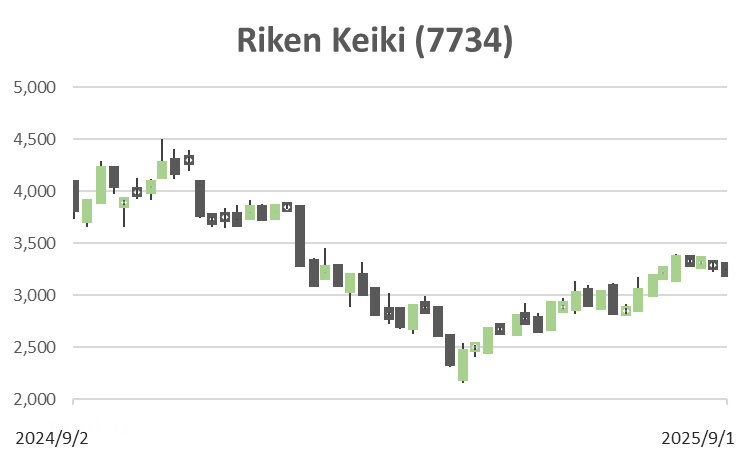

Riken Keiki (Price Discovery)

Buy

Conclusion

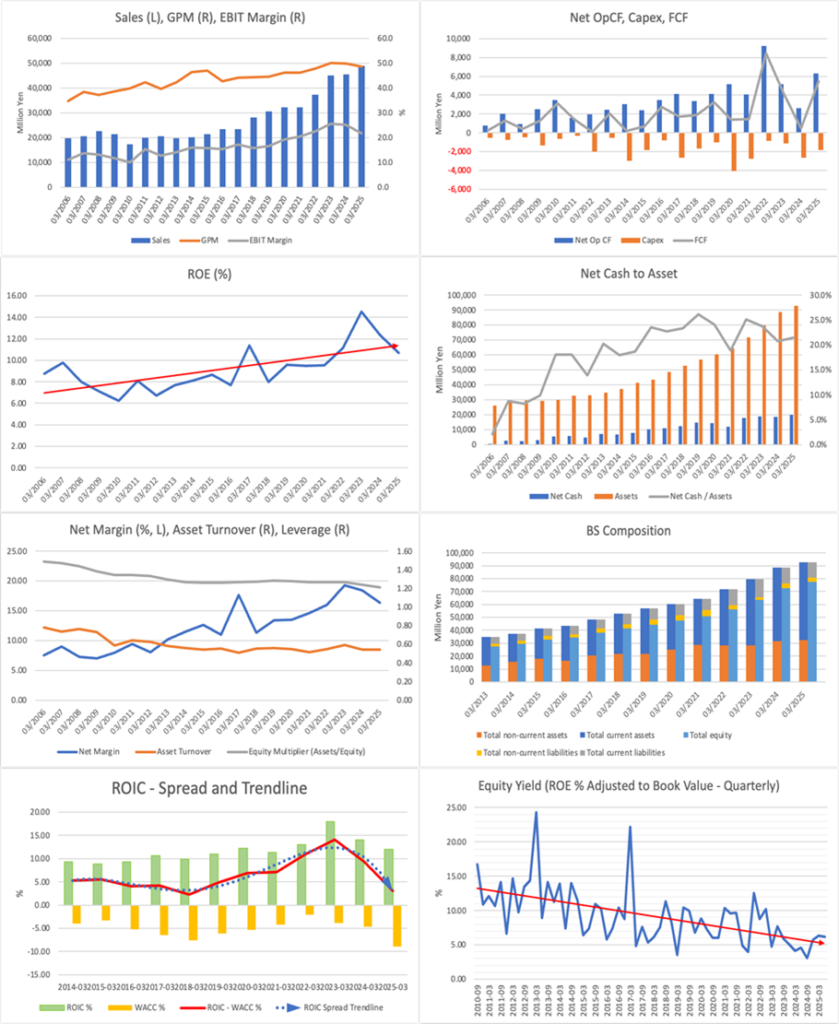

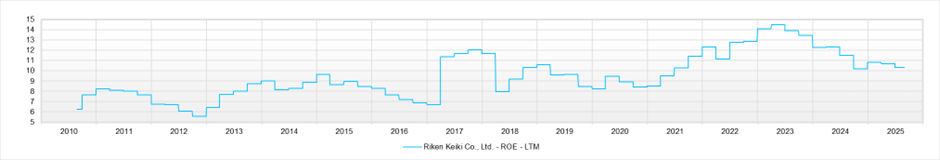

The shares have underperformed noticeably following the temporary profit decline since the year before last (i.e., since 2023), offering a good opportunity to build a position for long-term holding. The equity yield is around 6%, so the shares are not significantly cheap, though. The company is Japan’s domestic leader in gas detectors; sustained revenue/EPS growth, ample cash generation and ROE above 10%—normalisation to higher revenue and profit in FY3/2026.

Profile

As a pioneer in industrial gas detection, the company sustains stable revenue/EPS growth, ample cash generation, and an ROE above 10%, anchored by in-house sensor production, a high-value-added portfolio centered on fixed-type products, and Japan’s leading sales and maintenance network.

A pioneer in industrial gas detection and alarms, the company maintains stable growth, generates ample cash, and has an ROE above 10%, anchored by a high-value-added portfolio centered on fixed-type products and its in-house sensor development capabilities. It captures broad-based demand ranging from semiconductors, marine and petrochemicals, to infrastructure maintenance. Founded in 1939 and headquartered in Itabashi, Tokyo, it is Japan’s leading player in gas detection and alarms, with a robust domestic presence in semiconductors, where its share is around 70%, underscoring its market strength. Applications extend to “any site where gas may be generated”, spanning electricity/semiconductors, marine, petrochemicals, pharmaceuticals, and social infrastructure.

Products are built around two pillars: fixed-type and portable (hand-held/transportable); most recently (FY3/2025), the sales mix was approximately 64% fixed-type, 34% portable, and about 3% other. The overseas sales ratio was 44%. The lineup includes flagship models such as the smart transmitter GD-70D, the GX-3R series, and the SD-2500 furnace safety monitoring system, meeting diverse detection needs ranging from exhaust-duct monitoring at semiconductor plants to marine and petrochemical facilities, as well as sewer/civil-engineering sites.

Its sources of competitiveness lie in in-house development and production of gas sensors—the core components—together with a manufacturing setup that flexibly supports high-mix/low-volume production, and an uncompromising focus on quality. It operates approximately 60 sites in Japan and, overseas, around 30 group companies/sales bases, centered on North America, Europe, and Asia. By covering the full lifecycle—installation, calibration, and maintenance—it deepens its customer base. This model underpins a stable top line, abundant operating cash flow, and ROE above 10% over the long term.

While attention is warranted to external factors such as inventory adjustments in semiconductors and fluctuations in exchange rates and material prices, the company is strengthening its domestic sales structure and R&D, as well as upgrading the functions of its overseas subsidiaries. It intends to capture demand not only in semiconductors, marine and petrochemicals, but also in infrastructure safety. Over the medium term, it will raise the weight of high-value-added areas centred on fixed-type products and pursue ongoing value creation through combinations of products plus services.

| Securities Code |

| TYO:7734 |

| Market Capitalization |

| 152,377 million yen |

| Industry |

| Precision equipment |

Stock Hunter’s View

A pioneer in gas detectors and alarms. In the current fiscal year, it returns to higher revenue and profit.

Riken Keiki is a manufacturer of industrial gas detection and alarm equipment. It holds the top domestic share at 60–70% and a roughly 10% global share, ranking it fourth worldwide. Its product line-up runs to 100 types, sold to any industry that uses gas or where gas may be generated. It is particularly strong in the electrical and semiconductor industries.

Although in FY3/2025, it was affected by delayed recovery in semiconductor capital investment and the slump in China, sales of fixed-type detectors increased thanks to sales activities in other industries, including marine. Overseas sales were also strong, chiefly in North America. Reversing the previous year’s higher revenue but lower profit, it plans for FY3/2026 net sales of 52.0 billion yen (up 6.0% YoY) and operating profit of 12.0 billion yen (up 12.8% YoY).

For the semiconductor market, recovery is expected to begin in the second half. In addition to expanding sales to domestic infrastructure and semiconductor industries, it will also strengthen sales to the semiconductor, marine, and petrochemical sectors overseas. Furthermore, it will focus on developing tape-type gas detectors, which are mainstream in the overseas semiconductor industry.

The most recently announced Q1 (April–June) results showed net sales of 13.554 billion yen (up 20.6% YoY) and operating profit of 2.988 billion yen (up 11.8% YoY), a solid start.

In Japan, the frequency of sewer-pipe inspections is increasing, but accidents during these inspections are also becoming more frequent. The Ministry of Land, Infrastructure, Transport, and Tourism has recently requested that municipalities nationwide thoroughly enforce safety measures. The company is promoting the expansion of various gas detectors that contribute to safety management during inspections, cleaning/construction in sewer pipes, as well as for safety confirmation before entering manholes.

Investor’s View

Buy. While the equity yield is around 6%, limiting the absolute sense of undervaluation, this year’s pronounced underperformance presents a good opportunity to build a long-term position.

The company is very good. The top line grows steadily, continuing to generate ample cash. The long-term ROE trend is firm, having consistently stayed above 10% over the past five years. Currently, business momentum appears to be reverting towards normalisation, and we view this year’s marked underperformance as an opportunity to accumulate a high-quality name for long-term holding. On the other hand, over the long run, ROE has not kept pace sufficiently with the high PBR rating, and the equity yield trend line has been downward; it now stands at roughly 6%. Attention is warranted to the point that one cannot assert a substantial absolute undervaluation.

In valuation terms, the PER appears high relative to the ROE level, which reflects a high retention ratio and the pricing-in of future growth expectations. The EPS growth rate priced in by the market is estimated at roughly 8%; given that the actual five-year CAGR was 13%, this is a somewhat cautious estimate. The backdrop is caution towards a phase of profit declines that continued after peaking in 2023. That said, for FY3/2026, management expects EPS to recover and plans 9% growth. If a recovery in results is confirmed in the numbers and profit growth for FY3/2027 comes into view, investor sentiment is likely to improve.

In April of this year, Fidelity slightly reduced its stake, likely reflecting displeasure with the stagnation in earnings momentum, the sharp decline in economic profit creation capability, and the pronounced underperformance of the share price from 2024 onwards. Meanwhile, together with the largest shareholder, Capital Research, the two hold a combined 11%, which also attests to continued recognition of the company’s fundamentals by long-term, bottom-up global investors. A shareholder base lined with renowned institutions should provide the footing for a re-rating in a recovery phase.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)