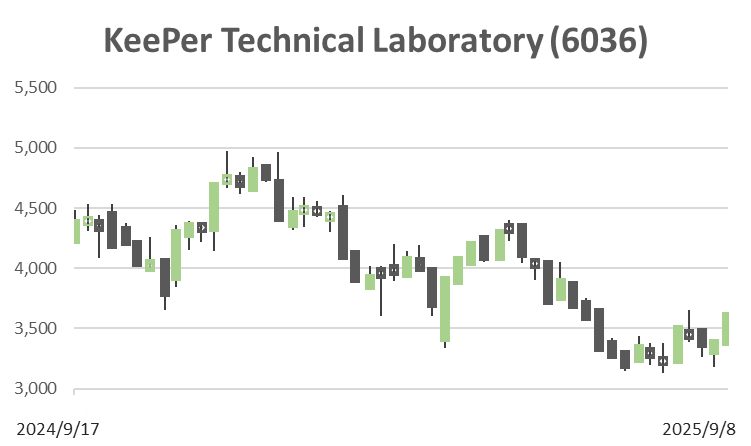

KeePer Technical Laboratory (Price Discovery)

Buy

Conclusion

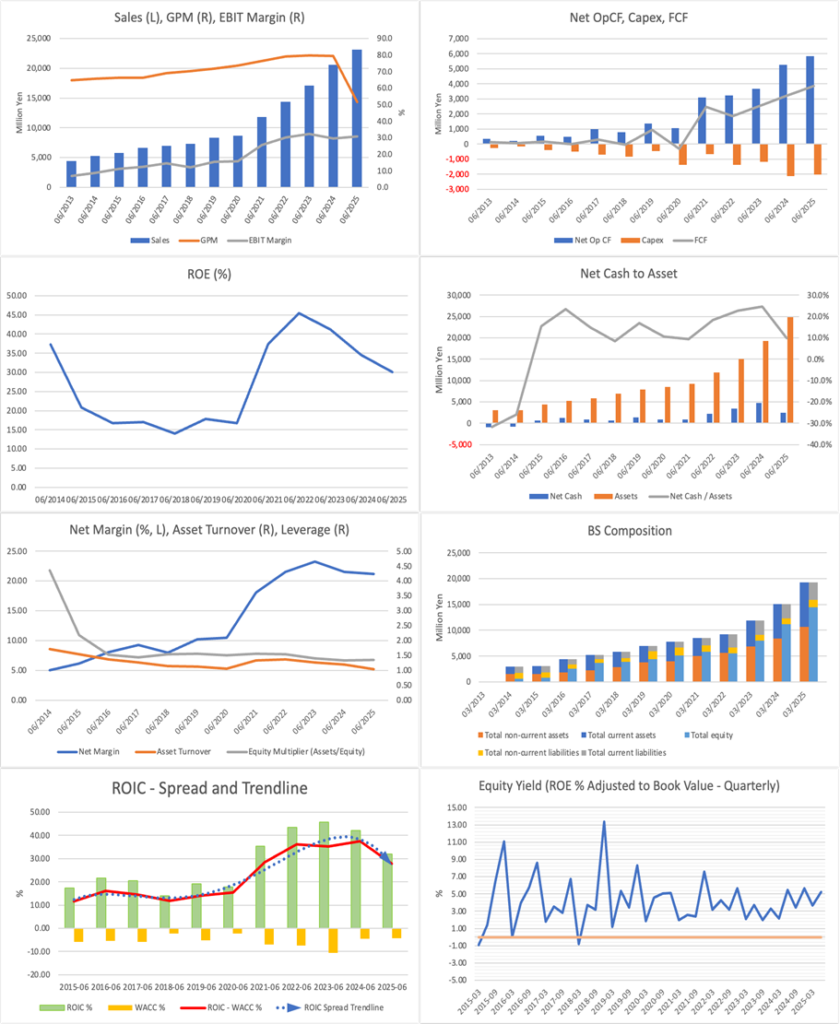

Supported by a stable ROIC–WACC spread and volume expansion across both the LABO and dealer channels, medium-term economic profit generation and EPS growth remain promising. On a normalized basis, both DCF and PBR indicate fair value materially above the current price; the shares are rated a Buy.

Profile

A revenue model with two pillars: manufacture and sale of automotive coating materials and car-wash chemicals (B2B), and operation of “KeePer LABO” stores both directly and via franchise (B2C). High-profit growth is sustained by an integrated focus on technology, quality, and channels.

KeePer Technical Laboratory operates a B2B business that develops, manufactures, and sells coating materials and car-wash chemicals, as well as a B2C business that runs “KeePer LABO” car-care stores directly and through franchises. By segment, as of FY6/2024, “Products, etc.” accounted for 46% of revenue (operating margin approx. 39%) and “LABO operations” for 54% (approx. 20%), yielding a portfolio balanced in scale and profitability.

The “Products, etc.” business supplies coating-related materials, car wash chemicals, application equipment, and training/certification materials to gas stations, new car dealers, and maintenance shops. The “LABO” business offers B2C services, including coating applications, car washes, and various maintenance services, while building a store network through both directly operated outlets and franchisees. Sales channels include, in addition to gas-station routes, factory-approved/recommended programs via new-car dealers. Key KPIs include the number of LABO stores, application count, average spend per customer, number of dealer locations adopting the products, and the number of technicians/certified personnel.

| Securities Code |

| TYO:6036 |

| Market Capitalization |

| 109,588 million yen |

| Industry |

| Service |

Stock Hunter’s View

Toward a 200-store footprint this fiscal year

As of August, KeePer Technical Laboratory operates 159 domestic stores and is aiming to reach the 200-store mark within the fiscal year ending June 2026. For the current fiscal year, revenue of 23.093 billion yen (+12.2% YoY) and operating profit of 7.098 billion yen (+16.3%) are projected, implying another year of double-digit growth and an eighth consecutive record. Existing-store sales are expected to see only a slight increase, but contributions from new stores and franchise-related revenue—recruitment for which began last year—are expected to remain firm.

In the previous fiscal year, customer visits increased 14% compared to the year before, aided by unusually hot weather that boosted demand to “get cars refreshed and clean.” In the “Products, etc.” business, growth in the “new-car market,” centered on new-car dealers, together with “non-automotive services” such as housecleaning and the B2C Bath Keeper/Kitchen Keeper products, drove segment revenue.

Separately, the company plans to tender all shares of Soft99 Corporation (4464) it holds into a tender offer (TOB) by Gyo Asset Management Inc., booking a special gain of 2.368 billion yen. This is incorporated into full-year guidance. The annual dividend will be maintained at a floor of 60 yen, in line with the prior year, and the presence or absence of additional shareholder returns will be indicated around the time of the first-quarter results.

Investor’s View

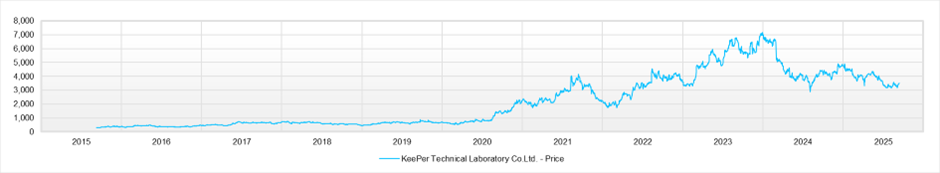

The valuation reset, prompted by sharp share-price declines last year—and again year-to-date this year—was overdone; fair value is meaningfully higher than the current share price.

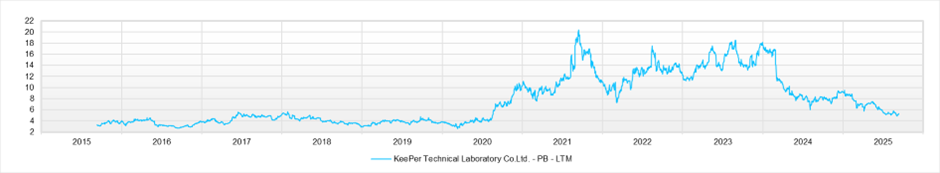

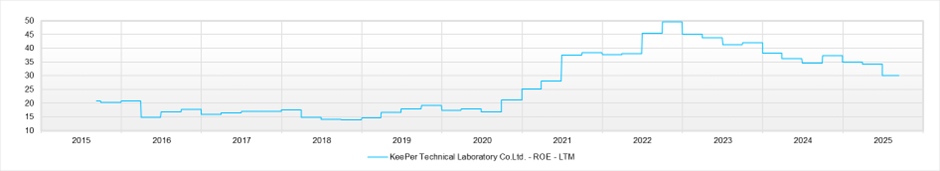

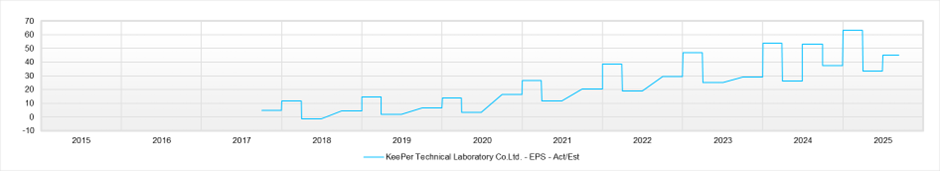

Based on a DCF with a discount rate (WACC) of 6% and a terminal growth rate of 2%, the intrinsic value is estimated to be roughly in the 4,700-yen range per share, which is above the current share price of 3,520 yen. Under a PBR approach, assuming medium-term normalization with ROE of 15%, a dividend payout ratio of 50%, and a cost of equity of 9%, the theoretical PBR is about 5.0x; applying FY26E BPS of roughly 865 yen yields about 4,325 yen, broadly consistent with the DCF level. In addition, ROIC is estimated to exceed WACC by a wide margin, indicating a structure capable of continuously creating corporate value through a positive spread over the cost of capital. In the near to medium term, there is room to compound EPS growth at around 20% annually; as long as this is achieved, valuation still has substantial scope for re-rating. Based on this, the 12-month price target is estimated to be between 4,600 and 4,800 yen.

The valuation framework rests on three pillars. First, DCF. Starting from the FY26 company plan, a tapered growth path is assumed, which factors in payback for store openings and headcount investments, along with practical ratio assumptions for depreciation and amortization (D&A), capital expenditures (capex), and working capital. Discounting at a WACC of 6% yields an intrinsic value converging in the 4,700-yen range. In terms of sensitivity, the theoretical value shows high responsiveness to small changes in the discount rate and terminal growth rate; however, under any realistic set of assumptions, the discount versus the current share price is prone to narrow. Second, PBR. A theoretical PBR derived from normalized ROE and payout supports a level in the mid-4,000-yen range, given the current business profitability. Third, ROIC. After-tax operating profit (NOPAT) relative to invested capital is high, and the spread over WACC is sufficiently broad. If the sustainability of capital efficiency is maintained, the persistence of a PBR premium is justified.

The sources of the company’s high profitability and growth are found in a triad of technology, quality, and channels. First, brand strength is underpinned by coating technology and quality control. A training system and evaluation framework that ensures uniform application quality, limits service variability, and creates a virtuous cycle in ticket size, utilization, and repeat visits. Second, a shift in channel strategy. Anticipating the contraction of the gas-station-centric market, the company pivoted toward expanding LABO openings and deepening the new-car dealer route, thereby gaining proposal opportunities at the point of new-car sales and broadening room for application-share gains. Third, economies of scale and operating standardization. Up-front investments in personnel and equipment enhance capacity and productivity, supporting margin durability and strengthening free cash flow generation over the medium to long term.

The equity case is based on these sources and can be summarized in three key points: robust value creation underpinned by a stable, positive spread of ROIC over WACC; a medium-term volume growth scenario driven by dealer-program adoption and LABO expansion; and longer-term expansion options preserved by still-limited market penetration. Together, these provide both downside protection on valuation and upside potential. That said, uncertainties remain—such as weather (e.g., extreme heat), cost inflation, fluctuations in existing-store utilization and ticket size, and variability in investment payback periods—necessitating continual validation of assumptions through quarterly KPI monitoring (store openings, technician staffing, number of dealer adoptions, and application unit price).

In summary, the DCF (WACC 6%) indication and the normalized P/B ratio assessment are broadly consistent, and the ROIC superiority underpins both. As long as EPS growth around 20% annually continues, the current share price remains attractive. Accordingly, phased buying on dips is recommended, with a base-case convergence toward 4,600–4,800 yen over 12 months.

The current valuation (PER 13.8, PBR 5.32, ROE 30.8%, payout ratio about 29%) implies the market is discounting roughly 21.9% EPS growth. While EPS CAGR over the past five years was +40% and the hyper-growth phase appears to have passed, the view that growth will decelerate is somewhat conservative yet remains within a reasonable range.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)