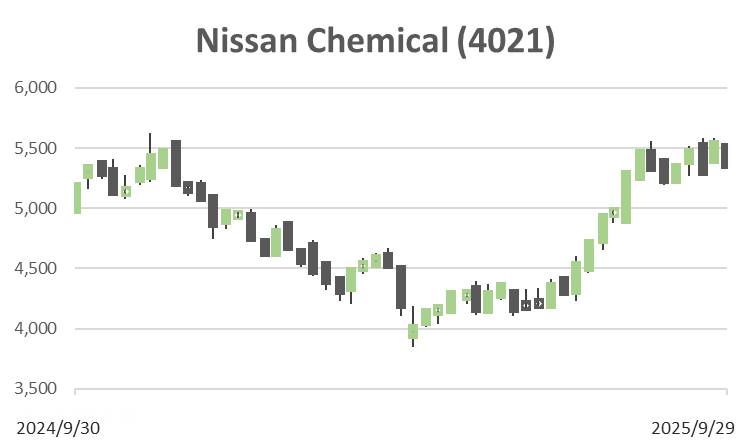

Nissan Chemical (Price Discovery)

Buy

Conclusion

Buy. A full recovery from the first earnings decline in a decade, led by advanced semiconductor materials and paddy-rice herbicides, has driven results to record highs. With valuation multiples having compressed excessively, the shares trade in undervalued territory; if excess equity is addressed and advanced materials continue to expand, a re-acceleration in ROE implies substantial upside in the share price.

Profile

A specialty chemical manufacturer centered on Performance Materials (for displays and semiconductors) and Agricultural Chemicals.

The company has pursued both top-line growth and profitability by focusing on high–value–added domains and continuously upgrading its products. Key earnings drivers include advanced-node semiconductor materials, high-performance display materials, and a portfolio of crop protection products with leading domestic brands. In contrast, wholesale operations (external sales of raw materials and products) provide a stable base that underpins group cash generation. Overseas sales account for more than half, and long-term supply relationships and qualification processes with global customers create barriers to entry.

Sales mix by business % (operating margin %): Chemicals 9 (0), Performance Materials 27 (29), Agricultural Chemicals 26 (30), Healthcare 2 (32), Wholesale 33 (3), Other 4 (2) [Overseas] 58 (FY3/2025).

The earnings structure has become more resilient to economic cycles and raw-material price volatility through mix improvement (a higher share of high-margin areas) and supply-chain efficiency. R&D is allocated to core domains, building a pipeline aimed at application expansion and driving generational upgrades (e.g., advanced semiconductor materials and high-performance agents). Capital allocation emphasizes a balance between growth investment and shareholder returns, while maintaining financial soundness on the back of robust cash-flow generation.

| Securities Code |

| TYO:4021 |

| Market Capitalization |

| 733,522 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

A complete recovery from the first earnings decline in a decade; Performance Materials and Agricultural Chemicals are the drivers.

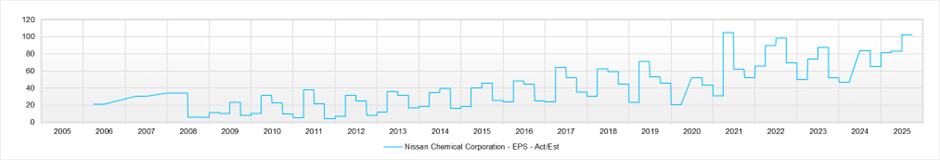

Nissan Chemical’s performance is robust in Performance Materials for displays and semiconductors and in crop protection, where it holds leading domestic shares. In the first quarter of FY3/2026 (April–June), revenue rose 19.1% and operating profit increased 25.4%, beating company guidance; sales, operating profit and net profit all marked record highs for a first quarter.

Within Performance Materials, display materials, semiconductor materials, and inorganic colloids all performed well, with robust growth in multilayer materials and EUV materials. In Agricultural Chemicals, Altea (herbicide for paddy rice) and Gracia (insecticide) grew in Japan, while Limei (fungicide) and Targa (herbicide) expanded overseas. Notably, Gracia reached its initial peak sales target of 10 billion yen last fiscal year, and the target was subsequently raised to 12.5 billion yen in May of this year.

Although full-year guidance remains unchanged from the initial announcement—sales of 262.2 billion yen (up 4.3% YoY) and operating profit of 57.6 billion yen (up 1.3% YoY)—we see no particular risks at present, and an upside to plan appears likely. Continued growth in leading-edge semiconductor materials and herbicides for paddy rice suggests a full recovery from last fiscal year’s first operating-profit decline in ten years.

Investor appreciation for shareholder returns is also rising. After executing a 10 billion yen share buyback in the previous fiscal year, the company announced an additional repurchase in March (up to 750,000 shares or 3 billion yen) and then, in May, a further buyback (up to 2.5 million shares or 9 billion yen).

Investor’s View

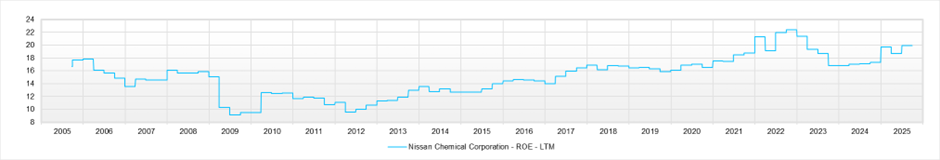

Buy. Relative to the company’s fundamentals—net profit margin at 17% and ROE around 20%—the compression in valuation multiples looks overdone. If excess equity is addressed and advanced materials growth continues, the ROE can re-accelerate, and the shares offer significant upside.

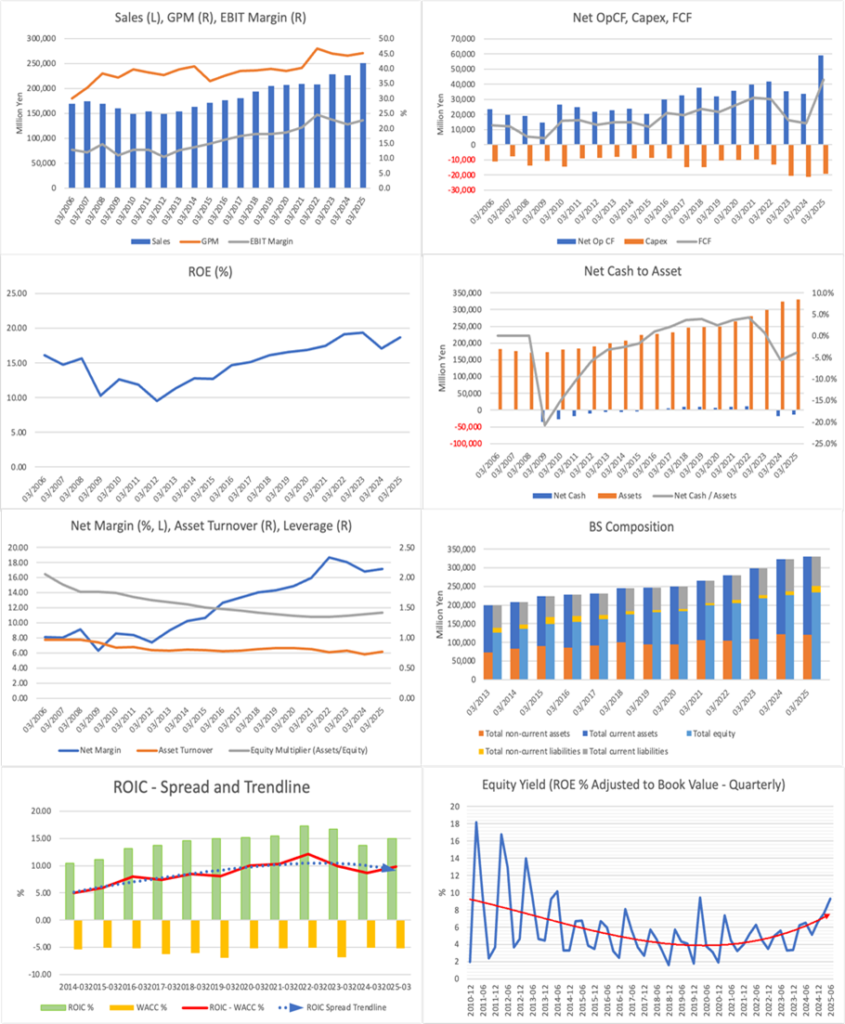

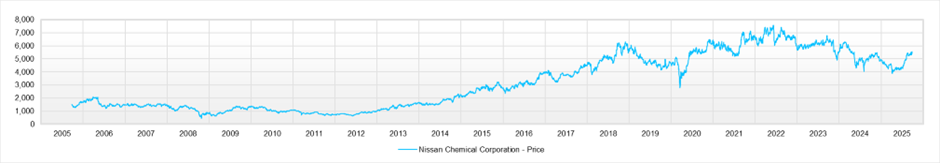

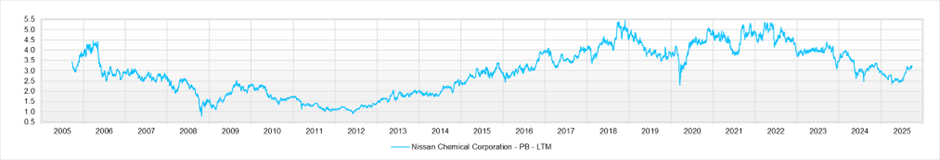

While expanding revenue, the company has consistently increased its net profit margin from 6.3% in FY3/2009 to 17.1% in FY3/2025—an impressive achievement and a major driver of a near-20% ROE that merits high marks for management. Nevertheless, the share price has been trending down since 2022, and the year-to-date rise is capped at 12%, underperforming TOPIX by 3%. Over this period, the equity yield has widened from over 3% to above 9%, a compelling development that should not be overlooked. Although it is difficult to forecast further momentum in margin expansion, the upside for ROE clearly lies in correcting the nearly 70% over-capitalised balance sheet. With ample cash-flow generation, executing on this should not be a difficult choice for management. As the Stock Hunter notes, the team has already begun to optimise capital.

The EPS growth rate implied by the market looks broadly reasonable

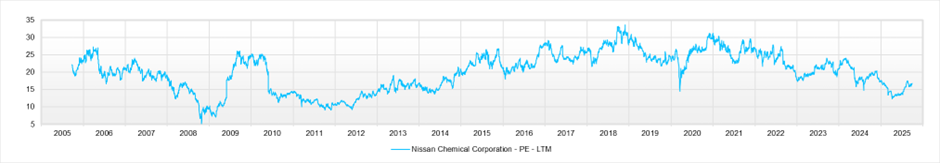

Given the inputs (forecast PER 16.28, actual PBR 3.23, forecast ROE 20.0%, forecast EPS 344.7 yen, forecast dividend 183 yen), the payout ratio is about 53.1% and the retention ratio is approximately 46.9%. These imply a long-term EPS growth rate of roughly 9.5%, suggesting the market already discounts a scenario in which high ROE is sustained and reinvested to deliver EPS growth in the high single digits. In practice, EPS has remained elevated despite cyclical effects, achieving a five-year CAGR of about 8%. This aligns with the medium-term plan’s sustained growth outlook driven by leading-edge semiconductor materials and paddy-rice herbicides. The multi-year share-price malaise thus appears driven less by an earnings shock or genuine growth deceleration and more by a correction of previously excessive expectations that compressed valuation multiples.

Why have the shares underperformed despite strong results

First, multiples that expanded on the lofty expectations of 2022 have compressed amid rising rates and a reassessment of risk premia. Second, while both semiconductors and crop protection are powerful growth engines, investors remain mindful of non-linearities—such as capex cycles, regulation, and weather—making straight-line growth harder to underwrite. Third, conservative guidance and high shareholder returns can be perceived by some as limiting “offensive” investment, thereby restraining multiple re-expansions. In short, a market regime has persisted for more than three years in which good results do not translate into immediate PER upside.

Fair value range (assumptions and outcomes only)

Common assumptions: EPS = 344.7 yen; payout ratio = 53.1%; ROE = 20%; BPS = 1,724 yen.

PER approach: 3,050–7,310 yen

PBR approach: 4,310–8,960 yen

ROIC–WACC spread approach: 5,200–6,200 yen

Overall, we centre fair value at 5,200–6,200 yen, with a bear case in the high 3,000s and a bull case around the 9,000s. Visible progress in correcting excess equity (through buybacks/dividends) and additional adoption wins in advanced materials would tilt outcomes toward the base-to-bull scenarios. Given the sizeable management-controllable levers to raise capital efficiency—and capital optimisation already underway—we maintain a bullish view.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)