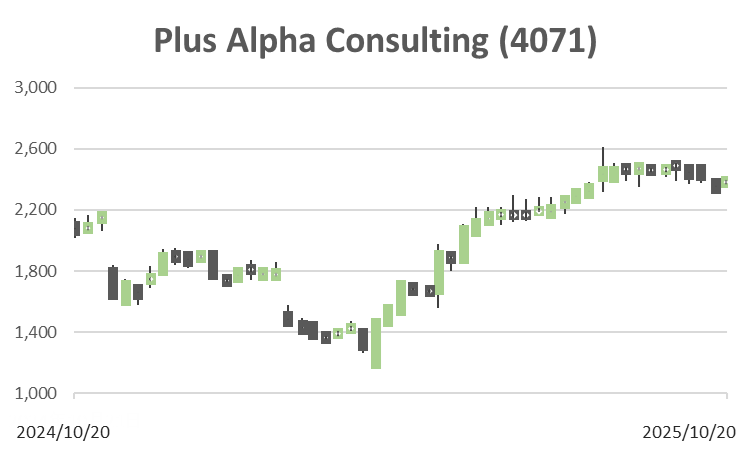

Plus Alpha Consulting (Price Discovery)

Cautious Hold

Conclusion

Concerns over declining capital efficiency persist due to the under-utilisation of abundant cash, making PBR expansion unlikely. On the other hand, incorporating a more positive view that anticipates effective deployment of the cash, the company’s valuation appears to have consolidated within a high range. High growth and high margins continue, centred on HR SaaS, and the upward revision to full-year operating profit underlines healthy momentum. The lift in the dividend-payout ratio to 30% and the collaboration with Mynavi are additional positives. Yet, it is reasonable, for the time being, to forecast share-price upside broadly limited to the degree of EPS/BPS growth. While we stop short of an outright Buy, the shares are worth rated a cautious Hold.

Profile

An independent software company centred on data visualisation and analytics, it provides HR-tech (including talent management) and marketing SaaS, with a subscription-led model that combines stability with scalability. Its distinctive features include the integrated operation of HR and customer data deeply embedded in clients’ workflows, product design that supports an end-to-end continuum from visualisation to execution, and a customer-success set-up geared to enterprise deployment. Its moat rests on three pillars: (i) high switching costs stemming from data-migration burdens and operational embedment; (ii) continual gains in analytical and recommendation accuracy driven by accumulated data and algorithmic improvement; and (iii) network effects and lock-in arising from cross-selling into adjacent functions and companion products. Business mix by revenue (%) (operating margin %): Marketing Solutions 27 (43), HR Solutions 73 (40) (FY9/2024).

| Securities Code |

| TYO:4071 |

| Market Capitalization |

| 102,111 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Supporting “visualisation” through data × AI. Strong momentum in the HR domain’s “Talent Palette”.

Corporate result announcements for companies whose quarters close in September are about to move into full swing. Plus Alpha Consulting is one of the names for which the current-year outlook appears promising. The company plans to announce full-year results for the fiscal year ending September 2025 on 13 November (as at 20 October). At the time of the most recent Q3 (October–June) results, it revised guidance, lifting full-year operating profit from 5.6 billion yen to 6.1 billion yen (+34.7% year on year). In tandem, it raised the dividend policy guideline from “approximately 20%” of net profit to “approximately 30%”, and increased the forecast year-end dividend from 18 yen to 29 yen. Leveraging advanced technologies such as natural-language processing and data mining, the company offers services that render clients’ vast information sets visible. In Q3, the flagship “Talent Palette” (talent-management system) continued to see increases in customer numbers and unit prices, driving a marked rise in monthly recurring revenue.

Meanwhile, a shift in new-customer acquisition towards the enterprise segment, combined with a review of marketing measures, helped contain costs. Although several subsidiaries continue to face soft order intake—implying that sales will fall roughly 700 million yen short of the initial plan—overall conditions are favourable, with all businesses profitable other than the start-up-phase “Yorisol”. Attention is also warranted on alliance-driven solution roll-outs, such as “Mynavi TalentBase”, launched in October in collaboration with Mynavi.

Investor’s View

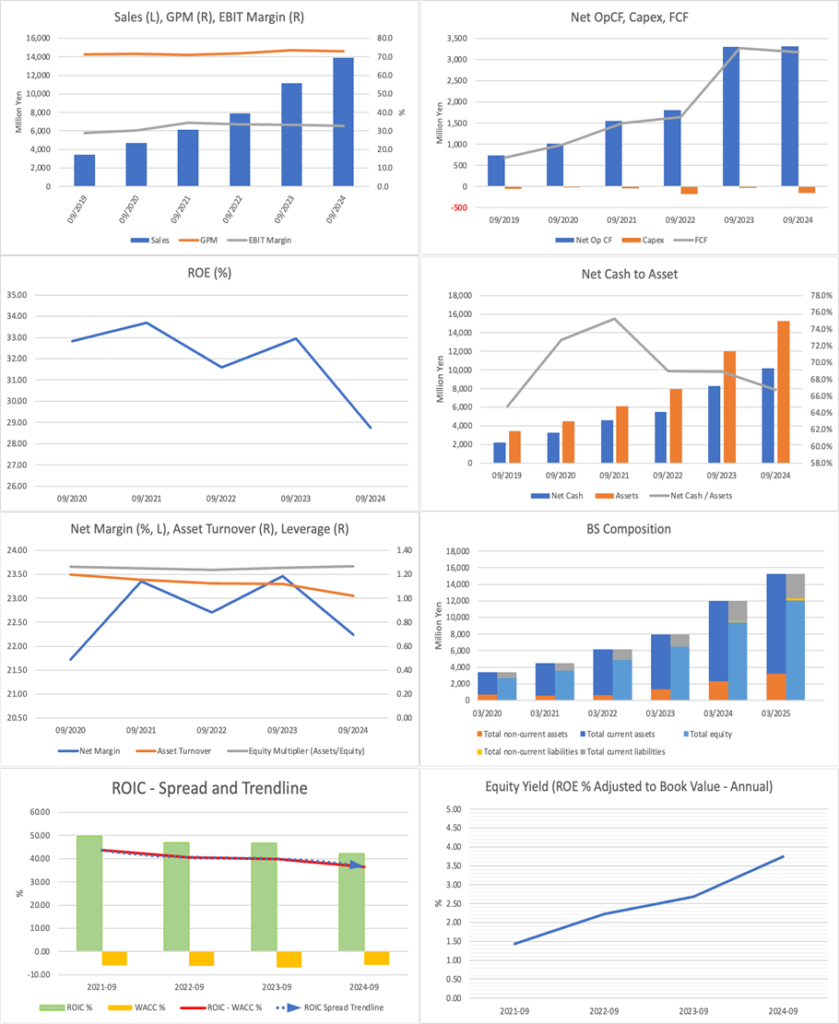

Cautious Hold. Revenue and profit remain in a high-growth, high-margin phase that justifies a premium multiple; however, concerns persist over declining capital efficiency due to under-deployment of substantial cash, leaving little room for further PBR expansion, and thus, upside appears limited largely to the growth rates of EPS and BPS.

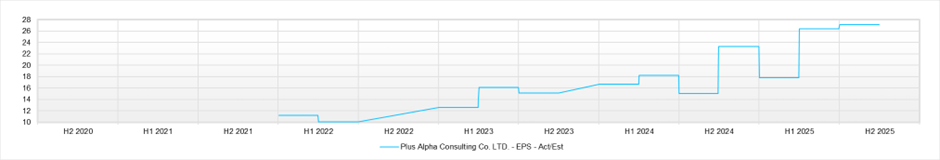

Top-line growth is firmly in high gear, and the combination of robust free-cash-flow generation with an asset-light balance sheet yields strikingly high returns on capital. The concurrent achievement of around +30% annual revenue growth and net profit margins in excess of 20% underpins this, warranting a premium valuation. Current valuation and forecasts (forecast PER 24.4x, actual PBR 8.42x, forecast ROE 36.1%, forecast EPS 97.5 yen, forecast dividend 29 yen) embed about 25% annualised EPS growth, consistent with a five-year EPS CAGR of +35% and the company’s forecast of +38% EPS increase in the current-year plan.

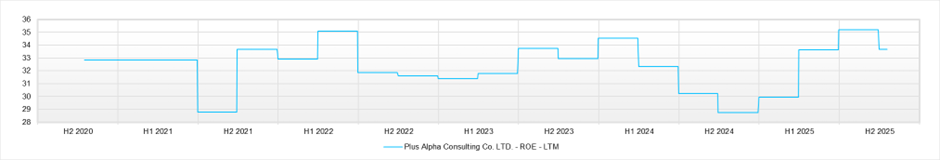

The principal concern for equity value, by contrast, is that ample cash remains unused mainly, suppressing headline capital-efficiency metrics such as ROE and ROIC; absent corrective action, the downward trend is unlikely to cease. Even high-profile investors on the share register may feel discomfort here, and PBR expansion is difficult to argue.

Although management has raised the payout-ratio guideline to 30%, it has not set out concrete uses for existing cash and future cash flows, leaving investor concerns unresolved. Net cash, which stood at 9.6 billion yen at end-3Q (June), increased further by 3.0 billion yen through the August disposal of treasury shares to Mynavi and is now estimated at roughly 12.6 billion yen, possibly accounting for about 72% of total assets; accordingly, the equity ratio should have risen from 78% to 82%, further skewing the balance sheet towards cash in the short term. For a growth company more than five years post-IPO, a cash-bloated balance sheet is, from an equity investor’s standpoint, evidence of inefficient capital deployment and invites doubts as to whether growth investment opportunities have been exhausted. That cash equates to only 12% of the market capitalisation, which is inflated by a high multiple, and a net-cash-adjusted PER of 22x is not cheap at all.

That said, ROE and ROIC remain at elevated levels, and even if they continue to ease, there is still ample spread over the cost of capital. With constructive engagement from leading institutional shareholders, management may yet identify practical uses of cash (growth investment, M&A, or share buybacks).

It is not, in itself, a negative to hold a large cash balance. If it is accompanied by clarity on how the cash will be used, the pace at which it will be put to work, and which KPIs will improve—and thereby accelerate cash inflows—then the reinvestment → cash-generation → shareholder-return flywheel is strengthened. Conversely, cash that does not contribute to this cycle will continue to depress headline ROE and act as a weight on PBR. Cash is not an idle asset but a source of flexibility that, by conferring the “right to choose” and the “right to wait,” allows a company to capitalise meaningfully on favourable opportunities while limiting the damage from headwinds. Accordingly, the assessment should not rest on a superficial decline in ROE but on the extent to which the future choices enabled by that cash raise the expected value of shareholder returns.

In all probability—reflecting this more positive reading as well—the company’s shares have converged within a sustainably elevated valuation range, and it is reasonable to believe that upside is broadly limited to the pace of EPS/BPS growth. While we stop short of an outright Buy, the shares are sensibly worth rated a cautious Hold.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

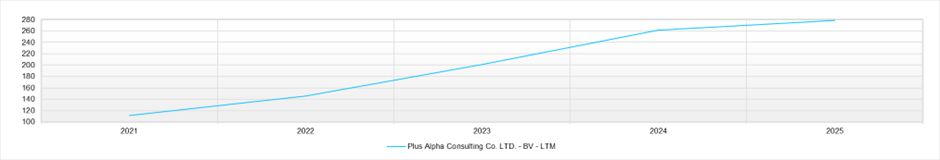

BPS (LTM)