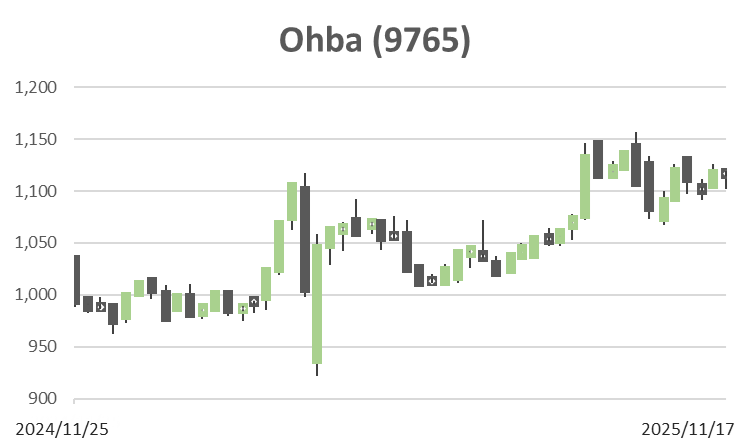

Ohba (Price Discovery)

Stay Away

Conclusion

Stay away. Deterioration in free cash flow driven by rising trade receivables and contract assets, and the resulting increase in working-capital needs and short-term borrowings, makes us reluctant to recommend the shares until the gap between earnings and cash flow begins to narrow. This is despite the company benefiting from tailwinds such as national resilience initiatives, defence-related civil engineering and industrial-site development, delivering 14 consecutive years of operating profit growth with ROE around 10%, and trading at an undemanding 13.2x forward PER and 1.39x PBR relative to its five-year EPS growth.

Profile

The company is a comprehensive construction consultant with strengths in town planning and civil and urban infrastructure development, and its main business domains are the “town planning” field, including urban planning and land readjustment; design of roads, bridges and water and sewerage systems; environmental fields such as environmental assessment and water quality conservation; geospatial information services centred on surveying and geographic information systems (GIS); and land management and business solutions. It handles a high proportion of private-sector projects and is a midsize construction consultant with a strong financial base headquartered in Chiyoda-ku, Tokyo.

Breakdown of sales by business segment (%): town planning 42, design 23, geospatial information 20, business solutions 11, environment 5 (FY5/2025).

| Securities Code |

| TYO:9765 |

| Market Capitalization |

| 18,693 million yen |

| Industry |

| Service |

Stock Hunter’s View

A comprehensive construction consultant with strengths in “town planning”. Benefiting from tailwinds such as national resilience initiatives and growing demand for defence-related civil engineering.

Ooba is a comprehensive construction consultant that handles the “pre-construction phase” from research and planning through to design. In the “town planning” field, where it makes proposals and provides consulting services in conjunction with infrastructure development projects such as urban planning and land readjustment, it enjoys top market share. It has a long track record of receiving awards from external institutions.

In the fiscal year ending May 2025, operating profit will have increased for the 14th consecutive year, and the company has also achieved its medium-term management plan one year ahead of schedule, indicating a favourable earnings trajectory. For the current fiscal year, it forecasts net sales of 17.0 billion yen (up 6.1% year on year) and operating profit of 2.0 billion yen (up 3.3% year on year). Its shareholder-return policy targets a total shareholder return of around 60% and a dividend payout ratio of around 50%, and its proactive stance on shareholder returns, including dividends and other benefits, is also a positive factor.

Public-sector business continues to be supported by robust public investment in the maintenance and management of social infrastructure, national resilience initiatives, and defence-related civil engineering, while on the private-sector side, the company is benefiting from tailwinds in the form of increasing demand for industrial- and logistics-site development work driven by the reshoring of production bases to Japan and the entry of overseas capital. In the most recently announced first-quarter (June–August) results, net sales increased by 25.6%, while operating profit declined by 36.2%. Still, given that the same period of the previous year was an exceptional quarter in which operating profit increased 9.7-fold due to special factors, the fact that the recoil has been limited to this extent can rather be regarded as a strong performance.

Investor’s View

Stay away. While the valuation offers a certain degree of comfort, taking into account the deterioration in free cash flow associated with the increase in trade receivables and the risks of a heavier working-capital burden and rising dependence on borrowings, we do not regard the current phase as one in which investors should be actively involved in the stock.

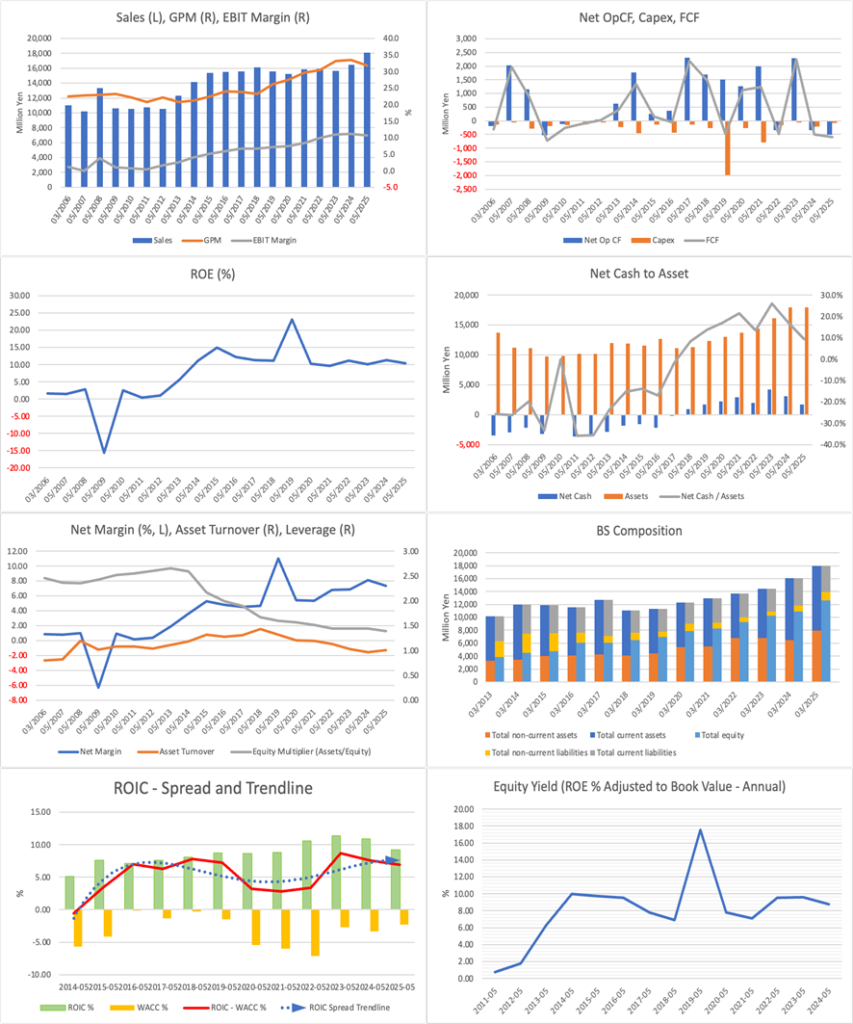

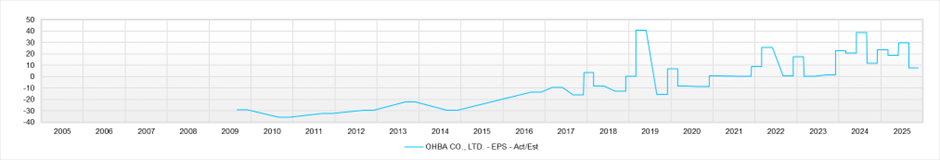

The EPS growth rate implied by the quantitative profile of a 13.2x forward PER, 1.39x actual PBR, 11.0% forecast ROE, a forecast EPS of 88.0 yen, and a forecast dividend of 43 yen is estimated at around +6% per year. Compared with the EPS CAGR of +10% over the past five years, this is a somewhat conservative assumption, and there is some comfort with the valuation’s downside risk. Net sales are maintaining a moderate long-term growth trend, and the EBIT margin is likewise solid. Although leverage and asset turnover ratios are declining, the company has maintained ROE around 10% through improved profitability, and it can be regarded as a business that has steadily built up its earnings.

That said, a concern is that over the past few years, the company’s cash position has eroded significantly due to an increase in trade receivables. While this is a typical pattern in the construction consulting industry, where the timing of order receipt, revenue recognition, and cash collection tends to be misaligned, the extent and persistence of this trend warrant close attention from investors. On the other hand, over the past seven to eight year,s Ooba has expanded operating profit from the low 1-billion-yen range to around 1.9 billion yen, raised its equity ratio from the 60% range to over 70%, and as of the end of FY5/2025 had zero interest-bearing debt, indicating a certain degree of soundness in its financial base itself. However, in terms of cash flow, operating cash flow was negative for two consecutive fiscal years in FY5/2024 and FY5/2025, and cash and deposits have declined significantly from 3.1 billion yen to just under 1.7 billion yen. Net sales have increased from 16.5 billion yen to 18.1 billion yen, and the picture is one in which increased working-capital requirements associated with the build-up of trade receivables and contract assets overlap with cash outflows for dividends and share buybacks. At present, short-term borrowings have also arisen to secure working capital, and this is a phase in which we intend to continue monitoring closely (i) the pace of increase and collection period of trade receivables, (ii) any widening of the gap between operating cash flow and profit, and (iii) any structural rise in dependence on borrowings.

Looking only at the cash-flow trend, one possible interpretation is that orders received around 2009 were collected in a short span over the five years starting from 2017, but even if the current disappearance of free cash flow is attributable to the business structure, investors would not welcome a scenario in which this situation continues over the long term. The fact that the share price has underperformed over the past two years despite an underlying earnings uptrend reflects investor concerns about cash flow and working capital.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)