JMDC (Price Discovery)

Avoid

Conclusion

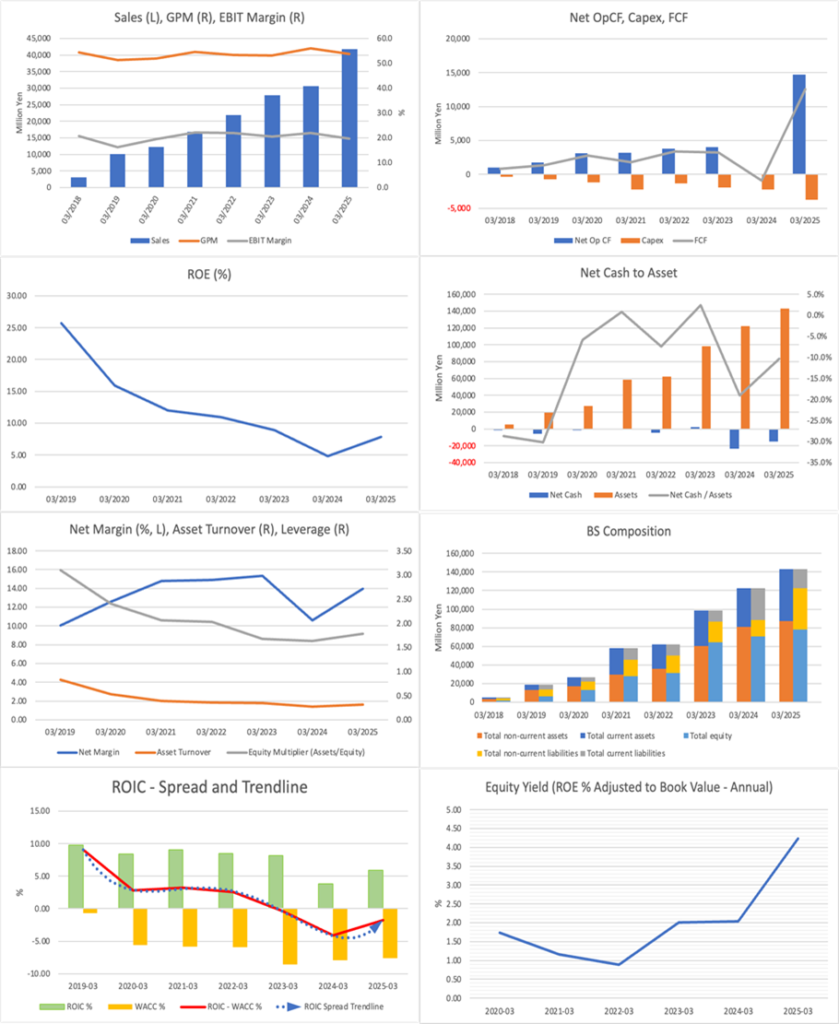

While the data business continues to deliver high growth and new growth drivers, such as elderly data, are in sight, economic value creation has fallen into negative territory due to the expansion of goodwill and borrowings associated with corporate acquisitions. It is difficult to expect the share price to outperform until balance sheet improvements are confirmed.

Profile

JMDC is a company that provides solutions utilising data and ICT in the medical and healthcare fields. It is a consolidated subsidiary of Omron (6645), which holds a 54.2% stake. The company was established in 2002 as Japan Medical Data Center and is currently listed on the Tokyo Stock Exchange Prime Market, with its business centred on two core segments: Health Big Data and Telemedicine. In the Health Big Data business, it provides, based on Japan’s largest medical big-data database created by anonymising claims and health check-up data originating from health insurance societies and medical institutions, data provision and analysis services for pharmaceutical companies and insurers, data analysis for insurers and the PHR service “Pep Up”, and management support and medical fee receivables factoring for medical institutions. Meanwhile, in the Telemedicine business, through its group company Doctor Net, it provides teleradiology services by radiology specialists and ASP services for image-reading systems. It is also developing and delivering the diagnostic assistance platform “AI-RAD” that uses AI technology. Through these businesses, under the banner of “realising a sustainable healthcare system through the power of data and ICT”, it is working to build data infrastructure that supports greater efficiency in Japan’s healthcare system and improvements in the quality of medical care.

Breakdown of sales by business (%) (operating margin (%)): Health Big Data 85 (27), Telemedicine 15 (37) (FY3/2025).

| Securities Code |

| TYO:4483 |

| Market Capitalization |

| 268,208 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

The data business is achieving high growth. Contributions from elderly data are also expected from the second half onwards.

JMDC is the largest company in Japan in terms of sales related to medical data. As a pioneer in the collection and utilisation of epidemiological data, it holds an enormous volume of real-world data (RWD) on roughly 19 million members of health insurance societies and mutual aid associations, and has built substantial barriers to entry.

In the most recently announced results for the first half of the fiscal year ending March 2026 (April–September), revenue was 23.08 billion yen, up 24.4% year on year, and operating profit was 4.025 billion yen, up 27.7% year on year. Although it did not have as much impact as the first quarter, when some projects were brought forward, the core Health Big Data segment remained strong. Given the seasonality, in which sales and profits are skewed towards the second half, this can be regarded as steady business progress.

Within Health Big Data, each of the industry businesses (pharmaceutical companies, insurance companies, and corporate clients), for insurers and individuals (insurer services for health insurance societies and municipalities and health management portals), and for medical providers (medical institutions) continues to grow in a well-balanced manner. The accumulation and utilisation of new data are also progressing smoothly. In addition to accelerating the accumulation of elderly data, it aims to achieve the most significant volume of data from DPC hospitals in the current fiscal year (at present, Medical Data Vision (TSE 3902) is the industry leader). The response of pharmaceutical companies and life insurers to the use of such data remains favourable. Elderly data utilisation solutions are expected to contribute to earnings from the second half onwards.

Investor’s View

Avoid: Despite EPS CAGR of +25% over the past five years, economic value creation has fallen into negative territory due to the sharp increase in goodwill and borrowings associated with M&A. Given the balance sheet’s substantial goodwill risk and the market’s scepticism about the company’s growth, share price outperformance is unlikely, and clear signs of improvement in the balance sheet are essential before upgrading our investment rating.

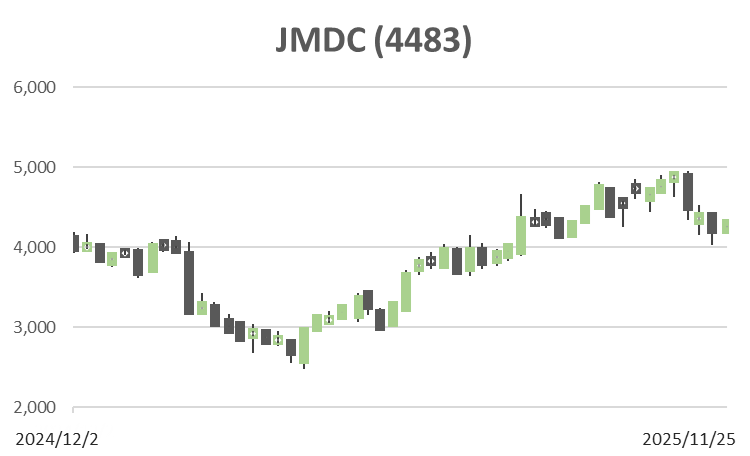

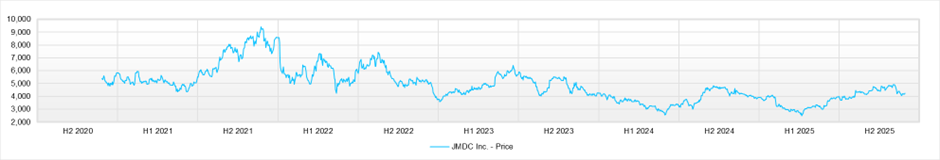

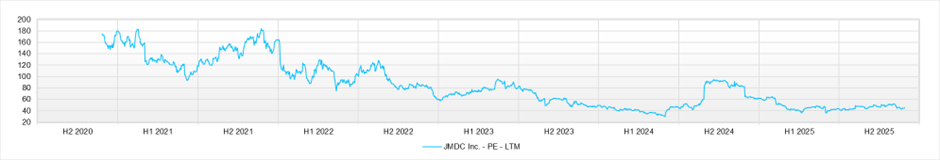

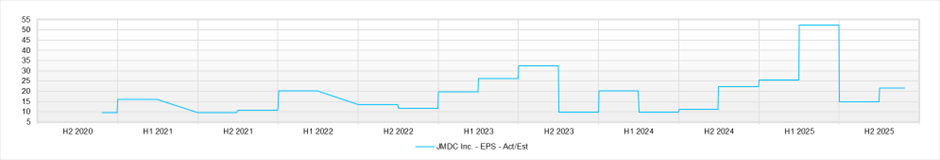

Although the company has achieved high growth with an EPS CAGR of +25% over the past five years, its share price has underperformed for nearly 4 years from 2022 to the most recent date. We consider the main background to be the rapid increase in goodwill and the expansion of assets resulting from hasty corporate acquisitions, which in turn have pushed economic value creation into negative territory.

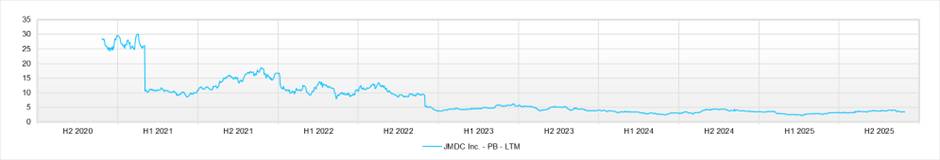

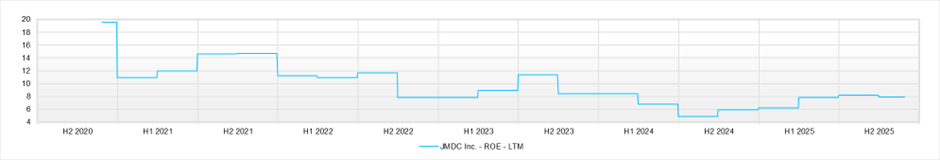

During this period, as corporate acquisitions have accelerated, goodwill has surged with a CAGR of +50% over the past five years and now accounts for around 40% of total assets. At the same time, amortisation expenses have also increased with a CAGR of +25%, reaching around 33% of operating profit and weighing on earnings. Interest-bearing debt has also built up significantly, and while ROE currently appears to be holding at a reasonable level of around 8%, economic profit, taking into account invested capital and the cost of capital, has fallen into negative territory.

Although the annual securities report briefly outlines the impairment testing for goodwill, investors cannot verify the underlying assumptions or sensitivities. Despite this, given that intangible assets centred on goodwill account for nearly half of total assets on the balance sheet, cautious investors have little incentive to take on aggressive risk.

The largest shareholder, Omron, holds 54.2% of the company’s shares, and because its parent company has a strong reputation for ROIC-focused management, the market envisages fundamental management reform through a takeover bid leading to full ownership. However, if a TOB were implemented under current conditions in which economic value creation is negative, it would likely become a factor that would impair Omron’s shareholder value. The likelihood that Omron’s management would carry out a TOB under such conditions is not high, and it is hard to regard this as a scenario that should be priced into the share price at present.

From a valuation perspective, based on assumptions of a forward PER of 37.6x, an actual PBR of 3.50x, a forecast ROE of 9.5%, forecast EPS of 113.2 yen, and a forecast dividend of 17 yen, we estimate that the medium- to long-term EPS growth rate implied by the market is roughly 8%. By contrast, the EPS CAGR over the past five years is +25%, and this gap is significant. In other words, the market takes a pretty sceptical view of the sustainability of the company’s high growth. Given the bloated balance sheet, negative economic value creation, and the unpredictability of impairment risk, the valuation is considered reasonable and demonstrates foresight. To raise our investment stance from “Avoid”, we require concrete signs of improvement in a healthier balance sheet, including goodwill, other intangible assets, and borrowings.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)