Advantest (Price Discovery)

Sell

Profile

A world leader in semiconductor test equipment, focusing on non-memory devices and the leading position in DRAM. The company’s product portfolio includes integrated circuit test systems, electron beam lithography, scanning electron microscope measurement, solid-state drive test systems, terahertz spectroscopy, and other electronic measurement equipment. The company operates in Japan, the United States, Europe, Singapore, China, Taiwan and South Korea. It was established in December 1954 by Ikuo Takeda and is headquartered in Tokyo. Sales by business segment % (OPM%): Semiconductor and Component Test Systems 68 (28), Mechatronics-related 11 (17), Services and others 21 (-3) [Overseas] 96 (FY3/2024)

| Securities Code |

| TYO:6857 |

| Market Capitalization |

| 6,175,865 million yen |

| Industry |

| Electronic equipment |

Stock Hunter’s View

SoC testers are performing well against the backdrop of demand for AI. Growth is expected to continue in the next fiscal year and beyond.

Advantest is a world leader in semiconductor test equipment (semiconductor testers). It has a competitive edge with an estimated market share of around 56% for memory testers and around 59% for SoC testers in 2023.

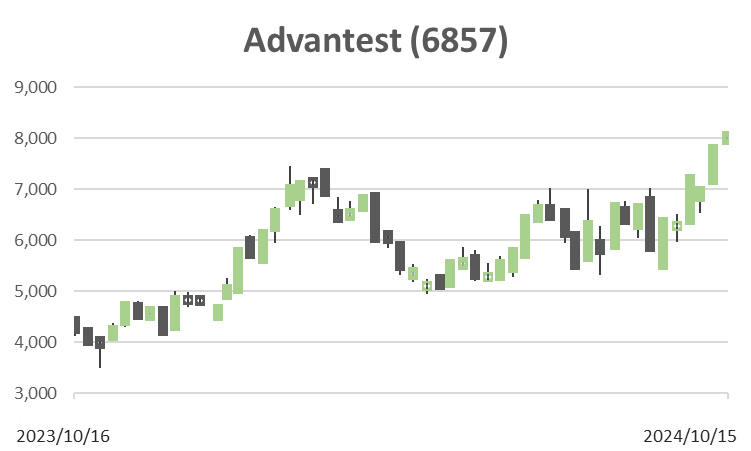

Since July, there had been a growing sense of caution that investor expectations for NVIDIA were getting too far ahead, but when Micron Technology’s earnings report on 25th September confirmed the strength of the DC (data centre) market, Japanese stocks related to the sector, which had been in a period of adjustment, regained their momentum. Recently, there has been a succession of increases in the target share prices of domestic brokers, and Advantest is highly favoured among semiconductor-related companies.

At the end of July, the company revised its earnings forecast for the current fiscal year, increasing its net sales forecast from 525 billion yen to 600 billion yen (a 23.3% increase YoY) and its operating income forecast from 90 billion yen to 138 billion yen (a 69.1% increase YoY). The company is currently enjoying high-end demand related to AI. The product mix has improved, and the gross profit margin has improved significantly in Q1. In addition, the company has largely completed the disposal of excess testers in Q1. The Q2 results, which are scheduled to be announced on 30 October, should also continue to attract attention.

The sales composition ratio of SoC testers is expected to increase further from 2025 onwards. The increase in edge AI devices, such as AI smartphones and AI PCs, is expected to drive strong demand for testers.

Investor’s View

Sell. There is no supportive valuation, and the share price is expensive, having discounted high expectations for vague medium- to long-term growth. The share price is at the top of the consensus cycle, and the risk is high, although the past is only an imperfect predictor of the future.

Price

PBR

Demand for testers in CY2024 is expected to be 15% higher than the previous year at the midpoint, and the management team’s initial forecast was conservative. This is why the company revised up the earnings forecasts at the end of July.

Most recently, approximately 50% of the company’s sales were from SoC testers, and just over 20% were from memory testers. For FY2024 full-year sales, management expects that 80% of SoC tester sales will be for computing and communications and 20% for consumer use, including automotive. While consumer demand is lacklustre, the increasing complexity of HPC/AI semiconductors is driving demand for SoC testers higher than management had anticipated, and this is thought to be a significant factor behind the high share price multiple.

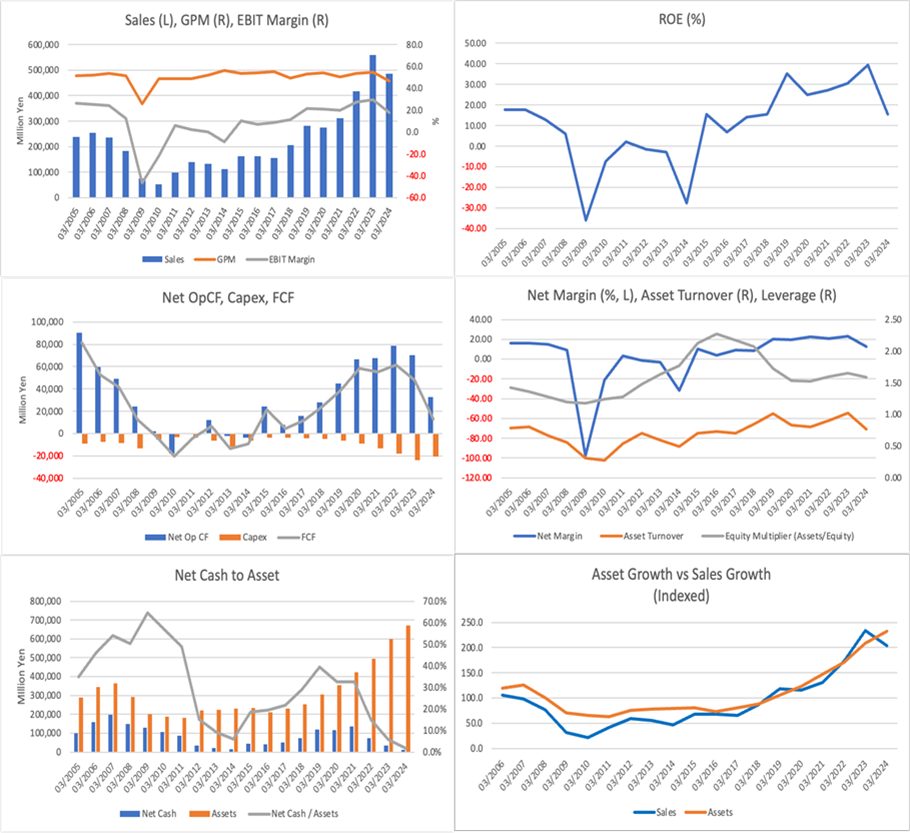

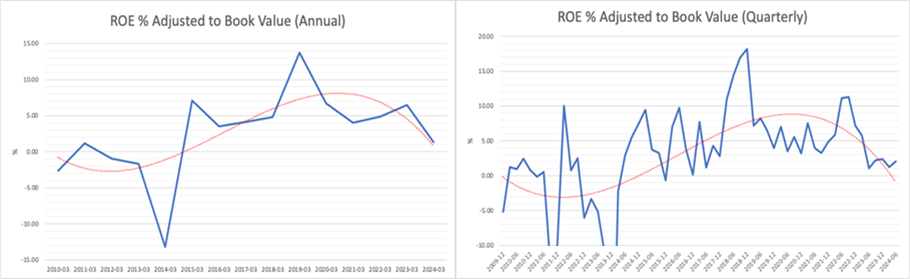

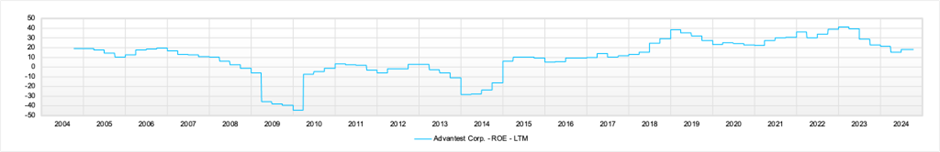

In the medium to long term, demand for testing will grow steadily as the complexity of SoC semiconductors for AI increases, and demand for testers will grow. In addition, the improvement in the product mix of SoC testers, driven by the rise in AI devices, is expected to impact profit margins positively. As the results over the past 20 years show, the management team is appropriately controlling BS not to burden ROE, and we expect ROE to remain high.

However, there are no supportive valuations for the company’s share price, and the share price is overvalued. The equity yield, i.e., ROE adjusted for PBR, is not attractive, staying around 2%. In addition, the beta has risen sharply, making it difficult to create economic value.

Equity Yield

Economic Value Creation

The strong performance in FY2024 is probably already reflected in the share price. More than 90% of major brokers rate the share a buy, and the share price is at the top of the consensus cycle for the past two years. The share price has risen by 35% in the past month and 77% since the beginning of the year. It is currently incorporating vague expectations for the medium to long term and will easily fluctuate depending on NVIDIA’s short-term earnings for the time being. The share is extremely high-risk.

PER

ROE

EPS

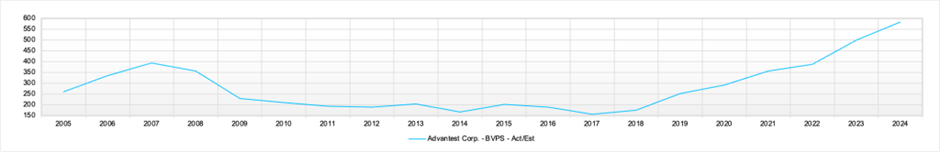

BPS