INTLOOP (Price Discovery)

Buy for Long-term

Profile

Provides consulting services through a mixed team of registered freelancers and employees and freelance staffing and system development support services. Established in 2005 by Hiroshi Hayashi. Sales by business segment %: Professional Human Resources Solutions & Consulting 100 <FY7/2024>

| Securities Code |

| TYO:9556 |

| Market Capitalization |

| 25,743 million yen |

| Industry |

| Service |

Stock Hunter’s View

Steady progress towards achieving medium-term targets. Expansion of new business areas with the potential for high profitability.

INTLOOP provides consulting services that use its employees and freelance professionals. Along with its business growth, the company’s efforts to achieve its medium-term targets attract attention.

For the year ending July 2025, the company plans to achieve record profits for the second consecutive year, with sales of 34.55 billion yen (up 27.6% YoY) and operating profit of 1.97 billion yen (up 30.7% YoY). It will continue to invest in ‘shaking out the foundations’ by investing in human resources, replacing its core systems, and relocating its head office.

The company got off to a good start in the most recent 1Q (August to October) financial results, with sales of 7.962 billion yen (up 63.3% year-on-year) and operating profit of 506 million yen (up 2.8 times year-on-year). The company expects the same growth trajectory to continue from the previous year’s fourth quarter to the current year’s first quarter in the second quarter. It also expects to see an increase in projects in all customer segments in the second half of the year due to the success of the sales system reinforcement it has been working on since the previous year.

Last year, there was a succession of collaborations, including with Itochu (8001) and Alt (260A), and progress was seen in expanding new business areas. Against this backdrop, on 30 January, Asahi Foods and the company announced a joint venture to create a buyout fund specialising in the food industry. The fund-related business in the medium-term plan has also started, and the path towards high profitability by 2030 is gradually being implemented.

Investor’s View

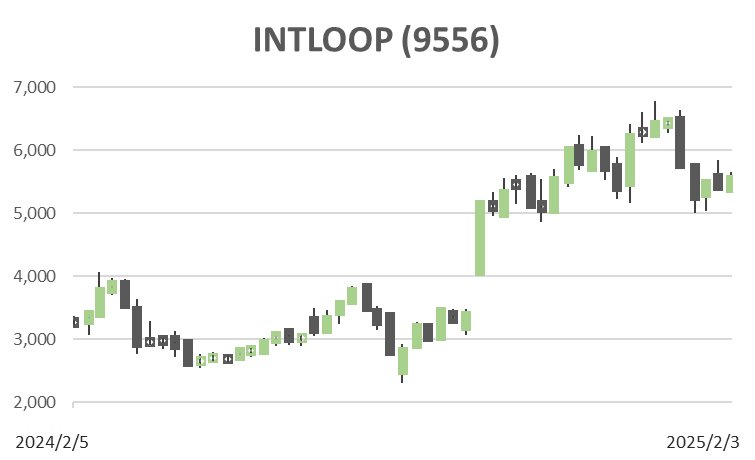

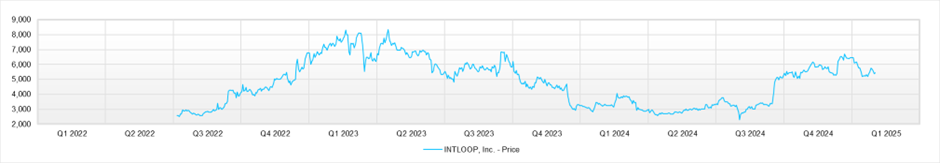

The attraction of the shares includes the possibility of an eventual takeover, making it a good investment for long-term investors.

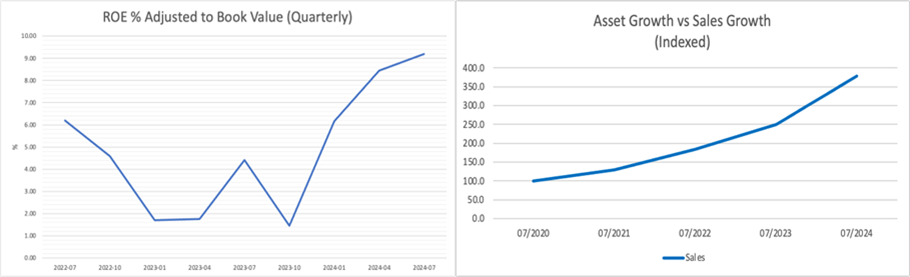

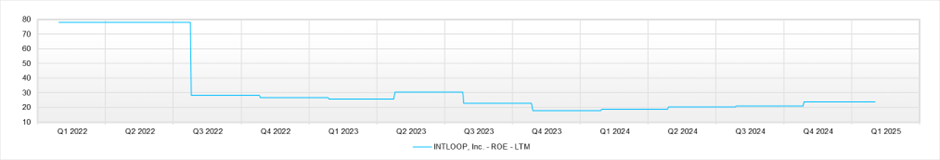

The company’s ROE is excellent in the snapshot, and its economic value and cash flow generation are abundant. As Stock Hunter points out, top-line growth is also strong. However, the company’s business structure, which relies heavily on outsourced labour, weighs so much on its profit gearing that even if sales continue to be strong it is difficult to expect attractive profit margin growth.

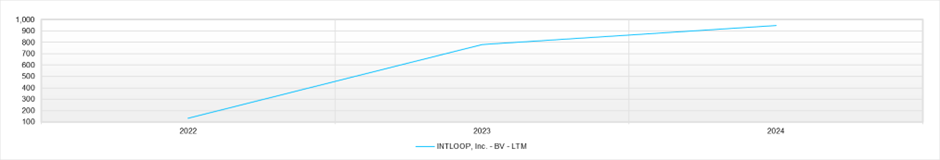

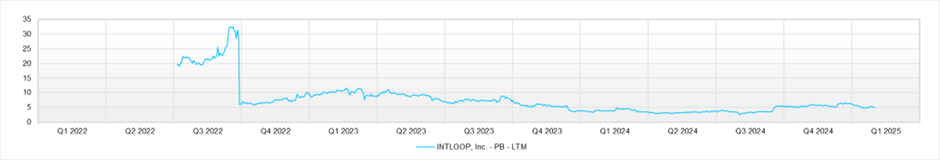

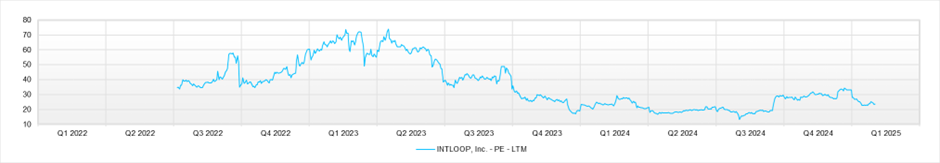

As shown in the above graphics, the company’s current profit margin is mediocre, and its high ROE of around 20% is primarily attributable to its high asset turnover. The company’s GPM is less than 25%, and its net profit margin is around 4%, slightly lower than the TOPIX average of 25% and 6.4%, respectively.

In FY7/2024, 99% of the cost of sales was made up of labour costs and outsourcing costs, which are estimated to be labour costs. Outsourcing costs account for 86% of the cost of sales, making the company a unique business; the high degree of dependence on registered freelancers is surprising. Unless there is a significant increase in the unit price of services, there will be no significant growth in profit margins with this structure.

The burden of capital investment is low, and the cash accumulation on the slim BS will be fast, significantly suppressing the return on capital. EV/EBITDA is about 12 times, which is not particularly attractive. Still, other companies, such as collaborative partners, may well try to make a TOB before the company’s value increases. Although the timing is impossible to predict, this is a major attraction of the shares, and the current share price is attractive for investors who hold them for the long term.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

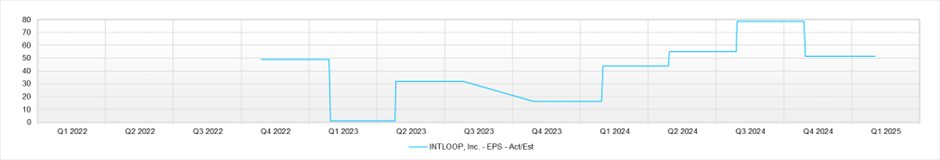

EPS (LTM)

BPS (LTM)