Shin Nippon Biomedical Laboratories (Price Discovery)

Buy

Upfront investment and TR losses weigh profits, but CRO earnings appear to be bottoming out.

Profile

A CRO with strength in non-clinical trials, with FDA approval achievements, expands globally.

A comprehensive contract research organisation (CRO) specialising in pharmaceutical development support, with particular expertise in primate studies and intranasal formulation technologies. The company has achieved U.S. FDA approval for its proprietary drug and is rapidly expanding its global non-clinical CRO infrastructure. Its affiliate, Shin Nippon Biomedical Laboratories PPD, is accelerating growth under the Thermo Fisher umbrella.

Segment Revenue Composition (Operating Margin):

CRO 97% (27%), Translational Research 0% (▲186%), Medipolis 2% (▲45%), Others 1% (6%) (FY3/2024)

| Securities Code |

| TYO:2395 |

| Market Capitalization |

| 54,289 million yen |

| Industry |

| Service |

Stock Hunter’s View

Experimental monkeys are expanding in market share. Migraine drug receives U.S. FDA approval.

SNBL is a CRO (Contract Research Organisation) with a strength in primate testing (non-clinical phase) in pharmaceutical development support, serving pharmaceutical companies as clients. In 2023, it established breeding facilities in Japan, successfully shortening lead times from order to testing. Backed by strong procurement capabilities, favourable order momentum is expected to continue, and a trend toward market share expansion under advantageous competitive conditions is observed.

In addition, the company operates a TR (Translational Research) business engaged in drug discovery, the Medipolis business involved in hospitality and geothermal power, and other corporate-wide operations. Most recently, in the TR business, U.S. subsidiary Satsuma Pharmaceuticals announced that its intranasal migraine drug “Atzumi” received marketing approval from the U.S. Food and Drug Administration (FDA). While migraine drugs have a long history, Atzumi is the first to achieve a powder formulation, allowing for better drug retention and absorption in the nasal mucosa with minimal side effects.

The company stated, “future royalty income from Atzumi has a potential of several billion yen annually.” It is accelerating negotiations with sales partners and aims to launch sales within the year.

Investor’s View

BUY. Upfront investment and TR losses weigh profits, but CRO earnings appear to be bottoming out. The company is breeding laboratory monkeys, which may lead some investors to exclude it from their investable universe on ethical grounds. This report sets that issue aside in forming its investment judgement.

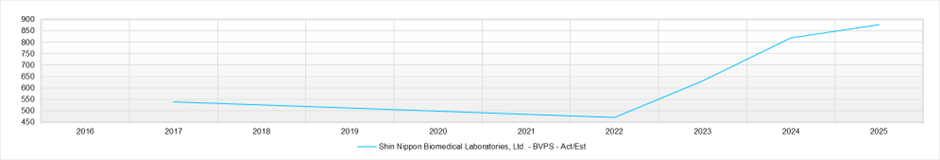

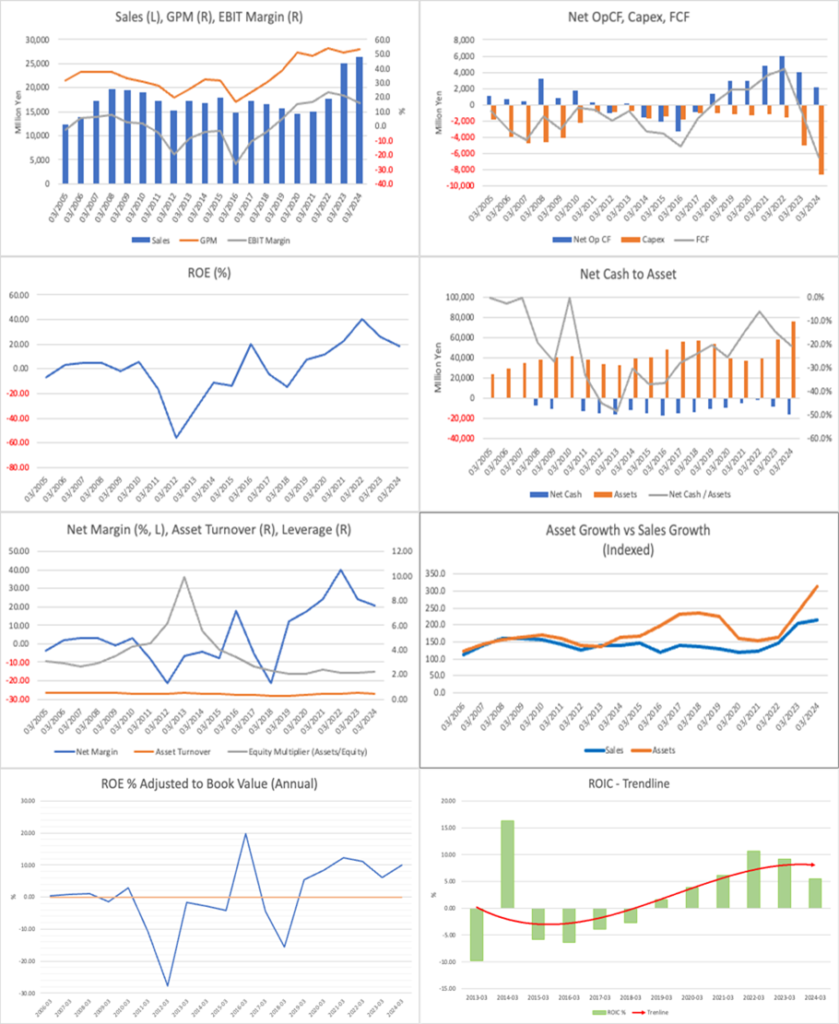

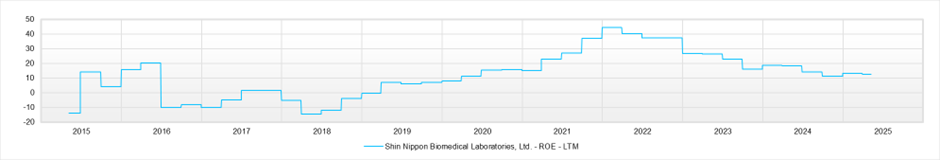

The company has actively reinvested the cash flow earned from strong performance over the past 4–5 years into developing infrastructure to accommodate increased overseas demand in its non-clinical business. As a result, free cash flow is negative. The balance sheet has expanded, and while ROE remains high, it has been somewhat suppressed. The same trend is seen in ROIC.

In FY2024, while the CRO business posted 7 billion yen in operating profit, the TR (Translational Research) business recorded an operating loss of 4 billion yen, resulting in 3 billion yen in consolidated operating profit. An additional 3.5 billion yen in equity method profit raised ordinary profit to 6.5 billion yen. The TR loss was due to expenses related to Satsuma Pharmaceuticals’ resubmission to the FDA for its intranasal migraine medication. The equity method profit stems from clinical operations at Shin Nippon Biomedical Laboratories PPD, a joint venture with U.S. clinical CRO PPD.

The CRO business remains robust, and the recent strategic investments are expected to bear fruit. Although TR profitability is difficult to predict, the FDA’s approval of “Atzumi” warrants a positive watch. Shin Nippon Biomedical Laboratories PPD continues to exhibit profit growth.

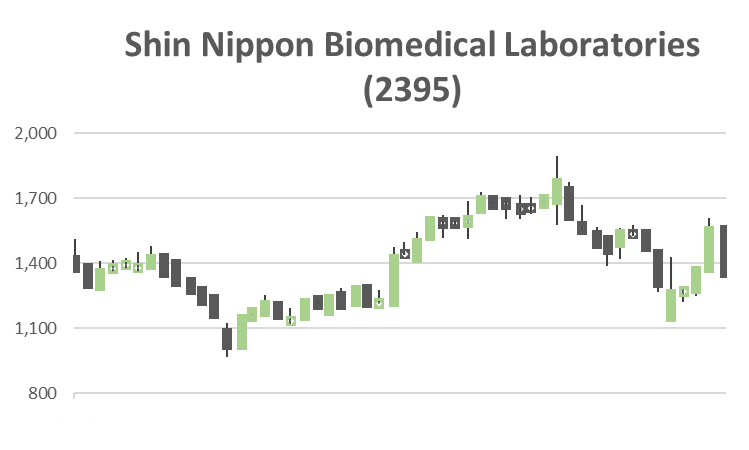

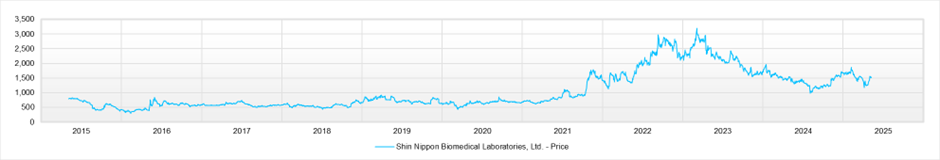

The stock price has underperformed since 2023 due to three consecutive years of declining profits. The background to this decline lies in upfront costs to strengthen the CRO business, including rising personnel, R&D, animal care expenses, and the construction of new research facilities. With the stock price declining, the earnings yield is just under 10%, making it attractive. The CRO earnings are expected to bottom out as the capacity expansion’s revenue impact materialises. Unless significantly negative news from the drug discovery division, the stock will likely recover to fill the upside potential.

Business Performance and Profit Structure

CRO drives earnings, while TR losses and investment burdens reduce profitability.

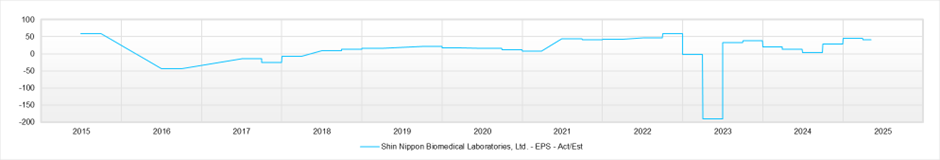

In FY2025, consolidated revenue rose 22.5% year-on-year to 32.4 billion yen, while operating profit fell 28.3% to 2.98 billion yen, marking a revenue increase and profit decline. The operating margin dropped sharply from 15.7% to 9.2% due to deepening losses in the Translational Research (TR) segment. The CRO segment maintained stable growth, with revenue of 31.6 billion yen (+22.1% YoY) and operating profit of 7.26 billion yen (+3.3%).

Conversely, the TR business posted a loss of 2.32 billion yen, worsening by about 1 billion yen from the previous year. This was due to increased expenses for Satsuma’s FDA resubmission. Sales in the TR business were limited to just 54 million yen, indicating that it remains at an uncertain commercial stage. The Medipolis business also remained red, with an operating loss of 420 million yen.

Ordinary profit fell 8.1% to 6.45 billion yen, but this was underpinned by 3.27 billion yen in equity method income from Shin Nippon Biomedical Laboratories PPD, which hit a record high. Without this, ordinary profit would have dropped significantly.

Operating cash flow remained strong at 7.03 billion yen, but investment cash flow was negative 11.7 billion yen due to large-scale capital investments in the non-clinical segment. As a result, free cash flow was a large deficit of approximately –4.7 billion yen.

While profitability in the CRO segment is maintained, losses in the TR business and capital outflows from investments negatively impact profit metrics and financial stability.

Strategic Growth Investment

Personnel and facility investments for growing overseas orders are laying the foundation for long-term growth.

SNBL positions the expansion of overseas orders in the non-clinical segment as a clear growth driver and continues strategic capital investment and recruitment to support it. Over the three years through FY2025, cumulative capital investment reached approximately 29 billion yen, with further investments planned for FY2026.

Overseas order intake surged 75.0% year-on-year to 12.34 billion yen, and the backlog hit a record high of 34.4 billion yen. Orders from Western clients stood out. In response, the company established a dedicated Global Study Team at its safety research institute to strengthen capabilities for international trials. As of March 2025, the total number of employees reached a record high of 1,436, and while personnel costs are heavy, they are expected to support long-term earnings growth.

The new research facility, completed in 2024, includes equipment to support MPS (Microphysiological Systems), positioning SNBL to respond to new testing methodologies such as NAMs (New Approach Methodologies).

Capital Policy

The dividend payout ratio is rising while maintaining sound finances, with potential for expanded shareholder returns.

As of the end of FY2025, the equity ratio stands at 43.3%, maintaining a stable financial foundation. Total assets reached 92.4 billion yen, a significant increase from the previous year. This increase is primarily attributable to capital investments and the accumulation of equity method income.

The company maintains an annual dividend of 50 yen per share, and the payout ratio rose to 42.3% (from 37.6% in the previous year). A continuation of the 50 yen dividend is planned for FY2026, with a forecast payout ratio of 58.6%.

Management has articulated a policy to enhance corporate value and capital efficiency over the medium to long term. As future royalty income becomes more visible, the company may consider strengthening shareholder returns further.

Risk

The company faces TR revenue uncertainty, rising fixed costs, and ESG-related demand-side risks.

First, there is the risk of profit volatility in the drug discovery business. If Satsuma’s product launch is delayed or royalty income falls short of expectations, it could significantly impact its overall earnings structure.

Second, there is the risk of rising fixed costs such as labour and administrative expenses. As the company continues to secure and retain R&D personnel domestically and internationally, associated costs increase. A decline in operating rates or worsening external conditions may compress margins.

Third, there is a supply-demand risk. Due to the company’s use of experimental non-human primates, certain institutional investors may exclude the stock from their investable universe, and it is expected to take time for institutional ownership to recover.

Stock Price and Valuation

While the stock price has stagnated, earnings recovery and royalty visibility offer upside potential.

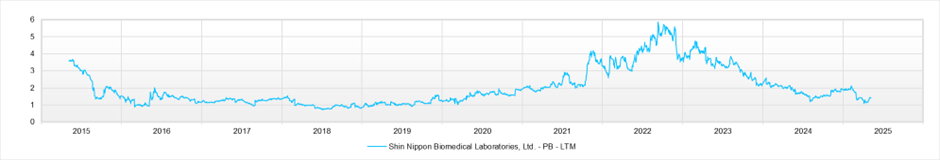

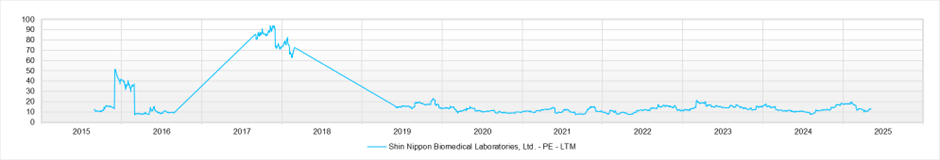

As of May 2025, the stock price is 1,520 yen, and the market capitalisation is approximately 63.2 billion yen. The forward PER is 14.4x (FY2025) and 12.7x (FY2026), and the actual PBR is 1.4x. ROE for FY2025 stands at 13.3%.

The stock has declined since peaking in 2023 amid three consecutive years of declining profits. However, assuming the CRO segment’s capacity enhancements begin to contribute to earnings and TR losses remain within range, upside potential is likely to be recognised. Should royalty income from the drug discovery segment begin to materialise, the stock could be revalued as a growth name.

Shareholder Structure

The founding family holds a dominant share, with limited float and slow institutional ownership recovery expected.

As of May 2025, approximately 67.0% of outstanding shares are held by major shareholders.

The largest shareholder is the founding Nagata family, which owns 40.3% (16.79 million shares). Related entities such as Medipolis Medical Research Institute (3.5%) and Mr. Takahisa Nagata (4.8%) are also significant holders. Combined, the founding group controls over 50% of the shares.

The float is relatively limited. Foreign institutional holders include The Vanguard Group (1.6%) and Norges Bank (0.9%), but positions are small.

Among Japanese institutional investors, Nomura Asset Management (1.9%), Sumitomo Mitsui DS Asset Management (1.9%), and Asset Management One (1.4%) rank near the top. Notably, Asset Management One reduced its position by 1.038 million shares in the past six months.

The limited float and ethical concerns related to the use of primates may influence investor behaviour, potentially leading to a slow recovery in institutional ownership in the near term.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)