WEATHERNEWS (Price Discovery)

Long-term Buy

Profile

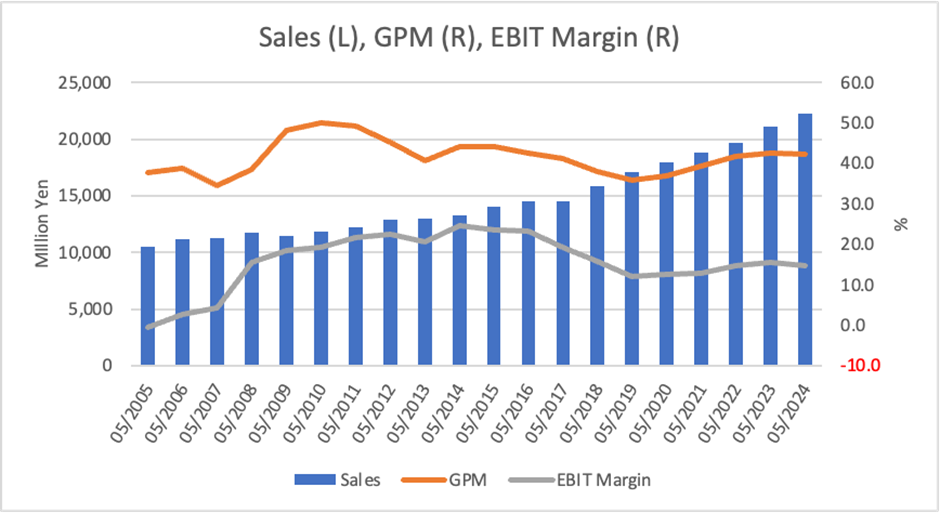

Weathernews is a SaaS-based company that provides information services grounded in meteorological and environmental data. It operates globally for both corporate (B2B) and individual (B2S) clients. For corporate clients, the company delivers services such as route optimisation and disaster prevention support for the shipping, aviation, and infrastructure sectors. For individuals, it generates subscription and advertising revenues through its proprietary app, “Weathernews.”

Leveraging Japan’s largest weather observation network, a vast user community, and AI-enhanced forecasting accuracy, the company has established a business model that contributes to solving societal challenges. In recent years, it has expanded into CO2 reduction support services and climate change-responsive data provision, thereby solidifying its position as a weather data platformer.

Revenue composition by segment % (OPM%): Sea 26, Sky 6, Land 31, Internet 37【Overseas】25 (FY5.2024)

| Securities Code |

| TYO:4825 |

| Market Capitalization |

| 88,593 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Opportunities expand with abnormal weather. Now navigating 10,000 large vessels.

Weathernews is the world’s largest private-sector weather information company. As of January 2025, its weather app had 45 million cumulative downloads, and both increased user numbers and engagement have contributed to rising advertising and subscription revenue.

Demand for corporate services is strong, in addition to individuals. The main growth driver is the company’s original domain, the globally deployed “Sea Domain,” which provides operational information and other services to over 10,000 vessels worldwide based on proprietary weather data.

Although shipping market conditions have slightly weakened due to ongoing logistics disruption stemming from Middle Eastern instability and U.S. tariff policies, the Sea Domain continues to expand its client base, particularly among large ocean-going vessels over 10,000 tonnes. Revenue remains firm, supported by increased unit prices among large European clients.

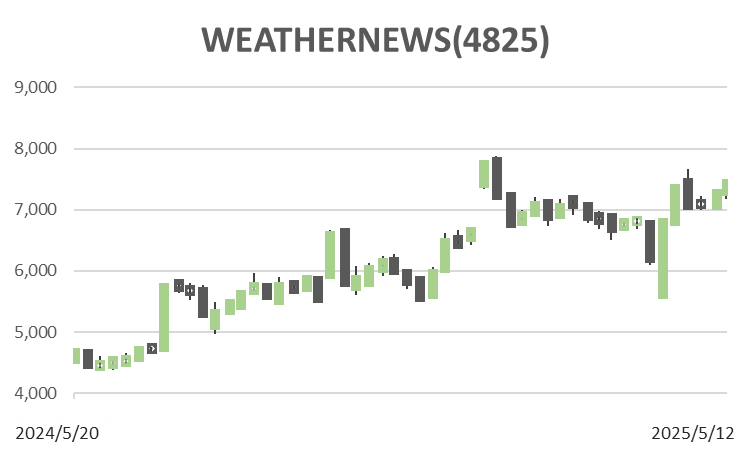

Elsewhere, sales to airline clients are growing, particularly in Asia, while on land, the number of clients in the expressway sector is rising. Internally, AI-driven systemisation of operational workflows is progressing, resulting in improved profit margins through efficiency gains. The company has successfully reduced around 3,000 hours of internal work per month and recently raised its FY5/2025 full-year operating profit forecast from 3.8 billion yen to 4.2 billion yen (a 28.4% YoY increase).

Investor’s View

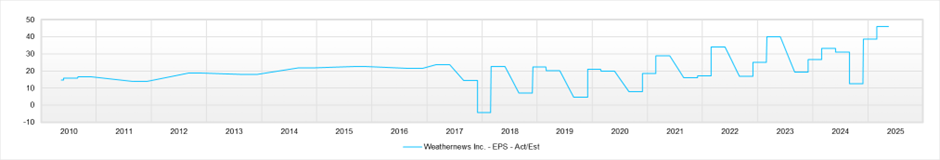

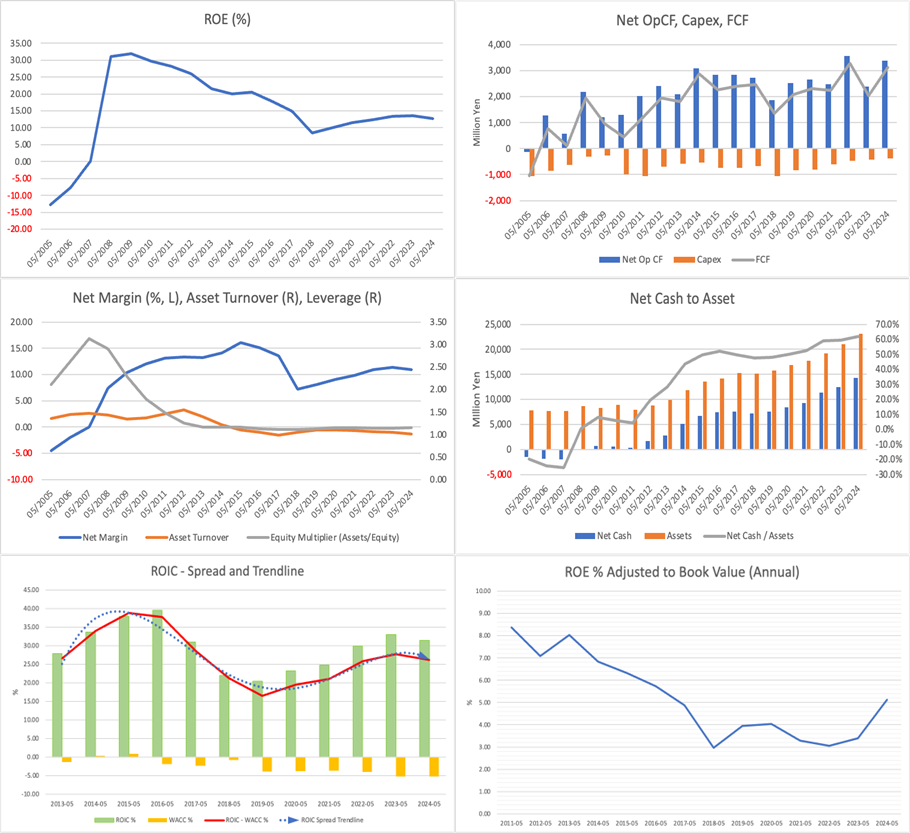

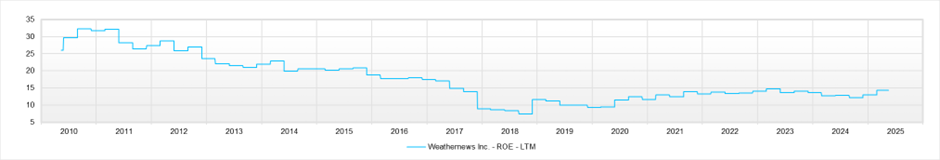

Long-term Buy. Stable revenue growth (CAGR 5.5%) and sustained profit margins over the past 5–6 years, with ROE consistently around 13%. Despite market uncertainty under Trump-era tariffs, earnings have remained solid. The most notable feature is the company’s robust cash flow generation. Net cash amounts to 62% of total assets, an excessive level even in light of its strategy of building a stock-based business model. The current PER is just under 30x, and the implied profit growth rate is approximately 6%. If EPS growth of 15% is factored in, the stock appears to have room for revaluation. Depending on capital policy, there is increasing potential for expanded shareholder returns.

If management voluntarily improves its literacy in capital markets, the company has considerable scope to deliver large-scale shareholder returns. Even if this does not materialise, it is likely only a matter of time before the substantial cash position on the balance sheet attracts shareholder pressure.

The current PER stands just under 30x, and based on the Gordon growth model, the implied growth rate is approximately 6%. Compared to the market’s forecasted EPS growth of around 15%, this reflects a conservative valuation. Moreover, should management raise the dividend payout ratio to 100%, the theoretical PER would exceed 50x.

Thoughts

Capital efficiency is the key issue behind the company’s strong cash generation and defensive business structure. The market’s attention is focused on management’s capital policy choices.

Weathernews has achieved stable profit margins and revenue growth over the past five years, with a five-year CAGR of 5.5% and ROE consistently around 13%. Even during the unstable market conditions of the 2020s—marked by U.S.-China tensions, Trump-era tariffs, and logistics disruptions in the Middle East—the company has posted numbers that underscore the resilience of its business model.

However, its huge cash position is the most significant focus in evaluating the company’s enterprise value. Net cash accounts for over 60% of total assets, and operating cash flow exceeds 3 billion yen annually. The equity ratio stands at around 85%, making the balance sheet extraordinarily sound, but this suppresses ROIC, and ROE has stagnated due to the absolute increase in equity capital. While the business model backed by stable, stock-type revenue warrants a favourable evaluation, this “idle capital” poses the risk of impairing economic value creation.

Currently, the company trades at a PBR of 3.99x and a PER just under 30x—levels that reflect its status as a “safe asset” and the market’s expectations of future capital reallocation. ROIC is estimated to be around 7%, with a 2–3 percentage point spread over WACC, but whether this spread can be maintained depends on future capital policy.

A stock revaluation would be inevitable if the company signals more substantial shareholder returns or proactive growth investment. Conversely, if its current cautious stance persists, the risk of activist intervention or external pressure via floating shares cannot be ruled out.

Shareholder Composition

A high proportion of stable shareholding by the founding family and internal entities is a defining feature. The key going forward will be balancing shareholder dialogue and flexibility in capital policy.

As of May 2025, the shareholder structure is dominated by the founding family and affiliated organisations, which collectively hold close to a majority. The largest shareholder is the WNI Weather Culture Creation Centre, with a 14.35% stake. Including other holdings under the founding family’s names—such as Taeko Ishibashi (2.99%), Shinichi Ishibashi (1.45%), and Tomohiro Ishibashi (1.45%)—as well as treasury stock (6.52%) and the employee stock ownership plan (3.95%), over 40% is effectively held by insiders and the founding family.

By contrast, external shareholders are more dispersed. Asset Management One holds 4.32%, followed by Nomura Asset Management (2.31%), Vanguard (1.71%), and Nippon Life Insurance (1.69%). Other foreign investors include Baillie Gifford, Norges Bank, and Dimensional, but none have established a dominant position in terms of governance influence.

This control structure enables management to make consistent, long-term decisions. Still, it has also raised concerns among investors calling for stronger engagement with the market and deeper literacy in capital strategy. Going forward, the balance between founding-family control and market discipline will likely become central to the company’s valuation narrative.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)