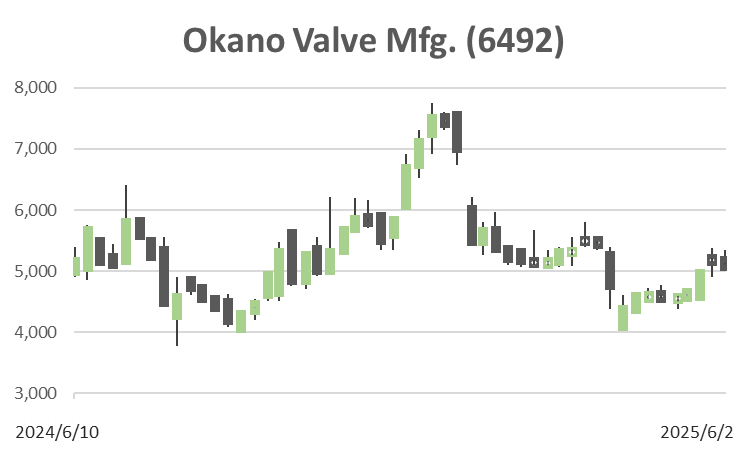

Okano Valve Mfg. (Price Discovery)

Buy for long-term accounts

Profile

Okano Valve Mfg. Co., Ltd. (6492) is a long-established manufacturer that was the first to successfully produce high-temperature, high-pressure valves for power generation domestically. Its core business is the manufacturing and maintenance of valves for power plants, with particular strength in demand related to nuclear power generation. The business comprises 100% of valve operations, with overseas sales accounting for a limited 6% (FY11/2024).

The company has a market capitalisation of 8.75 billion yen, PER around 7x, PBR 0.73x, and ROE approximately 10%. Net cash accounts for about 40% of market capitalisation, indicating room for improvement in capital efficiency. From FY ending September 2025, the fiscal year-end has been changed from November to September, resulting in an irregular 10-month fiscal period this year.

| Securities Code |

| TYO:6492 |

| Market Capitalization |

| 9,108 million yen |

| Industry |

| Machinery |

Stock Hunter’s View

Growing energy demand highlights nuclear-related plays. Hopes are also placed on next-generation nuclear power plants.

Okano Valve Mfg. succeeded in the first-ever domestic production of high-temperature, high-pressure valves for power generation. Its main business today is the manufacturing and maintenance of valves for power plants.

Regarding nuclear power, the government has indicated in its new Basic Energy Plan that it will utilise atomic energy to the maximum extent. Furthermore, about 10 billion yen is planned to be invested in establishing equipment for the technical demonstration of nuclear fusion, which produces energy by fusing atomic nuclei, by the 2030s. The company is working on developing valves for next-generation nuclear power plants such as small modular reactors (SMRs), and from time to time, it is regarded as a theme-based stock concerning small reactors.

Due to the change in fiscal year (from November to September), this year will be a 10-month irregular accounting period. Furthermore, in terms of profits, the high utilisation rate maintained by the maintenance division in the previous fiscal year is expected to return to normal levels. The recently announced 1Q (December–February) results started weakly, with operating profit at 173 million yen (down 35.5% YoY).

Meanwhile, as part of the power infrastructure, demand remains firm. From 2Q onwards, the valve manufacturing division plans sales to the Tokai Daini Nuclear Power Plant and the Kashiwazaki-Kariwa Nuclear Power Plant for specific severe accident facility valves, as well as for Unit 1 and Unit 2 of the Joetsu Thermal Power Plant. The maintenance division plans equipment installation at Unit 6 of the Kashiwazaki-Kariwa Nuclear Power Plant and decommissioning-related work at the Fukushima Daiichi Nuclear Power Plant.

Investor’s View

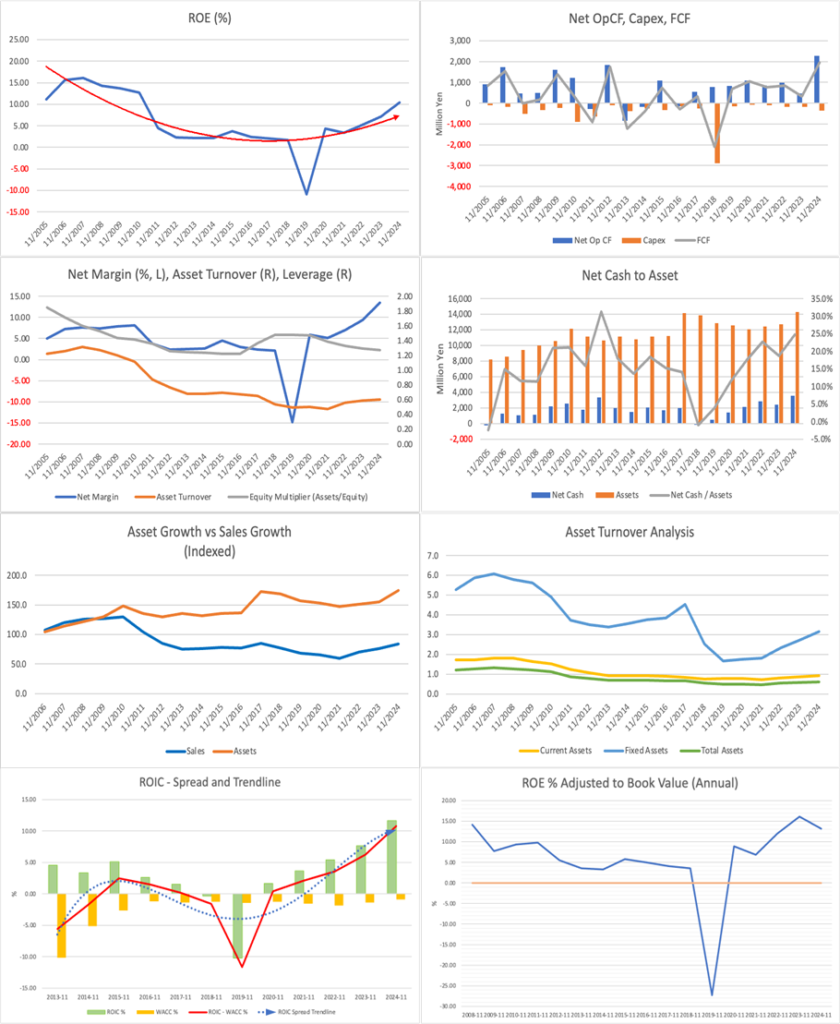

Buy for long-term accounts. The company’s earnings are unpredictable, and a conservative valuation multiple is appropriate. Nevertheless, the net-cash-adjusted PER is around 4x—astonishingly cheap. Over the medium to long term, revitalisation of nuclear demand presents a favourable environment. If the family-controlled management were to transform, shareholder return expectations could rise and the stock could attract popularity; however, such a change is unlikely unless an aggressive activist emerges.

Management is under family control and appears not to prioritise minority shareholders. On the other hand, the medium—to long-term nuclear-related business is expected to become more active, and the company’s future business environment is favourable. However, given the limited disclosure materials, it is impossible to forecast orders or profitability, making earnings forecasts difficult. Still, the net-cash-adjusted PER remains around 4x, and the stock is highly undervalued. Equity yield exceeds 10%, offering ample appeal.

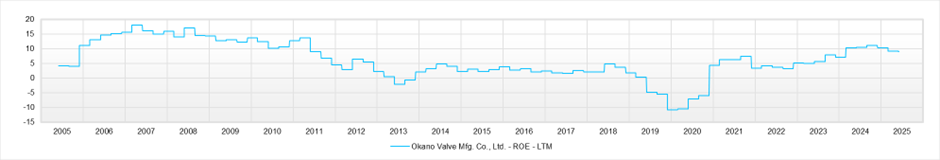

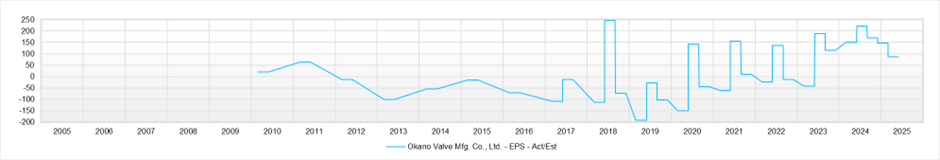

The equity ratio is 79%, which is excessive even if preparing for potential earnings volatility. The company has shown a remarkable turnaround from losses in 2019, and ROE has reached 10%. Still, cash has accumulated, with net cash amounting to 40% of the market cap, indicating poor balance sheet efficiency.

At the February 2025 general meeting of shareholders, a proposal to increase the dividend and payout ratio was rejected. The proposal sought to raise the year-end dividend to 160 yen and the 20 yen interim dividend already paid, aiming for a payout ratio of around 25%. For FY11/2024, the payout ratio was 7.17%, and for FY9/2025, which is 10 months due to the fiscal year change, the annualised ratio is 14.8%, indicating the company is not proactive in shareholder returns.

Hikari Tsushin holds a 6.3% stake. Mr. Tatsuro Kiyohara, a former fund manager at Tower Investment Advisory, has 4.9%, but both are believed to be long-term value investors and unlikely to engage in activism. Former President Masatoshi Okano, who served for 34 years, stepped down in 2020 but remains involved in management as an advisor without a fixed term. He is 82 years old. Although an IR department has been established, the management currently appears passive about IR. No medium-term management plan has been disclosed, nor are there earnings presentation materials or integrated reports. No English translations of disclosure materials have been prepared. Without a major earnings shock or hostile activist involvement, the company’s intrinsic value is unlikely to be reflected in the stock price.

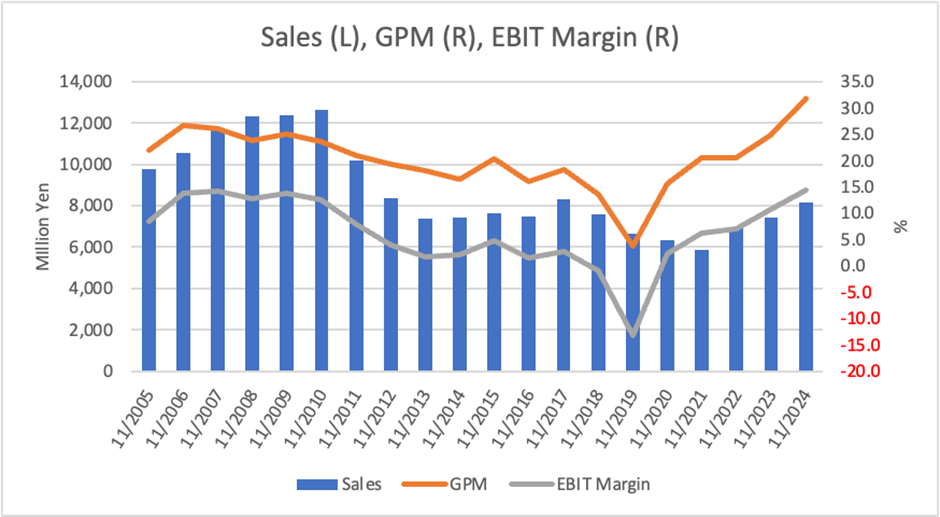

Earnings have been stable after a sharp recovery from the 2019 loss, though growth has recently slowed.

Having bottomed out with a loss in 2019, the company made a sharp recovery and has secured mostly stable earnings since 2021. In FY11/2024, it recorded net sales of 6.727 billion yen, operating profit of 818 million yen, ordinary profit of 909 million yen, and net income attributable to owners of the parent of 621 million yen. ROE stood at 10.1%, and the operating margin at 12.2%, reflecting sound profitability and capital returns by company standards.

Meanwhile, FY9/2025 is 10 months due to the fiscal year change. For the first quarter (December 2024–February 2025), cumulative results show net sales of 1.442 billion yen (–8.2% YoY), operating profit of 173 million yen (–35.5% YoY), ordinary profit of 206 million yen (–36.7% YoY), and net income of 137 million yen (–43.2% YoY), indicating a marked downward trend in profits. The operating margin has dropped from over 12% to around 6%, suggesting deterioration in cost structure.

PER adjusted for net cash is hugely undervalued. With few signs of governance reform, a catalyst is needed for revaluation.

The company’s share price has lacked a strong trend over the past five years and has remained in a long-term flat range. The PBR remains around 0.7x—below book value—and PER is also in the low 7x range on a headline basis and around 4x adjusted for net cash, which is extremely cheap. While ROE appears attractive at around 10%, capital efficiency is low considering the high equity ratio and ample net cash.

Assuming an annual dividend of 40 yen, the dividend yield is around 0.8% and is not appealing. Given the shareholder structure that rejected a proposal to increase dividends, aggressive shareholder returns through dividend policy or share buybacks are unlikely.

While stable shareholders dominate, signs of potential governance reform catalysts can be seen.

According to the latest shareholder structure, the founding family’s asset management company, Okano Sangyo, maintains control. The second-largest shareholder, Hikari Tsushin, holds 6.3%, and Mr. Tatsuro Kiyohara holds 4.9%. Both are confirmed as external long-term value investors, but neither shows signs of activism.

The floating share ratio is relatively low, restricting liquidity from a supply-demand perspective. At the February 2025 general meeting, the external shareholders’ proposal to increase dividends was rejected. Although the shareholder structure strongly reflects the founding family’s influence, it can catalyse governance reform.

Nonetheless, a shift in management stance is unlikely without significant changes in shareholder composition. Corporate value revaluation will require structural governance improvement or the emergence of activist investors.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)