CHUGAI RO (Company note – Basic)

| Share price (7/11) | ¥3,410 | Dividend Yield (3/26 CE) | 4.4 % |

| 52weeks high/low | ¥2,183/4,045 | ROE(3/25 act) | 10.7 % |

| Avg Vol (3 month) | 34.3 thou shrs | Operating margin (3/25 act) | 7.5 % |

| Market Cap | ¥26.59 bn | Beta (5Y Monthly) | 0.29 |

| Enterprise Value | ¥25.08 bn | Shares Outstanding | 7.800 mn shrs |

| PER (3/26 CE) | 8.9 X | Listed market | TSE Prime |

| PBR (3/25 act) | 0.9 X |

| Click here for the PDF version of this page |

| PDF version |

Leading manufacturer of industrial furnaces and burners in Japan. Business opportunities have emerged with the advent of carbon neutrality, and the Company is undertaking efforts to enhance corporate value through traditional means.

Summary

◇ Overview of CHUGAI RO: A leading domestic industrial furnace company under the slogan “Pioneering the future with thermal technology.” With a strong technology orientation, the Company has a track record of developing over 100 types of industrial furnaces since its founding in 1945, earning it the nickname “department store of industrial furnaces.” Its strength lies in its broad expertise in industrial furnaces.

◇ Carbon neutrality requirements for industrial furnaces: There are approximately 37,000 industrial furnaces in Japan, of which 5,000–7,000 are reportedly owned by the company. The CO₂ emissions produced by these furnaces amount to 12 million tons per year (base year FY2013), equivalent to 1% of Japan’s total emissions. To achieve carbon neutrality, it is necessary to reduce this amount by virtually 100%, which represents a significant business opportunity for the Company.

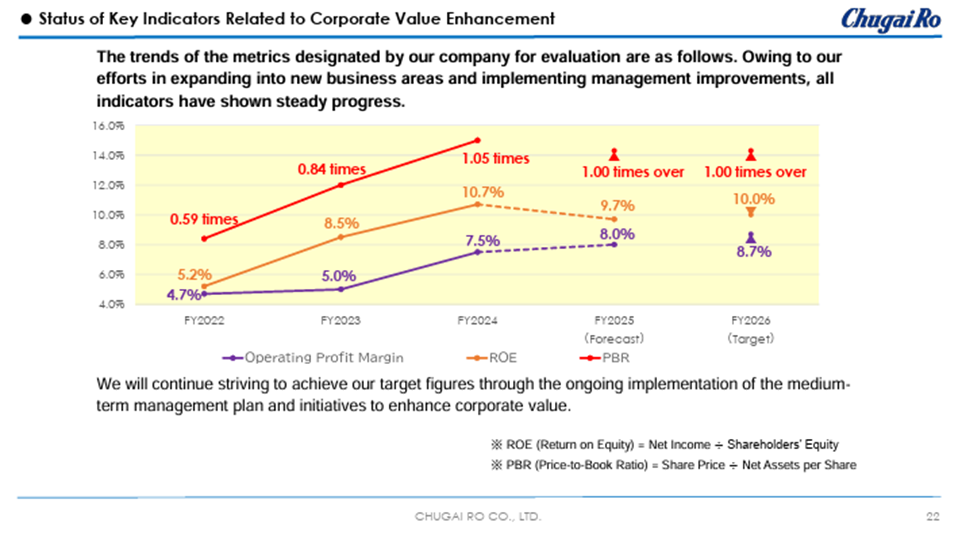

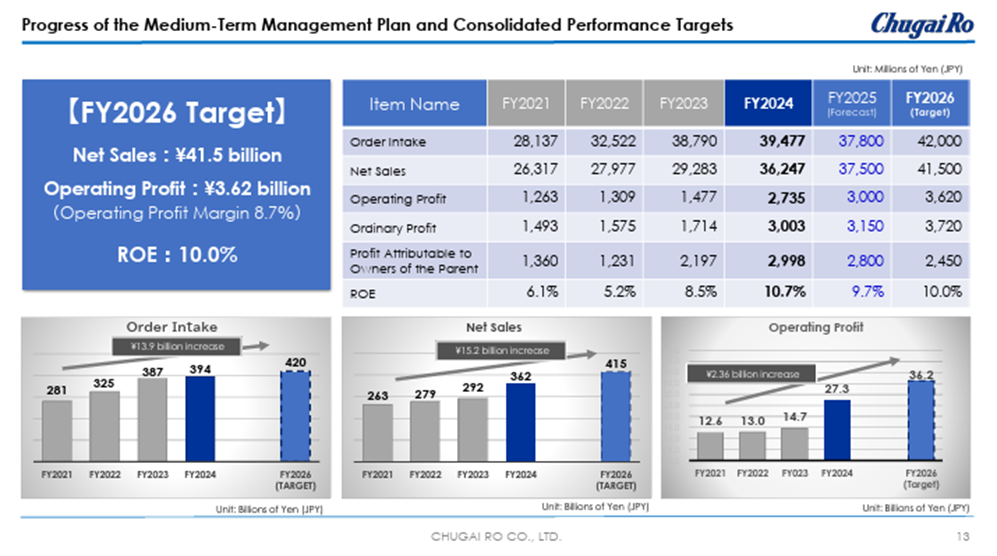

◇ Medium-Term Management Plan that sees carbon neutrality as a business opportunity: In light of this context, on May 13, 2022, the Company announced the “CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026).” The plan promotes three key strategies: “The creation of new markets centered on carbon neutrality,” “Brushing up of existing products suited to needs to expand sales and increase profits,” and “The creation of rewarding workplaces.” The Company aims to achieve 41.5 billion yen in net sales, 3.62 billion yen in operating profit (operating profit margin of 8.7%), and ROE of 10.0% in the final fiscal year ending March 2027.

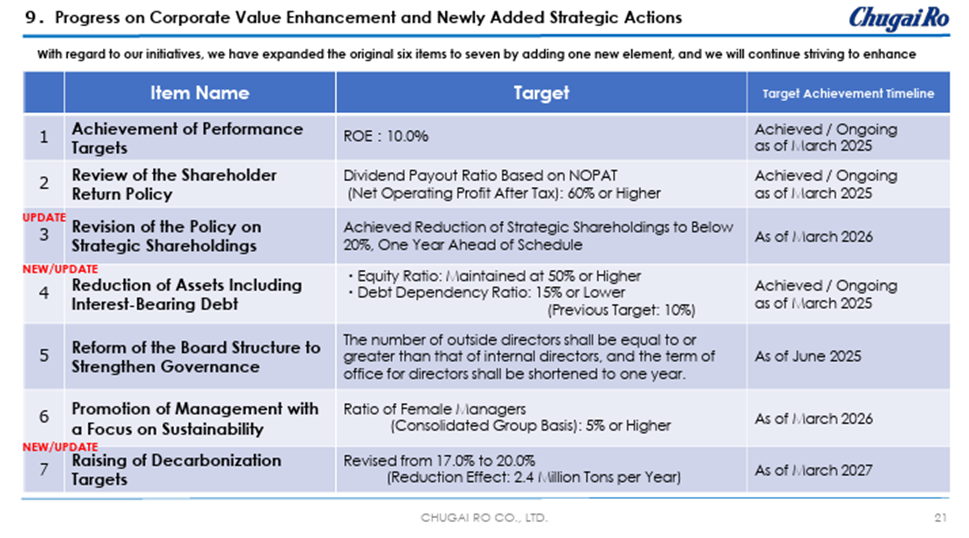

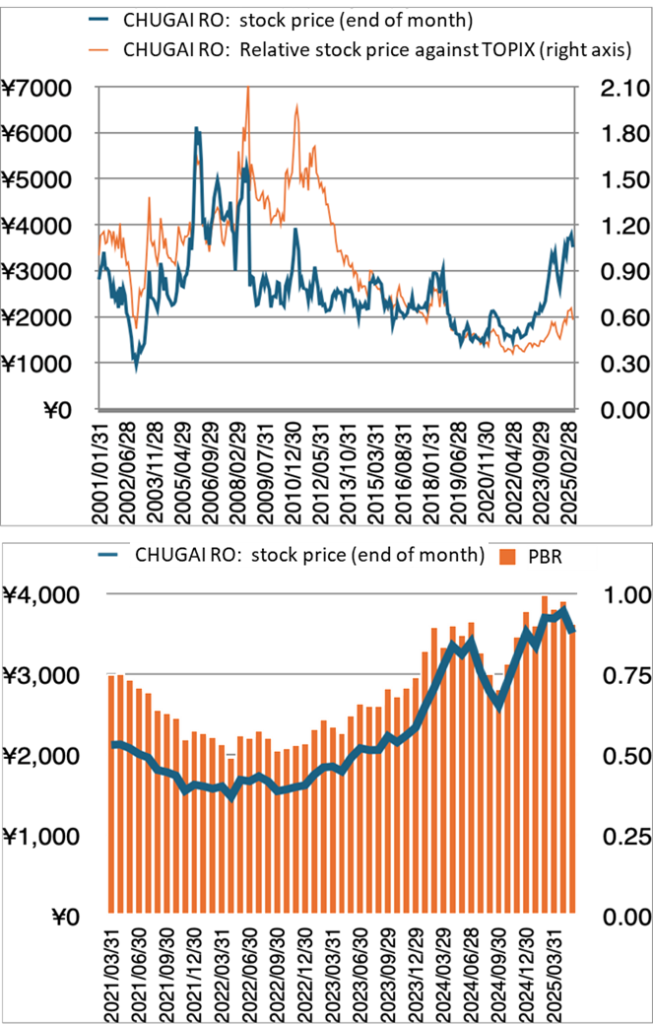

◇ Toward achieving and sustaining a PBR of 1.0: The Company is implementing many initiatives based on the “Initiatives to enhance corporate value” to achieve and maintain a PBR of 1.0. It is currently working on seven items, many of which have already been completed. The stock market has responded favorably to this management approach, and the PBR level has been rising. Although it temporarily exceeded 1.0 times, the current level is 0.86 times.

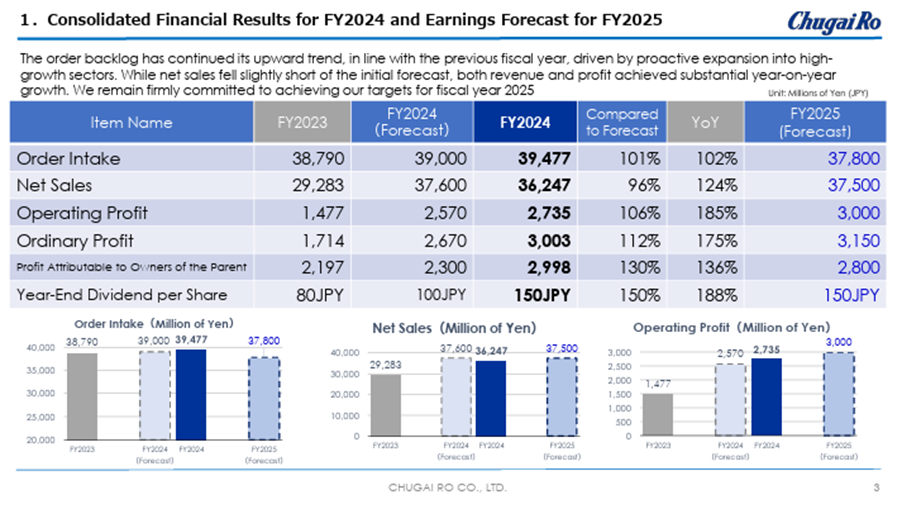

◇ Business trends: The Company’s recent performance is solid. For the fiscal year ended March 2025, order intake was 39.4 billion yen (up 2% year on year), net sales were 36.2 billion yen (up 24%), operating profit was 2.7 billion yen (up 85%), ordinary profit was 3.0 billion yen (up 75%), profit attributable to owners of parent was 2.9 billion yen (up 36%), and dividend per share was 150 yen (up 88%). The forecast for the fiscal year ending March 2026 is: order intake of 37.8 billion yen (down 4% year on year), net sales of 37.5 billion yen (up 3%), operating profit of 3.0 billion yen (up 9%), ordinary profit of 3.15 billion yen (up 4%), and profit attributable to owners of parent of 2.8 billion yen (down 6%), indicating steady progress toward achieving the goals of the final year of the Medium-Term Management Plan. The forecast for the dividend per share is 150 yen (unchanged). Still, the Company has a firm intention to enhance shareholder returns through dividend increases, and if operating profit increases as expected, it is highly likely to increase dividends.

◇ Stock price trends and catalysts: The recent stock price (3,335 yen) has broken through the 3,000 yen level, which had been a resistance line since the 2010s. The stock market appears to have heightened expectations for the Company’s timely Medium-Term Management Plan and initiatives to enhance corporate value. However, despite solid business performance, it cannot yet be said that a PBR of 1.0 has been firmly established.

Given that performance tends to be weighted toward the second half of the year, we would like to pay attention to whether order intake continues to accumulate steadily each quarter, whether the outlook for achieving for the fiscal year ending March 2026 earnings becomes more certain, whether factors for a further leap in performance toward for the fiscal year ending March 2027, the final year of the Medium-Term Management Plan, will materialize, what direction the New Medium-Term Management Plan will take, and whether there will be changes in the decarbonization efforts of key customers. Should positive factors emerge, a PBR of 1.0 will finally be established.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Company profile | 3 |

| History/Company’s group | 3 |

| Business overview | 5 |

| History / Group overview | 5 |

| Industrial furnace market / Our strengths | 5 |

| Long-term performance trends | 10 |

| CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026) | 12 |

| Financial results | 21 |

| Full-year results for FY3/2025 | 21 |

| FY3/2026 full-year forecast | 22 |

| Initiatives to enhance corporate value | 23 |

| Share price trends and catalysts | 24 |

| Financial data | 26 |

| Corporate data | 27 |

| Corporate profile/history | 27 |

| The top management/Corporate governance | 28 |

| Major shareholders/Shareholding by ownership | 29 |

Key financial data

| Unit: million yen | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 CE |

| Sales |

24,717 |

26,317 | 27,976 | 29,283 | 36,247 | 37,500 |

| EBIT (Operating Income) | 389 | 1,264 | 1,310 | 1,479 | 2,737 | 3,000 |

| Pretax Income | 527 | 1,594 | 1,699 | 3,129 | 4,222 | |

| Net Profit Attributable to Owner of Parent | 329 | 1,360 | 1,231 | 2,197 | 2,998 | 2,800 |

| Cash & Short-Term Investments | 7,121 | 11,130 | 7,884 | 10,061 | 4,392 | |

| Total assets | 38,577 | 38,141 | 41,178 | 48,863 | 48,736 | |

| Total Debt | 5,988 | 3,988 | 3,988 | 7,288 | 5,507 | |

| Net Debt | -1,133 | -7,142 | -3,896 | -2,773 | 1,115 | |

| Total liabilities | 16,784 | 14,928 | 17,134 | 21,092 | 20,125 | |

| Total Shareholders’ Equity | 21,681 | 23,068 | 23,860 | 27,570 | 28,329 | |

| Net Operating Cash Flow | 3,300 | 6,090 | -2,500 | -891 | -3,696 | |

| Capital Expenditure | 442 | 317 | 240 | 1,335 | 798 | |

| Net Investing Cash Flow | -551 | 510 | -63 | 550 | 654 | |

| Net Financing Cash Flow | -4,481 | -2,508 | -727 | 2,451 | -2,701 | |

| Free Cash Flow | 3,036 | 5,963 | -2,688 | -2,161 | -4,419 | |

| ROA (%) | 0.77 | 3.55 | 3.10 | 4.88 | 6.14 | |

| ROE (%) | 1.56 | 6.08 | 5.25 | 8.54 | 10.73 | |

| EPS (Yen) | 42.9 | 177.2 | 162.0 | 293.8 | 407.6 | |

| BPS (Yen) | 2,824.1 | 3,005.3 | 3,146.7 | 3,709.0 | 3,859.0 | |

| Dividend per Share (Yen) | 60.00 | 70.00 | 70.00 | 80.00 | 150.00 | |

| Shares Outstanding (Million shares) | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 |

Source: Omega Investment from company materials

Company profile

CHUGAI RO CO., LTD. is Japan’s leading manufacturer of industrial furnaces and industrial burners, whose management philosophy is: “Chugai Ro creates new value through its core of thermal technology, thus contributing to society while realizing the prosperity of the company and the happiness of its employees.” With a track record of developing over 100 types of industrial furnaces, the Company is known as a “department store of industrial furnaces.” Under the slogan “Pioneering the future with thermal technology,” and based on its foundational technologies in thermal technology, engineering capabilities, and advanced technology accumulated since its founding in 1945, the Company provides industrial furnaces and related equipment to the steel, automotive, and information and communications industries. Currently, based on its Management Vision 2026, “Renovate ourselves to develop our future with the technology for carbon neutrality!”, the Company aims to contribute to society and expand corporate value through carbon-neutral technology under its Medium-Term Management Plan (FY2022–FY2026). Attention from the stock market is increasing.

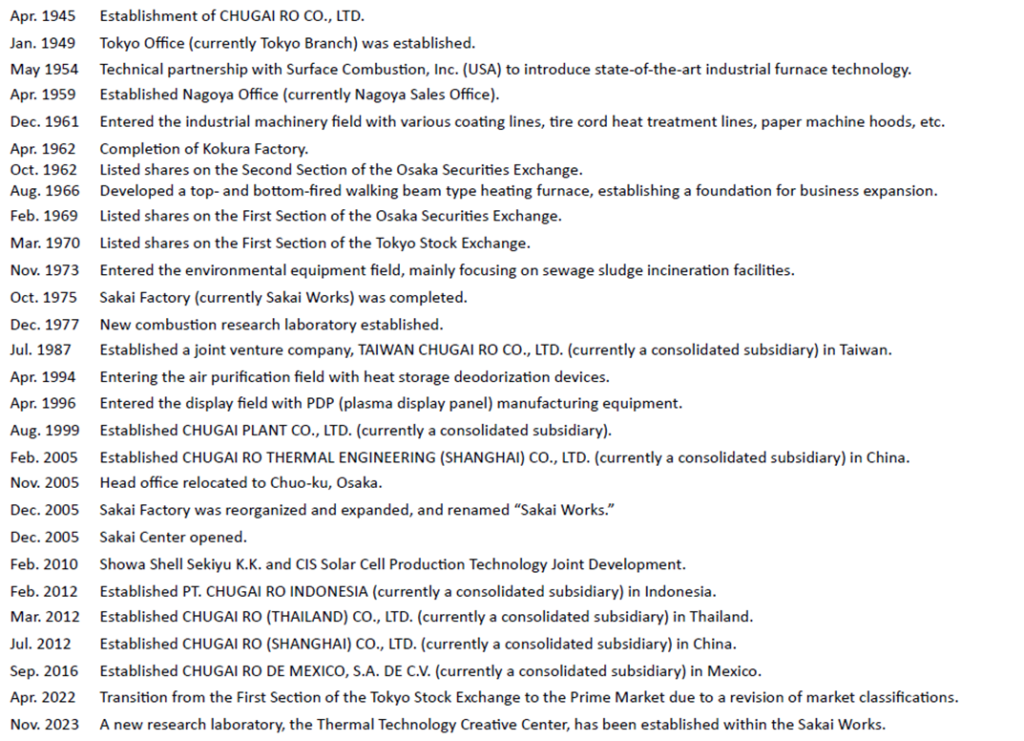

History

The Company was founded in 1945, and in the 1950s, it established thermal technology and popularized industrial furnaces in Japan. A turning point was its 1954 technical partnership with Surface Combustion, Inc. (USA), through which it completed Japan’s first domestically produced batch-type gas carburizing furnace and introduced the atmosphere heat treatment method to Japan on a wide scale. This enabled the mass production of metal parts with high surface strength and uniform precision, laying the foundation for the development of the automotive industry. In the following year, 1955, the Company began supplying state-of-the-art industrial furnaces to a wide range of industries, including steel, nonferrous metals, electric machinery, and glass. In 1966, it developed the top- and bottom-fired walking beam type heating furnace, supporting the growth of the steel industry. More recently, in 2014, the Company expanded and received orders for the “HIFALCON,” a mass-production-type vacuum carburizing furnace.

Since the 1960s, the Company has expanded its business domain to include environmental response. In 1961, it began manufacturing industrial machinery, including various coating lines, tire cord heat treatment lines, and paper machine hoods. After the oil shocks of the 1970s, it developed energy-saving burners, entered the field of environmental protection in 1973 starting with sewage sludge incineration facilities, entered the information and communication field in 1988 with inline sputtering systems, the air purification field in 1994 with regenerative thermal oxidizers, the display field in 1996 with PDP (plasma display panel) manufacturing equipment, launched ultra-precision coating and drying systems for LCD and OLED in 2004, developed and received orders for solar cell manufacturing equipment in 2009, jointly developed CIS solar cell production technology with Showa Shell Sekiyu K.K. in 2010, jointly developed the world’s first general-purpose hydrogen burner for industrial use with TOYOTA MOTOR CORPORATION in 2018 (and began operation in Toyota’s production process in 2023), received orders in 2019 for precision coating systems for flexible OLED substrates, in 2020 jointly researched and developed ammonia-only combustion technology with Osaka University, and in 2022 received an order for a hydrogen combustion exhaust gas treatment system.

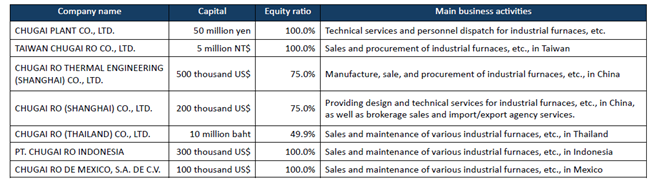

Overseas, the Company established bases in Taiwan in 1987, China in 2005, Indonesia and Thailand in 2012, and Mexico in 2016.

In November 2023, the Company opened a new research facility, the “Thermal Technology Creative Center”, within its Sakai Works. The aim is to focus on the development of next-generation combustion technologies, such as ammonia combustion and hydrogen combustion, as well as highly efficient energy-saving technologies, to promote the decarbonization of industrial furnaces and machinery that consume large amounts of energy in manufacturing processes.

The Company’s shares were listed on the Second Section of the Osaka Stock Exchange in 1962, then moved to the First Section of the Osaka Stock Exchange in 1969, and subsequently to the First Section of the Tokyo Stock Exchange in 1970. The shares were transferred to the Prime Market in 2022 (see also the history table on page 22).

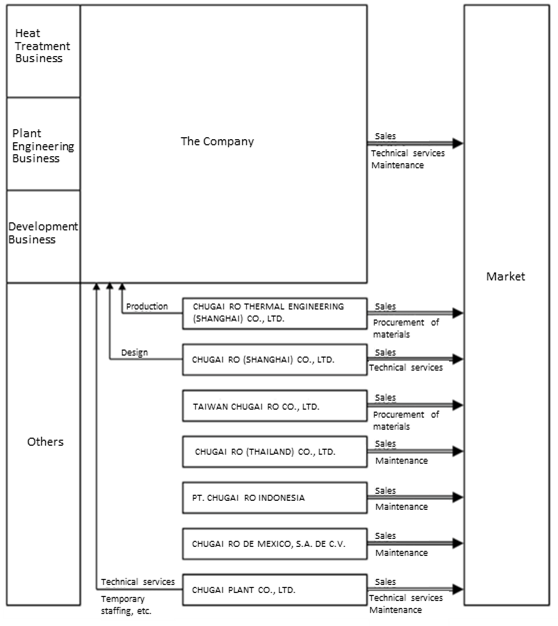

Company’s group

The Group consists of the Company and seven subsidiaries. It is mainly engaged in the design, manufacturing, and construction of industrial furnaces, industrial machinery, environmental equipment, and combustion equipment, as well as the manufacturing and sales of combustion devices, across three business segments: the Heat Treatment Business (primarily related to automobiles, machinery, semiconductors, chemicals, and battery manufacturing), the Plant Engineering Business (mainly associated with steel, nonferrous metals, and ceramics), and the Development Business (primarily related to decarbonization, precision coating and drying, and waste treatment and recycling). In addition, the Group conducts engineering, research, and development, as well as other services ancillary to its various businesses.

Overview of the Group and product flow

Source: Company materials

As for the Company’s business locations, its main domestic sites include the head office (Chuo-ku, Osaka), Sakai Works, Sakai Center, Kokura Factory, Tokyo Branch Office, and Nagoya Sales Office. Of these, Sakai Works is responsible for production, research, and development. Overseas, the Company has bases in Shanghai, Taiwan, Thailand, Indonesia, and Mexico. It also has partners involved in technology export in the United States and South Korea.

Sakai Works

Source: Company materials

Business overview

Industrial furnace market

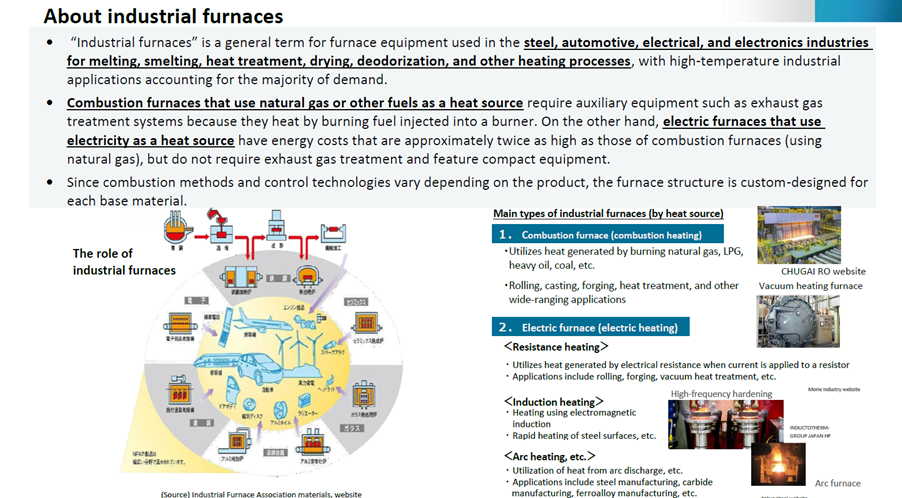

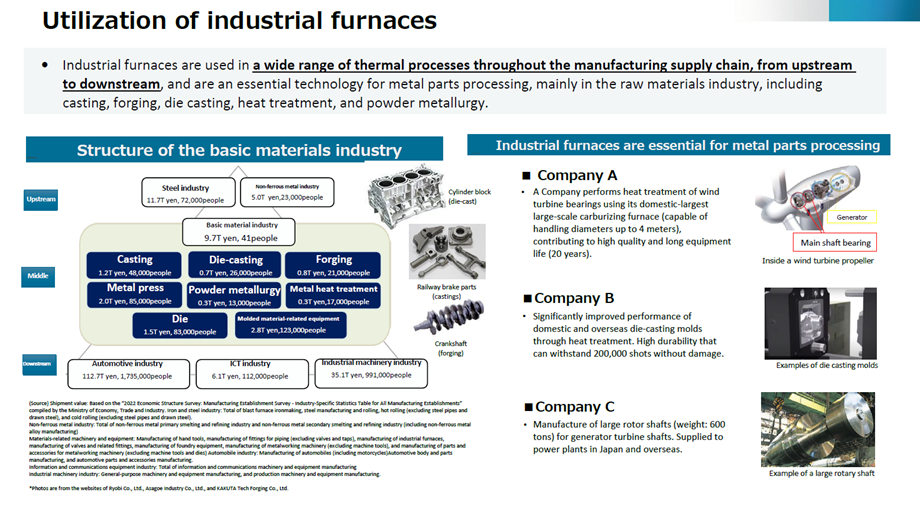

Industrial furnaces play a crucial role in manufacturing processes that determine the characteristics of metal parts and are widely used throughout the manufacturing industry’s supply chain, from upstream to downstream. The industries of end users are also diverse, including steel, automotive, electrical, and electronics sectors.

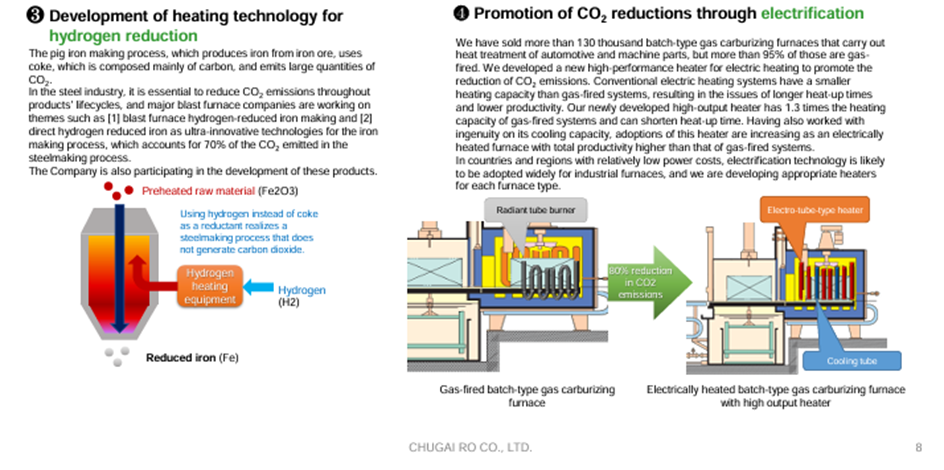

In terms of heat sources, there are combustion furnaces, which utilize natural gas and other fuels, and electric furnaces, which rely on electricity as their primary heat source. The former heats by burning fuel with a burner, while the latter uses electricity as the heat source. Electric furnaces are one of the promising methods for decarbonizing industrial furnaces, and demand for them is increasing, including for replacing combustion furnaces.

Furthermore, because combustion methods and control technologies differ depending on the product, one of the characteristics of this business is that furnace structures and other elements are custom-designed for each substrate.

In Japan, it is estimated that approximately 37,000 industrial furnaces are in operation, of which the Company manufactures an estimated 5,000 to 7,000. The size of the domestic market is estimated to be around 200 billion yen (based on a survey by the Ministry of Economy, Trade and Industry and interviews with the Company).

Industrial furnaces

Source: Ministry of Economy, Trade and Industry, “Trends in Japan and abroad related to decarbonization of thermal processes in the manufacturing sector” (October 2, 2024, Manufacturing Industries Bureau, Casting and Forging Industry Office)

https://www.meti.go.jp/shingikai/sankoshin/green_innovation/industrial_restructuring/pdf/026_03_00.pdf

Japan’s leading manufacturer of industrial furnaces and industrial burners, advocating itself as a technology-oriented company

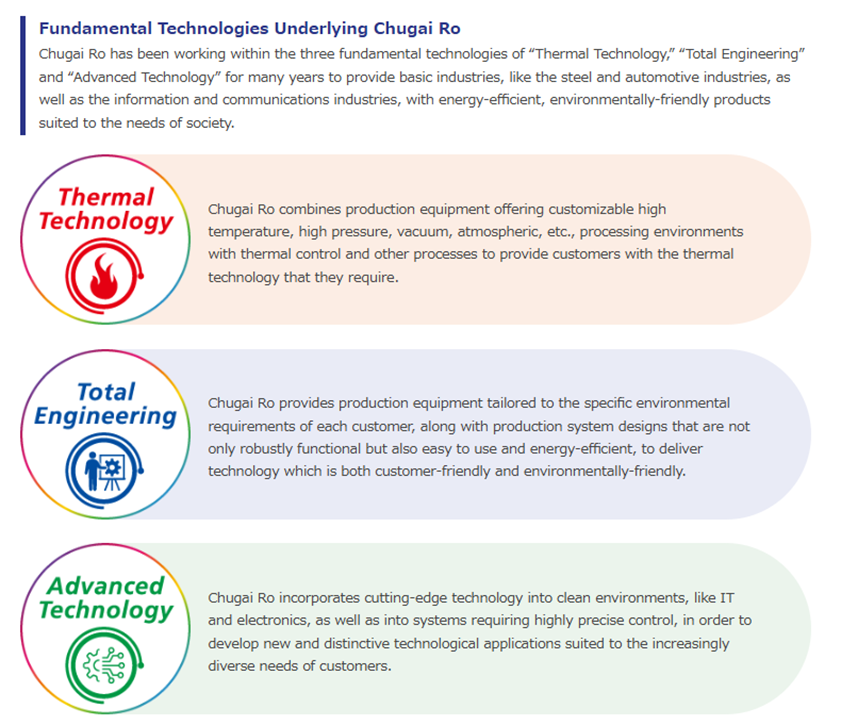

As evident in the Company’s history, it has a proven track record of supplying a diverse range of industrial furnaces to various industries. The foundational technologies cultivated in this way are “Thermal Technology,” “Total Engineering,” and “Advanced Technology.”

CHUGAI RO’s foundational technologies

Source: Company materials

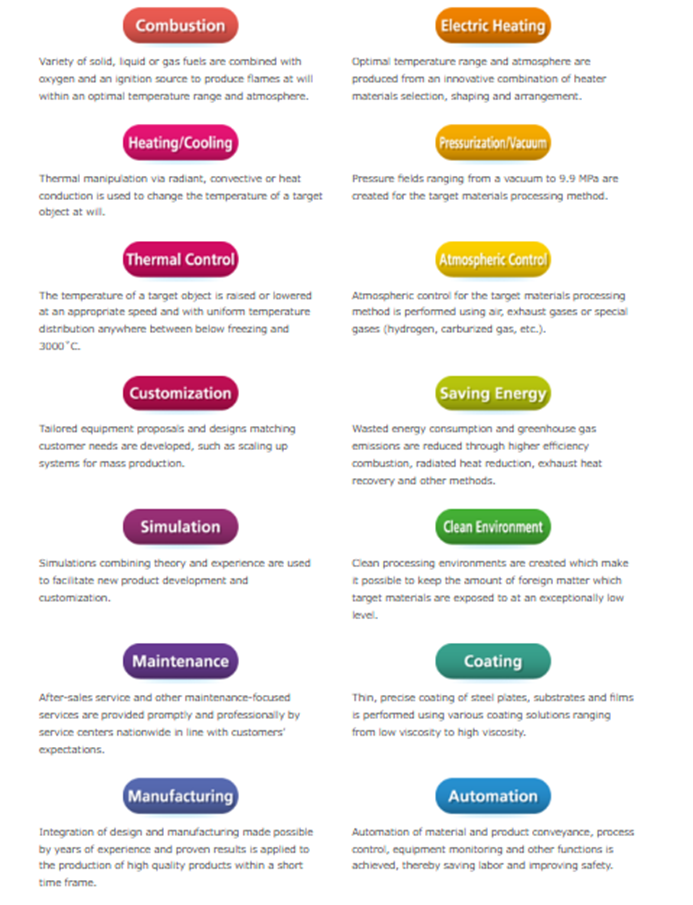

These foundational technologies have been refined into 14 core technologies.

CHUGAI RO’s core technologies

Source: Company materials

The Company’s research and development, based on the above technologies, is being carried out in three key areas: the Heat Treatment Business, the Plant Engineering Business, and the Development Business, to respond to social demands such as carbon neutrality, advanced materials, and resource circulation (zero emissions). R&D expenses for the fiscal year ended March 2025 are approximately 1.2 billion yen.

In terms of development structure, the Company established the “Thermal Technology Creative Center” within its Sakai Works in November 2023. It consists of three zones: the “Combustion Zone” for developing decarbonization and energy-saving combustion technologies using next-generation fuels (hydrogen and ammonia), the “Functional Materials Zone” for researching heat treatment technologies for advanced materials, and the “Co-Creation Space” to promote joint research and development with internal and external parties. It is also being utilized in the Green Innovation Fund project of NEDO, which is being promoted mainly by the GX Project Office.

Furthermore, as of April 1, 2025, the Company established a new Development Division Headquarters, integrating under it the previously independent Product Development Department (responsible for product development utilizing thermal technology), the Convertech Department (responsible for development and design of precision coating equipment for display panels, batteries, and semiconductors), and the GX Project Office (responsible for developing new combustion technologies using hydrogen and ammonia fuels for the decarbonization of industrial furnaces, as well as new electric heating technologies), aiming to improve development efficiency.

The Company primarily handles development and design, while manufacturing, assembly, and installation are outsourced to partner companies, resulting in a reduced capital investment burden.

Segment structure

The Company’s current segment structure is as follows.

Heat Treatment Business

Design, manufacture, construction, and sales of heat treatment furnaces for the automotive, machinery, semiconductor, and chemical industries, as well as heat treatment furnaces for batteries, substrates, catalysts, and magnetic materials. Additionally, we offer air purification equipment. Handled by the Company.

Plant Engineering Business

Design, manufacturing, construction, and sales of heating furnaces and heat treatment furnaces for steel and nonferrous metals; metal strip process lines; coating lines; various types of industrial burners; and energy-saving control devices. Handled by the Company.

Development Business

Research and development related to decarbonization; design, manufacturing, construction, and sales of precision coating and drying equipment, kilns, and environmental process equipment. Handled by the Company.

Other

Operations of domestic and overseas subsidiaries.

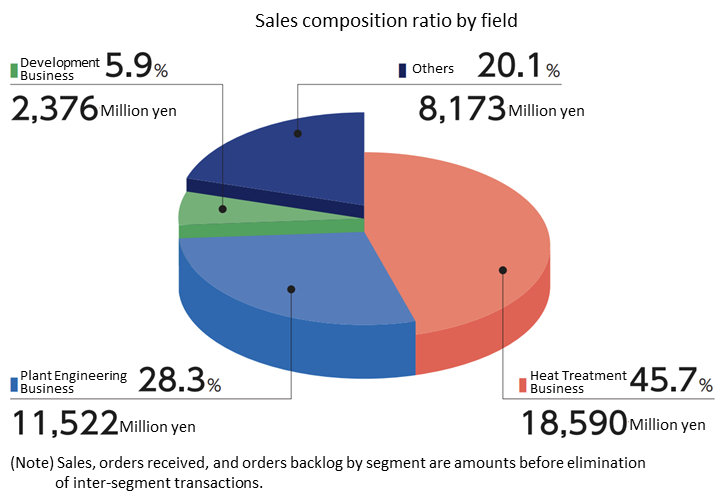

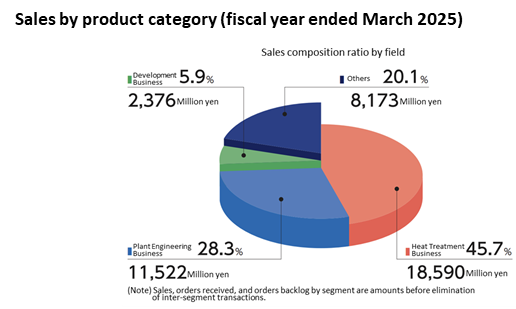

The composition ratios of order intake, net sales, and other key metrics for the fiscal year ended March 2025 are as shown below and are well-balanced.

Breakdown of net sales (Fiscal year ended March 2025)

Source: Company materials

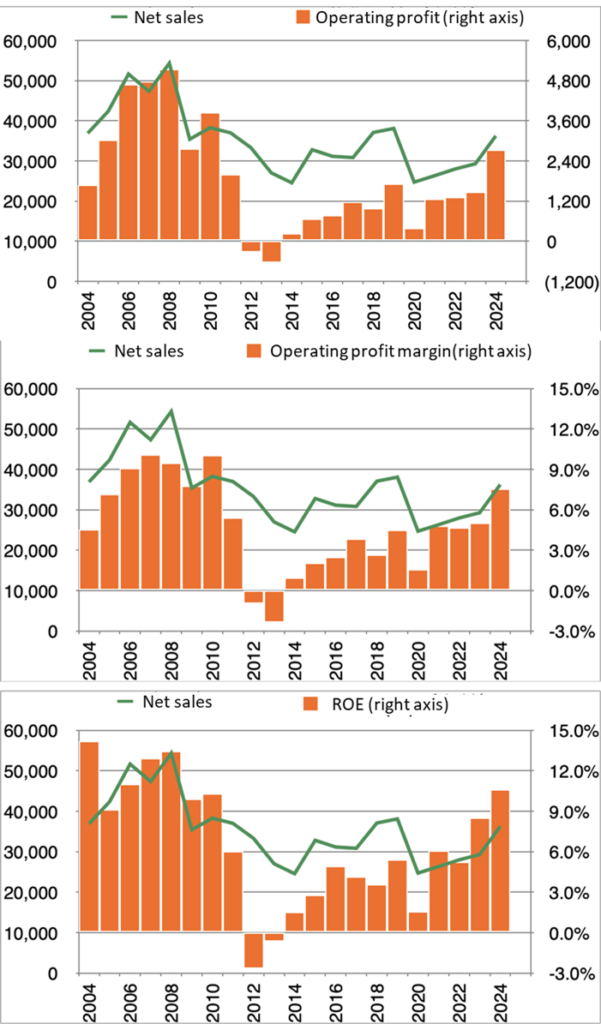

Long-term performance trends

Before analyzing the Medium-Term Management Plan currently being promoted, let us review the company’s long-term performance trends. The graphs below show the performance trends from FY2004 (fiscal year ended March 2005) to FY2024 (fiscal year ended March 2025).

Long-term performance trends

Source: Company materials, Factset

As these graphs indicate, the Company has emerged from the stagnant period of the 2010s. It is now in a recovery phase, reaching a level at which it appears capable of targeting the scale of net sales and profitability it achieved in the 2000s.

In the 2000s, new products, such as heat treatment furnaces and precision coating systems for display manufacturing and solar cell production equipment, contributed to the Company’s profits. By the fiscal year ended March 2009, the Company had recorded net sales of 54.3 billion yen and an operating profit of 5.1 billion yen. During the 2000s, the Company’s peak operating profit margin reached 10.1%, and peak ROE reached 14.2%, demonstrating high profitability.

Subsequently, in the 2010s, performance stagnated due to the slowdown in the growth of the Chinese market, the rise of local manufacturers, and the shift of customers to Asia for precision coating systems for display manufacturing and solar cell production equipment, as well as intensifying competition with equipment manufacturers.

During this period, the Company actively made proposals to domestic automobile manufacturers, capturing needs for higher strength, lighter weight, lower cost, and environmental compliance in auto parts. It also reviewed its cost structure, and since the latter half of the 2010s, performance has steadily recovered.

In this way, the Company achieved strong performance by leading the market with new technologies and responding appropriately even when the market environment turned adverse. The Company’s history as a “department store of industrial furnaces” demonstrates its ability to create new value and its high adaptability to changes in the business environment.

CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026)

Perspective for viewing the CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026)

On May 13, 2022, the Company announced the “CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026),” which is currently being promoted.

Practical perspectives for interpreting this Medium-Term Management Plan are as follows:

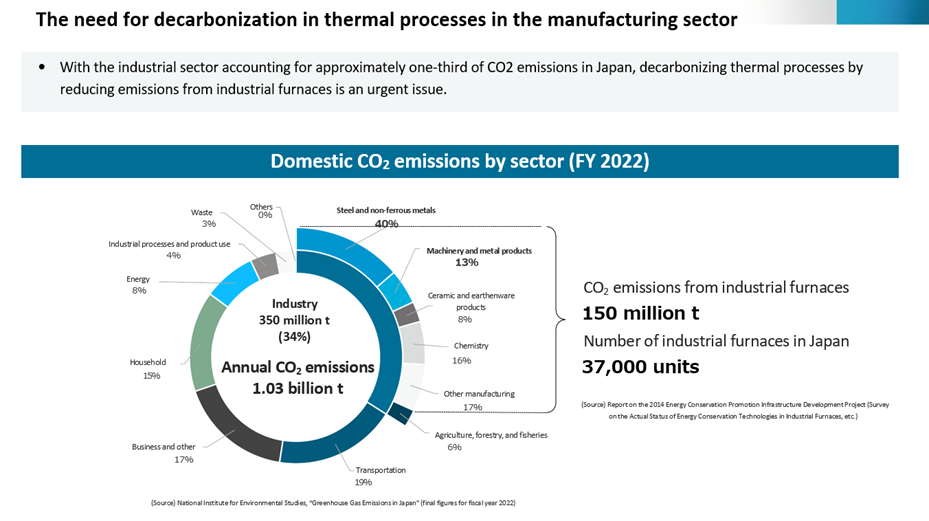

- CO₂ emissions from the approximately 37,000 industrial furnaces operating in Japan are said to amount to 150 million tons annually, accounting for about 15% of Japan’s total CO₂ emissions

- Of these, the company’s industrial furnaces are estimated to number 5,000-7,000, with annual CO₂ emissions of 12 million tons (base year: FY2013), equivalent to 1% of Japan’s total emissions

- The decarbonization of these industrial furnaces is a significant long-term societal issue, a need of the Company’s customers, and directly linked to the reduction of the company’s Scope 3 CO₂ emissions

- Addressing these issues is an excellent profit opportunity for the company, which seeks to “create new value” through thermal technology, by leveraging thermal technology to promote the use of hydrogen and ammonia and the electrification of industrial furnaces

If the Company succeeds in technological development and commercialization, it could also lead to business expansion into industrial furnaces not yet handled by the Company.

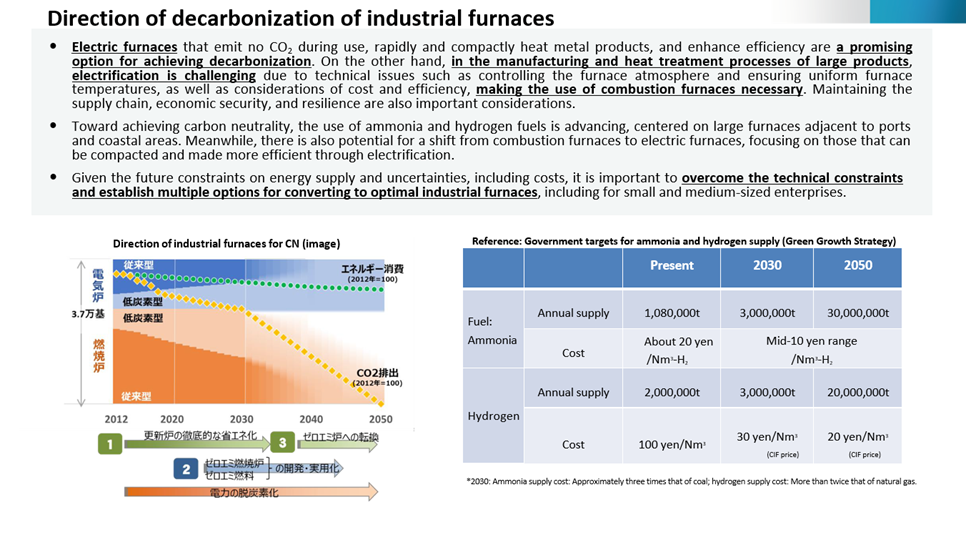

As a reference, materials showing Japan’s macro-level need for decarbonization are presented.

Japan’s macro-level need for decarbonization

Source: Ministry of Economy, Trade and Industry, “Trends in Japan and abroad related to decarbonization of thermal processes in the manufacturing sector” (October 2, 2024, Manufacturing Industries Bureau, Casting and Forging Industry Office)

https://www.meti.go.jp/shingikai/sankoshin/green_innovation/industrial_restructuring/pdf/026_03_00.pdf

Additionally, a reference material is provided regarding the direction of industrial furnace decarbonization as envisioned by the Ministry of Economy, Trade and Industry.

Direction of industrial furnace decarbonization

Source: Ministry of Economy, Trade and Industry, “Trends in Japan and abroad related to decarbonization of thermal processes in the manufacturing sector” (October 2, 2024, Manufacturing Industries Bureau, Casting and Forging Industry Office)

https://www.meti.go.jp/shingikai/sankoshin/green_innovation/industrial_restructuring/pdf/026_03_00.pdf

CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026)

The following outlines the key points of the “CHUGAI RO Group Medium-Term Management Plan (FY2022–FY2026)” announced on May 13, 2022. In conclusion, as noted in the previous perspective, the plan demonstrates an accurate understanding of the business environment, beginning with the megatrend of decarbonization, and aims to boost performance and improve capital efficiency by leveraging the Company’s strengths through appropriate initiatives. It is a commendable plan.

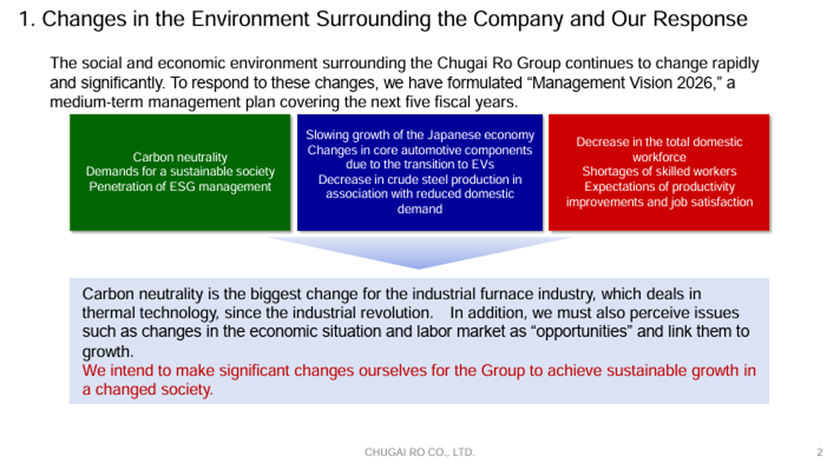

First, regarding the business environment, the Company recognizes the demands for carbon neutrality, changes in the macro environment (specifically, the slowdown in domestic demand growth, the shift to EVs in the automotive industry, which is a major customer, and the decline in crude steel production), and the securing of skilled labor as essential issues.

Recognition of the business environment that underlies the Medium-Term Management Plan (FY2022–FY2026)

Source: Company materials

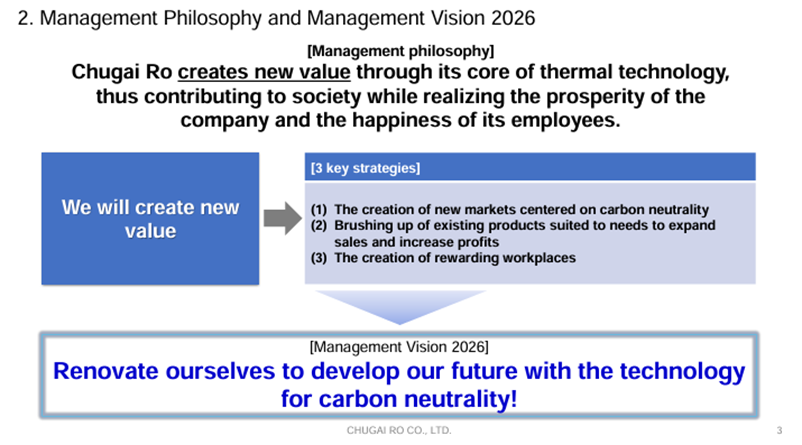

Next, based on its management philosophy, the Company has presented the following three key strategies and has unified them by setting forth Management Vision 2026.

Source: Company materials

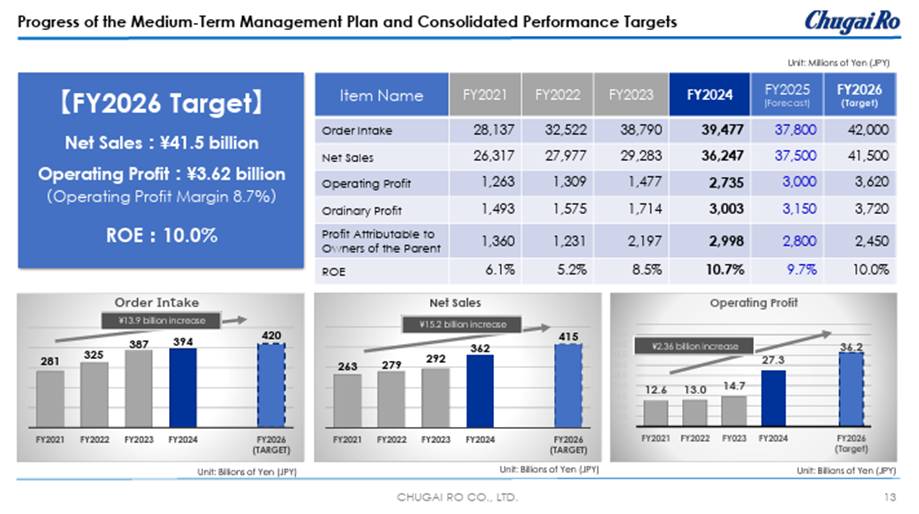

Next, the consolidated performance targets are set as follows: net sales of 41.5 billion yen, operating profit of 3.62 billion yen (operating profit margin of 8.7%), and ROE of 10.0% in FY2026. The transition, including actual results up to FY2024 (fiscal year ended March 2025), is as shown below.

Consolidated performance targets

Source: Company materials

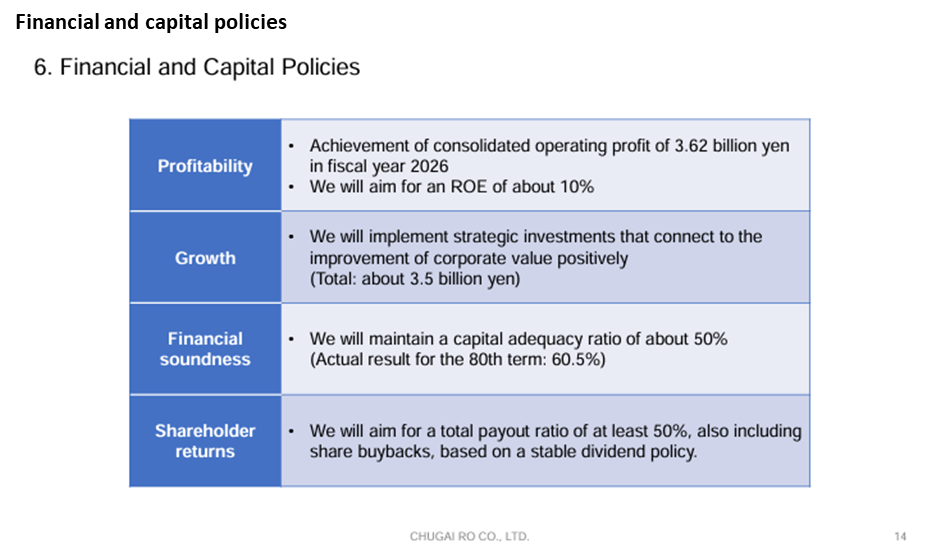

Related financial and capital policies are as follows:

Financial and capital policies

Source: Company materials

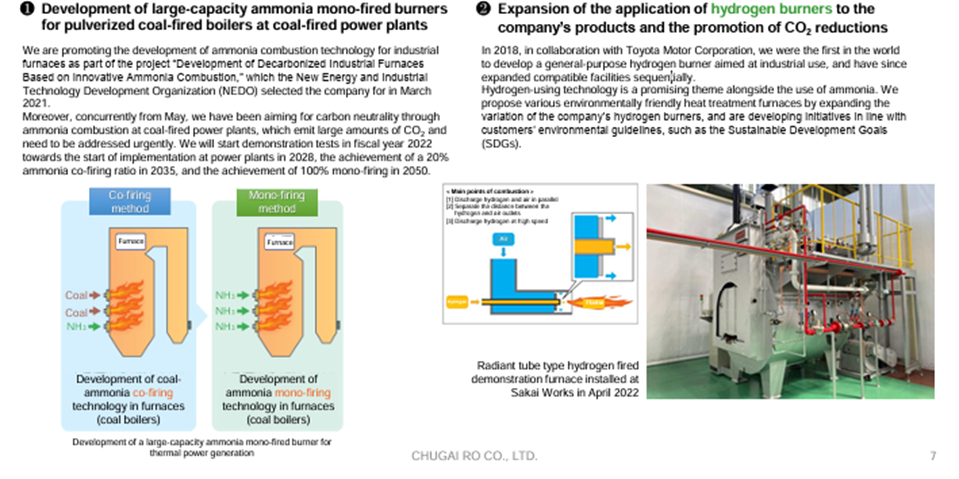

Key Strategy 1: The creation of new markets centered on carbon neutrality

The details of the three key strategies mentioned earlier are explained below. First is the “The creation of new markets centered on carbon neutrality.”

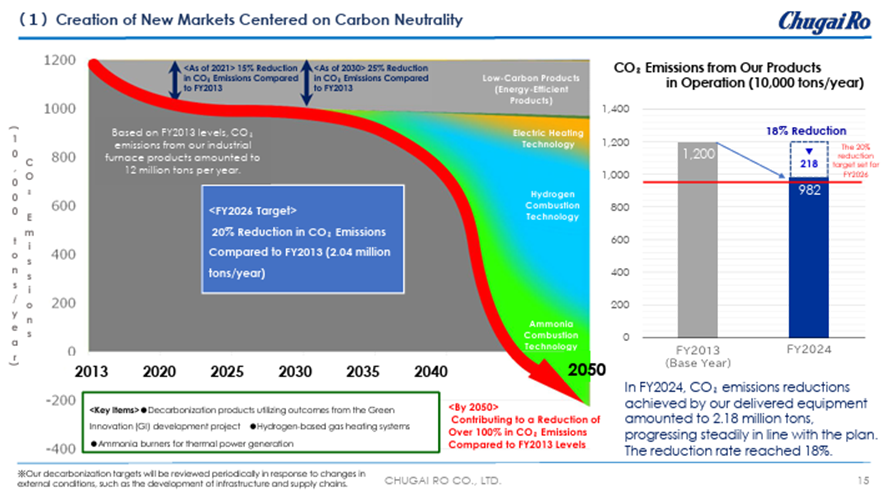

Let us first look at the CO₂ reduction targets and results for the Company’s industrial furnace products. Starting from 12 million tons in FY2013 (base year), the goals and progress are as follows:

FY2021 result 15% reduction

FY2024 result 18% reduction (2.18 million tons reduced)

FY2026 initial target 17% reduction

FY2026 current target 20% reduction (2.4 million tons reduced)

FY2030 target 25% reduction

FY2050 target 100%+ reduction

Progress is favorable, exceeding the original plan. Currently, the reduction is primarily being achieved through burners that significantly contribute to energy savings, such as regenerative burners and oxygen burners.

CO₂ reduction targets and results

Source: Company materials

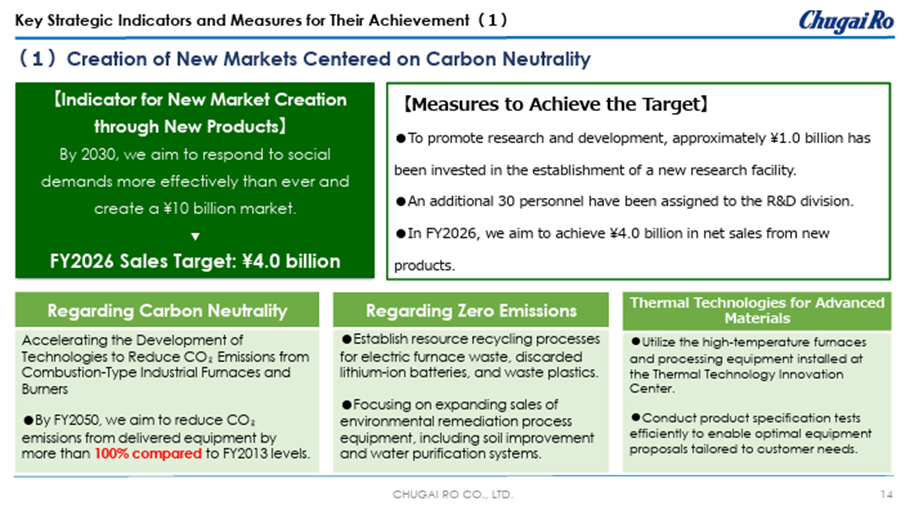

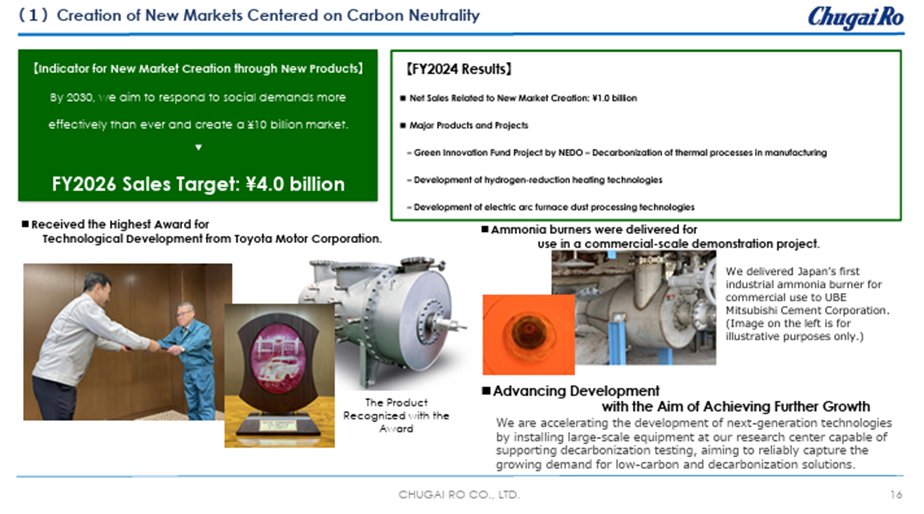

Next, regarding the sales targets (annual basis) and progress for the creation of new markets through new products centered on carbon neutrality, we can see that performance is also progressing smoothly:

FY2024 sales result 1.0 billion yen FY2026 sales target 4.0 billion yen FY2030 sales target 10.0 billion yen

For specific initiatives and achievements related to new products, please refer to the Company’s materials below. Notably, the NEDO “Green Innovation Fund Project / Decarbonization of Thermal Processes in the Manufacturing Sector” is progressing smoothly. In addition, the Company’s hydrogen combustion afterburner furnace, jointly developed with DENSO CORPORATION and others, received the Toyota Excellent Development Award (co-awarded with DENSO CORPORATION), and the Company has delivered Japan’s first commercial-use industrial ammonia burner to Mitsubishi UBE Cement Corporation, indicating steady progress.

Specific initiatives for new market creation

Source: Company materials

Note: In November 2023, the new research facility, the “Thermal Technology Innovation Center,” was established within Sakai Works.

Achievements in new market creation

Source: Company materials

Examples of specific development projects are shown below.

Examples of development projects

Source: Company materials

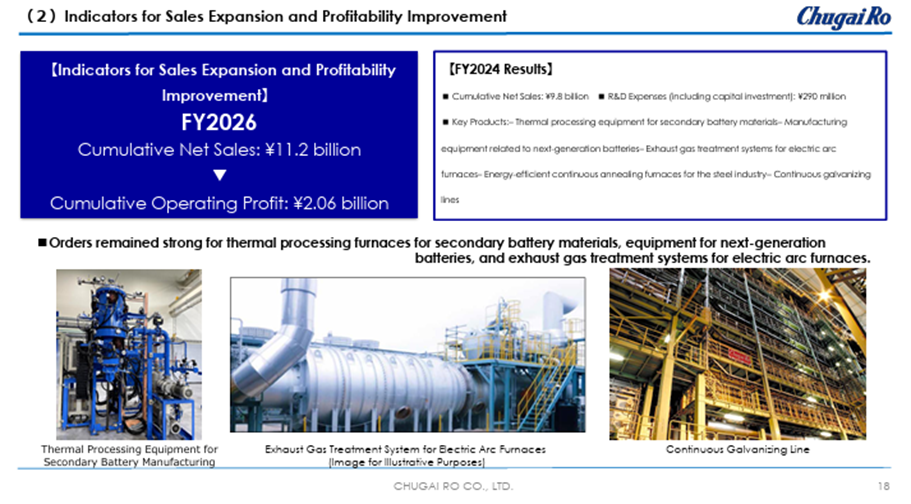

Key Strategy 2: Brushing up of existing products suited to needs to expand sales and increase profits

Next is “Brushing up of existing products suited to needs to expand sales and increase profits.”

First, the accumulation targets and progress for net sales and operating profit are as follows:

FY2024 result: Net sales accumulation of 9.8 billion yen

FY2026 target: Net sales accumulation of 11.2 billion yen

Operating profit accumulation of 2.06 billion yen

Although the accumulated amount of operating profit is not disclosed, judging from the progress of net sales, this area is also progressing well.

Initiatives to expand sales and increase profits through brushing up on existing products

Source: Company materials

Progress in expanding sales and increasing profits through brushing up on existing products

Source: Company materials

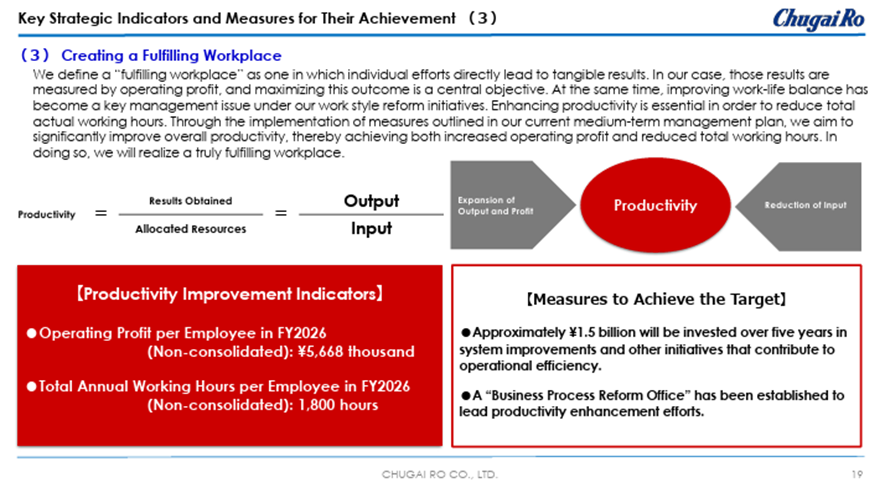

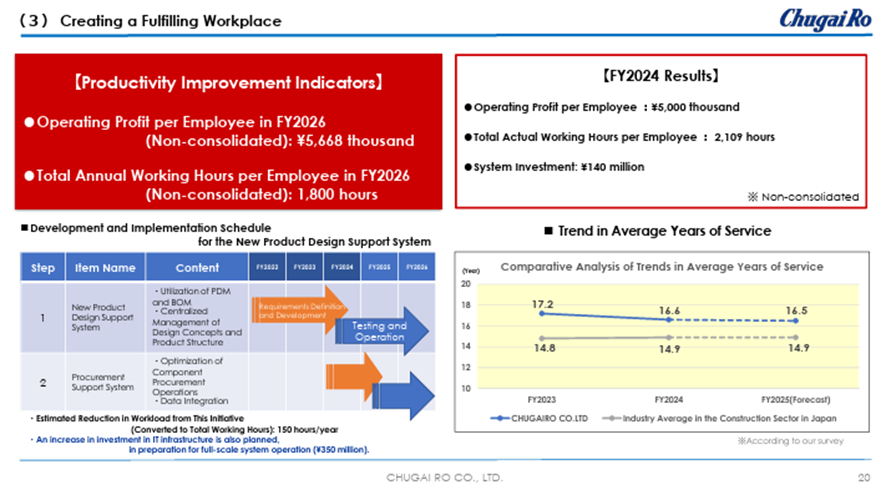

Key Strategy 3: The creation of rewarding workplaces

The final key strategy is “The creation of rewarding workplaces.”

This initiative aims to enhance labor productivity by simultaneously increasing operating profit per person and reducing total work hours per person, thereby improving work ease and job satisfaction for employees. The specific targets and progress are as follows: while the former is progressing well, the latter is showing limited improvement.

(Unit: non-consolidated) Operating profit per person Total work hours per person

FY2023 result 2,848 thousand yen 2,086 hours

FY2024 result 5,000 thousand yen 2,109 hours

FY2026 target 5,668 thousand yen 1,800 hours

Initiatives to create a fulfilling workplace

Source: Company materials

Progress in creating a fulfilling workplace

Source: Company materials

Financial results

Full-year results for FY3/2025

The consolidated financial results for the fiscal year ended March 2025 showed significant increases in both revenue and profit. Although net sales slightly underperformed the Company’s forecast, order intake and all profit stages, from operating profit downward, exceeded the forecast. The dividend per share was also significantly increased compared to the initial forecast. Progress toward the Medium-Term Management Plan’s net sales and operating profit targets remains steady, and the ROE has reached its target.

Consolidated performance trends

Source: Company materials

Order intake increased by 2% year-over-year, led by the Plant Engineering Business. In the Heat Treatment Business, the Company secured orders for domestic next-generation battery manufacturing equipment, heat treatment furnaces for advanced materials, heat treatment equipment for aircraft-related materials, regenerative exhaust gas treatment systems, and heat treatment equipment for aluminum parts for automobiles. In the Plant Engineering Business, it secured orders for energy-saving continuous annealing equipment and continuous galvanizing lines for domestic steelmakers, as well as exhaust gas treatment equipment and flame-in processing equipment for advanced materials. In the other business segment, overseas subsidiaries received orders for motor core annealing furnaces and annealing/tempering furnaces for automotive parts for the Chinese market.

Operating profit was 2.73 billion yen (up 85% year on year), and the operating profit margin was 7.5% (up 2.5 percentage points). The primary factor was a 24% increase in net sales, achieved while maintaining a stable gross profit margin, thanks to proactive pricing strategies and effective cost control.

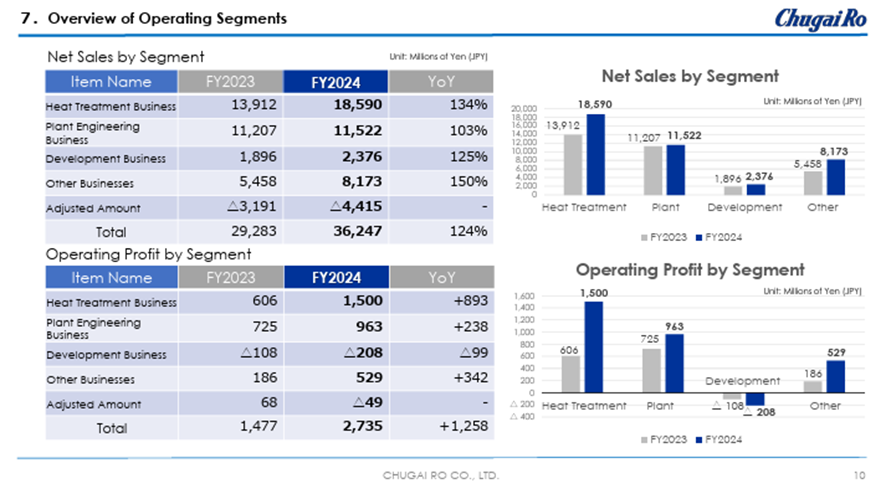

By segment, all segments—Heat Treatment, Plant Engineering, Development, and other—posted increased sales, and all except the Development Business recorded increased profits.

Segment information

Source: Company materials

Note that cash flow (CF) requires attention. Operating CF was negative 3.6 billion yen due to an increase in accounts receivable and contract assets stemming from the significant increase in sales. On the other hand, investing CF was positive 600 million yen, as proceeds from the sale of investment securities exceeded expenditures for the acquisition of property, plant, and equipment. Financing CF was negative 2.7 billion yen due to a total reduction of 1.7 billion yen in short- and long-term borrowings, as well as dividend payments and share buybacks. As a result, the balance of cash and cash equivalents at the end of the period decreased by 5.6 billion yen to 4.3 billion yen. Net debt at the end of the period was 1.1 billion yen. However, considering that accounts receivable and contract assets are expected to be converted into cash in due course and that the Company holds 6.5 billion yen in investment securities, financial concerns at this point can be considered minimal.

FY3/2026 full-year forecast

The Company’s forecast is ordering intake of 37.8 billion yen (down 4% year on year), net sales of 37.5 billion yen (up 3%), operating profit of 3.0 billion yen (up 9%), ordinary profit of 3.15 billion yen (up 4%), profit attributable to owners of parent of 2.8 billion yen (down 6%), and dividend per share of 150 yen (unchanged). This represents further progress toward the final-year targets of the Medium-Term Management Plan.

The main reason for the expected decline in profit attributable to the owners of the parent is that the gain on the sale of investment securities recorded in the previous fiscal year is not included in extraordinary income in the fiscal year ending March 2026, and the basic trend of performance expansion remains unchanged.

Furthermore, the Company is firmly committed to enhancing shareholder returns through dividend increases. If operating profit increases as expected, a dividend increase is highly likely.

For orders related to heating furnaces, solar cells, and secondary battery equipment, contributions are expected. With the order backlog at the end of March 2025 at 37.8 billion yen (up 10% year-over-year), the net sales forecast is considered reasonable. The profit forecast is also generally deemed appropriate (however, as profit and loss tend to be weighted toward the second half of the fiscal year, attention should be paid to the progress).

Initiatives to enhance corporate value

In addition to promoting the Medium-Term Management Plan, the Company has announced its “Initiatives to enhance corporate value”. It is implementing measures aimed at achieving and sustaining a PBR of 1.0. It is currently working on the seven items listed below, many of which have already been completed. Although the current PBR is 0.86 times, it has exceeded 1.0 on several occasions since December 2024, indicating that a structure is emerging in which the stock price is steadily reflecting business expansion and improved ROE.

Initiatives to enhance corporate value and additional measures

Source: Company materials

Trends in operating profit margin, ROE, and PBR

Source: Company materials

Share price trends and catalysts

The Company’s stock price has broken through the 3,000 yen level in 2024, which had served as a resistance line since the 2010s. This should be viewed as a sign that the stock market is reassessing the Company in a positive light. That is, it is likely being recognized that the Company has strong potential to grow its performance with the tailwind of the social demand for carbon neutrality, that it is responding appropriately through its Medium-Term Management Plan and other measures and has improved performance, and that it is demonstrating a proactive stance toward establishing a PBR of 1.0.

However, compared to the 2000s, the Company’s stock price remains relatively low, its relative stock price against TOPIX is still weak, and PBR has yet to stabilize above 1.0. Its forward PER remains at 9 times. This may be interpreted as suggesting upside potential for revaluation in the stock price (room for further price gains from the current level). Still, conversely, it could also be seen as a sign that the stock market has not yet gained complete confidence in the Company’s growth potential or its ability to improve capital efficiency, as represented by ROE.

Based on the above, key stock price catalysts to watch going forward are as follows:

• That for the fiscal year ending March 2026, performance achieves the plan

• That the certainty of achieving the fiscal year ending March 2027 performance targets outlined in the Medium-Term Management Plan increases

As shown below, a significant gap exists between the fiscal year ending March 2026 earnings forecast and the fiscal year ending March 2027 performance targets.

Therefore, particular attention should be paid to the increase in order intake in the fiscal year ending March 2026.

• Specific explanations are provided regarding the direction of the next Medium-Term Management Plan

Specifically:

- Currently, the company’s CO2 emission reduction target for its industrial FY 2030 is 25%. Will this target be revised? And what profit opportunities are available?

- Will initiatives to increase recurring revenue lead to greater profit stability?

- Will new approaches be introduced to improve the gross profit margin?

- Will the promotion of the intellectual property strategy contribute to revenue growth?

- Will diversity among executives and employees advance?

- Can the Company achieve significant growth in overseas business opportunities?

These points merit attention.

• As the Company is indispensable to the metals industry, it is also indirectly involved in the defense sector. It is worth watching whether this will be reflected in future business performance and stock price.

As for risk factors, attention should be paid to whether enthusiasm for carbon neutrality among major customers may wane, whether relationships with suppliers may deteriorate, whether employee engagement can be maintained or improved, and whether there are any intellectual property risks.

Financial data

Source: Company materials, repost

Financial data

| Unit: million yen | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

| (Income Statement) | ||||||||||

| Sales | 32,795 | 31,146 | 30,829 | 37,089 | 38,089 | 24,717 | 26,317 | 27,976 | 29,283 | 36,247 |

| Year-on-year | 33.6% | -5.0% | -1.0% | 20.3% | 2.7% | -35.1% | 6.5% | 6.3% | 4.7% | 23.8% |

| Cost of Goods Sold | 28,449 | 26,575 | 25,795 | 32,140 | 32,023 | 20,282 | 21,007 | 22,494 | 23,448 | 28,656 |

| Gross Income | 4,346 | 4,571 | 5,034 | 4,949 | 6,066 | 4,435 | 5,310 | 5,482 | 5,835 | 7,591 |

| Gross Income Margin | 13.3% | 14.7% | 16.3% | 13.3% | 15.9% | 17.9% | 20.2% | 19.6% | 19.9% | 20.9% |

| SG&A Expense | 3,669 | 3,797 | 3,853 | 3,962 | 4,354 | 4,046 | 4,046 | 4,172 | 4,356 | 4,854 |

| EBIT (Operating Income) | 677 | 774 | 1,181 | 987 | 1,712 | 389 | 1,264 | 1,310 | 1,479 | 2,737 |

| Year-on-year | 180.9% | 14.3% | 52.6% | -16.4% | 73.5% | -77.3% | 224.9% | 3.6% | 12.9% | 85.1% |

| Operating Income Margin | 2.1% | 2.5% | 3.8% | 2.7% | 4.5% | 1.6% | 4.8% | 4.7% | 5.1% | 7.6% |

| EBITDA | 1,037 | 1,112 | 1,527 | 1,378 | 2,080 | 749 | 1,676 | 1,710 | 1,953 | 3,289 |

| Pretax Income | 715 | 967 | 1,294 | 1,177 | 1,701 | 527 | 1,594 | 1,699 | 3,129 | 4,222 |

| Consolidated Net Income | 572 | 1,000 | 905 | 781 | 1,158 | 364 | 1,429 | 1,295 | 2,216 | 3,072 |

| Minority Interest | 27 | 21 | 40 | 26 | 37 | 35 | 69 | 64 | 19 | 74 |

| Net Income ATOP | 545 | 978 | 864 | 754 | 1,120 | 329 | 1,360 | 1,231 | 2,197 | 2,998 |

| Year-on-year | 79.9% | 79.4% | -11.7% | -12.7% | 48.5% | -70.6% | 313.4% | -9.5% | 78.5% | 36.5% |

| Net Income Margin | 1.7% | 3.1% | 2.8% | 2.0% | 2.9% | 1.3% | 5.2% | 4.4% | 7.5% | 8.3% |

| (Balance Sheet) | ||||||||||

| Cash & Short-Term Investments | 6,923 | 7,833 | 6,858 | 5,169 | 8,658 | 7,121 | 11,130 | 7,884 | 10,061 | 4,392 |

| Total assets | 39,665 | 38,502 | 41,368 | 42,731 | 46,696 | 38,577 | 38,141 | 41,178 | 48,863 | 48,736 |

| Total Debt | 3,988 | 3,988 | 4,010 | 4,995 | 9,988 | 5,988 | 3,988 | 3,988 | 7,288 | 5,507 |

| Net Debt | -2,935 | -3,845 | -2,848 | -174 | 1,330 | -1,133 | -7,142 | -3,896 | -2,773 | 1,115 |

| Total liabilities | 20,300 | 18,131 | 20,131 | 21,774 | 26,006 | 16,784 | 14,928 | 17,134 | 21,092 | 20,125 |

| Total Shareholders’ Equity | 19,292 | 20,295 | 21,138 | 20,875 | 20,589 | 21,681 | 23,068 | 23,860 | 27,570 | 28,329 |

| (Cash Flow) | ||||||||||

| Net Operating Cash Flow | 1,260 | 1,033 | 377 | -1,348 | -580 | 3,300 | 6,090 | -2,500 | -891 | -3,696 |

| Capital Expenditure | 290 | 113 | 420 | 456 | 244 | 442 | 317 | 240 | 1,335 | 798 |

| Net Investing Cash Flow | -499 | 402 | -837 | -478 | -442 | -551 | 510 | -63 | 550 | 654 |

| Net Financing Cash Flow | -405 | -484 | -468 | 279 | 4,510 | -4,481 | -2,508 | -727 | 2,451 | -2,701 |

| Free Cash Flow | 1,016 | 933 | 2 | -1,725 | -775 | 3,036 | 5,963 | -2,688 | -2,161 | -4,419 |

| (Profitability ) | ||||||||||

| ROA (%) | 1.45 | 2.50 | 2.17 | 1.80 | 2.51 | 0.77 | 3.55 | 3.10 | 4.88 | 6.14 |

| ROE (%) | 2.78 | 4.95 | 4.18 | 3.59 | 5.41 | 1.56 | 6.08 | 5.25 | 8.54 | 10.73 |

| Net Margin (%) | 1.66 | 3.14 | 2.81 | 2.04 | 2.94 | 1.33 | 5.17 | 4.40 | 7.50 | 8.27 |

| Asset Turn | 0.87 | 0.80 | 0.77 | 0.88 | 0.85 | 0.58 | 0.69 | 0.71 | 0.65 | 0.74 |

| Assets/Equity | 1.92 | 1.97 | 1.93 | 2.00 | 2.16 | 2.02 | 1.71 | 1.69 | 1.75 | 1.75 |

| (Per-share) Unit: JPY | ||||||||||

| EPS | 70.0 | 125.7 | 111.0 | 97.2 | 145.9 | 42.9 | 177.2 | 162.0 | 293.8 | 407.6 |

| BPS | 2,478.6 | 2,607.8 | 2,716.9 | 2,718.6 | 2,681.5 | 2,824.1 | 3,005.3 | 3,146.7 | 3,709.0 | 3,859.0 |

| Dividend per Share | 60.00 | 60.00 | 60.00 | 60.00 | 60.00 | 60.00 | 70.00 | 70.00 | 80.00 | 150.00 |

| Shares Outstanding (million shares) | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 | 7.80 |

Corporate data

Corporate profile/history

CHUGAI RO CO., LTD.

【Head Office】

3-6-1 Hiranomachi, Chuo-ku, Osaka

https://chugai.co.jp/

【Sakai Works】

2-4 Chikko-Shinmachi, Nishi-ku, Sakai, Japan

【Important subsidiary】

Number of Employees : 721 (Consolidated; as of Mar. 31, 2025)

Sales by product category (fiscal year ended March 2025)

History

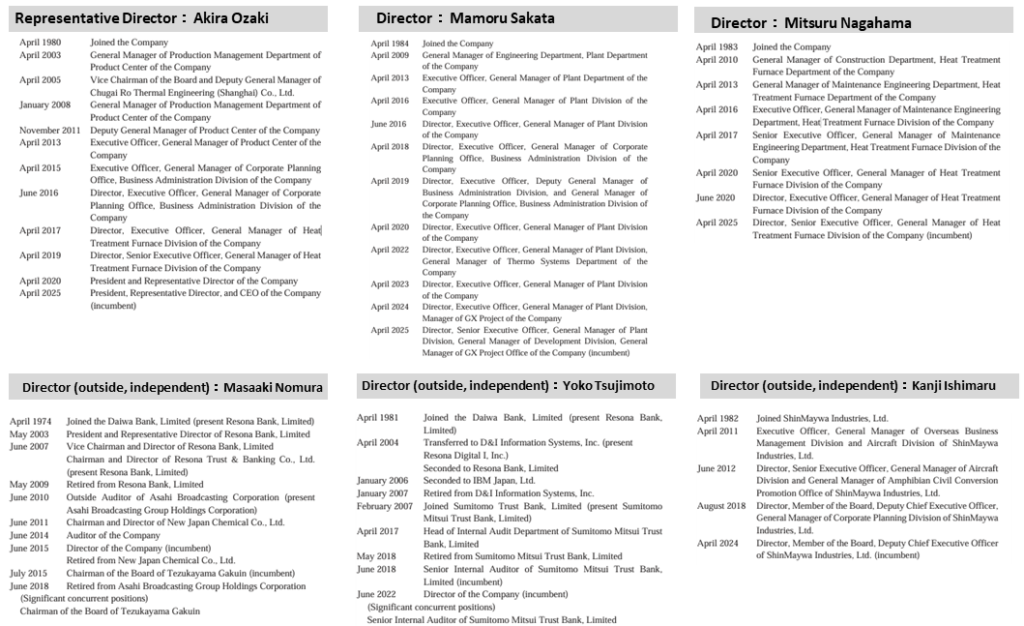

The top management

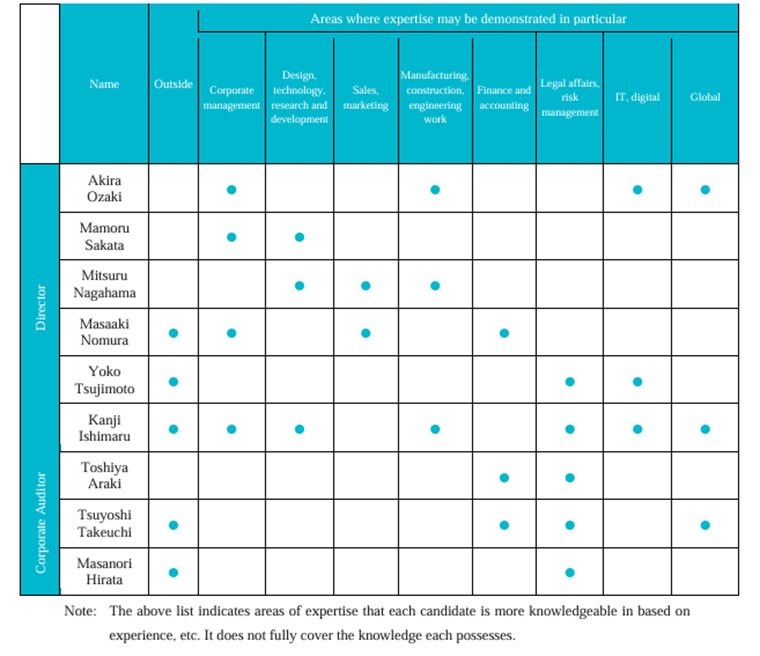

Skills matrix of the Board of Directors’ members

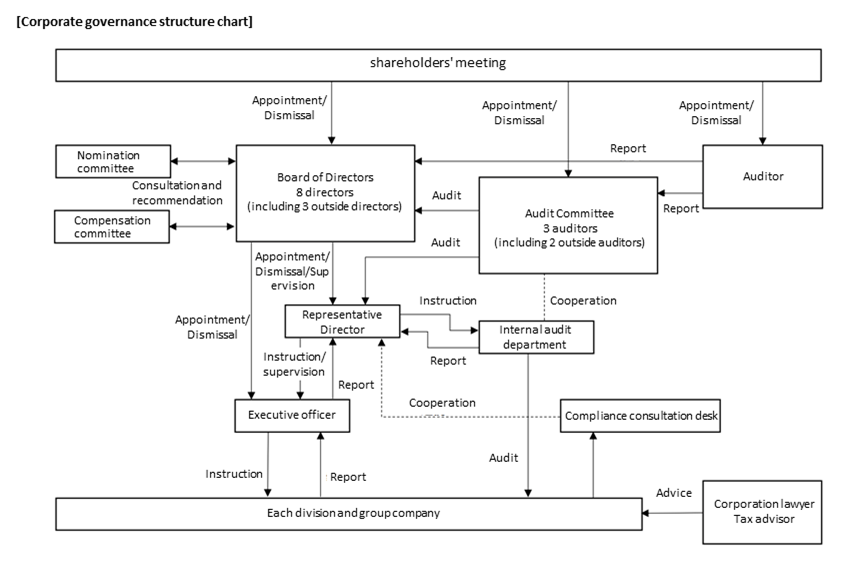

Corporate governance structure

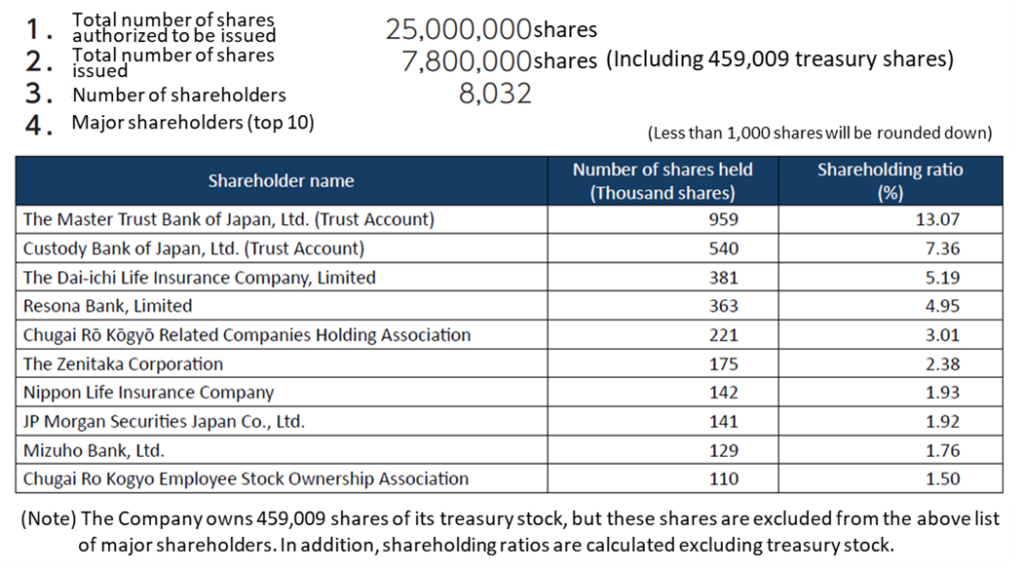

Major shareholders (As of March 31, 2025)

Source: Omega Investment from company materials

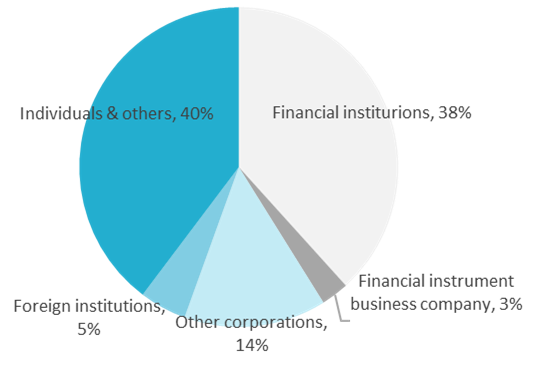

Shareholding by ownership (As of March 31, 2025)

Source: Omega Investment from company materials