TWOSTONE&Sons (Price Discovery)

Neutral

Profile

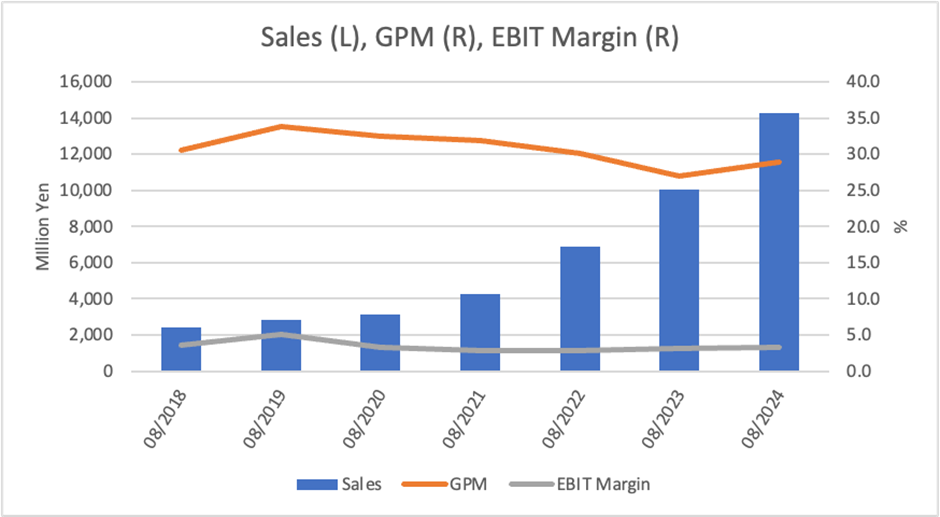

A growth company redefining personnel services through freelance utilisation. Continued topline growth and non-linear expansion via M&A.

TWOSTONE&Sons (formerly Branding Engineer) is a personnel services company centred on platforms that match freelance IT engineers with corporate clients, such as “Midworks.” Its core engineer platform business has reached record highs in both registrations and active workers, leading to rapid business expansion.

The company offers multifaceted services, including support for freelance independence and career changes, contract development for corporations, education and training, and consulting, which reinforces its stock-based revenue model. It has also actively pursued an M&A strategy, having acquired Carecon in 2024 and SAICOOL in 2025, which has brought the group to 12 companies. Operating profit has grown significantly year-on-year, and the company aims to surpass one billion yen in operating profit for the first time in FY08/2025.

As of FY08/2024, the sales breakdown by segment (operating margin) is as follows: Engineer Platform Services, 89% (9%); Marketing Platform Services, 3% (8%); and Consulting & Advisory Services, 7% (27%).

| Securities Code |

| TYO:7352 |

| Market Capitalization |

| 43,058 million yen |

| Industry |

| Service |

Stock Hunter’s View

Accelerated growth through M&A; upward revision to FY08/2025 results appears likely

TWOSTONE&Sons (formerly Branding Engineer) focuses on engineer matching, dispatching IT engineers to corporate clients. It also provides marketing services, strategic consulting, and M&A advisory services. Following its transition to a holding company structure in June 2023, the firm adopted its current name and now comprises 12 subsidiaries.

In addition to organic growth, the company seeks non-linear expansion through M&A. Particularly in peripheral areas of its engineering platform services, deal flow has been increasing. For FY08/2025, the company forecasts revenue of 18.6 billion yen (+30.2% YoY) and operating profit of 1.018 billion yen (2.1x YoY). By the end of Q2, operating profit had reached nearly 80% of the full-year target, and with SAICOOL to be consolidated from Q4 (announced in April through M&A), further upward revisions are expected.

In June, the company also acquired three consulting firms, securing businesses in AI/IT solution development, cross-border consulting, and marketing support.

Investor’s View

Neutral. Share price aligns with intrinsic value; sustainability of growth is key to future valuation

A five-year CAGR of +38% in topline revenue is striking. The core IT engineer services business has expanded amid DX-driven demand, with gross margins also remaining strong. However, strategic investment priorities have historically constrained EBIT margins. For FY08/2025, these margins are expected to improve from the 3% range to the mid-5% range, possibly marking a turning point in profitability.

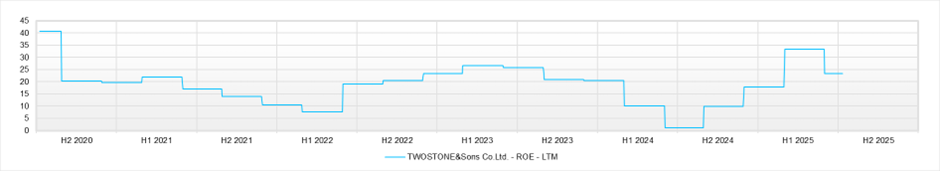

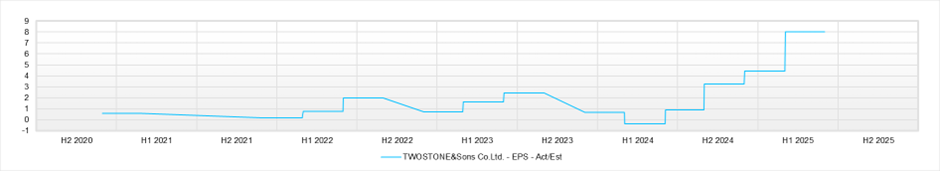

In the previous year, declines in net profit margins and asset turnover brought ROE down to around 10%, with the share price falling 20% during 2024. For the current fiscal year, ROE is expected to recover to approximately 17%, and following the upward revision in April, the share price has risen 12% YTD.

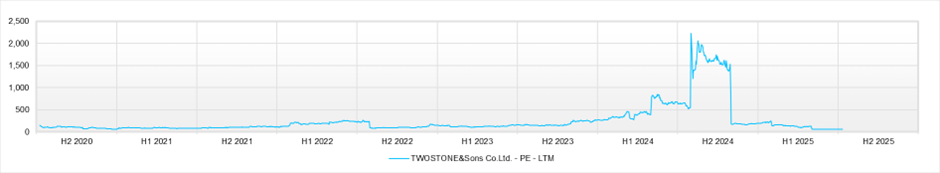

Assuming an ROE of 17.1%, PER of 73.6x, payout ratio of 4%, and EPS growth of +10%, the theoretical equilibrium PBR is calculated at 11.1x. The current PBR stands at 12.5x, which is broadly in line with this valuation, suggesting the share price is within a fair value range.

However, the forecast equity yield is just 1.4%, making it difficult to argue that the current share price offers sufficient long-term return. Market confidence in continued EPS growth is critical to justifying current valuations.

Management attributes recent profit recovery to improved sales efficiency, AI integration, and contributions from the consulting and advisory business. Nonetheless, given the company’s growth phase, strategic investments will likely continue, and there is no guarantee that high ROE and profit growth can be consistently maintained. Earnings volatility remains elevated.

In the short term, an entry at a dip could offer 10–15% upside potential. However, a more robust fundamental confirmation is needed to justify a mid- to long-term holding.

Recent Results

FY08/2025 Q2 operating profit surged 1,102% YoY, reaching 80% of the full-year target.

For the second quarter of FY08/2025 (September 2024–February 2025), consolidated revenue reached 8.909 billion yen (+37.3% YoY), operating profit was 808 million yen (+1,102.2%), and ordinary profit was 802 million yen (+1,122.1%). Net profit attributable to owners of the parent was 539 million yen (+3,885.2%).

By segment, the core Engineer Platform Services drove performance with revenue of 7.553 billion yen (+26.2% YoY) and segment profit of 732 million yen (+50.2%). The Marketing Platform Services segment recorded revenue of 232 million yen (–17.2% YoY) and profit of 38 million yen (–14.2%). In comparison, Consulting & Advisory Services posted revenue of 670 million yen (+1,215.6%) and profit of 108 million yen (a turnaround into the black).

Notably, the Consulting & Advisory segment benefited from the consolidation of Carecon (joined December 2024), significantly boosting revenue and profit. By the end of Q2, operating profit had reached approximately 80% of the full-year forecast of 1.018 billion yen. This substantial progress led to an upward revision of full-year guidance in April.

Full-Year Forecast

FY08/2025 projects +30% revenue growth and +115% operating profit. SAICOOL consolidation in Q4 provides further upside potential.

The company forecasts full-year revenue of 18.6 billion yen for FY08/2025 (+30.2% YoY), operating profit of 1.018 billion yen (+114.8%), ordinary profit of 1.001 billion yen (+124.9%), and net profit attributable to the owners of the parent of 580 million yen (+208.5%).

Growth is being driven by the ongoing expansion of the core engineering platform business, along with non-linear growth through mergers and acquisitions. In December 2024, the company consolidated Carecon, and in April 2025, it acquired SAICOOL, a strategic consulting firm. SAICOOL is scheduled to be included in consolidated results from Q4, potentially further boosting full-year earnings.

EPS is forecast at 13.36 yen, and ROE is expected to recover to approximately 17%. Management emphasizes that this year’s earnings growth is not a one-off, but rather a result of improved operational efficiency, AI adoption, and the contribution of newly acquired businesses. The company plans to reinvest its increased profits in talent acquisition and advertising to drive further growth in the second half.

Growth Strategy and Risks

Accelerated growth through executive hiring and M&A. However, investment burden and earnings volatility warrant attention.

TWOSTONE&Sons outlines four strategic pillars: executive and talent acquisition, expansion of existing businesses, active M&A, and enhanced group collaboration and governance. In FY08/2025, the company is focusing on hiring sales and consulting personnel, with 10 new hires in H1. By strengthening sales capabilities and training, it aims to improve project acquisition and profitability.

In the engineer platform segment centred on Midworks, the company continues to invest in advertising to increase registrations and active users. It leverages internal group databases and operational efficiency systems to build both economies of scale and organisational strength. In parallel, it is expanding its presence in the growing web advertising market through its marketing platform business.

On the M&A front, following the consolidation of Carecon and SAICOOL, the company is reinforcing its IT and strategic consulting capabilities. Deal flow has increased, particularly in adjacent domains, and further acquisitions are under consideration to generate synergies with core businesses.

However, this aggressive growth strategy comes with risks. While recent margin improvements are attributed to AI integration and efficiency gains, ongoing investment in recruitment, training, and advertising represents a cost burden that could lead to profit volatility. Additionally, organisational and governance costs from group expansion and complexity in post-merger integration (PMI) will need to be managed.

To support long-term shareholder value creation, it is essential that the company carefully balances strategic investment with capital efficiency while leveraging structural tailwinds in the freelance workforce market.

Medium-Term Management Plan

Balancing organic and non-linear growth through group synergies. PMI execution and disciplined investment remain key challenges.

TWOSTONE&Sons is strengthening its group management structure while expanding across multiple domains, including engineering platforms, marketing, and strategic/IT consulting. The company positions its medium-term growth strategy around both the continuous expansion of existing businesses and non-linear growth via M&A.

Key KPIs include continued growth in engineer registrations and active users. The company also prioritises in-house development of sales and consulting talent through strategic hiring. In FY08/2025, management is focused on hiring senior and sales-level personnel to drive growth, while fostering integration and collaboration among subsidiaries to maximise group value.

On M&A, the company continues to explore opportunities, particularly in adjacent areas to its core engineering platform. Acquisitions target consistently profitable companies even after goodwill amortisation. Through disciplined deal screening and post-merger integration, TWOSTONE&Sons pursues synergies without overpaying.

In the long term, the company aims to outpace market growth by combining organic business development with strategic acquisitions and new businesses. It seeks to raise its industry profile, increase average project value, and expand its service domains—ultimately evolving into a next-generation human capital services group that blends engineering and consulting capabilities.

Share Price and Valuation

Current PBR aligns with theoretical valuation; continued EPS growth is crucial to sustain high multiples.

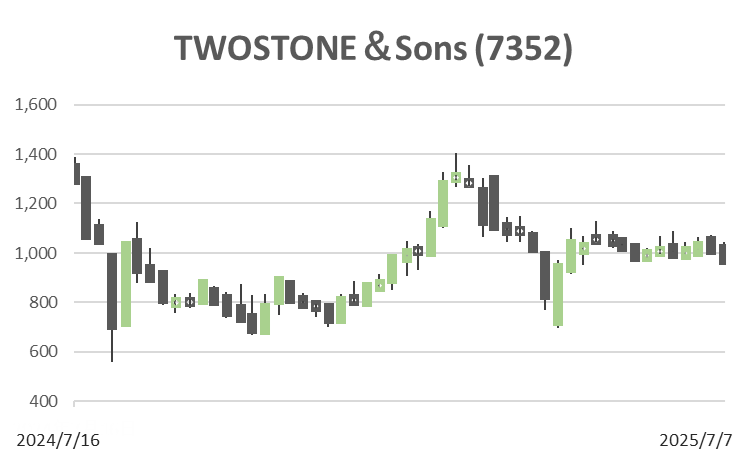

As of July 2025, the share price has risen approximately 12% year-to-date, following the upward earnings revision in April. For the current fiscal year, forecast ROE is 17.1%, PER is 73.6x, dividend payout ratio is 4%, and EPS growth is estimated at +10%. Based on these assumptions, the calculated theoretical PBR is 11.1x, while the current market PBR stands at 12.5x—broadly consistent with intrinsic value.

However, the forecast equity yield is only 1.4%, raising questions about the adequacy of returns at current price levels. Sustained investor confidence in the company’s earnings growth trajectory will be key to maintaining the present valuation.

Recent earnings improvements have been attributed to sales efficiency, AI integration, and profit contributions from the consulting and advisory segment. Nonetheless, as the company remains in a growth phase, continued strategic investment is expected, and consistent maintenance of high ROE and profit growth is not guaranteed. Earnings volatility remains a concern.

In the near term, a tactical entry on dips could provide 10–15% upside potential. However, for a longer-term investment case, a firmer confirmation of fundamental strength will be required.

Shareholder Composition

Founders hold over 75%; shareholder structure is highly stable and insider-controlled.

As of July 2025, the top shareholders of TWOSTONE&Sons are as follows:

- Yasushi Kawabata (CEO): 37.47% (16.291 million shares)

- Katsuya Takahara (Co-founder): 37.36% (16.243 million shares)

- Masashi Kurata (Executive): 3.94% (1.711 million shares)

- Mayumi Ueda (Executive): 3.53% (1.534 million shares)

- Yuta Misaki (Executive): 2.97% (1.289 million shares)

- Mynavi Corporation: 3.58% (1.559 million shares)

- JSH Holdings Godo Kaisha: 0.44% (192 thousand shares)

Institutional ownership is minimal, with Nikko Asset Management (0.24%), BlackRock (0.09%), and Dimensional Fund Advisors (0.04%) maintaining small positions. The free float is limited, which poses a hurdle to broader institutional participation due to liquidity constraints.

Conversely, the high insider ownership structure enables management to align shareholder communications and capital policy effectively. The coherent governance framework and founder-led strategic direction serve as a strength in capital markets evaluation.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)