Tri Chemical Laboratories Inc. (Price Discovery)

Cautious Watch

Conclusion

Niche high-k leader with a record 1Q; Minami-Alps ramp could trigger a re-rating—await proof of sustained mix-driven ROE above 16% and buy on weakness.

Profile

Niche leader in high-purity chemical compounds indispensable for advanced semiconductors. With overseas sales accounting for about 80 per cent, the Company rides the wave of global demand.

The Company engages in the development, manufacture, and sale of high-purity chemical compounds for semiconductor fabrication. Among these, High-k materials (high-dielectric-constant insulating films) are the mainstay, and their contribution to securing yield and reliability at advanced nodes is the source of competitiveness. As at FY01/2025, business revenue is in substance a single segment (high-purity chemical compounds for semiconductor fabrication), with overseas sales accounting for approximately 79 per cent. In the first quarter of FY01/2026, the equity ratio stood at 80.7 per cent, maintaining a robust financial base.

| Securities Code |

| TYO:4369 |

| Market Capitalization |

| 99,933 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

Niche-top strategy in materials for semiconductors. Indispensable in the field of advanced semiconductors.

Tri Chemical Laboratories engages in the development, manufacture, and sale of high-purity chemical compounds for semiconductor fabrication. Its mainstay products are high-dielectric-constant insulating film materials (High-k materials), which are indispensable in the field of advanced semiconductors. Although the market is by no means large, the Company achieves high profitability and high growth by holding a high share in a niche market.

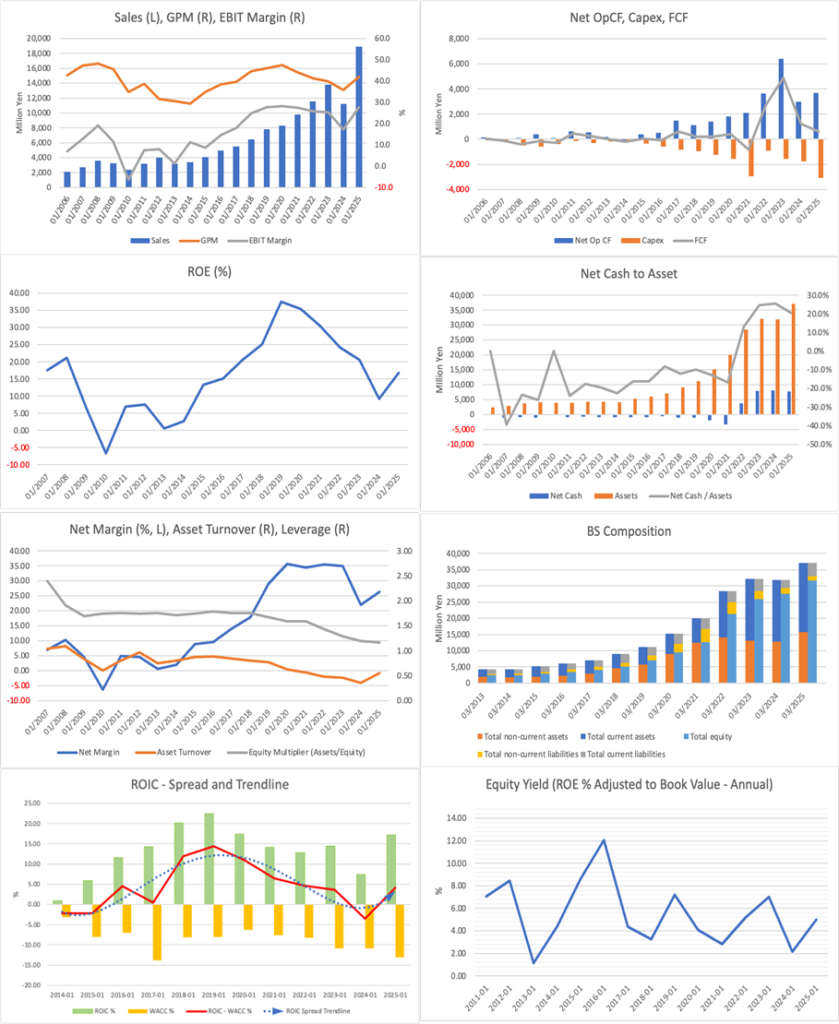

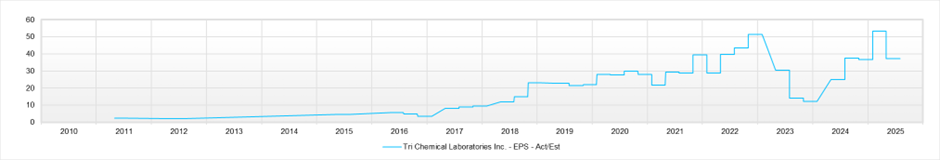

Continuing from the substantial profit increase in the previous year, for the fiscal year ending January 2026, the Company foresees double-digit growth, with net sales of 26.0 billion yen (up 37.5 per cent year on year) and operating profit of 6.05 billion yen (up 15.1 per cent). The first-quarter (February–April) results announced in May showed net sales of 6.569 billion yen (twice the level of the same period of the previous year) and operating profit of 1.712 billion yen (2.5 times), both marking a strong start with record highs. Expectations are rising for the second-quarter results scheduled to be announced on 29 August.

In the first quarter, the Company recovered from the memory downturn in the previous year, with sales to China growing rapidly. Sales to Taiwan also reached an all-time high. Looking at semiconductor end-use, both memory and logic posted sales at record-high bases.

Going forward, contributions to results are envisaged from mass production of etching materials for next-generation 3D NAND and the development of new materials at the Minami-Alps Works, which commenced operation in March, as well as increased shipments from the Taiwanese subsidiary, and there are expectations for an upward revision to the full-year Company plan.

Investor’s View

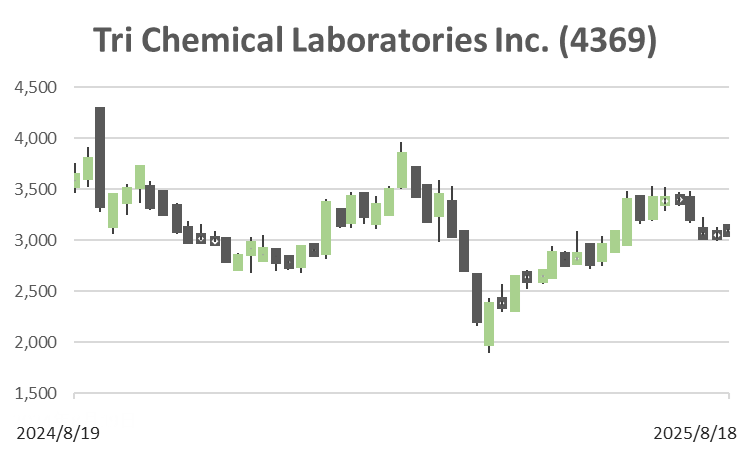

Cautious watch. The earnings momentum at hand is unmistakable, yet the share price continues to carry the adjustment following the peak in early 2024.

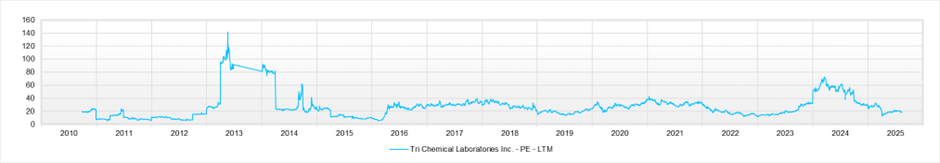

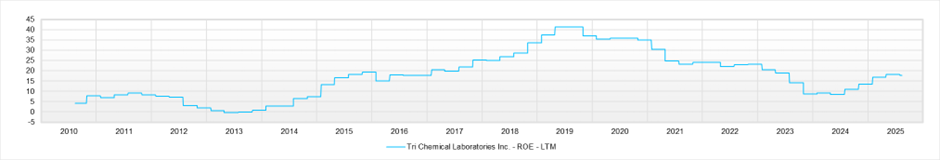

The current levels—forecast PER of roughly 19.9 times, PBR of approximately 3.18 times, and forecast ROE of nearly 16 per cent—can be read, on a residual-income approach, as a neutral zone that prices in a long-term growth rate of g≈5 per cent. Until the body of evidence that the recovery is transitioning into “sustained growth” increases, caution remains regarding a step-up in the evaluation.

Conversely, in the first quarter, both sales and profit reached record highs, and demand broadened with China and Taiwan at the centre. By application, growth was confirmed in core products such as High-k and Etching, and if the mass-production ramp-up at the new Minami-Alps plant proceeds in earnest, improvements in mix together with higher utilisation are likely to underpin profitability, increasing the plausibility of ROE≥16 per cent becoming entrenched. Whether this transition “from volume to quality” is made explicit is the crux of the next step in the evaluation.

The stability on the financial front merits special mention. Since FY01/2011, there has not been a single instance of falling into the red or a management crisis, and the equity ratio consistently exceeds 80 per cent, a powerful position. While the structure shows resilience even in phases of low visibility, capital is at the same time excessive, leaving room to optimise between growth investment and shareholder returns. The shareholder base is deep with domestic and overseas institutions; in particular, the 7.94 per cent holding by Capital Research & Management (Small Cap World Fund) is the most significant stake among outsiders and can be regarded as an expression of confidence in the quality of the business.

As to the implications for valuation, if g is lifted to 6 per cent, the theoretical PBR would be at roughly the 4-times level, bringing a range around 3,800 yen into view. Alternatively, if g remains in the 4-per-cent range, levels in the 2,600-yen range are also explainable, and a DCF cross-check likewise converges on a fair value of approximately 3,300–3,700 yen. Accordingly, for the time being we maintain a cautious watch, and judge that a strategy of buying on weakness in stages is appropriate in phases where the sustainability of quantity × mix improvement, the economics of the new plant ramp-up (fixed-cost absorption and yield), and the stickiness of orders under a geopolitical and tariff environment can be confirmed.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

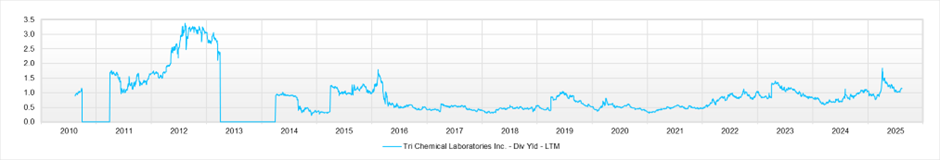

Dividend Yield (LTM)