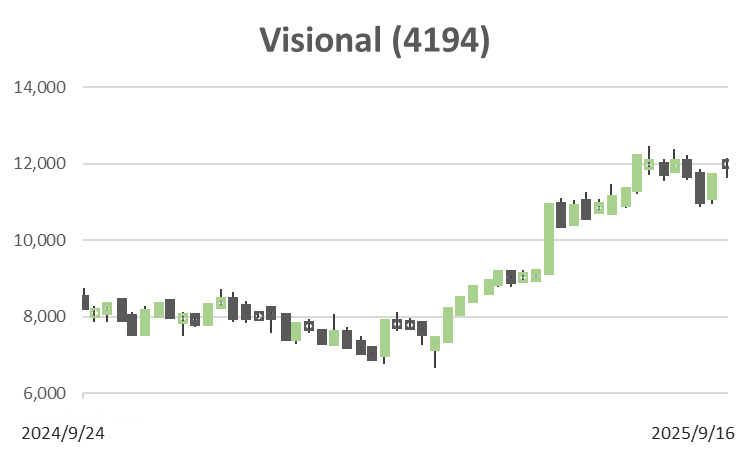

Visional (Price Discovery)

Hold

Conclusion

Hold. While expansion in demand for professional talent with “BizReach” supports fine growth, valuation is broadly at a fair level. Hence, the scope for a significant expansion of price multiples is limited. Nevertheless, with constant earnings growth expected, continued shareholding would be a reasonable approach.

Profile

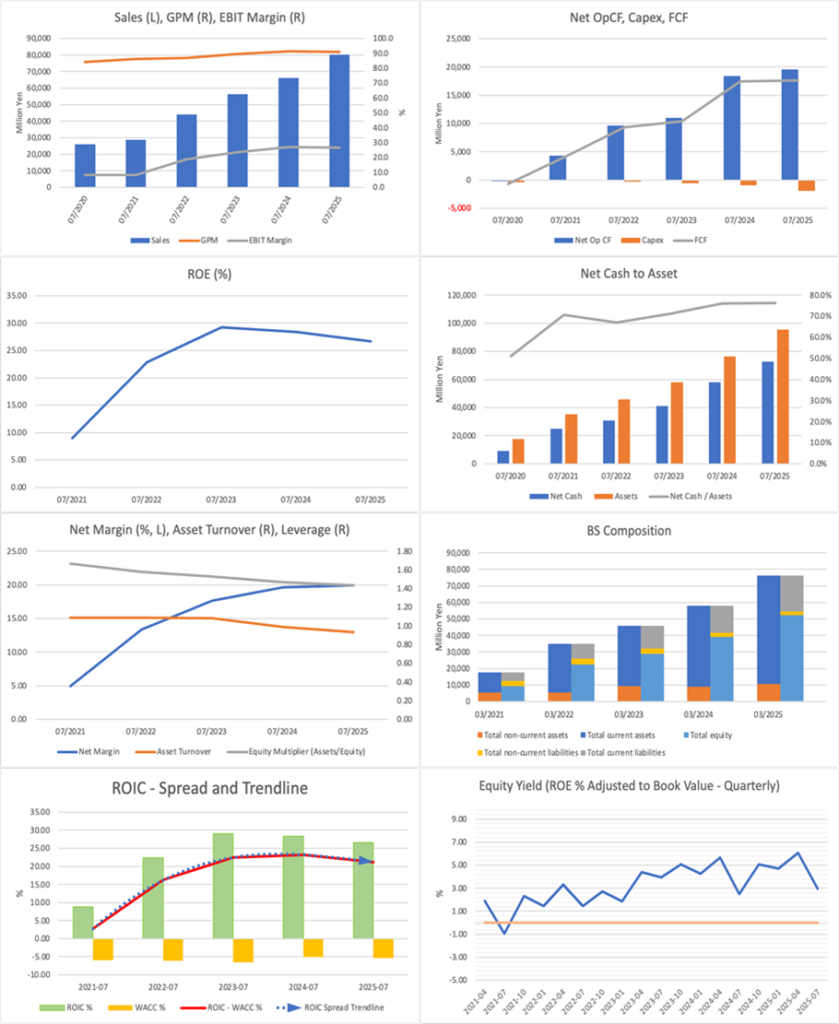

Visional is an HR technology company with the professional-talent job-change platform “BizReach” as its core. The business composition is that HR Tech accounts for 97% of revenue and maintains a high operating margin of 31%. By contrast, the Incubation business accounts for only 3% of revenue, and its operating margin is −45%, indicating it is loss-making (FY7/2024). While capturing demand for professional talent centered on the core “BizReach,” the company is also expanding into adjacent areas such as the talent-management service “HRMOS,” and it aims for growth that captures structural changes in Japan’s labor market.

Revenue mix by business % (operating margin %): HR Tech 97 (31), Incubation 3 (−45) <FY7/2024>

| Securities Code |

| TYO:4194 |

| Market Capitalization |

| 472,949 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Demand for professional talent is intense. Attention on the growth of the “in-house BizReach” marks the dawn of a “great job-change era.”

Visional continues to generate substantial revenue from the professional-talent job-change site, “BizReach.”

In the results for the prior fiscal year ending July 2025 announced on 12 September, revenue increased by 21.2% and operating profit increased by 20.2%. “BizReach” slightly exceeded the plan, landing above guidance as demand for professional talent and the effects of active advertising and promotion worked together. The talent-management “HRMOS” also saw the sales of each service expand steadily, resulting in a smaller operating loss than initially expected.

For the current fiscal year, the company plans revenue of 99.2 billion yen (a 23.7% increase year-over-year) and operating profit of 23.1 billion yen (a 7.7% increase year-over-year). For “HRMOS,” although it had previously assumed a turnaround to profit in the current fiscal year, it has shifted its policy to make upfront investments for further growth going forward. Even so, the operating loss is expected to narrow further to 200 million yen, and the company has indicated the view that “profitability is possible at any time” for the business.

The “in-house BizReach by HRMOS,” released this January to prevent talent outflows through the use of generative AI, is already being introduced at large enterprises such as Sumitomo Mitsui Banking Corporation and the Kirin Group. The job-change market increased in liquidity with the COVID-19 pandemic as a catalyst. In 2023, the number of people seeking job changes exceeded 10 million for the first time, creating a favorable market environment.

Investor’s View

Hold. While the share price has risen on the back of increased profit, the valuation is at a fair level. It is an excellent business, but unless new factors emerge, such as the resolution of excess cash, the scope for valuation expansion is limited.

Although the share price has risen by nearly 50% year to date, there has been no significant change in the PER or PBR; the shares’ assessment itself has remained unchanged. Increased profit was the main driver of the share price.

Cash is accumulating while not being utilized effectively. Net cash has reached 76% of assets, but accounts for only 15% of market capitalization. Even after adjusting for this, PER is 24.7 times, which does not indicate any particular sense of undervaluation.

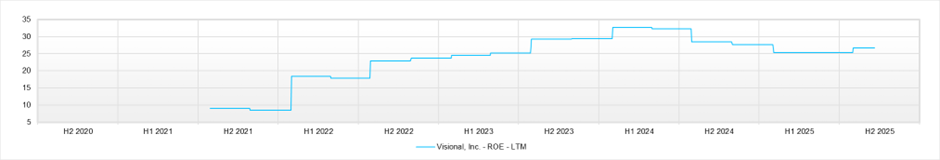

The current valuation (PER 29.1, PBR 6.98, forecast dividend 0 yen) implies an EPS growth rate of 23%, which is a reasonable level, as it nearly matches the +24% CAGR over the past five years. Moreover, as evident from the company’s balance sheet composition, the burden of fixed assets is extremely light, and the underlying return on capital is exceptionally high. However, the cash that has accumulated to an enormous level is depressing capital efficiency, and ROE is being significantly dressed down.

Overall, the company’s growth potential and profitability appear to be appropriately incorporated into the share price. Unless major factors are presented, such as a step-up in profit margin or the resolution of excess cash, the possibility of valuation expansion is low.

On the other hand, since earnings growth is steady, a significant decline in the share price is considered unlikely. That said, if a share-price dip occurs due to external factors not attributable to the company’s fundamentals, it would be a good opportunity to buy aggressively.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)