Simplex Holdings (Price Discovery)

Buy

Conclusion

Buy. A bullish investment rating is sensible based on the company’s unique, high-profitability business model, its strong business performance, and a thematic interest in its stablecoin business.

The shares are rated a Buy. At the core of the company’s unique business model, ‘Simplex Way’, is an end-to-end system of direct, prime contractor transactions specialising in the financial domain and the reuse of its intellectual property; this is the source of its high profit margins, which exceed the industry average, and its abundant cash flow generation capability. This fundamental strength is not only clearly reflected in its recent strong business performance (with a substantial increase in profit in Q1 FY 3/2026), which has captured robust demand for systems integration, but is also augmented by the expectation that its newly noteworthy stablecoin-related business will serve as a future growth driver. Even after the sharp rise in its share price year-to-date, the profit growth expectations factored into its current valuation are consistent with the company’s medium- to long-term plan and are not at an excessive level; this is therefore judged to be an opportune moment to appreciate the twin pillars of its solid business foundation and its new growth themes.

Profile

A technology-driven systems integrator, originating in the financial domain, that provides end-to-end services from consulting through to systems integration and operations.

With its strengths in the financial domain, the company is a tech consulting and systems integration firm that undertakes everything from strategy/DX consulting to systems integration and operations in an end-to-end manner. The company champions the ‘Simplex Way’, a philosophy that avoids reliance on the multi-layered subcontracting structure prevalent in Japan’s domestic IT industry. It is characterised by the in-house retention and reuse of copyrights (Simplex Library), the elimination of intermediary margins, and project execution handled entirely in-house from end-to-end by hybrid personnel who are well-versed in both business and technology. This model achieves both a high level of commitment and efficient operations.

The group structure is composed of two layers: the tech firm, Simplex, and the consulting firm, Xspear. It is designed to enable Xspear to engage with untapped areas in the upstream phase, connecting the downstream implementation and operations to Simplex. The core of their synergy lies in directly engaging with client management to provide vertical support, from strategy formulation through to implementation and operations.

Percentage of sales revenue by business segment: Strategy/DX Consulting 16, Systems Integration 55, Operations Services 29, Other 0 (for the fiscal year ending March 2025).

| Securities Code |

| TYO:4373 |

| Market Capitalization |

| 249,697 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

While gathering attention for stablecoin-related developments, its recent business performance is strong against a backdrop of robust demand for systems integration, and there appears to be potential for its full-year forecast to be exceeded.

Simplex Holdings, Inc.’s primary business is the building of systems for major financial institutions. In June of this year, it announced the ‘Simplex Stablecoin’ issuance and redemption system, and is also drawing attention as one of the related stocks.

‘Stablecoins’ are a type of crypto-asset designed to maintain a stable transaction price by linking to fiat currencies or various other assets. Their practical use is envisioned for daily payments and international remittances, and they are distinguished from crypto-assets (virtual currencies) that serve as investment targets.

Since 2024, the company has been developing a transaction system for ‘JPYC’, the yen-pegged stablecoin issued by JPYC Inc. (Chiyoda-ku, Tokyo), which recently acquired Japan’s first license as a Fund Transfer Service Provider. More recently, it has also begun offering stablecoin business development support through its subsidiary Xspear, a comprehensive consulting firm, and is also undertaking initiatives such as a joint proof-of-concept using ‘Simplex Stablecoin’ with a US company.

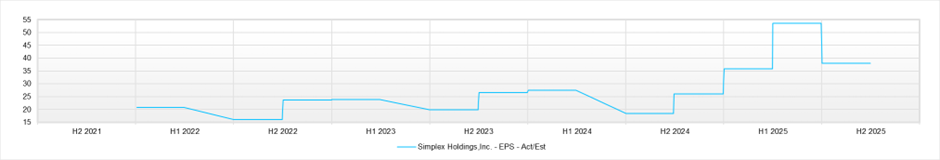

The most recently announced financial results for the first quarter of the fiscal year ending March 2026 (April to June) showed sales revenue of 13.464 billion yen (a 22.9% increase year-on-year) and operating profit of 3.213 billion yen (a 97.6% increase year-on-year), showing progress at a faster pace than anticipated. Against the backdrop of robust domestic demand for IT investment, its core systems development business is performing well, and the situation of assigning research and development engineers to client projects continues.

Based on the Q1 results and the current situation, the business forecasts for the first half and the full fiscal year have been revised upwards. The full-year forecast merely reflects a carry-over of the outperformance from the first half, and a sense of further potential remains.

Investor’s View

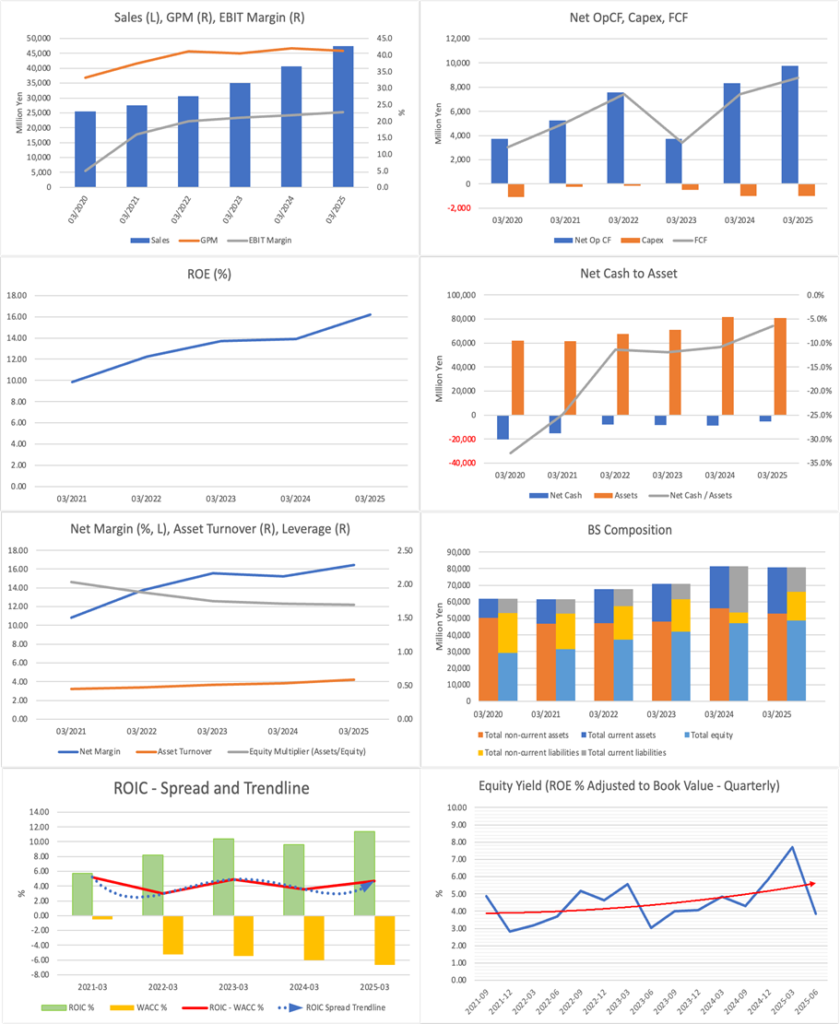

The core of its investment appeal lies in the high profitability generated by its unique business model and the ability to simultaneously pursue both shareholder returns and growth investment, using this profitability as a resource.

The investment rating for the company is ‘Buy’, and the basis for this lies in the fundamental strength derived from its highly unique business model and the future potential it holds. The ‘Simplex Way’, which eschews the multi-layered subcontracting structure, achieves both high profit margins and an abundant cash flow generation capability, supporting a financial constitution that enables both growth investment and shareholder returns. The recent strong business performance is proof that this model accurately captures the current robust demand for DX. Furthermore, with the addition of the new growth theme of stablecoins, future upside potential has also increased. Even after the rise in its share price since the beginning of the year, the valuation remains at a level that does not indicate excessive optimism regarding future growth expectations; rather, it is considered an opportune moment to appreciate the company’s sustainable economic value creation capability (ROIC > WACC).

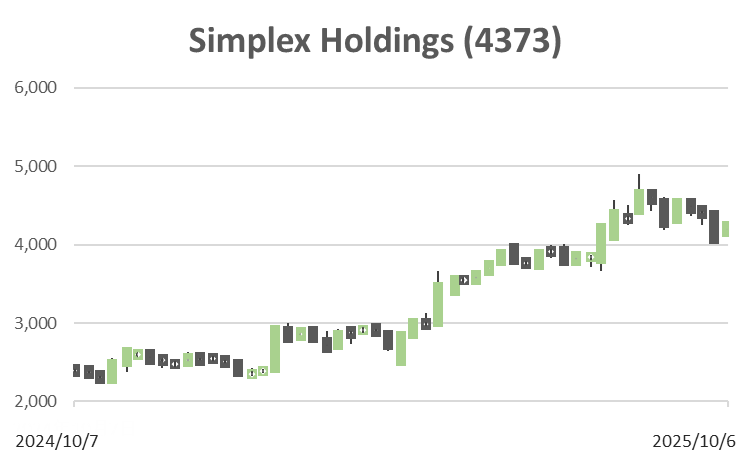

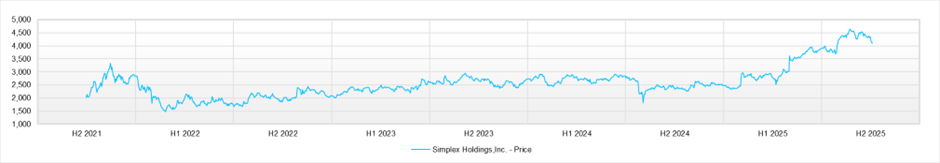

Background to Share Price Movements: The Resonance of Fundamentals and Catalysts

Strong Q1 financial results, along with the upward revision of the full-year forecast, demonstrated fundamental strength. Share buybacks and expectations for stablecoins provided impetus to the rise in the share price.

Marking a turnaround from the share price’s sluggish performance since last year, it is considered that the sharp increase of nearly 70% since the start of the year was driven by the combined effect of three factors: a reaffirmation of strong fundamentals, favourable share supply-demand dynamics, and expectations for a new growth theme.

Firstly, on the fundamentals side, the fact that the financial results for the first quarter of the fiscal year ending March 2026 were robust was a significant factor. Sales revenue was 13.46 billion yen (a 22.9% increase year-on-year) and operating profit was 3.21 billion yen (a 97.6% increase year-on-year), showing progress that surpassed market expectations. This was because, in addition to growth in the core systems integration business against a backdrop of robust domestic demand for IT investment, engineers who were initially intended for research and development were redirected to revenue-generating projects, which pushed up profit margins. In response to these results, the company revised its first-half and full-year business forecasts upward, which increased market confidence.

Secondly, an improvement in supply and demand pushed up the share price. The company conducted a share buyback of approximately 5.0 billion yen from January to April 2025, the completion of which reduced the number of shares in circulation on the market, leading to expectations of higher value per share and a tightening of supply and demand. For investors, this was perceived as a sign of the company’s focus on improving capital efficiency and its stance on shareholder returns, and became a positive factor.

Thirdly, the addition of expectations for ‘stablecoins’ as a future growth theme acted as a catalyst. The ‘Simplex Stablecoin’ issuance and management platform announced by the company holds the potential to form the core of a new financial infrastructure in the coming Web3 era. Its track record of collaboration with JPYC Inc., which acquired Japan’s first license as a Fund Transfer Service Provider, has also raised market expectations. Consequently, in addition to the stable growth of the conventional systems integration business, the possibility that a new, thematic business could discontinuously boost future revenues has been recognised, which is analysed as having led to an upward re-rating of its valuation.

Competitor Comparison and Valuation: The Premium Generated by a Unique Model

Compared with domestic and international competitors, the company’s finance-focused ‘end-to-end model’ and ‘IP reuse’ accentuate its uniqueness, justifying its high profit margins and share price premium.

To clarify the company’s characteristics, a comparative analysis is conducted with similar domestic and international companies. By considering both its business model and valuation, the source of the company’s share price premium is articulated.

Domestically, major systems integrators such as Nomura Research Institute (NRI), TIS Inc., and SCSK Corporation serve as points of comparison. While these companies also have financial institutions as major clients, Simplex sets itself apart with its ‘Simplex Way’, as it specialises more in the front-office areas of finance (such as trading and risk management) and handles everything from consulting to development and operations in-house in an end-to-end manner. While many major systems integrators rely on large-scale subcontracting structures, the company eliminates intermediary margins through prime contracts and a self-contained model, achieving high profit margins (gross profit margin of 41.4% for the fiscal year ending March 2025). This high profitability is the basis that justifies its valuation premium, as evidenced by a higher PER and PBR compared to its industry peers.

Looking internationally, several comparable companies can be considered, depending on the business model. Digital engineering firms such as EPAM Systems and Endava are similar in that they support client DX with agile development and cloud-native technologies. However, whereas these companies cover diverse industries globally, Simplex differs in that it is deeply rooted in the Japanese financial market. Furthermore, Simplex turns its developed system components into intellectual property (IP) as the ‘Simplex Library’. It reuses them in other projects to enhance development efficiency and quality, which is a revenue enhancement model different from that of companies like EPAM, which are centred on general contract development. On the other hand, financial software/platform companies like Temenos and FIS provide packaged software in a licensed or SaaS format. While Simplex also generates recurring revenue from sources such as shared-use services, the foundation of its business is custom development and consulting aimed at solving each client’s specific issues, resulting in a revenue structure that differs from that of pure product vendors.

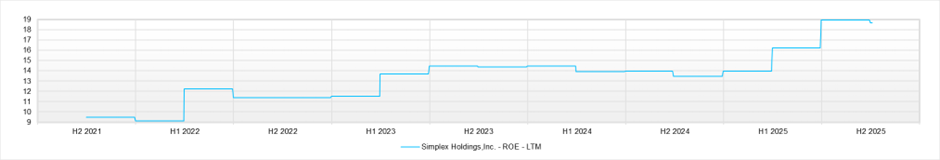

The reason the company’s shares are valued at a premium to similar companies can be summarised by the uniqueness of its business model. By specialising in the expert domain of the financial front office, and by thoroughly implementing direct prime contracting and IP reuse, it achieves profit margins that significantly exceed the industry average, leading to a high ROE. Moreover, systems, once introduced, tend to lead to long-term operations, maintenance, and additional development, meaning that approximately 60% of its sales revenue is composed of ‘low-risk, stable revenue sources’ such as repeat orders and recurring business. This revenue stability increases the predictability of future cash flows and reduces the discount risk in its valuation. Furthermore, the cultivation of hybrid personnel equipped with both ‘business knowledge’ and ‘technical skill’, and the ‘Simplex Library’, accumulated over many years of projects, has become a source of competitive advantage (a moat) that cannot be imitated overnight. In conclusion, the company’s share price premium reflects the market’s appreciation for a unique business model that goes beyond the framework of a mere systems integrator, one that combines specialisation, efficiency, and stability.

Valuation Analysis: Priced-in Growth Expectations

The current share price has priced in mid-teen annual EPS growth, reflecting a somewhat optimistic market view that is consistent with the company’s medium-term plan targets.

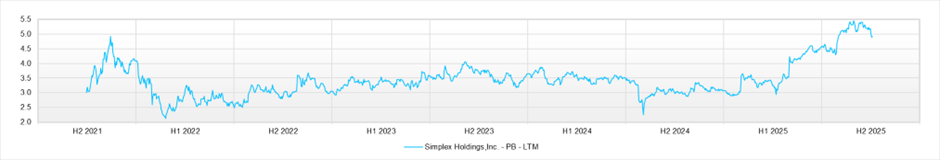

An analysis is conducted to assess the extent of profit growth priced into the current valuation, determining whether market expectations are optimistic or cautious. Using the given metrics (Forecast PER 26.5x, Trailing PBR 4.95x, Forecast ROE 19.3%, Forecast EPS 161.8 yen), the implied EPS growth expectation in the share price is calculated. Estimating from factors such as the relationship between PBR and ROE, it is reasonable to interpret that the market is pricing in annual EPS growth of approximately 11-15%.

Evaluating these market expectations, the company’s published medium-term management plan, ‘MTP 2027’, sets a target for a CAGR in operating profit of 19.3% from the fiscal year ending March 2024 to the fiscal year ending March 2027, and in its latest full-year forecast for the fiscal year ending March 2026, it projects a growth rate of 17.5% in profit attributable to owners of parent. The market’s priced-in growth expectation of 11-15%, while slightly lower than the company’s own profit growth targets, is consistent with a level that takes long-term sustainability into account. This suggests that while the market positively appraises the company’s growth story, it also sees certain hurdles to achieving the medium-term management plan’s targets. It is neither an excessively optimistic bubble nor undervalued. In conclusion, the market’s view can be assessed as ‘neutral, leaning slightly optimistic, supported by actual results’. Going forward, if the company expands its business performance at a pace exceeding the medium-term management plan’s targets, or demonstrates a concrete path to monetisation in new areas such as the stablecoin business, there is room for its valuation to be re-rated further upwards.

Shareholder Structure

This is a well-balanced structure in which the founder and management team support the business as stable shareholders, while domestic and international institutional investors provide liquidity and diverse perspectives.

Based on the Annual Securities Report for the fiscal year ended March 2025 and data from FactSet, the company’s shareholder structure exhibits several notable characteristics. The founder, President Hideki Kaneko, is the top shareholder, including shares held by affiliated companies, and other founding members are also listed among the top shareholders; this high equity stake held by the management team forms the foundation for business stability and long-term decision-making. At the same time, major domestic and international institutional investors, such as The Vanguard Group, Nomura Asset Management, and FIL Investments, are also included on the shareholder list, which can be seen as evidence that the company’s business model and growth potential are appreciated by professional investors. The presence of such institutional investors not only enhances the liquidity of the shares but also contributes to sound external discipline regarding corporate governance. Furthermore, SBI Holdings, Inc., a key business partner, also holds a significant stake as a major shareholder, underscoring a strong relationship between the two companies. The company itself also has approximately 3% of its own shares as treasury stock, ensuring flexibility in its future capital policy. Overall, the founder shareholders who ensure business stability, the institutional investors who bring liquidity and governance discipline, and the corporate shareholder, which symbolises a business alliance, are arranged in a balanced manner, creating what can be assessed as a sound shareholder structure.

Financials and Valuations

Price

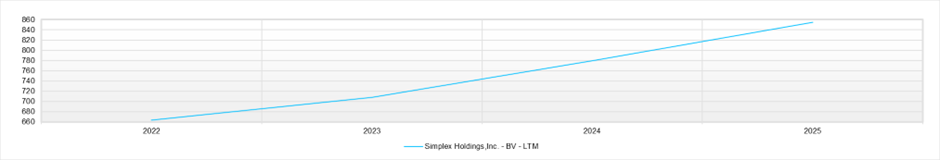

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

BPS (LTM)