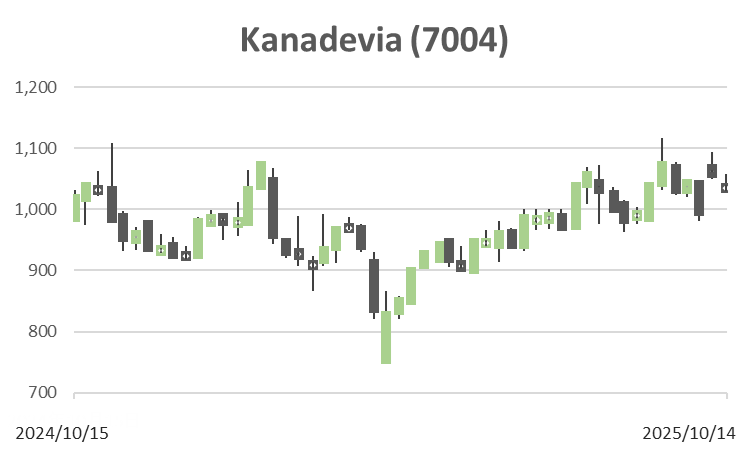

Kanadevia Corp (Price Discovery)

Avoid

Conclusion

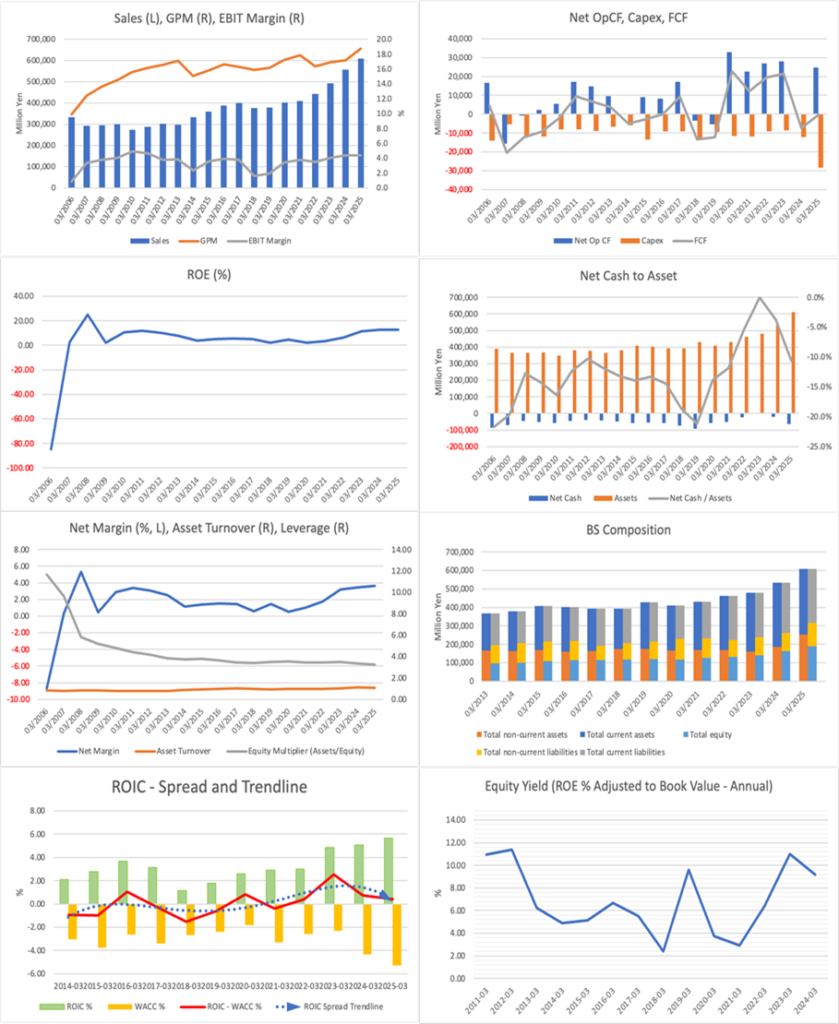

Avoid. While an essentially unchanged balance-sheet mix for more than a decade reflects discipline, excess returns have not been secured commensurate with the increase in invested capital, and the spread between ROIC and the cost of capital appears to be hovering around zero. As a result, the valuation remains around book value, and under current assumptions, the upside seems limited. Although the company has shifted its focus from the former Hitachi Zosen towards an environment-centred business, earnings momentum is weak, with seasonal factors compounded by a decline in high-margin domestic projects and costs related to quality measures, even with full-year guidance maintained. For a re-rating, it would be effective to clarify capital-allocation priorities—with KPIs and timelines—covering the reduction of non-operating assets, tighter discipline in working capital and investment, and a review of low-return areas; however, until the degree of execution is visible, the risk–reward is not compelling.

Profile

Founded in 1881. Having diversified from its original shipbuilding business, the company now operates a portfolio centred on environmental domains such as resource circulation, water treatment, and waste-to-energy, combined with machinery and infrastructure and decarbonisation-related activities. On 1 October 2024, it changed its corporate name from “Hitachi Zosen Corporation” to “Kanadevia Corporation”, clarifying its positioning as a company oriented towards a circular society and decarbonisation.

Overseas expansion is a key priority in the medium-term plan “Forward 25”, with the overseas sales ratio having recently risen to nearly half. In the current fiscal year, overseas sales account for around 49% of the total, supported by the expansion of overseas subsidiaries such as Inova in Europe, Osmoflo in Australia, and NAC in the United States.

Leveraging its foundational capabilities in large structures and machinery manufacturing, the company aims to enhance capital efficiency by increasing recurring revenue streams, including operations and maintenance, in addition to EPC. Over the medium term, it plans to pursue business investment and portfolio optimisation, positioning environment, water, and renewables as the pillars of growth.

Business mix by sales (%) with operating margin (%): Environment 74 (6), Machinery & Infrastructure 14 (1), Decarbonisation 12 (0), Other 1 (11) [Overseas] 49 (FY3/2025)

| Securities Code |

| TYO:7004 |

| Market Capitalization |

| 176,002 million yen |

| Industry |

| Machinery |

Stock Hunter’s View

Transitioned from shipbuilding to environmental businesses. Currently focused on recurrence-prevention measures.

Formerly known as Hitachi Zose, the company changed its name to “Kanadevia” in October 2024. Its capital relationship with Hitachi, Ltd. was dissolved in 1948, and the shipbuilding division was separated in 2002. Today the mainstay is environmental businesses centred on waste-to-energy facilities.

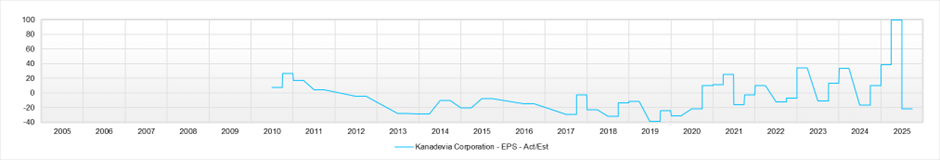

In the first quarter of the fiscal year ending March 2026 (April–June), which was announced earlier, revenue rose by 3.2%, while operating profit was a loss of 4.055 billion yen (a loss of 878 million yen in the same period of the previous year). Although the Environment segment posted higher revenue due to increased sales at overseas subsidiaries, it fell into an operating loss owing to a decline in high-margin domestic projects. The Machinery & Infrastructure and Decarbonisation segments also underperformed, weighing on overall results.

By its business nature, the first quarter is typically soft and sales and profits tend to be concentrated in the fourth quarter. The company has therefore kept its full-year outlook unchanged, expecting a recovery from the second quarter onwards, maintaining its initial forecasts for net sales of 620.0 billion yen (up 1.6% year on year) and operating profit of 27.0 billion yen (up 0.2%).

In July last year, a misconduct case involving marine engines came to light. The company is strengthening its quality assurance framework, including establishing a division to promote prevention of recurrence, holding briefings for employees and reviewing the organisation of quality assurance departments at each site. This case is included in the Decarbonisation segment, and the impact is likely to persist for some time. For the time being, the Environment business, including waste-to-energy facilities in Europe, is expected to remain the main driver.

Investor’s View

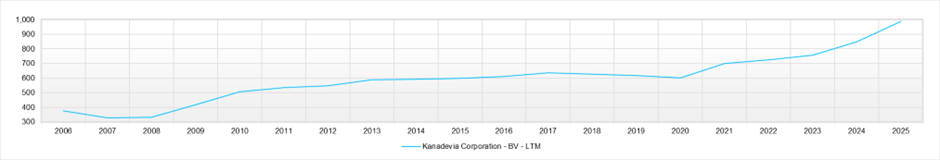

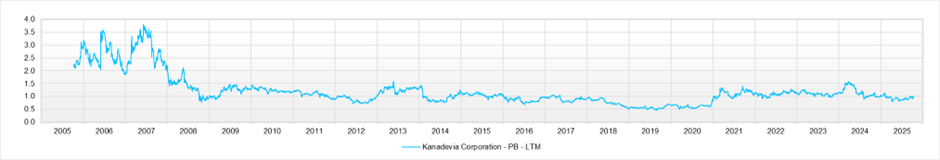

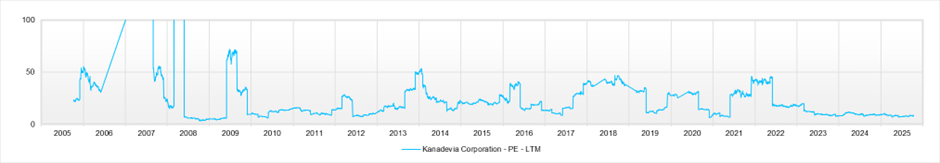

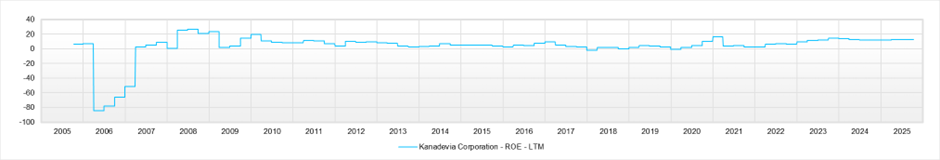

Avoid. Despite a sustained improvement in ROE, the shares have underperformed since 2023 and remain priced around book value. The background is that economic value creation is fading: invested capital is increasing while excess returns are thin, and the spread between ROIC and the cost of capital has narrowed to near zero.

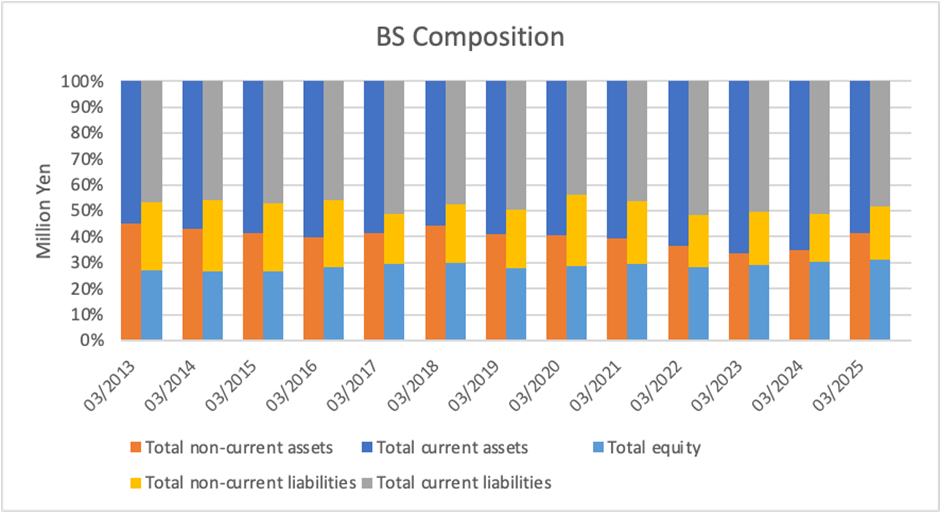

A balance-sheet mix that has barely changed for more than a decade is a sign of discipline, but without asset re-mixing and the reduction of non-core holdings, further gains in capital efficiency are unlikely. Management advocates running the business with an awareness of the cost of capital and share price, but initiatives are dispersed and it is unclear what will be exited and where capital will be concentrated. The market leans towards the view that value creation will be difficult if the company stays on its current path, and the present situation is hard to defend. Conversely, if the company tackles the core issues—disposing of non-operating assets, lightening the asset base and scaling back low-return areas—its low PBR could adjust quickly; at present, however, the probability of decisive execution is unclear.

The company’s finances have been stable over a long period, and the allocation between assets and liabilities has not changed significantly. While this appears sound on the surface, from a capital-efficiency perspective, such “unchanged” status is becoming a constraint. ROE has improved through gains in margin and turnover, but excess returns commensurate with the increase in invested capital have not materialised, and economic value creation is waning. What investors focus on is whether the company will continue to refine the existing structure or reshape it; currently, it is the former, and commitment to the latter is weak.

In the medium-term plan, management sets out to run the business with an awareness of the cost of capital and maintaining a PBR above one. However, while the initiatives are wide-ranging, priorities are unclear, and the centre of gravity in capital allocation is hard to discern. Improving working-capital efficiency and increasing the share of recurring revenues, such as O&M, are sensible directions. However, without accelerating asset rotation and exiting low-return areas, ROIC will not materially exceed the cost of capital. This is why the market remains cautious.

The valuation points to the same conclusion. The current share price assumes a “plain” company whose capital efficiency is roughly in line with its cost of capital, and bakes in only modest earnings growth. Meanwhile, the current plan starts with lower profits, and it will take time to re-establish a growth trajectory. In other words, the shares are not priced for strong optimism, but there is also limited scope for a re-rating without execution. Expectations are not high, yet it would be unrealistic to assume that the share price will rise simply by delivering the plan.

A re-rating hinges on decisions that change the balance sheet itself: reducing cross-holdings and surplus assets, externalising assets, tightening inventory and project management to improve cash conversion, and reshaping the portfolio, including exiting low-ROIC businesses and investments. The test is whether the company can present these with clear KPIs and timelines and restore a firm premium of ROIC over the cost of capital. Conversely, once execution becomes visible, the pace of re-rating is likely to be swift; for now, the shares remain in a pre-execution phase.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

BPS (LTM)