Entrust (Price Discovery)

Buy on Weakness

Conclusion

With stable growth in rent-guarantee at the core and rising momentum in medical and nursing-care guarantees, the company’s economic value creation underpinned by an ROIC of around 20% and a capital-allocation policy oriented toward a return to the Prime Market are supportive. However, as the share price is broadly close to our equally weighted fair-value median of approximately ¥1,260 (range ¥1,020–¥1,570), we prefer to wait for weakness before accumulating.

Profile

A growth company expanding medical and nursing-care guarantees around a core of rent-guarantee, containing credit costs through rigorous screening and collections, and shifting its focus from solutions to higher-value guarantees.

Entrust continues steady growth in its core rent-guarantee business while new fields—medical-expense and nursing-care guarantees—have moved from launch phase to a firmer trajectory. Operations consist of two pillars: a guarantee business that assumes credit risk, and a solutions business that provides services without assuming risk. In the former, the company bears certain credit risk as a joint guarantor, but strict underwriting and efficient collections have kept credit losses broadly stable. In the latter, know-how developed in rent-guarantee, screening, credit management, and collections, is offered as operational support services that enhance clients’ efficiency. In recent years, a shift in portfolio toward higher-ticket guarantee products has progressed, supporting growth in both the number of outstanding contracts and revenue. Revenue mix (%): Guarantee 90, Solutions 10 (FY3/2025).

| Securities Code |

| TYO:7191 |

| Market Capitalization |

| 23,626 million yen |

| Industry |

| Other financial services |

Stock Hunter’s View

New medical and nursing-care lines are inflecting; growth orientation strengthens with Prime relisting in sight.

Entrust continues steady growth in its core rent-guarantee business, and new domains, medical-expense guarantees and nursing-care guarantees, have begun to gain traction. The company operates with two axes: the guarantee business and the solutions business. The former entails the company assuming certain credit risk as a joint guarantor; its hallmark is stricter underwriting standards and efficient collections, which have kept credit losses stable. The latter provides only services without assuming risk, delivering proprietary operational support built on rent-guarantee know-how. A shift from solutions to higher-unit-price guarantee products has advanced, boosting both the total number of guarantee contracts and revenue.

In the FY3/2026 second quarter (April–September), announced on October 29, revenue was ¥5.86bn (+15.8% YoY) and operating profit was ¥1.388bn (+22.4% YoY). In the rent segment, the growth engine, both initial and renewal guarantee fees trended firmly. As for subsidiary Premier Life (PRL), there was a period when collections were unsatisfactory, but the application of screening and collection know-how now makes it a solid profit contributor. In medical, the number of institutions adopting “Sumahosu,” the proxy-guarantor scheme, increased, driving revenue up 41.6% YoY. In nursing care, 31 new operators were onboarded in Q2 (July–September) alone, with revenue up 55.4% YoY. Products bundled with accident insurance performed well, raising the guarantee attachment rate. Across these areas, market recognition is advancing, with inquiries and leads on the rise.

The company listed on the former Mothers market in December 2016, moved to the First Section the following year, and from April 2022 had been classified on the Prime Market; however, amid TSE reforms and with little prospect of meeting the continued-listing criteria, it transferred to the Standard Market in October 2023. Management has openly stated its intention to return to the Prime Market and is pursuing enhanced shareholder returns and the ambitious targets of its medium-term plan. Notably, the pace of dividend increases has picked up in recent years, and the company currently meets the 50% payout ratio indicated in the plan; for the final year of the plan (next fiscal year), it aims to achieve a 60% payout ratio. The criteria currently not met are the tradable share ratio and tradable market capitalization, and the company has indicated it will consider timing and the assistance of securities houses.

Investor’s View

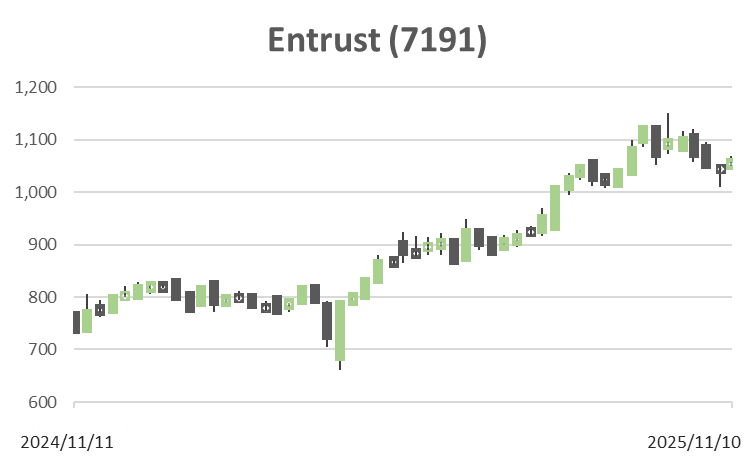

Buy on Weakness. The shares have been re-rated year-to-date and now look only modestly undervalued; we would buy a high-quality franchise on pullbacks.

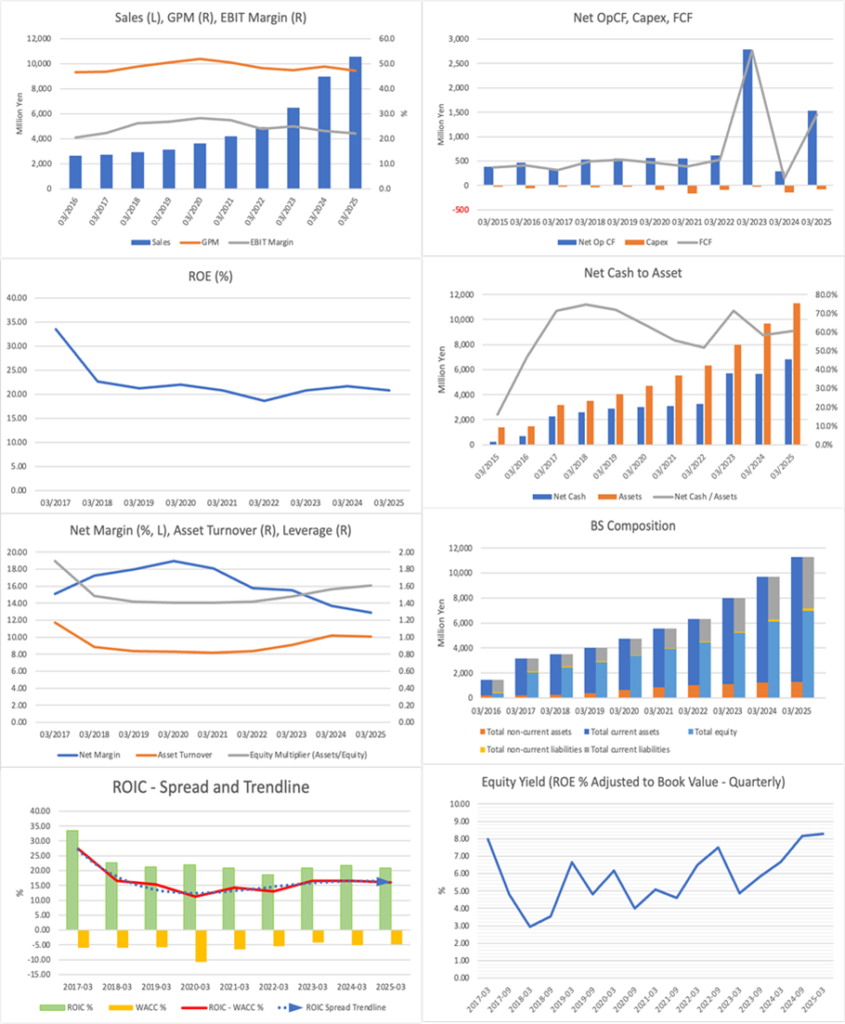

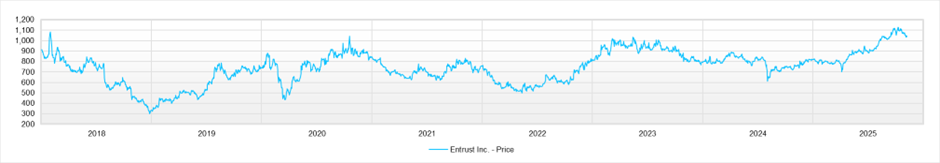

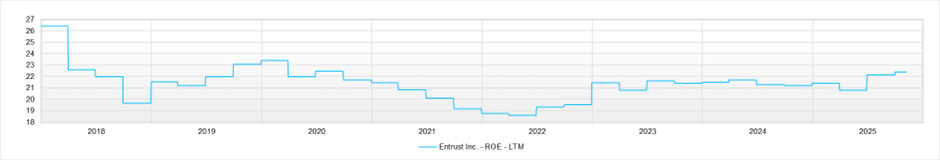

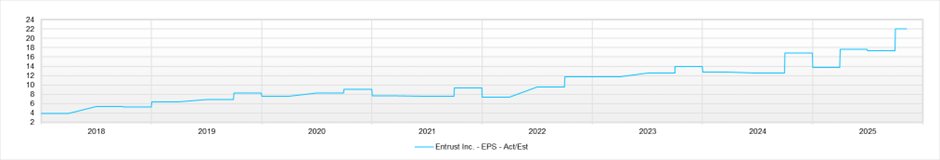

The company is a strong performer: the top line has grown around 20% annually, margins are stable, and EPS has compounded at 15% over 5 years. ROE and cash flow are steady; ROIC remains around 20%, evidencing healthy economic value creation. Historically, as a small-cap with limited IR exposure, the company was under-recognized, and the share price languished from 2021 to 2024. Year-to-date, however, performance has been firm. We attribute the re-rating to a combination of consecutive record earnings that clarified guarantee-driven growth, clearer capital policy via dividend increases and a stated payout-ratio range, expectations for growth via M&A and new products, and an improved valuation environment catalysed by JPX reforms.

The investment call hinges on the gap between fair value and the current price. Our equally-weighted median fair value across four methods is about ¥1,260, with an average range of ¥1,020–¥1,570; method-level medians are PBR ¥990, PER ¥1,050, DCF ¥1,500, and ROIC–WACC ¥1,500. Net cash accounts for 29% of market capitalization, implying a net-cash-adjusted PER of 10.3x; however, the current headline valuation and forecasts (forward PER 14.45x, trailing PBR 3.07x, forecast ROE 22.8%, forecast EPS ¥72, and forecast dividend ¥35) already embed roughly 12–13% EPS growth. We therefore prefer to await share price weakness before adding.

Financials and Valuations

Price

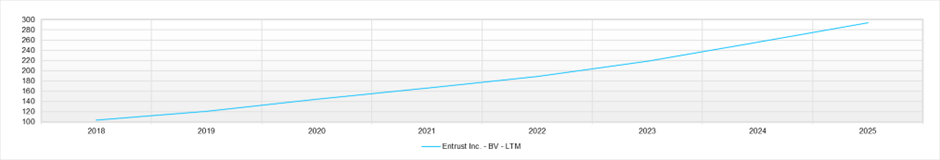

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

BPS (LTM)