MAMEZO (Investment report – 2Q update)

| Share price (11/26) | ¥2,998 | Dividend Yield (26/3 CE) | 2.0 % |

| 52weeks high/low | ¥1,090/3,325 | ROE(25/3) | 50.6 % |

| Avg Vol (3 month) | 178.5 thou shrs | Operating margin (25/3) | 19.6 % |

| Market Cap | ¥48.12 bn | Beta (5Y Monthly) | N/A |

| Enterprise Value | ¥44.94 bn | Shares Outstanding | 16.050 mn shrs |

| PER (26/3 CE) | 15.5 X | Listed market | TSE Growth |

| PBR (25/3 act) | 14.9 X |

| Click here for the PDF version of this page |

| PDF version |

Impressively high ROIC and the accelerating integration synergies. Neutral to positive looking to buy on dips.

Investment conclusion

The investment stance toward MAMEZO Inc. (hereafter, the “Company”) remains “neutral to positive,” as in the previous report. The current indicators of a market capitalization of 49.5 billion yen, a forecast PER of 15.49x, a PBR of 15.34x, an ROE of 50.57%, an ROIC of 54.83%, and net cash of 1.528 billion yen are already pricing in a considerable portion of the high-profitability, high-growth story. However, given that ROIC still significantly exceeds the estimated WACC, we judge that the shares remain attractive for medium- to long-term investment on dips.

The first reason is the strength of earnings momentum. For the cumulative second quarter of the fiscal year ending March 2026, net sales were 5,809 million yen (up 10.3% YoY), operating profit was 1,113 million yen (up 14.7% YoY), and the operating margin reached 19.2%, renewing record-high levels. If the strategic investment of 62 million yen in the AI robotics area is deducted, we estimate that operating profit on an adjusted basis increased by 20.3% YoY, and we can say that our previous view that “the upside potential for full-year results has increased compared with before” has generally proven correct at this point. Second, the Company explains that the impact of the automobile tariff issue is “minimal,” and given that the current orders and operating environment are also solid, the macro risk assumed in the previous report has been evolving more mildly than initially expected.

The sources of the Company’s strength lie in (1) capital efficiency with an ROIC of around 55% that greatly exceeds WACC, (2) a high-unit-price, high-continuity model that participates from the ultra-upstream phase with a client-side perspective, (3) a strong pool of specialist personnel spanning growth areas such as AI robotics and mobility, and (4) investment capacity backed by net cash and high equity capital. In October 2025, three subsidiaries were integrated, consolidating brand, hiring, sales, and development into the stand-alone “Mamezou,” and in addition, measures to differentiate the Company around AI technology and human resource development are progressing, such as the establishment of the cross-business “AI Technical Sector” and the co-creation with DENSO of the SOMRIE® certification system. These are factors that reinforce, on the execution side, the investment theme of an “intangible-asset-driven, high-turnover model” set out in the previous report.

At the same time, it is necessary to review the consistency with the previous investment conclusion. Points where consistency was achieved are (1) the operating margin was maintained in the 19% range while absorbing investment in AI robotics, (2) tariff risk proved to be limited, and (3) the gross margin improved from 32.9% to 33.9%, confirming the build-up of high-value-added projects. Points where consistency was not achieved (or where goals have not yet been met) are (1) the quantitative disclosure of the progress and monetization roadmap for the national project remains limited, and (2) the unified disclosure of post-integration KPIs (orders, utilization rate, unit prices, etc.) is still in progress, making it difficult for investors to numerically connect the medium-term plan (net sales CAGR of +10–12%, operating profit CAGR of +15–17%) with the current actual results. In addition, while in the previous report we stated that “in the short term we would actively buy on dips while keeping an eye on a near-term sense of a valuation ceiling,” the share price subsequently re-rated at a faster pace than expected, and the time window for forming a dip may have been somewhat short. In summary, while the Company can be evaluated, in terms of stage of development, as a “high-profit tech company that has entered a growth–expansion phase,” we believe that, to consider an overweight stance going forward, additional conditions will be (1) more advanced disclosure of post-integration KPIs, (2) visualization of progress in monetizing AI robotics, and (3) clarification of the outline of capital policy, including dividends plus additional measures such as share buybacks.

◇ Highlights of results for the second quarter of the fiscal year ending March 2026: Record-high profit pace in the second quarter while absorbing strategic investment, with simultaneous improvement in gross margin and profit margin

For the second quarter of the fiscal year ending March 2026, while the Company continued its strategic investment in AI robotics, it delivered results that can be positively evaluated, as both net sales and profits reached record highs, and both the gross margin and the operating margin improved. On a cumulative basis for the second quarter, consolidated net sales were 5,809 million yen (up 10.3% YoY), operating profit was 1,113 million yen (up 14.7% YoY), and interim net income attributable to owners of parent was 786 million yen (up 26.7% YoY). The gross margin was 33.9%, the operating margin was 19.2%, and the net margin was 13.5%, all exceeding those of the previous year.

Even on a stand-alone quarterly basis (July–September), net sales were 2,920 million yen (up 14.6% YoY), gross profit was 976 million yen (up 21.5% YoY), and operating profit was 575 million yen (up 31.5% YoY). Net income was 422 million yen (up 47.6% YoY), with the pace of increases in both net sales and profits expanding. While maintaining a high-profit structure with an operating margin of 19.7% and a net margin of 14.5%, the progress rates versus the full-year plan are 25.2% for net sales, 26.9% for operating profit, and 29.2% for net income. At this point, there is no sign of lagging behind the plan line. Compared with the full-year forecast (net sales of 11,607 million yen and operating profit of 2,142 million yen), the progress for both net sales and each profit item is around 50%. At this point, we do not see any negative factors regarding the guidance.

Structurally, the key point is that the existing three areas are driving profit growth while bearing the investment burden in robotics. On a cumulative basis, 62 million yen was invested in the AI robotics area as a strategic investment in the second quarter. Excluding this, gross profit increased by 17.3% YoY, and operating profit increased by 20.3% YoY, securing growth exceeding nominal figures. The Company also explains that, even in the stand-alone second quarter, while investing 36 million yen in this area, the growth rate of net sales on an investment-adjusted basis was 20.4%, and gross profit increased by 8.4%, indicating that strategic investment is starting to link to future top-line expansion positively.

On the cost side, although recruitment costs and advertising expenses increased by a total of 58 million yen compared with the previous fiscal year, operating profit grew by 142 million yen, a much larger increase. This reflects a structure in which gross profit increased in high-upstream-ratio Cloud Consulting, AI Consulting, and Mobility Automation, absorbing the burden of investment and higher SG&A expenses. On the balance sheet, the financial base remains solid, with total assets of 4,491 million yen and an equity-to-asset ratio of 72.0%. Operating cash flow remains positive, driven by higher profit before income taxes. In contrast, cash flow from operations is significantly negative due to dividend payments of 963 million yen, indicating that the Company is strengthening shareholder returns while continuing to invest in growth.

On the macro front, regarding the tariff issue in the automobile industry that was a concern at the beginning of the fiscal year, the Company explains that the impact is “minimal” and that there has been no significant change in current orders or the operating environment. In terms of shareholder returns, since the fiscal year ending March 2026, the Company has shifted to a system of paying dividends twice a year, interim and year-end, and indicated a dividend policy of 30 yen at interim and 31 yen at year-end, for an annual dividend of 61 yen. The interim dividend of 30 yen at the end of the second quarter has already been decided and implemented, representing an effective dividend increase from the previous fiscal year’s annual dividend of 60 yen.

In the second quarter, the structure of “accelerating profit growth while increasing investment” has become clear, and we can evaluate that the quality of earnings has improved compared with the previous fiscal year. On the other hand, the scenario for recouping investment in robotics and the disclosure of KPIs by service remains limited, and going forward, together with the progress of the national project, the extent to which quantitative information, such as orders, utilization, and unit prices, is visualized will be the key focus in judging whether there is room for further valuation expansion.

◇ Segment analysis: All four services are achieving higher sales, with AI consulting and mobility driving growth, while AI robotics remains in an investment phase

The Company’s business consists of four service categories: Cloud Consulting, AI Consulting, AI Robotics Engineering, and Mobility Automation, and each area is achieving balanced net sales growth. In the cumulative second quarter of the fiscal year ending March 2026, net sales of 5,809 million yen were composed of Cloud at 36.3%, AI Consulting at 7.1%, AI Robotics at 17.2%, and Mobility at 39.4%, with all segments increasing by 8.8–17.6% YoY. Meanwhile, gross profit totaled 1,966 million yen, and although only AI Robotics posted a decline (down 15.0%), the other three services achieved double-digit growth.

In accounting terms, the Company has a single reporting segment of information services. However, in practical operations, the four service categories, which differ in customer industries, value propositions, and revenue models, are used as management units in a structure that combines consulting-type, contract development-type, and education-type services. Most customers are large enterprises in the automotive, manufacturing, financial, and trading industries. Across all categories, many projects involve participation in upstream phases such as requirements definition and architecture design. The Company aims for a “knowledge-intensive” revenue structure that brings the expertise of highly skilled personnel to the forefront.

Cloud Consulting steadily expanded, with net sales of 2,110 million yen (up 8.8% YoY) and gross profit of 813 million yen (up 17.1% YoY), and remains the most significant pillar in both categories. Projects for migration to Microsoft Dynamics 365 Finance & Operations, core system renewal in anticipation of the end of SAP ERP support, and the “modernization cliff” triggered by the end of maintenance for Fujitsu systems are acting as tailwinds. By combining ERP implementation, education, and support for in-house development around the cloud, the Company is raising both project unit prices and continuity.

AI Consulting recorded net sales of 410 million yen (up 17.6% YoY) and gross profit of 168 million yen (up 61.0% YoY), showing the highest growth rate among the four categories. Co-creation projects utilizing generative AI and consulting projects, such as data utilization, business design, and PoC support, are expanding, and the high upstream ratio of high-value-added projects appears to be driving rapid improvement in gross margin. Many projects are deepening relationships with existing large corporate customers, and, through cross-selling with cloud projects, AI Consulting also helps increase LTV (lifetime value).

AI Robotics Engineering maintained double-digit growth in net sales, with 998 million yen (up 11.1% YoY), while gross profit declined to 225 million yen (down 15.0% YoY). While projects such as support for automation through robot deployment, autonomous driving, and factory automation, and strategic human resource development are solid, greater recognition of strategic investment in national projects and next-generation robotics is a factor putting pressure on gross profit. The Company positions this area as a “strategic core area” and has set a policy to strengthen technology and accelerate growth by reallocating resources from other services. In the medium term, this is a position where growth in product- and license-type revenue is expected.

Mobility Automation posted net sales of 2,290 million yen (up 10.2% YoY) and gross profit of 759 million yen (up 13.9% YoY), and continues to be the largest in both net sales and gross profit, serving as the core of the Company’s overall growth. Projects are expanding in areas such as software-defined vehicles (SDV), driven by the progress of CASE and SDV in automobiles, and in support of ADAS (Advanced Driver-Assistance Systems), autonomous driving, and motor control. At the same time, horizontal expansion into aerospace, industrial machinery, and energy is also progressing. In the Nagoya area in particular, DX investment appetite remains high, and by integrating AI, system design, and control technology through the Mamezou integration, the Company is strengthening its involvement in upstream phases such as specification development and architecture design.

Based on the above, while all four services are contributing to growth, in terms of revenue structure, the portfolio can be characterized as one in which the stable revenues of Cloud and Mobility form the foundation, AI Consulting drives profit growth, and AI Robotics is positioned as a challenge area with medium- to long-term growth potential.

◇ Full-year earnings forecast for the fiscal year ending March 2026: Progress exceeding plan under conservative guidance, with the growth track after the shift to non-consolidated reporting in focus

The Company’s outlook for the fiscal year ending March 2026 is conservative, and while, based on the progress at the second quarter, there remains upside potential, the timing of recouping investment in robotics and the change in the way the numbers appear due to the shift to non-consolidated reporting remain medium-term uncertainties.

First, if consolidation were to be continued, the full-year reference values would be net sales of 11,607 million yen (up 10.0% YoY), operating profit of 2,142 million yen (up 3.5% YoY), ordinary profit of 2,140 million yen (up 4.3% YoY), net income attributable to owners of parent of 1,447 million yen (up 0.9% YoY), and net income per share of 90.17 yen. The progress rates for the cumulative second quarter are 50.0% for net sales, 52.0% for operating profit, and 54.4% for interim net income, with net sales tracking roughly in line with the plan line and profits running somewhat ahead. As long as the current trend does not deteriorate significantly, we can regard the probability of achieving the Company’s plan as high.

On the other hand, following the completion of the absorption-type merger of the three subsidiaries, the Company will shift to non-consolidated financial statements from the fiscal year ending March 2026; accordingly, non-consolidated full-year forecasts have also been disclosed. On a non-consolidated basis, net sales are forecast at 7,437 million yen, gross profit at 3,623 million yen, operating profit and ordinary profit at 2,393 million yen, and net income at 3,207 million yen, implying extremely high profitability with an operating margin of 32.2% and a net margin of 43.1%. As goodwill amortization and non-controlling interests disappear, the profitability appears higher than in the consolidated reference values, and it is necessary to note that, on the surface, profits will appear to jump.

In the medium term, in addition to the medium-term management plan for fiscal 2025–2027 (net sales CAGR of +10–12% and consolidated operating profit CAGR of +15–17%), the Company explicitly indicated in the explanatory materials for the current fiscal year a policy of targeting an “average profit growth rate of 30%” in the next medium-term plan. Of this, around 15% is intended to be generated by the Company’s conventional organic growth, and the remaining 15% by returns on strategic investment in AI robotics and integration synergies. For the cumulative second quarter, the Company explains that the adjusted operating profit growth rate, excluding robotics investment, was 20.3% YoY, which it views as a preparatory stage toward 30% growth.

Positive factors are (1) progress for both net sales and profits that is slightly ahead of the plan as of the second quarter, (2) the potential for strengthening AI capabilities and creating new businesses through the establishment of the AI Technical Sector, and (3) a stable dividend policy, including the introduction of an interim dividend. Negative factors are (1) continuity of KPIs on a consolidated basis will be temporarily impaired due to the shift to non-consolidated reporting, (2) the schedule for monetizing investment in AI robotics is still only disclosed in a range format, and (3) external environmental uncertainties, such as U.S. tariff policy. However, the Company explains that it will “continue to expand existing businesses and investment in tandem while assessing the risks” regarding the impact of tariffs and that, at this point, it does not see a need to revise its earnings guidance.

Judging from results through the current fiscal year, downside risk to this fiscal year’s earnings does not appear large; instead, the guidance suggests room for upside. On the other hand, the extent to which the share price will discount in advance the scenario of an average profit growth rate of 30% in the future will, we believe, be heavily influenced by the specific milestones for robotics investment and the degree to which KPIs can be made transparent after the shift to non-consolidated reporting.

◇ Share price trends and future points of focus: A sharp rise of around 1.8x in three months, with a tug-of-war between high valuation and a growth story rich in catalysts

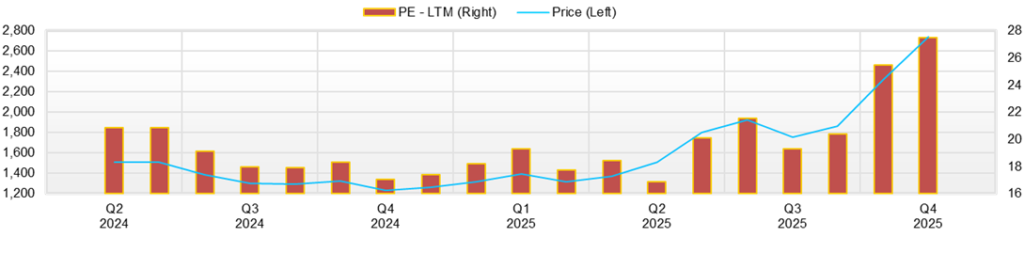

Over the past three months, the Company’s share price has entered a steep uptrend, with both PER and PBR rising to high levels, while a series of news flows has strongly supported the growth story. In the short term, we should monitor overheating in valuation and technical indicators. In contrast, in the medium term, the situation can be organized as a phase of “waiting to buy on dips while searching for a timing to move to overweight.”

First, we organize the share price level and three-month movements. On a monthly closing basis, the closing share price was 1,758 yen in August 2025, 1,861 yen in September, 2,320 yen in October, and 3,085 yen as of November 14, representing an increase of about 75% in three months. At the current share price of 3,085 yen as of November 14, the market capitalization is 49.5 billion yen, the forecast PER is 15.47x, the PBR is 15.32x, and the dividend yield is 1.97%.

Looking at daily price movements, the share price rose about 18% from a closing price of 1,967 yen on October 16 to 2,320 yen on October 31. Then it reached 2,623 yen on November 4, 2,824 yen on November 5, 2,824 yen on November 12, and a year-to-date high of 3,140 yen (intraday high of 3,325 yen) on November 13. The range from the year-to-date low of 1,090 yen (April 7) to the year-to-date high of 3,325 yen (November 13) is about threefold, indicating that market evaluation has been significantly raised in the past several months.

In terms of valuation, a key point is that, backed by extremely high capital efficiency with actual ROE of around 50% and ROIC of around 55%, the shares have been bought up to a PBR exceeding 15x. While a PER in the 15x range cannot be described as an excessive level for a growth stock, the PBR has significantly diverged to the upside from the 1–4x range typical of peer IT services names. It is reasonable to regard this level as incorporating a “capital efficiency premium” and an “AI and robotics expectation premium.” Rather than a dichotomy of expensive vs. cheap, we would say that this is a level that can be tolerated “as long as the premise of high growth and high ROE does not collapse,” but that expectations are correspondingly high.

Looking at catalysts and the share price response, a significant milestone was the publication on November 12 of the financial results for the second quarter of the fiscal year ending March 2026 and the related explanatory materials, together with IR announcements that included the completion of subsidiary integration, the shift to non-consolidated reporting, and the annual dividend policy of 61 yen. The share price rose about 12.6% in the two days from 2,787 yen at the close on November 11 to 2,824 yen on November 12, the day after the results, and 3,140 yen on November 13, reflecting a sudden influx of buying that valued earnings momentum, integration synergies, and enhanced shareholder returns.

Furthermore, on November 11, the Company’s AI Technical Sector issued a press release announcing that a research paper on LLMs (Large Language Models) was accepted for presentation at an international conference. The paper empirically demonstrated the phenomenon of generative AI “outputting incorrect regularities while recognizing that they are incorrect,” and the acceptance of this finding in EMNLP 2025 Findings is a technological upgrade factor. In addition, on November 12, a press release was issued announcing that the SOMRIE® certification system, co-created with DENSO, would expand into an industry-wide human resource development platform, raising expectations for strengthening the Company’s presence in the mobility area and developing the human resource development business. The concentration of these news items at the exact time as the results, integration, and dividend policy announcements is considered the background to the approximately 33% rise from the end of October to November 14.

From a technical perspective, on a monthly chart, since June, both lows and highs have been rising in an uptrend, with a gentle rise from August (closing price of 1,758 yen) to October (closing price of 2,320 yen), followed by a steeper upward slope in November. On the daily chart as well, since mid-October, the trend has become clear, with both highs and lows rising. The 2,100–2,300 yen range is likely to be recognized as a recent threshold and “candidate for a dip,” while the area near 3,300 yen is likely to be perceived as a short-term resistance level. At the same time, the current share price has moved up significantly over a short period, even monthly, forming a pattern similar to a typical sharp rally without a flag, so we should also be mindful of the risk of a correction in phases when trading volume thins.

Overall, market evaluation can be organized as a “premium valuation that prices in high growth expectations.” The Company has a rich set of story-driven catalysts, including the establishment of the AI Technical Sector, participation in national projects, and the concept of a human resource development platform built on the SOMRIE® certification system. However, at this stage, many of these factors are still at a stage where the incremental future cash flows cannot be fully quantified, and we can say that the balance of evaluation is currently “story-advantaged, with numerical substantiation yet to come.”

Conditions under which an overweight stance could be considered include, first, that after the shift to non-consolidated reporting, KPIs such as net sales and gross profit by service, project unit prices and utilization rates, and robotics investment amounts and recoupment outlook are continuously disclosed, enabling the numerical confirmation of the pathway to the following medium-term plan message of an average profit growth rate of 30%. Second, in the AI robotics area, national projects and commercial projects for products get underway, and the specific sales contributions from license and recurring revenue are disclosed. Third, based on the dividend of 61 yen, a total shareholder return policy including share buybacks is organized, and a capital policy story that supports the 15x-plus PBR level becomes clear.

Conversely, in terms of investment timing, if, after the news flow runs its course, a correction brings the share price close to the 2,000–2,300 yen range, this could serve as an entry point for medium-term investors. Future catalysts include (1) an upward revision at the time of the next set of results or updates related to the medium-term plan, (2) announcements of additional projects or expanded partners related to the AI Technical Sector and SOMRIE, and (3) strengthened disclosure of quantitative KPIs at IR seminars and events for individual investors. If these emerge positively, then even after short-term volatility around highs, we see room for a further upward shift in the medium- to long-term trend.

The current share price fully prices in the story of “high ROE and high ROIC plus AI and human resource development,” and, in absolute terms, it is by no means cheap. On the other hand, the sharp rally thus far has a strong “event-driven” aspect, with news and results converging at once, and increased volatility after events is also a natural development. From the perspective of institutional investors, we believe that three points, (1) the quality of KPI disclosure after the shift to non-consolidated reporting, (2) the setting of milestones for AI robotics investment, and (3) clarification of the total shareholder return policy, will be the watershed determining whether to move to overweight or maintain a neutral stance.

Company profile

◇ An independent tech company that operates its growth engines in an integrated manner as an operating company, with AI software engineering at its core

MAMEZO Inc. (formerly MAMEZO DIGITAL HOLDINGS CO., LTD.) is an independent technology company that develops a high-profit, knowledge-intensive model centered on AI software engineering and robotics engineering, and, through the absorption-type merger of its subsidiaries in October 2025 and the resulting shift “from a holding company to an operating company,” has reached a stage where it has established a growth base for integrated operation of its brand, human resources, sales, and development.

The Company provides four services, Cloud Consulting, AI Consulting, AI Robotics Engineering, and Mobility Automation, and mainly to enterprise customers such as large financial institutions, telecom operators, manufacturers, and trading companies, it adopts a client-side, upstream-focused business model that supports them end-to-end from requirements definition and architecture design through implementation and education.

On the technology side, the Company is pursuing R&D in AI robotics that has been adopted as a national project, aiming to build recurring revenue through licenses and cloud-based offerings. In October 2025, it established the cross-business organization “AI Technical Sector,” which brings together AI specialists with academic experience, and positions it as the core for AI technology support across each service area and for creating new businesses. In addition, through co-creation with DENSO of the SOMRIE® software human resource certification system, the Company is also involved in building a cross-industry human resource development platform rooted in the mobility industry. It is seeking synergies with the education and human resource development business.

Key financial data

| Unit: million yen | 2022 | 2023 | 2024 | 2025 CE |

| Sales | 8,175 | 9,586 | 10,552 | N/A |

| EBIT (operating profit) | 651 | 1,799 | 2,070 | |

| Pretax Income | 1,351 | 1,672 | 2,034 | |

| Net Profit Attributable to Owner of Parent | 1,134 | 1,160 | 1,434 | N/A |

| Cash & Short-Term Investments | 469 | 828 | 1,833 | |

| Total assets | 3,424 | 3,544 | 4,715 | |

| Total Debt | 10 | 0 | 103 | |

| Net Debt | -459 | -828 | -1,730 | |

| Total liabilities | 1,021 | 1,282 | 1,305 | |

| Total Shareholders’ Equity | 2,403 | 2,262 | 3,409 | |

| Net Operating Cash Flow | 588 | 1,155 | 1,372 | |

| Capital Expenditure | 202 | 335 | 127 | |

| Net Investing Cash Flow | -1,145 | 1,922 | -180 | |

| Net Financing Cash Flow | -27 | -2,288 | -187 | |

| Free Cash Flow | 455 | 933 | 1,271 | |

| ROA (%) | N/A | 28.42 | 34.72 | |

| ROE (%) | N/A | 41.04 | 50.57 | |

| EPS (Yen) | 70.6 | 72.3 | 89.4 | |

| BPS (Yen) | 149.7 | 140.9 | 212.4 | |

| Dividend per Share (Yen) | N/A | 4.35 | 60.00 | 61.00 |

| Shares Outstanding (Million shares) | N/A | 16.05 | 16.05 |

Share price

Key stock price data

Source: Omega Investment from company data, rounded to the nearest whole number.

Financial data (quarterly basis)

| Unit: million yen | 2025/3 | 2026/3 | ||||

| 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | |

| (Income Statement) | ||||||

| Sales | 2,718 | 2,548 | 2,572 | 2,714 | 2,888 | 2,921 |

| Year-on-year | 16.4% | 6.3% | 14.6% | |||

| Cost of Goods Sold (COGS) | 1,790 | 1,745 | 1,735 | 1,747 | 1,898 | 1,945 |

| Gross Income | 928 | 803 | 837 | 968 | 990 | 976 |

| Gross Income Margin | 34.1% | 31.5% | 32.5% | 35.6% | 34.3% | 33.4% |

| SG&A Expense | 394 | 366 | 358 | 347 | 452 | 401 |

| EBIT (operating profit) | 534 | 438 | 478 | 621 | 538 | 576 |

| Year-on-year | 48.1% | 0.8% | 31.5% | |||

| Operating profit Margin | 19.6% | 17.2% | 18.6% | 22.9% | 18.6% | 19.7% |

| EBITDA | 554 | 458 | 498 | 642 | 557 | 614 |

| Pretax Income | 504 | 437 | 479 | 614 | 540 | 573 |

| Consolidated Net Income | 335 | 286 | 326 | 486 | 364 | 423 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 335 | 286 | 326 | 486 | 364 | 423 |

| Year-on-year | 99.8% | 8.8% | 47.6% | |||

| Net Income Margin | 12.3% | 11.2% | 12.7% | 17.9% | 12.6% | 14.5% |

| (Balance Sheet) | ||||||

| Cash & Short-Term Investments | 926 | 1,208 | 1,383 | 1,833 | 1,432 | 1,531 |

| Total assets | 3,827 | 3,743 | 3,915 | 4,715 | 4,457 | 4,492 |

| Total Debt | 210 | 3 | 3 | 103 | 303 | 3 |

| Net Debt | -716 | -1,205 | -1,380 | -1,730 | -1,129 | -1,528 |

| Total liabilities | 1,517 | 1,146 | 992 | 1,305 | 1,646 | 1,259 |

| Total Shareholders’ Equity | 2,310 | 2,597 | 2,923 | 3,409 | 2,810 | 3,233 |

| (Profitability %) | ||||||

| ROA | 34.72 | 35.33 | 38.85 | |||

| ROE | 50.57 | 57.15 | 54.87 | |||

| (Per-share) Unit: JPY | ||||||

| EPS | 20.9 | 17.8 | 20.3 | 30.3 | 22.7 | 26.3 |

| BPS | 143.9 | 161.8 | 182.1 | 212.4 | 175.1 | 201.4 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 60.00 | 0.00 | 30.00 |

| Shares Outstanding (milion shares) | 16.05 | 16.05 | 16.05 | 16.05 | 16.05 | 16.05 |

Source: Omega Investment

Financial data (full-year basis)

| Unit: million yen | 2022 | 2023 | 2024 |

| (Income Statement) | |||

| Sales | 8,175 | 9,586 | 10,552 |

| Year-on-year | N/A | 8.2% | 10.1% |

| Cost of Goods Sold | 5,794 | 6,406 | 7,017 |

| Gross Income | 2,381 | 3,181 | 3,535 |

| Gross Income Margin | 29.1% | 33.2% | 33.5% |

| SG&A Expense | 1,729 | 1,381 | 1,465 |

| EBIT (operating profit) | 651 | 1,799 | 2,070 |

| Year-on-year | N/A | 15.1% | 15.1% |

| Operating profit Margin | 8.0% | 18.8% | 19.6% |

| EBITDA | 698 | 1,899 | 2,152 |

| Pretax Income | 1,351 | 1,672 | 2,034 |

| Consolidated Net Income | 1,134 | 1,160 | 1,434 |

| Minority Interest | 1,134 | 1,160 | 1,434 |

| Net Income ATOP | #N/A | 5.1% | 23.6% |

| Year-on-year | 13.9% | 12.1% | 13.6% |

| Net Income Margin | |||

| (Balance Sheet) | 469 | 828 | 1,833 |

| Cash & Short-Term Investments | 3,424 | 3,544 | 4,715 |

| Total assets | 10 | 0 | 103 |

| Total Debt | -459 | -828 | -1,730 |

| Net Debt | 1,021 | 1,282 | 1,305 |

| Total liabilities | 2,403 | 2,262 | 3,409 |

| Total Shareholders’ Equity | |||

| (Cash Flow) | 588 | 1,155 | 1,372 |

| Net Operating Cash Flow | 202 | 335 | 127 |

| Capital Expenditure | -1,145 | 1,922 | -180 |

| Net Investing Cash Flow | -27 | -2,288 | -187 |

| Net Financing Cash Flow | 455 | 933 | 1,271 |

| Free Cash Flow | |||

| (Profitability ) | N/A | 28.42 | 34.72 |

| ROA (%) | N/A | 41.04 | 50.57 |

| ROE (%) | 13.87 | 12.10 | 13.59 |

| Net Margin (%) | N/A | 2.35 | 2.56 |

| Asset Turn | N/A | 1.44 | 1.46 |

| Assets/Equity | |||

| (Per-share) Unit: JPY | 70.6 | 72.3 | 89.4 |

| EPS | 149.7 | 140.9 | 212.4 |

| BPS | N/A | 4.35 | 60.00 |

| Dividend per Share | N/A | 16.05 | 16.05 |

Source: Omega Investment