User Local (Price Discovery)

Profile

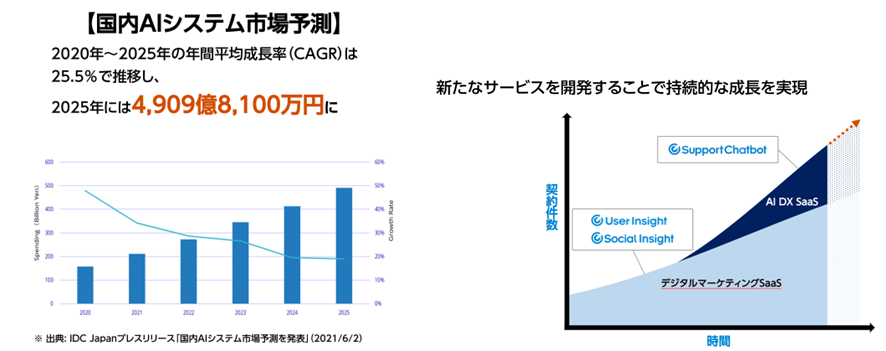

Data Technology and Cloud Business. Research and development of big data analysis tools, artificial intelligence web marketing support tools, media analysis tools, and management of artificial intelligence chatbots. Founded in 2005 by Masao Ito.

| Securities Code |

| TYO:3984 |

| Market Capitalization |

| 33,647 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Strong technological presence. Generative AI-related products have shifted to a realistic buying phase.

UserLocal provides proprietary AI services in SaaS format based on advanced big data analysis and natural language processing technology based on more than 34 billion data items.

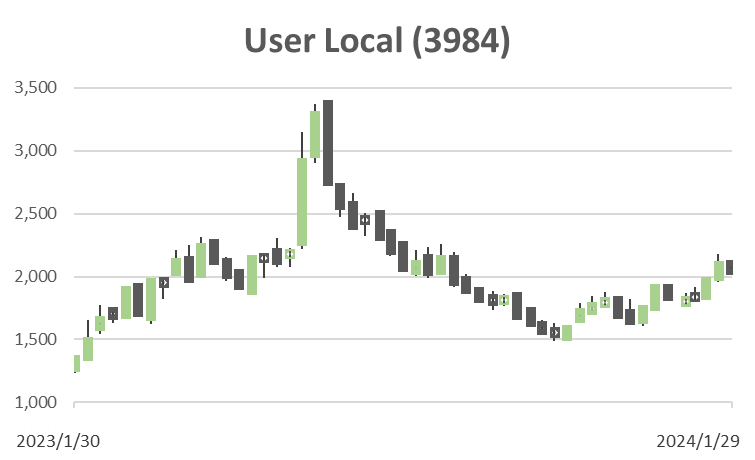

Last year, when the company became popular for its AI-related products, the market did not continue to buy in anticipation of the future. However, the company’s strong 1Q (July-September) financial results and the successive release of tools related to generative AI have led to a shift to realistic buying based on actual market valuations. The company’s selection as a provider of government cloud services and its cooperative relationship with SAKURA Internet (3778), which is enjoying feverish popularity due to expectations of collaboration with NVIDIA, are also likely to attract attention.

The company has successfully secured tech talent, a key component of AI-related companies, and the percentage of AI engineers among all engineers has now increased to more than 70%. The company is also unique, a young organisation with many engineers with graduate degrees and an average age of 28.

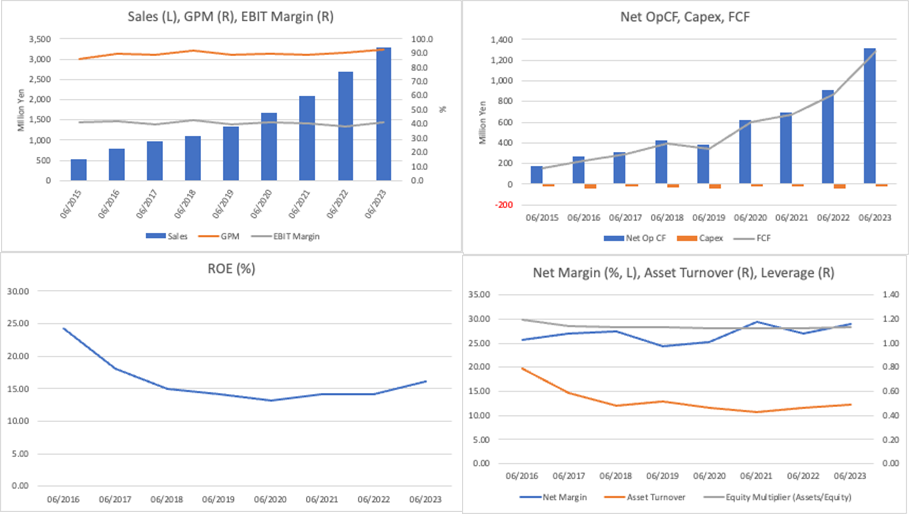

Without slackening its investment in growth, the company plans to achieve record-high results for the current FY6/2024, with net sales of 3,903 million yen (up 18.7% YoY) and operating income of 1,556 million yen (up 13.4% YoY) following the previous fiscal year.

The company plans to actively utilise generative AI for digital marketing and AI DX product development.

Investor’s View

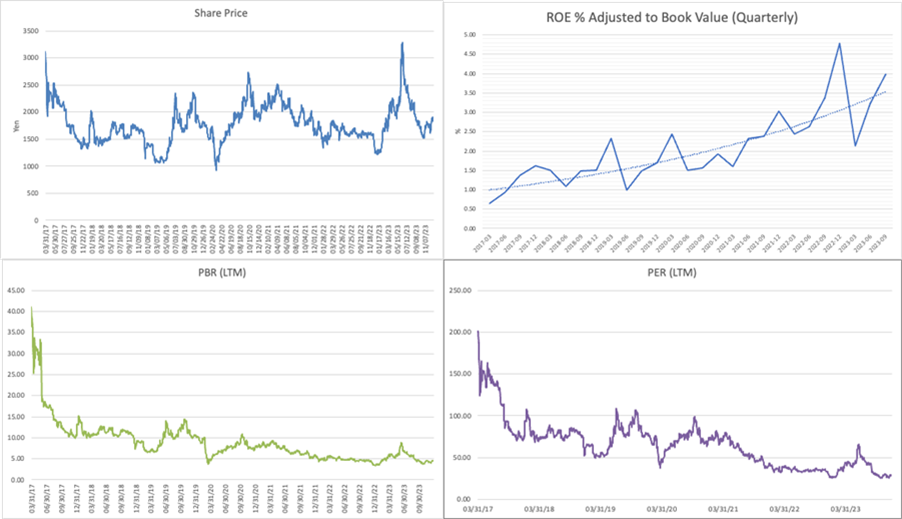

BUY. Valuations suggest high risk, but the shares are worth holding to gain exposure to the potential of the global productivity revolution in our portfolio.

Top-line growth and profitability are both extremely stable. Cash has swelled sixfold in seven years and accounts for 89% of total assets at the end of September 2023. While this has inflated the company’s assets significantly, it has not damaged ROE severely. This is because the PL margin continues to improve moderately.

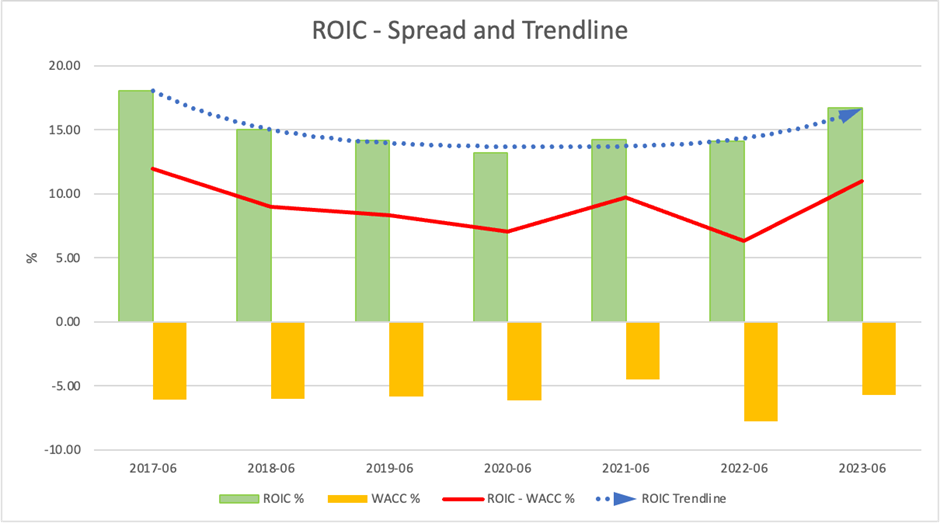

The cost of invested capital, which is only shareholders’ equity with no debt, is high, but economic value has been generated well.

Don’t overlook promising generative AI stock

As noted by Stock Hunter, a series of generative AI tools have been launched, and there are already real revenue streams. After the enormous share price rally at the end of last year cooled down, the stock may well come into favour again as an AI-related name, and its valuation could expand.

High risk, but the shares are worth holding in long-term accounts

Now seems a good time to buy the shares as valuations have fallen. Having reflected investors’ high expectations, price multiples are not cheap. The fair value of DCF with a beta of 1.17, a shareholder premium of 6%, and an assumed average growth rate over the past five years is about 1,500 yen, which is not supportive for buyers. However, PBR and PER are at the low end of their historical ranges, and the equity yield is improving. We take these as positive. While this would be a high-risk bet, we would dare to add this small company, which is directly related to the big theme of the productivity revolution in the global industry, to a long-term portfolio.