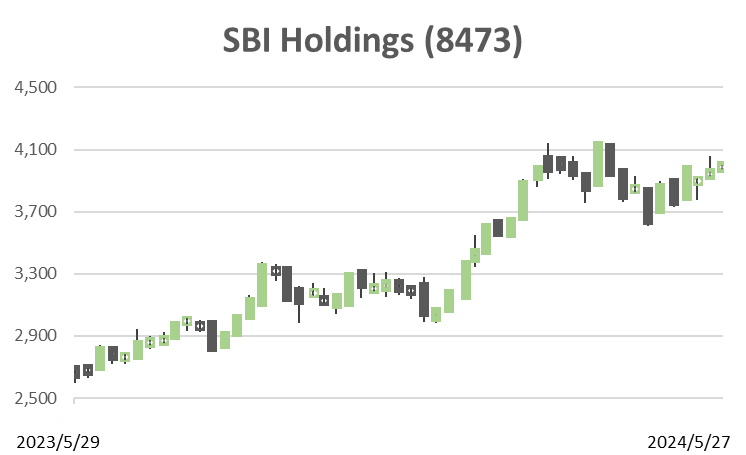

SBI Holdings (Price Discovery)

Sensibly valued

Profile

SBI Holdings is a financial conglomerate offering various services, including securities, banking, and insurance. Its businesses include financial services, asset management, and biotechnology-related businesses. Most traditional financial services are part of the Financial Services segment, including mortgage and foreign exchange margin trading, as well as the main banking and insurance businesses. The investment business invests in domestic and foreign venture companies in the IT, biotechnology, environment and energy, and finance sectors. Outside of financial services, a subsidiary in the biotechnology business develops cosmetics, health foods, and pharmaceuticals. The company was established in 1999 and is headquartered in Tokyo.

Sales mix % (OPM%): financial services 88 (17), asset management 3 (36), investments 4 (-45), crypto assets 3 (-60), non-financial 3 (-12) [Overseas] 18 <FY3/2024>

| Securities Code |

| TYO:8473 |

| Market Capitalization |

| 1,207,312 million yen |

| Industry |

| Securities business |

Stock Hunter’s View

Expanding the customer base with ‘Zero Revolution.’ New accounts opened reached a record high.

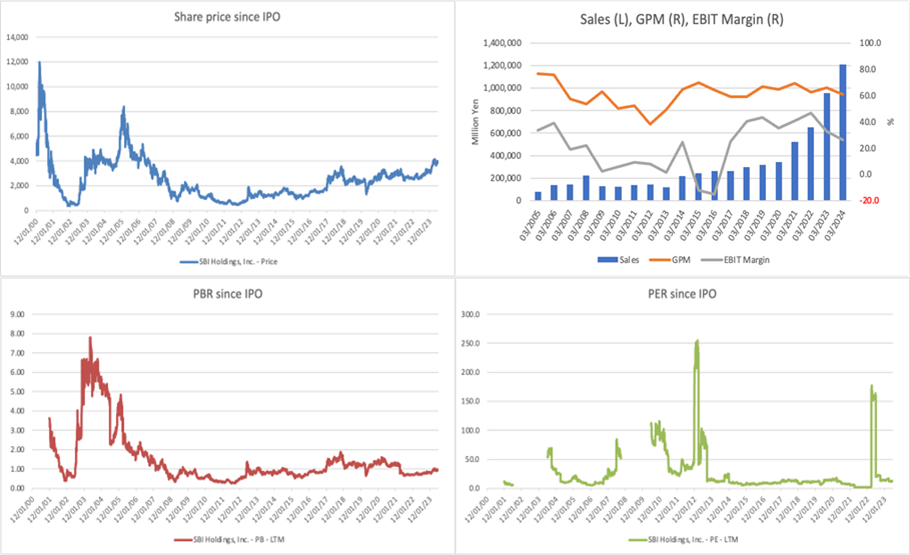

SBIHD’s ‘Zero Revolution’ (no commissions on domestic stock trading) has been successful. The company’s financial results for FY3/2024 achieved record sales of 1,210,504 million (up 26.5% YoY), breaking the 1 trillion yen mark for the first time, and a record final profit of 87,243 million yen (2.4 times YoY).

The number of new accounts opened between January and March this year reached a quarterly record of 760,000 amid the trend away from savings and towards investment under the new NISA (small investment tax exemption scheme). The expansion of the customer base at SBI Securities also led to the transfer of customers to group companies, with SBI Shinsei Bank and SBI Sumishin Net Bank (7163) also achieving good results.

The Zero Revolution caused the securities business to miss out on profits of around 15.8 billion yen. Still, on the other hand, the influx of new customer segments has led to record highs in margin trading, investment trust balances, and fees. In addition, there has been a growing trend within the industry to strengthen wealth management business to target wealthy individuals, and the company has also demonstrated its strength here. In the previous year, the number of large clients with more than 100 million yen assets increased by 90%.

Against this backdrop, on 21 January, it officially announced that it had agreed a business alliance with National Technology Group (NTG), a major local information and communications technology company and fintech operator, to list an exchange-traded fund (ETF) incorporating Saudi Arabian equities on the Tokyo Stock Exchange. It also announced four other basic agreements, including a business alliance with the Saudi Arabian Ministry of Investment (MISA) and others to establish an investment fund.

Investor’s View

Sensibly valued: While the future development of the business is interesting, the return on capital is unattractive, and the visibility of earnings is poor. For conservative investors, the current PER of around 13x and PBR of around 1x are reasonable. The equity premium is unlikely to move significantly in the future.

President Kitao, formerly an excellent investment banker, is an exceptional strategic thinker and a bold CEO in acquisitions and investments. In the securities business, the cost of the zero commission revolution was significant, but the number of customers expanded dramatically. Without the price of the Zero Revolution, SBI would have overtaken Daiwa Securities to become Japan’s second most profitable securities company. On the other hand, the company’s conservative stance on investment, driven by a prudent risk management approach, is evident. President Kitao is an excellent manager and is cautious in the management and investment of acquired banks. The company has also successfully controlled the balance in its shareholder structure, with foreign shareholdings falling from 49% at the end of March 2022 to 34% at the end of March 2024. In return, the proportion of individual shareholders has increased from 19% to 26%. In FY3/2024, the securities and banking businesses accounted for 42% and 54% of the pre-tax income of the financial services business, respectively.

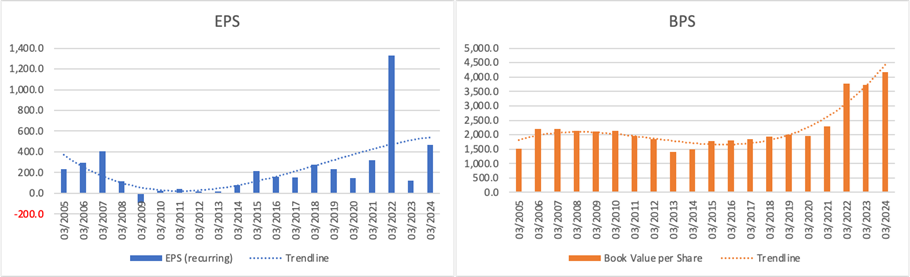

While there are high expectations for top-line expansion, the company’s costs are unpredictable. In addition, the investment business, which covers 1,241 companies, is unpredictable due to the high volatility of profit and loss. Therefore, the visibility of EPS and BPS is poor, and EPS has yet to form a reassuring trend.

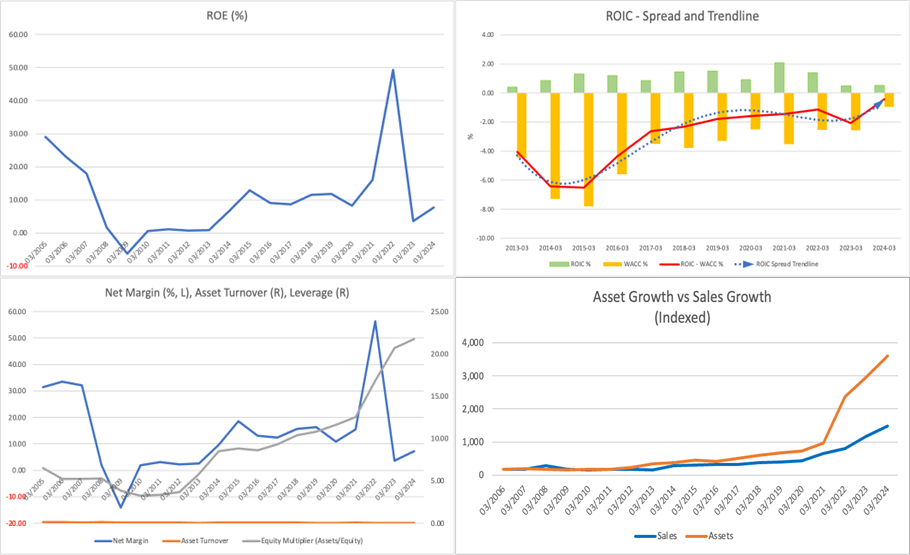

ROE is not attractive. This is because leverage is offset by asset turnover, while net profit margins do not increase; ROIC spreads have been negative for many years, although the trend is positive.

President Kitao stated that his main Interests are semiconductors and the repayment of SBI Shinsei Bank’s public funds; SBI took SBI Shinsei Bank private through a TOB last year. The company is actively working on a plan to repay the approximately 330 billion yen in public funds, which will be decided by the end of June 2025. The bank’s health is likely to improve due to the favourable interest rate environment and the management flexibility afforded by going private. On the other hand, investments in businesses such as the semiconductor business, whose earnings swing between market conditions and investments, are a discount factor for the share price.