santec Holdings (Price Discovery)

Sell

Profile

The main businesses are optical communication components and optical measuring instruments. Applications include optical communications, medical imaging, optoelectronics, optical equipment and AV cables. Many proprietary products. Established in 1979, headquartered in Komaki City.

Sales by segment (OPM %): optical components 20 (22), optical measuring instruments 74 (33), others 6 (13) (FY3/2024)

| Securities Code |

| TYO:6777 |

| Market Capitalization |

| 108,726 million yen |

| Industry |

| Electronic equipment |

Stock Hunter’s View

Second Lasertec (6920) candidate. Share price incentives are abundant, including data centres and submarine cables.

satec Holdings’ two main businesses are optical communication components and optical measuring instruments. The company is benefiting from the growing demand for data centres, which is in line with the popularity of generative AI and the increased investment in base stations by various companies. In the optical measuring instruments business, NVIDIA, whose market capitalisation has surged, is a customer, and there is speculation about Google’s optical submarine cables.

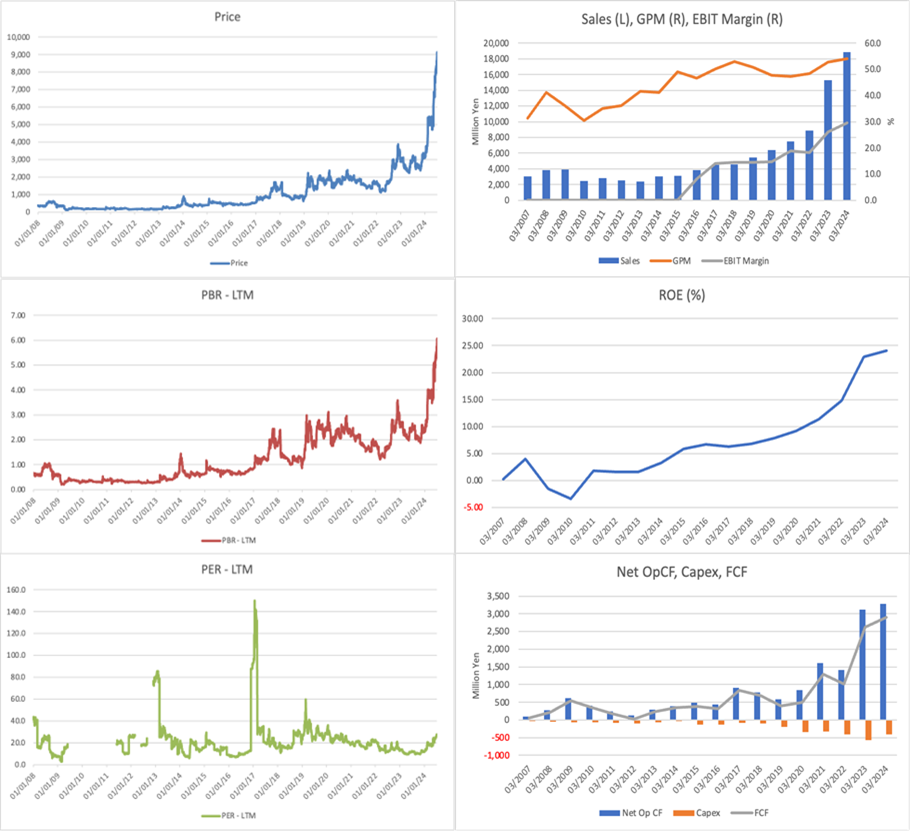

In FY3/2024, net sales, operating income, ordinary income and net income were the highest since the company was listed, driven by solid sales of optical measuring instruments for ophthalmic and optical communications applications. Enquiries from domestic and overseas manufacturers of optical transmission equipment and others are expected to increase steadily in the current financial year, with net sales of JPY 20 billion (+6% YoY) and operating income of JPY 5.8 billion (+4.2% YoY), with higher sales and profits expected.

The theme for the current financial year is ‘Development of new high-value-added products and market traction’. In telecommunications, the company is developing many products for compact, high-capacity transceivers, which are indispensable for high-capacity data transmission amid the trend towards high integration in data centres and base stations. In the non-telecommunications field, new customers will be developed for industrial applications such as quantum computers, optical science research, 3D printers, laser processing and IC trimming, leading to mass production; in OCT (optical tomography), the application of measuring equipment for semiconductor manufacturing equipment will be expanded.

Investor’s View

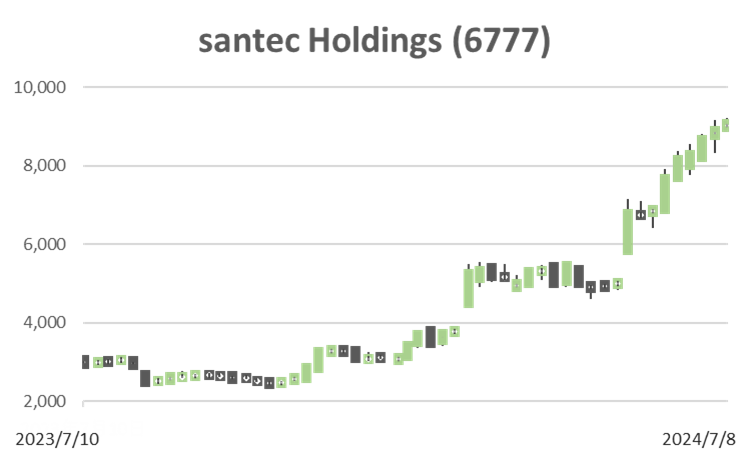

Sell: Despite strong earnings, the risk of chasing the share price from here, which has tripled since the beginning of the year, is significant.

The share price rise was initially driven by the dramatic increase in profits in recent years, but we believe that by now, the driver has turned into a thematic interest in tech stocks.

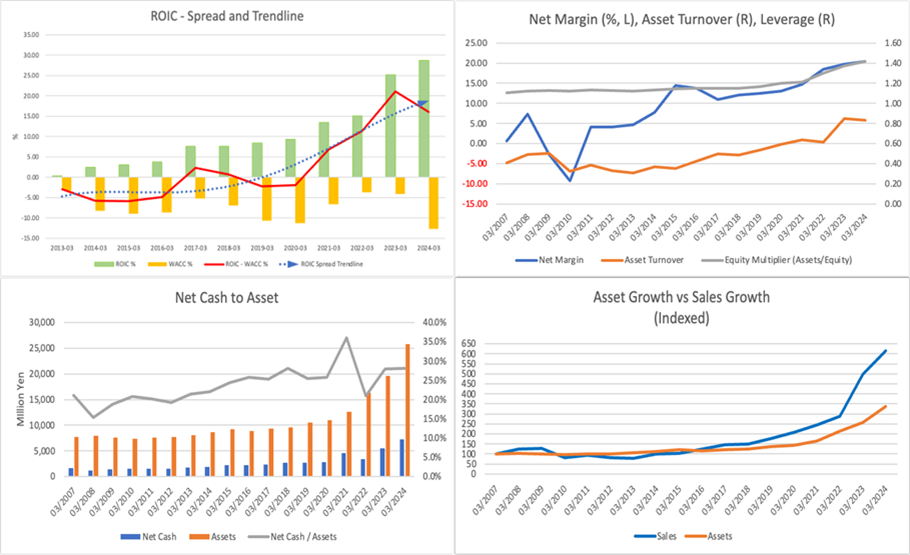

Two years ago, the company was an undervalued stock with solid earnings, trading at a PER of 13x and PBR of 1.7x, with a market capitalisation of just under 20 billion yen while delivering ESP above 20% CAGR and ROE over 10%.

Financial performance took a significant turnaround in FY3/2023, with net sales increasing by 70% YoY. Operating income grew by 2.4 times. Although there was some effect of acquisitions, the drivers of operating income growth were organic growth and the weak yen, which contributed 46% and 47%, respectively, to the increase in profits. It is assumed that from the following year onwards, profit growth continued to follow this dynamic and has continued to the present day. Currently, 75% of sales are overseas, mainly in the US, and the benefits of the weak yen are significant.

The company explains that the earnings growth is due to increased sales of optical monitors, a highly profitable product, in the optical components business and strong sales of medical and industrial products in the optical measuring instruments business. Indeed, the company’s steady profit growth is underpinned by the global expansion of optical data transmission volumes and its ability to launch proprietary products. At the same time, however, the details of recent years’ rapid expansion are not that clear.

Nevertheless, economic value creation, high ROE and strong cash flow generation are attractive. The hunch is that the financial performance achieved in 2023 and 2024 will not be broken going forward and will be sustainable in the medium to long term. However, we believe that growth after this year will be steady but not spectacularly big for now.