Nippon Yusen Kabushiki Kaisha (Price Discovery)

Sell

Profile

Japan’s largest provider of ocean transport. The company is evolving into a comprehensive logistics company offering ocean, land and air transport services. The liner shipping business includes ocean freight forwarding, transport agencies, container terminals, harbour transport, and tugboat services. The air transport business is air freight forwarding. The logistics business provides warehousing and comprehensive logistics network services by sea, land and air. The tramp business provides ocean freight forwarding services and transport agency services. The real estate business manages and sells real estate. Others include sales of machinery, equipment, and petroleum products, as well as information processing services and cruise ship operations. Founded in 1885. Sales by segment % (OPM%): liner 8 (35), air transport 6 (4), logistics 29 (4), bulk shipping 52 (14), real estate 0 (51), others 5 (1) (FY3/2024)

| Securities Code |

| TYO:9101 |

| Market Capitalization |

| 2,158,402 million yen |

| Industry |

| Shipping industry |

Stock Hunter’s View

Significant upward revision has increased investor interest. The company’s second-half outlook is cautious, with scope for further earnings upside.

On 22 November, NYK, Japan’s largest shipping company, substantially revised its financial forecasts for the first half and full year. If containership freight rates remain high, further increases may be possible.

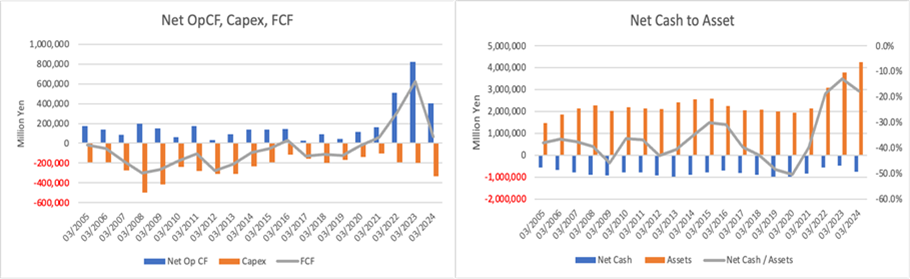

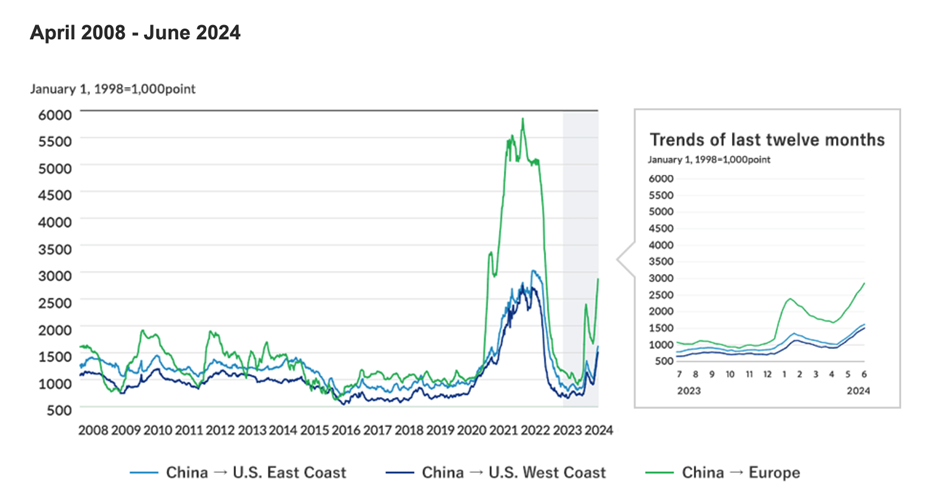

Operating income has been revised up by 40 billion yen to 120 billion yen for 1H and by 50 billion yen to 215 billion yen for the full year compared to the previous plan. Meanwhile, ordinary income is set to increase by 130 billion yen to 270 billion yen in 1H and 160 billion yen to 410 billion yen for the full year. This is due to tight supply and demand for container vessels using the Cape of Good Hope route to avoid the Red Sea against a backdrop of heightened geopolitical risk, better-than-expected freight rates, and improved performance at Ocean Network Express (ONE), a container shipping company in which the company has an equity stake. As ONE is accounted for by the equity method, it only contributes to the increase in ordinary income. Many believe it will be difficult to resume Red Sea operations by at least the year’s end. Therefore, the company’s profit forecast for ONE for the year’s second half is quite cautious.

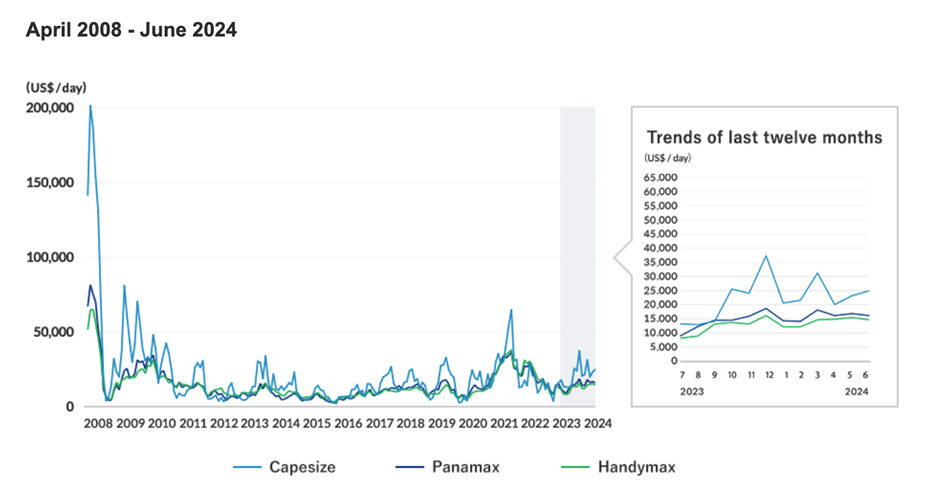

Operating income reflects increases in bulk shipping, air freight, and logistics operations. The company should be able to capitalise on the recovery in air cargo demand in the second half of the year. The company’s strong performance and proactive shareholder returns are also rated highly and may provide an opportunity to reassess the undervalued share price.

Investor’s View

Sell. Near-term earnings momentum is discounted. The outlook for the underlying business environment is not good, and there is a risk of a cyclical downturn. Sell the shares when valuations are cheap.

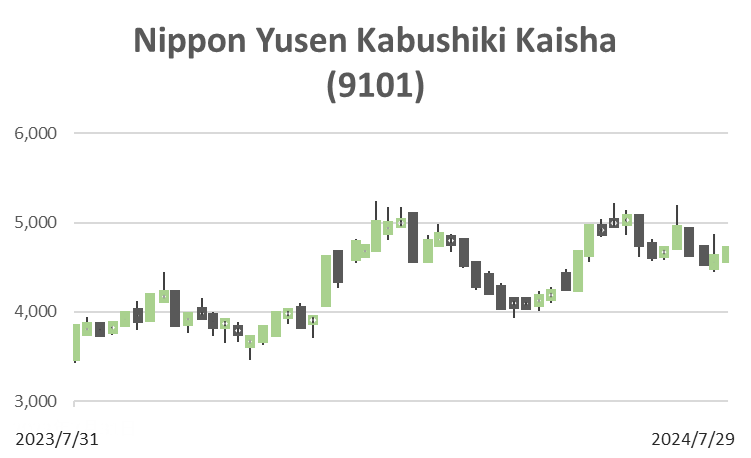

The upward revision was significant, and, as Stock Hunter notes, the earnings look likely to err on the upside further. There were some share price spikes following the earnings announcement, but overall, the share price has not reacted much, rising only 6% YTD and underperforming TOPIX by 10%. Investors have already sensibly discounted the strong earnings momentum as a one-off. The sentiment favouring the yen’s appreciation would also be negative for the share price. It will likely take time for ship demand to recover, and demand and supply of shipping tonnage will deteriorate. Hence, the ship market is more likely to experience a cyclical downturn.

Container Market Freight Index

(Company material)

Dry Bulk Market

(Company material)

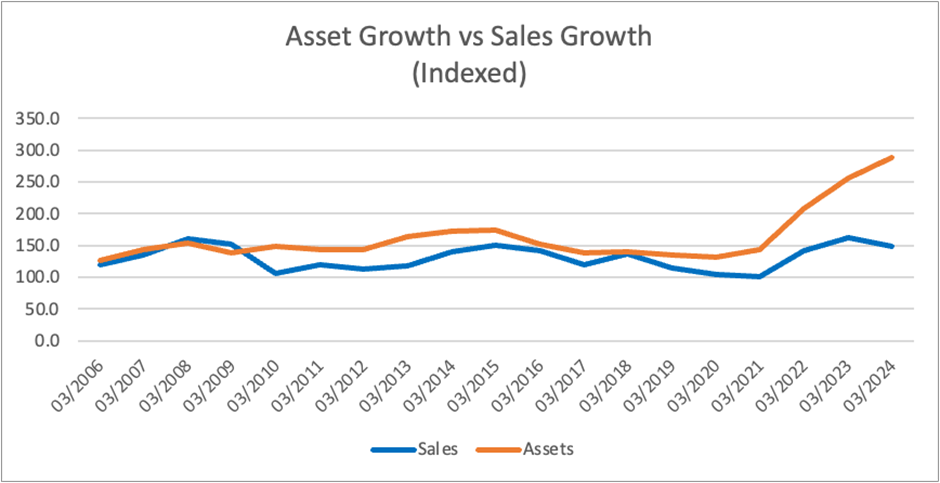

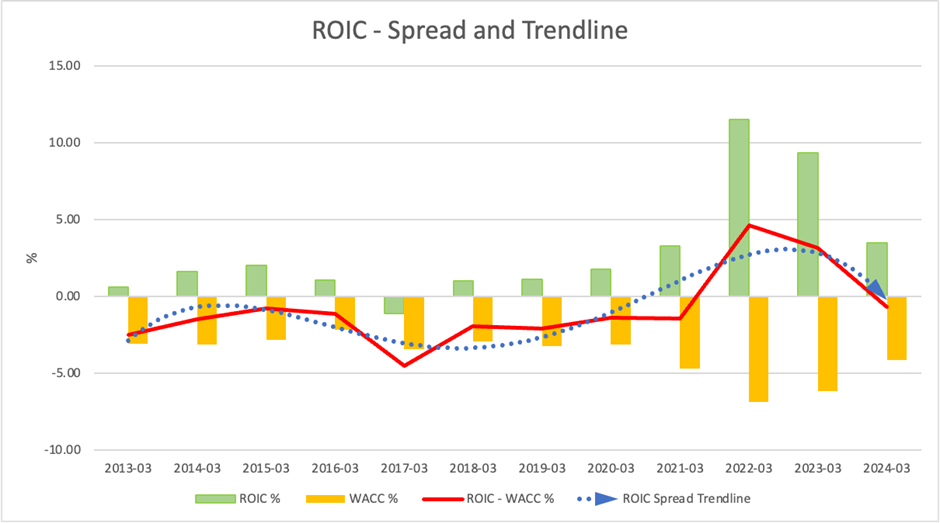

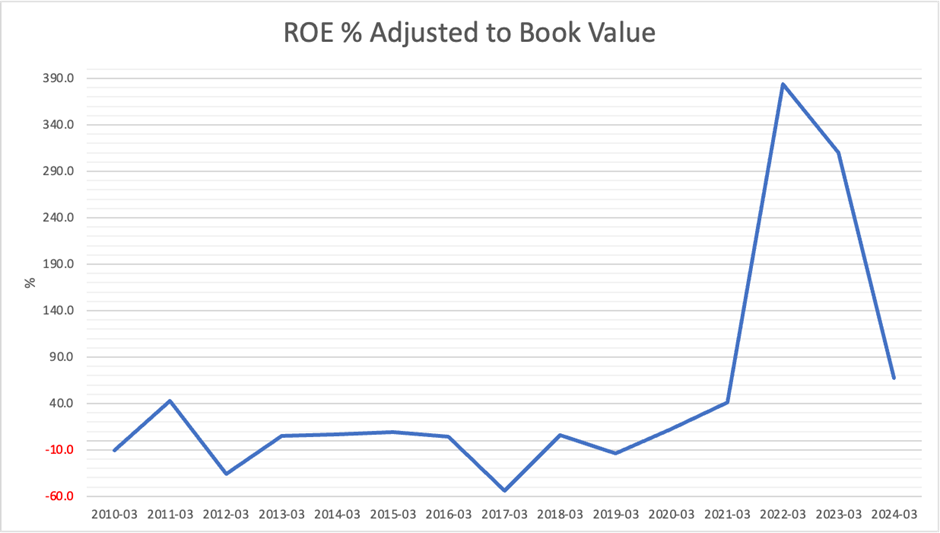

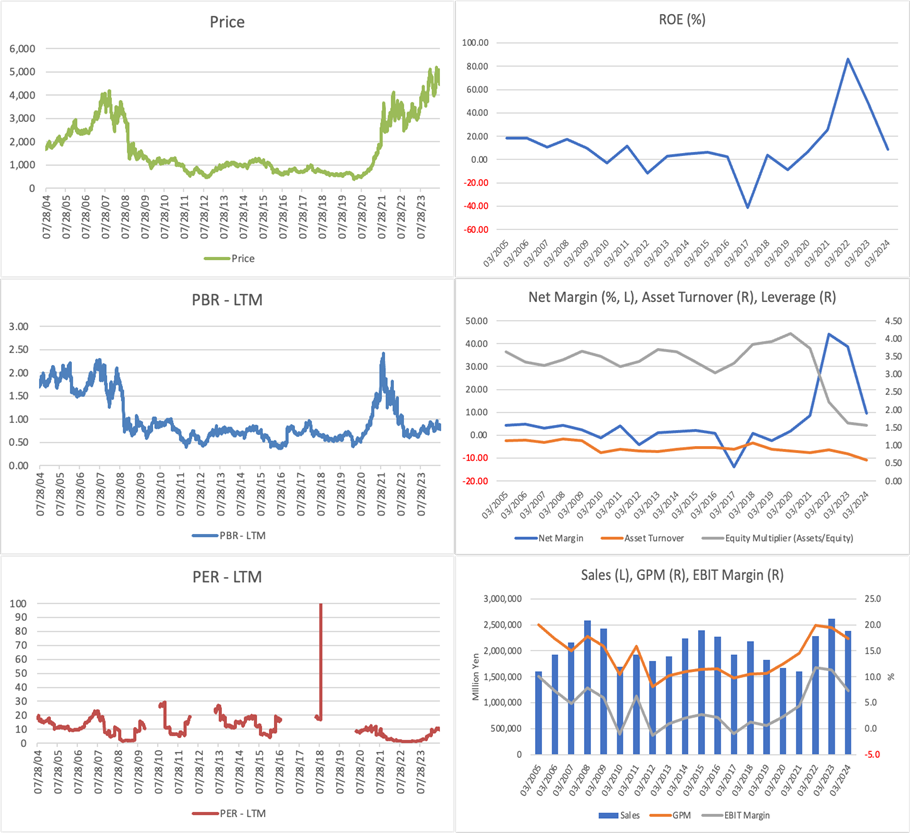

Although the situation in the Red Sea and the associated freight market situations are favourable, the business environment in the longer term is negative. It will take time for transport demand to recover fully, and the supply-demand balance for shipping capacity is expected to soften this year as new shipbuildings peak. Regarding investment-relevant indicators, the shares trade on a forecast PER of 5.5x and PBR of 0.80 despite good levels of ROE and ROIC. A strong cyclical boost is an attraction of shipping stocks. In terms of when to exit, the classic strategy of selling out at low valuations, i.e. at the peak of the business cycle, will work.

Management targets ROIC of 6.5% and ROE of 8% to 10% in FY2026. These targets assume a 57% equity ratio, i.e., low leverage, and significant scope exists to target an even higher return. Management has a clear analysis of PBR being below book value and is proactive in share buybacks and dividends. However, more in-depth capital measures than management believes are necessary to raise ROIC and ROE to more attractive levels.

The company’s beta is 1.1 over five years, which indicates that the shares are not existentially high risk. However, the visibility of the company’s earnings, which have a high cyclical drive, is extremely low. Therefore, the shares deserve a significant valuation discount. Management probably underestimates this point: an ROE of around 10% is far from sufficient to raise secular medium to long-term valuations, including PBR. If capital measures are to compensate for this, they will need to be quite bold.