Fanuc (Price Discovery)

No Attraction

Profile

The company has the world’s top share in CNC systems and industrial robots. The company began as a division of Fujitsu that developed early numerical control systems and was founded in 1955 by Seiemon Inaba. Sales ratio by segment: FA 23, Robot 48, Robomachine 13, Service 16 (Overseas) 87 (FY3/2024)

| Securities Code |

| TYO:6954 |

| Market Capitalization |

| 3,664,137 million yen |

| Industry |

| Electronic equipment |

Stock Hunter’s View

Order recovery in China was confirmed; FA adjustment and robots bottomed out.

Fanuc’s earnings results for 1Q (April-June) of FY3/2025, announced on July 29, confirmed the recovery of orders in the Chinese market, reassuring investors.

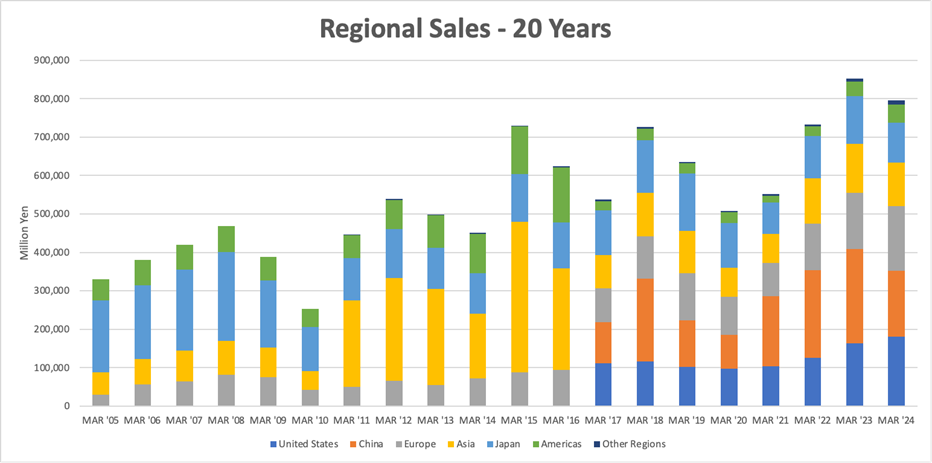

The company is the world’s top manufacturer of NC (numerical control) equipment for machine tools, and its 1Q results showed a 1.1% YoY increase in operating profit to 32,958 million yen. Sales to China exceeded market expectations in the FA equipment and Robomachine segments, and robot inventory levels are becoming more appropriate. Quarterly orders bottomed out at 165 billion yen in October-December 2023 and increased for two consecutive quarters to 173 billion yen in January-March 2024 and 197.9 billion yen in April-June 2024.

The company revised up its 1H and full-year forecasts, citing more robust performance than initially projected. For the full year, the company now expects net sales of 784.3 billion yen, down 1.4% YoY (the previous forecast was for a 6.1% decline), and operating profit of 143 billion yen, up 0.8% YoY (previously, a 14.7% decline). The new forecasts suggest that profits in the 2H will increase and recover from the 1H. In addition, the assumed exchange rate has been revised from 135 yen to the dollar to 147.72 yen.

In addition to the recovery, mainly in China, some believe that in the U.S., the expansion of investment in hybrid vehicles instead of EVs (electric vehicles) will compensate for the decline in demand.

Investor’s View

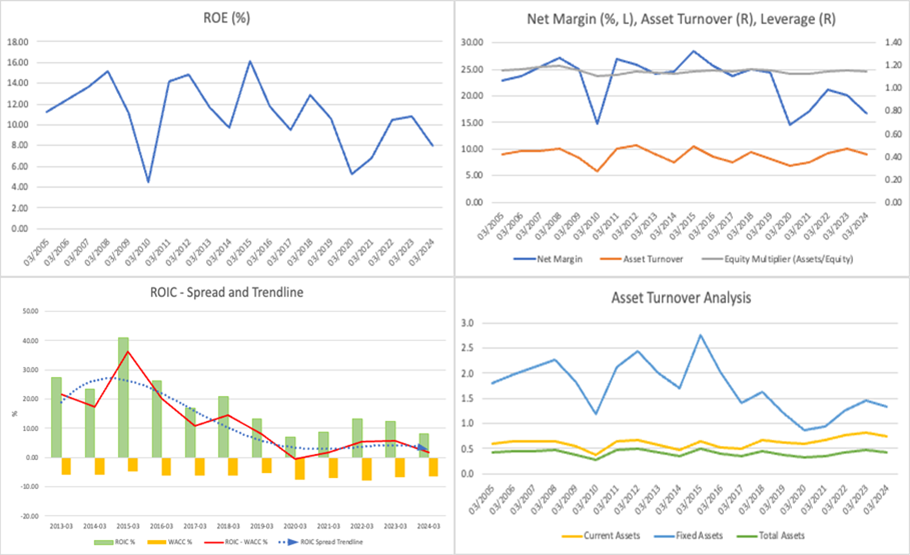

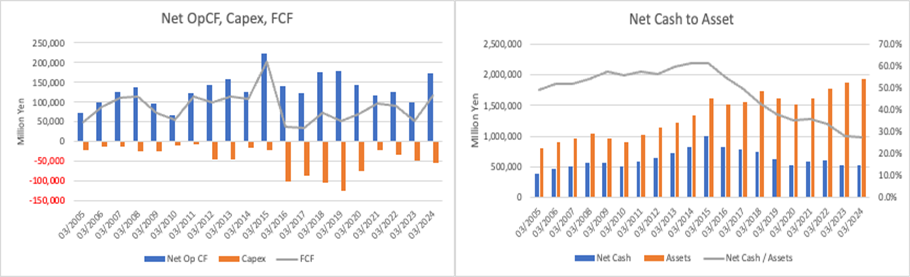

No attraction. Profit margins have fallen in the long term, while BS efficiency remains remarkably low with its vast amount of cash and securities, inventory, and equipment. There is a strong impression that capital investment has not led to profits in recent years; IR is far from satisfactory. If management had been shareholder-focused in recent decades, the company would have achieved a spectacular market capitalisation and become a company to be admired by shareholders. Overwhelming cash flow is great, but a company that does not actively use it for the benefit of its shareholders is not an attractive investment.

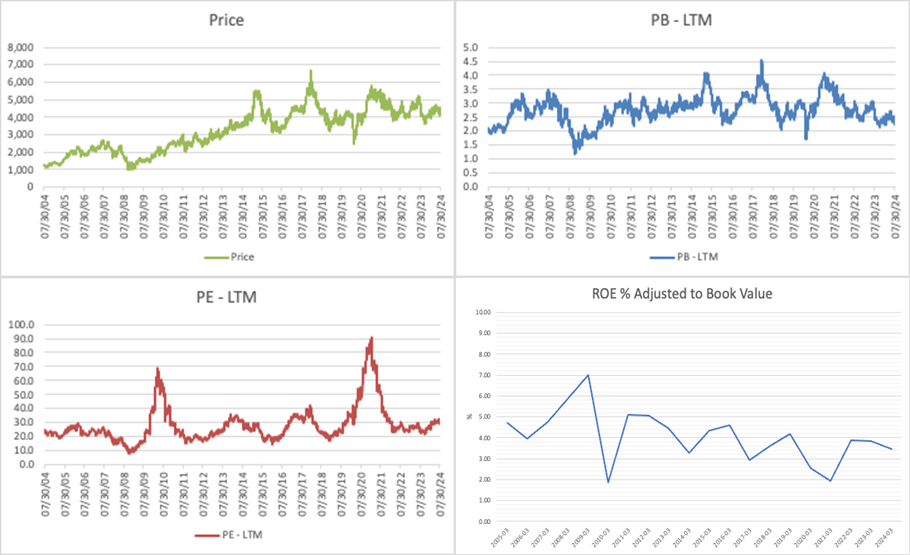

Fanuc’s asset turnover is as low as those of power companies and railway industries. Its ROE is mediocre and almost no economic value is created.

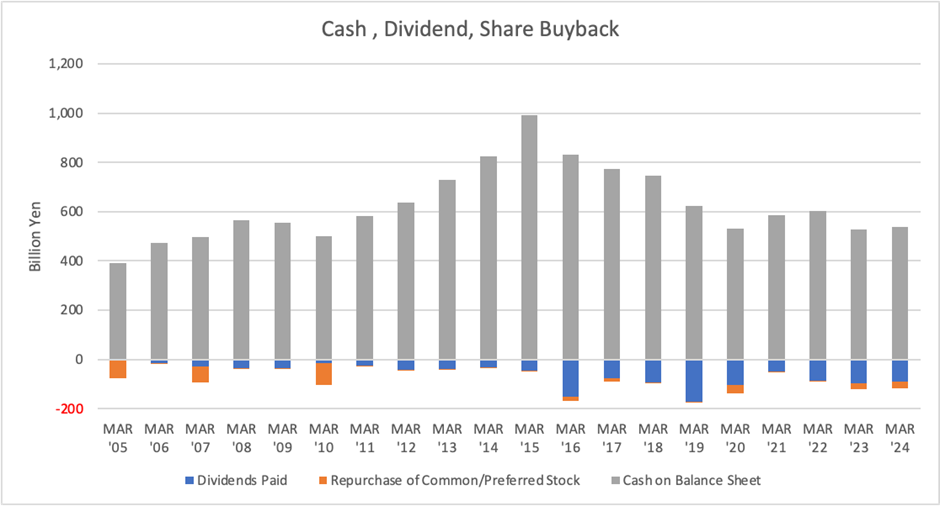

Turning to BS and return on capital, it is evident that vast amounts of cash are not spent, spoiling the shares’ attraction.

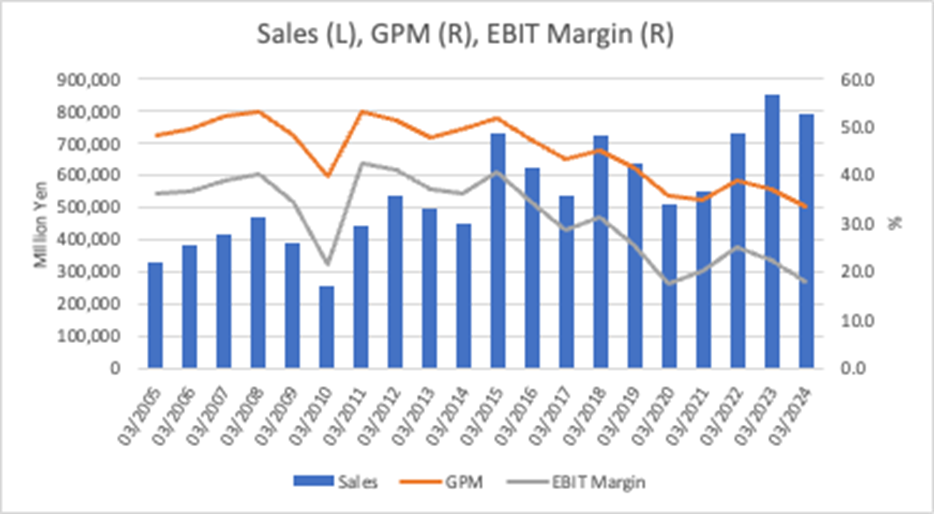

Despite a significant slowdown last year, China has accounted for 30% of sales in recent years and is the most critical market alongside the USA. While consolidated sales have expanded since FY3/2020, profit margins have declined markedly, a trend that has continued since 2015. We speculate that the main reasons for this include the market environment that has become considerably tougher in the 60 years since the spread of NC, dilution of profit margins due to robot expansion (profit margins are not disclosed), and poor of cost control.

Management’s policy is to maintain a consolidated dividend payout ratio of 60%, and the DoE for the previous year was high at 4.7%. However, the problem for investors is the huge cash pile, which these measures do nothing to solve: in 1Q, cash accounts for 29% of assets, and if investment securities are added, 38% are financial assets. The equity ratio at the end of 1Q was 88.7%, which is of questionable significance.

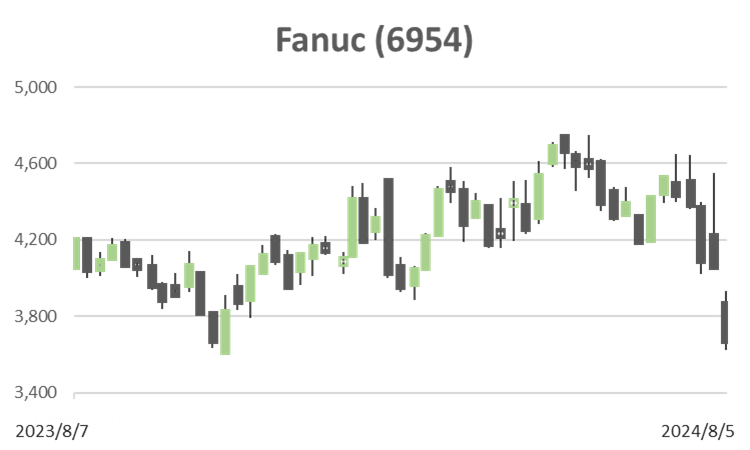

The share price has been dull ever since outperforming the TOPIX in CY2019 and CY2020, with underperformance continuing for three and a half years. With the stock market collapse over the last week, technical indicators for most large-cap stocks suggest that the shares are oversold, and a near-term rebound can be expected. On the other hand, the decline in Fanuc’s share price does not look that attractive.

Compared to the average Japanese company, the company’s IR has been far less than proactive for decades, and various information on management and the business environment has been poorly disclosed. The company does not reveal a medium-term management plan. When asked by analysts about measures to improve profitability over the medium term, it merely cited enhancing the attractiveness of its products, improving COGS ratios by introducing new models, and reducing costs.

Regarding shareholder ownership, institutional investors account for 52.3%, and insiders for 5.7%. Still, there have been no proposals at shareholder meetings for management to act on behalf of shareholders, and investors generally seem sleepy. Catalysts to change management’s mindset are hard to find at the moment.