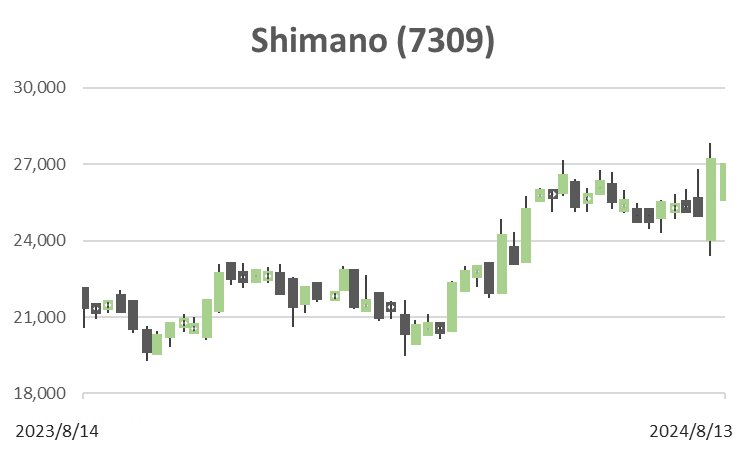

Shimano (Price Discovery)

Buy

Profile

World leader in bicycle parts, with a dominant market share. Also develops fishing tackle. Approximately 80% of sales are bicycle parts. Established in 1921 and headquartered in Osaka. Sales by division (OPM%): bicycle parts 77 (18), fishing tackle 23 (17), other 0 (-2), <overseas> 90 (FY12.2023)

| Securities Code |

| TYO:7309 |

| Market Capitalization |

| 2,413,966 million yen |

| Industry |

| Transportation equipment |

Stock Hunter’s View

Sales to China exceeded expectations. Demand for high-end road bikes is strong.

Shimano, the leader in the bicycle parts industry, continues to record lower sales and profits due to inventory adjustments, but the company’s most recently announced 2Q results (Jan-Jun) for FY12/2024 confirm that it is maintaining solid sales to China. The company has revised up its full-year forecasts to reflect the positive performance up to 2Q. Sales have been revised from 420 billion yen to 450 billion yen (-5.1% YoY) and operating profit from 56.8 billion yen to 66 billion yen (-21.1% YoY).

The popularity of sports bikes, particularly road bikes, continues in the Chinese market; although this was seen as short-lived, it is increasingly expected to continue in 2H and beyond. On the other hand, inventory adjustments for Europe are protracted. The adjustment of finished vehicle inventories in the market will likely take until the end of 3Q, and the company’s performance is expected to pick up from 4Q.

Despite short-term headwinds, such as the current trend of the strong yen, demand for high-end classes of Japanese production is strong, especially for road bikes, for which a complete model change haIn addition, dividends have been on a steady upward trend since FY12/2020, the company’s centenary year. The company has announced that it will increase the interim and year-end dividends by 12 yen each for the current financial year, bringing the annual dividend to 309 yen, up from the initial forecast of 285 yen.s been completed.

Investor’s View

Buy. Profitability is falling due to the current inventory adjustment. However, the company is a cyclical growth, and the share price weakness presents a buying opportunity for long-term investment. We expect cashpile to be returned to shareholders in the long term. PBR is near 20-year lows.

Share Price (20 Yr)

PBR – LTM (20 Yr)

PER – LTM (20 Yr)

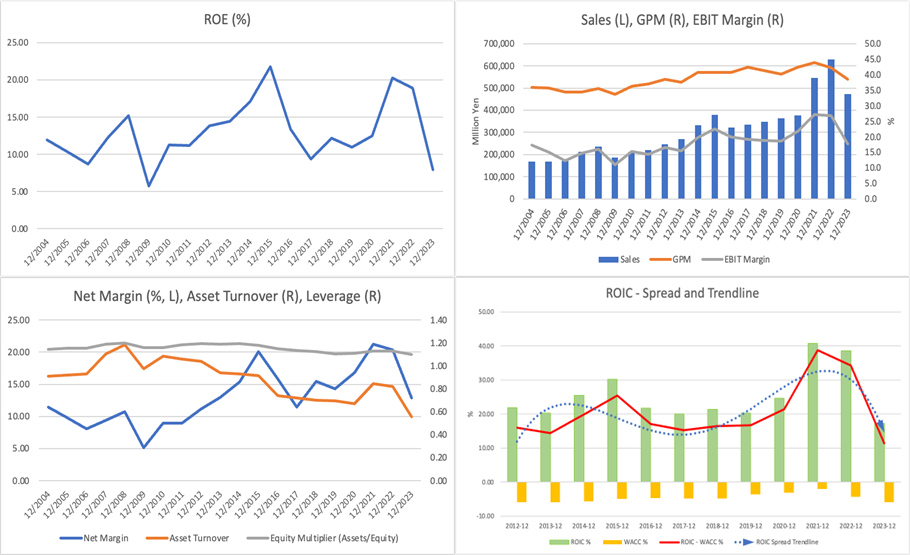

The company’s bicycle components have gained enormous trust worldwide, including in world cycling events like the Tour de France. The company’s global market share in high-end components is probably more than 80%, and it has been without a rival for a long time. No strong competitors will appear for a long time to come. The company’s ability to generate cash flow is immense and is a major attraction of its fundamentals. The secular ROE is estimated to be around 15%. Current economic value creation is at the bottom of the cycle and should pick up as the market demand recovers and inventory adjustment gets over.

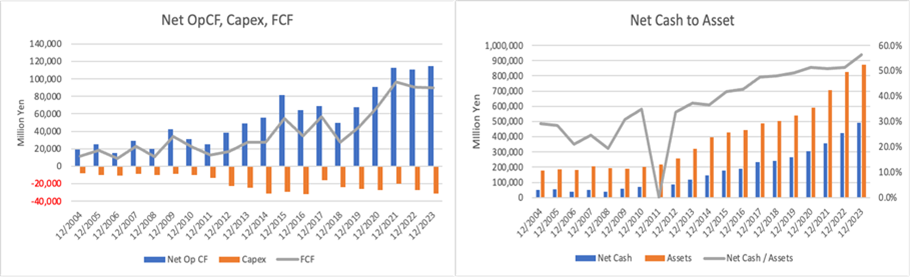

Having repurchased 18% of its outstanding shares over the last 20 years, the company is one of the most active Japanese companies in terms of share buybacks over the long term and has been proactive in increasing dividend payments. However, shareholder returns and capital expenditure have yet to fill the strong cash generation, and net cash has been on the rise for the last decade. Being already a giant in the global market, the company does not have room for a significant MA. In addition, its manufacturing facilities are much less sophisticated and extensive than the likes in the automotive industry, and although it has been active in capital investment in recent years, it cannot invest large sums of money in capital expenditure.

The Shimano family has produced the company’s presidents without interruption since the company was founded in 1940. President Taizo Shimano, now 57, is the sixth generation. As long as there is no significant opposition from shareholders, the Shimano family will continue to take over the company’s top management. Therefore, solid management and long-term shareholder returns will remain unchanged. The ownership of foreign shareholders is 50.5%, and it is estimated that most of them are generally satisfied with the management. Shareholders will continue to exert gentle pressure over the long term to optimise the BS by actively returning excess cash to shareholders and maintaining an attractive ROE. In response, we expect management to listen and act. Given the company’s ability to generate cash flow, this strikes us as a big attraction for long-term investment.