Japan Elevator Service Holdings (Price Discovery)

Buy

Profile

An elevator maintenance company that maintains, repairs, and renews lifts and escalators. Services include lift maintenance services such as inspections and testing, modernisation of elevators, supply of lift parts, training of personnel and operation of control centres for emergency calls, GPS tracking of technicians, remote diagnosis, and error code monitoring. The company was founded in 1994 by Katsuji Ishida and is headquartered in Tokyo. Sales mix by business%: Operating Preservation & Maintenance 63, Operating Renewal 34, Others 3 (FY3/2024)

| Securities Code |

| TYO:6544 |

| Market Capitalization |

| 248,587 million yen |

| Industry |

| Service |

Stock Hunter’s View

Strong uptake of maintenance demand. May play a leading role in industry restructuring.

Japan Elevator Service HD is a lift and escalator maintenance company with 32 consolidated subsidiaries and five equity method affiliates. As an independent company, its strength lies in its ability to provide services at market-competitive prices without being bound by manufacturer-driven pricing. It is also the only independent company with an elevator test tower.

As a rule, lifts, and escalators require maintenance and inspection once a month and periodic inspection once a year as stipulated by building code standards, and the company provides such maintenance and maintenance work and renewal services. The number of maintenance contracts and renewal units are both strong. In the 1Q of the current FY3/2025 (Apr-Jun), the number of maintenance contracts registered a record organic net increase (4,440 units) on a quarterly basis.

The supply of genuine parts has normalised, leading to a recovery in the volume of construction work for maintenance services. Needs for renewals also remain strong, with 1Q results reaching record highs with sales of 11,544 million yen (+21.6% YoY) and operating income of 1,924 million yen (+47.1% YoY).

The company is also very keen on mergers and acquisitions and is expected to continue to expand its market share. Many independent maintenance companies in Japan are small, medium, and micro enterprises, and there is a growing trend toward industry restructuring against the backdrop of labour shortages and other factors.

Investor’s View

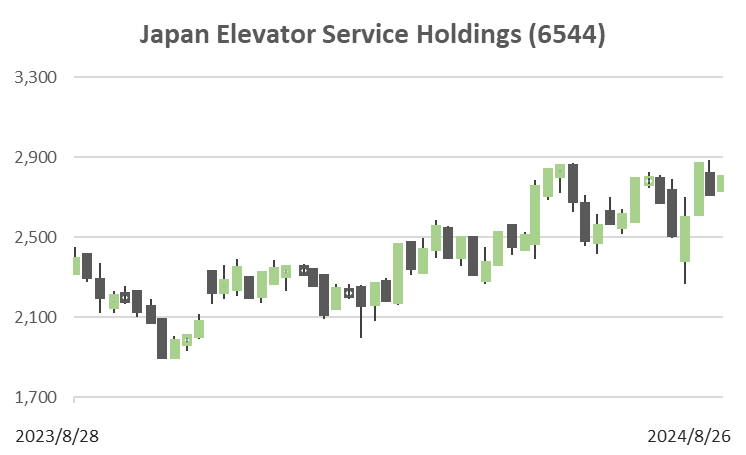

Buy. The shares are highly rated due to high ROE and solid earnings growth. While upside to price multiples is unlikely, we expect the share price to continue to rise over the medium to long term, reflecting solid growth in EPS and BPS.

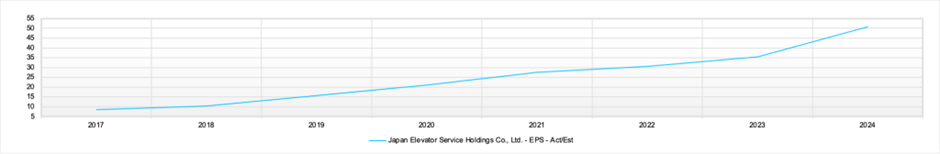

Looking at the company’s share price, EPS, and share price multiples side by side in the chart since the IPO, it can be seen that over the last three years or so, valuations have consolidated at around 50x the earnings and 16x the book, indicating that the high valuations are well established. The consistent rise in share prices over that period has been solely due to growth in EPS and BPS, with high five-year CAGRs of 28% and 31% for EPS and BPS, respectively. Reflecting this, the share price has performed well, rising an average of 32% per year over the five years and outperforming the TOPXI by 22%.

Share Price

EPS (Fiscal Year)

PBR (LTM)

PER (LTM)

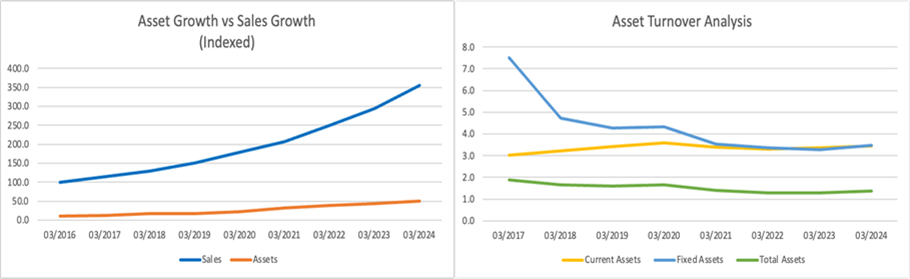

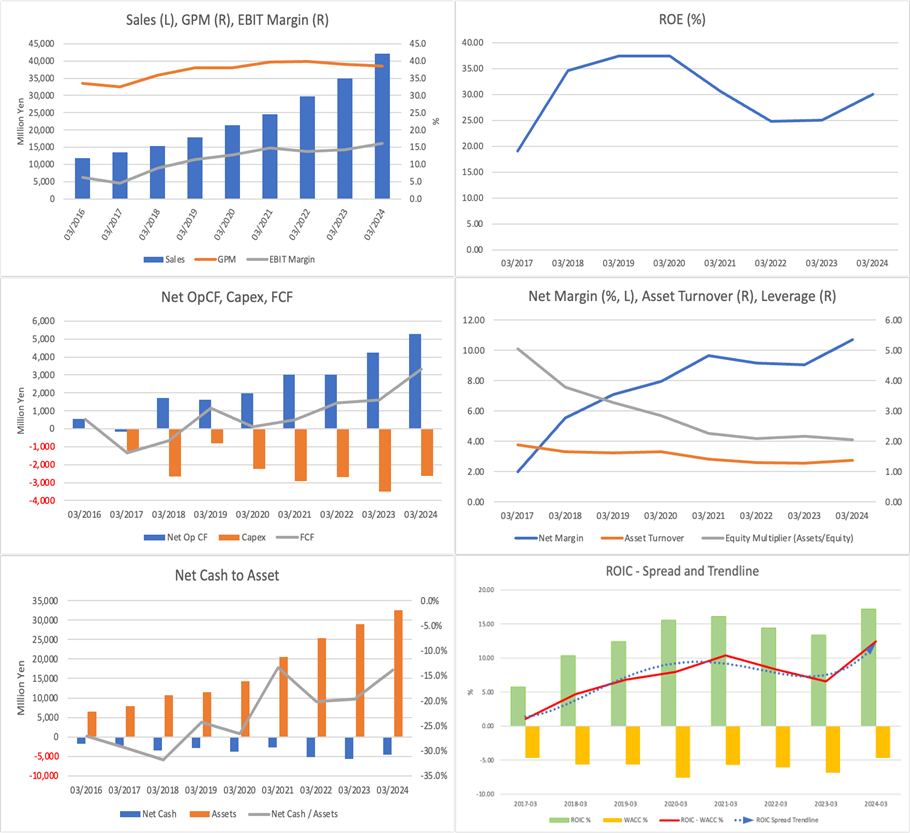

The company’s sales are strong, averaging +19% over five years; the EBIT margin is stable at around 15%, well above the profit margin of the manufacturing sector; the high ROE of 30% is a reflection of the high PL margin; in addition, the company has modest financial leverage and, based on sales and asset growth trends, the asset turn will likely remain positive going forward. Economic value is also being created well.

As noted by Stock Hunter, the current business is strong, and the aggressive MA is positive for maintaining the momentum of earnings growth going forward. With a high return on capital and earnings growth, the share price will continue to be rated highly. Although there are no expectations of upside to valuations, we expect the share price to continue to rise, reflecting strong EPS and BPS growth.