eGuarantee (Price Discovery)

Sell

Profile

eGuarantee, Inc. provides services to underwrite credit risks from various commercial transactions. The company’s services include sales credit guarantee services, contractor credit guarantee services, debtor trust guarantee services and various credit guarantee services. Founded by Kiminori Eto in September 2000. Headquartered in Tokyo. Sales by business %: Credit Guarantees 100(FY3/2024)

| Securities Code |

| TYO:8771 |

| Market Capitalization |

| 66,710 million yen |

| Industry |

| Other financial business |

Stock Hunter’s View

The business environment is favourable. The increasing number of bankruptcies increases the need for debt protection.

eGuarantee’s (8771) core business is a service that guarantees the risk of uncollectibility of various receivables, including accounts receivable, arising from business-to-business transactions. If a business partner defaults due to bankruptcy or other reasons, the company pays a deposit up to a pre-determined payment limit. The company subdivides and reduces the risk it assumes into smaller units and sells them to funds and financial institutions for securitisation.

The company plans sales of 10.1 billion yen (+10.2% YoY) and operating profit of 5.1 billion yen (+5.2% YoY) for the current financial year ending 31 March. The earnings are expected to err on the upside due to the strengthening of the sales structure and the growing need for debt protection. In an uncertain economic climate, with an increase in the number of bankruptcies, rising interest rates, inflation concerns and geopolitical risks, worries about collecting receivables are likely to emerge, and the need for guarantees will likely increase.

Note that the number of nationwide corporate bankruptcies in the first half of the year (Jan-Jun) increased for the third consecutive year. The rising cost of living, including higher prices due to the weak yen and rising labour costs, is hurting the earnings of small and medium-sized enterprises (SMEs) and is expected to push up bankruptcies from early autumn onwards, when demand for funds becomes more active, especially among companies that are having difficulty raising funds.

The most recently announced first quarter (Apr-Jun) results showed a solid start, with sales of 2,406 million yen (+7.4% YoY) and operating profit of 1,168 million yen (+1.5% YoY).

Investor’s View

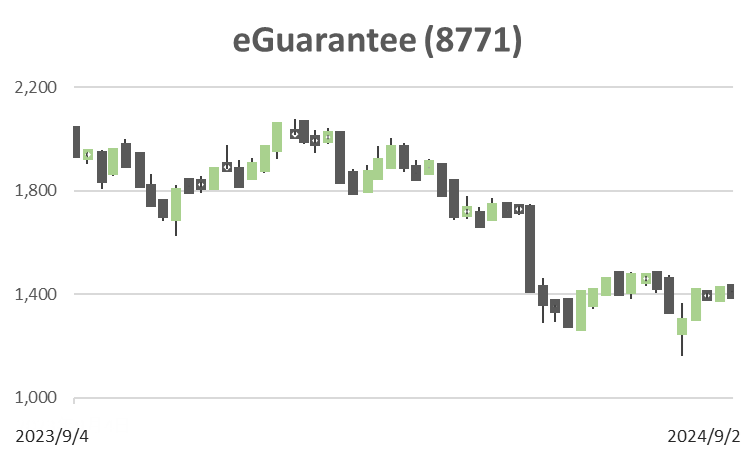

SELL. The share price has not stopped falling since the end of 2022 and has fallen by 31% since the beginning of the year. We expect the derating to continue, reflecting the structural decline in ROE.

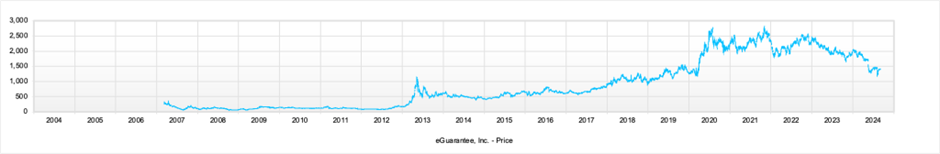

Share Price Since IPO

PBR (LTM)

PER (LTM)

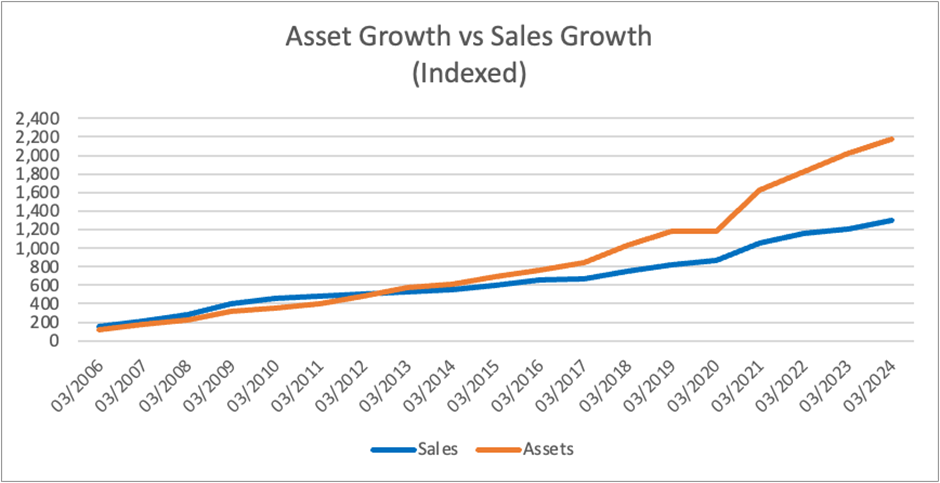

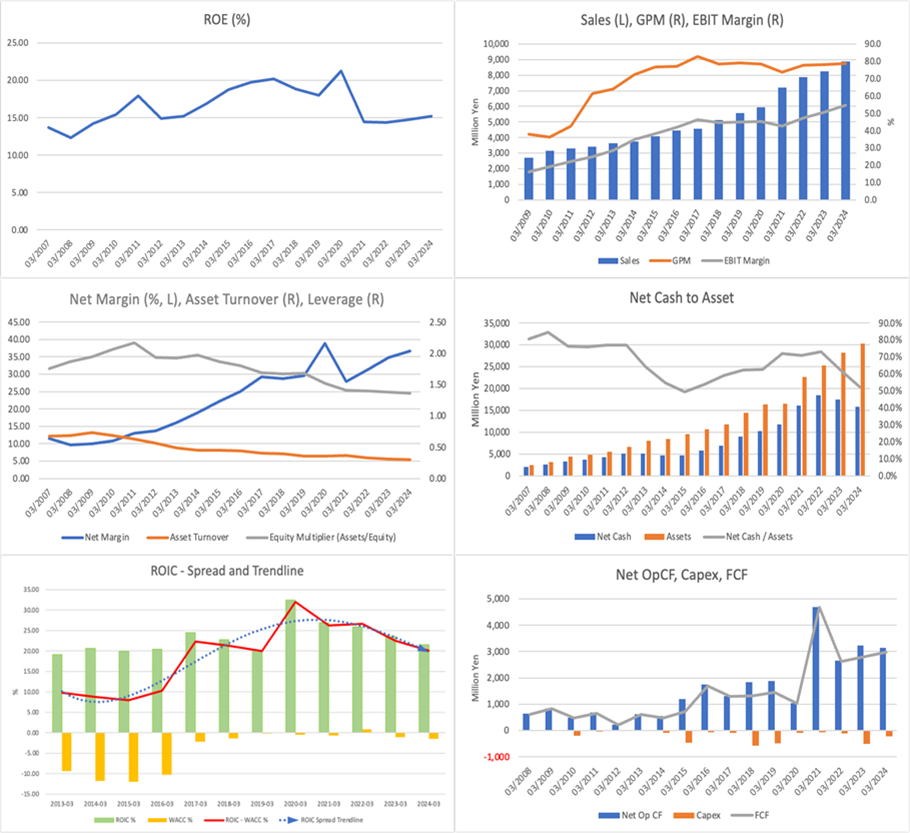

The marked decline in share price multiples from 2020 to 2021 reflects a structural decline in ROE. Balance sheet expansion during this period has been significant, and asset turnover has deteriorated markedly. As a result, ROE has been declining notably. For a long time, investors had given high multiples to share prices, rating good growth in EPS, BPS, and other per-share indicators highly. However, from around FY2021, the speed of asset expansion has far outpaced sales growth, weighing on ROE. Net cash is excessive.

Management aims to increase ROE from around 15% to 20%, but no specific measures have been announced. As Stock Hunter notes, BS’s efficiency will deteriorate further if the company accelerates its expansion. While eGurarantee is a good business, management is currently sacrificing return on capital for profit growth. We would anticipate the shares will continue to be derated for the foreseeable future.