Chiome Bioscience (Company note – 2Q update)

| Share price (9/6) | ¥105 | Dividend Yield (24/12 CE) | – % |

| 52weeks high/low | ¥102/106 | ROE(23/12 act) | -83.6 % |

| Avg Vol (3 month) | 771.2 thou shrs | Operating margin (TTM) | -176.6 % |

| Market Cap | ¥6.0 bn | Beta (5Y Monthly) | 0.6 |

| Enterprise Value | ¥5.1 bn | Shares Outstanding | 57.049 mn shrs |

| PER (24/12 CE) | – X | Listed market | TSE Growth |

| PBR (23/12 act) | 5.6 X |

| Click here for the PDF version of this page |

| PDF version |

Despite a decrease in revenue, the deficit has been reduced. It is awaited that the Drug Discovery and Development Business will be licensed out and the company will be profitable in a single year.

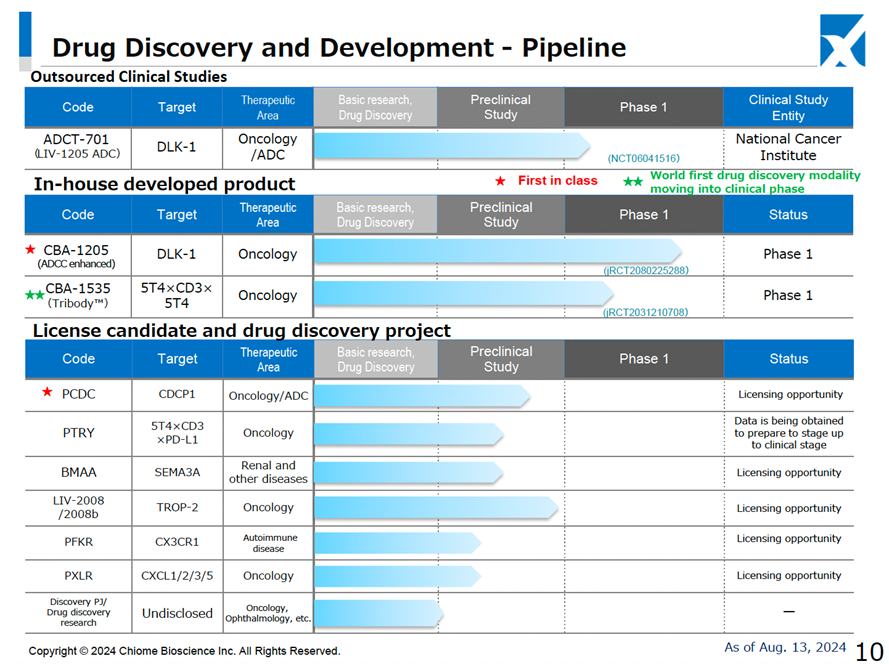

◇ 2Q of FY12/2024: Highlights of Financial Results: Despite a decrease in revenue, the deficit has been reduced

In the second quarter results of FY12/2024, announced by Chiome Bioscience (hereafter, the company) on 13 August 2024, the company saw a YoY decrease in revenue, but the deficit narrowed. Net sales were 260 million yen (- 26% YoY), operating loss was 580 million yen (vs. a loss of 650 million yen in the same period of the previous fiscal year), and ordinary loss was 560 million yen (vs. a loss of 660 million yen). Interim net loss was 560 million yen (vs. a loss of 660 million yen).

Looking at the results by division, in the Drug Discovery and Development Business, despite recording R&D expenses of 440 million yen due to progress in clinical development, the amount recorded for expenses such as investigational new drug manufacturing costs decreased YoY, resulting in an segment loss of 440 million yen (an improvement of 150 million yen YoY) (the development status is described later).

In the Drug Discovery Support Business, the company provides antibody generation services and antibody affinity enhancement services utilising its antibody generation technology platform centred on the ADLib®︎ system, the company’s proprietary antibody generation method, as well as protein preparation, expression, and purification services, under contract to Ono Pharmaceutical, Chugai Pharmaceutical and others. The company concluded an outsourcing agreement with Takeda Pharmaceutical in the current fiscal year. However, sales were 260 million yen (- 90 million yen YoY) due to a delay in the inspection period for some new projects and a decrease in transactions due to organisational changes on the part of customers. Segment profit was 130 million yen (- 70 million yen YoY) due to factors such as capital investment in anticipation of the expansion of the contract business. The full-year sales forecast for the Drug Discovery Support Business, which was initially expected to be 720 million yen (a forecast increase of 40 million yen YoY), has been left unchanged, with the company anticipating orders will recover in 2H.

In terms of cash flow, the company has made up for the cash decrease associated with the losses mentioned above by issuing new shares in conjunction with the exercise of stock acquisition rights, and the balance of cash and deposits at the end of the period was 1.1 billion yen(- 220 million yen YoY). Short-term borrowings were 290 million yen, a slight decrease YoY.

The above summarises the financial results, which are typical of bio-ventures where drug discovery and development costs come first. Hence, the impact on the share price is thought to be limited.

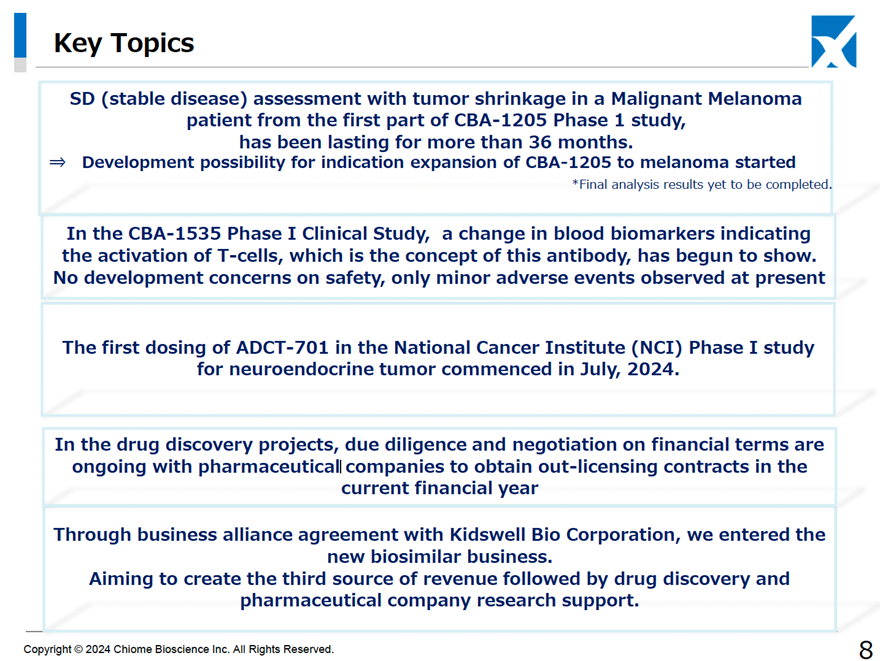

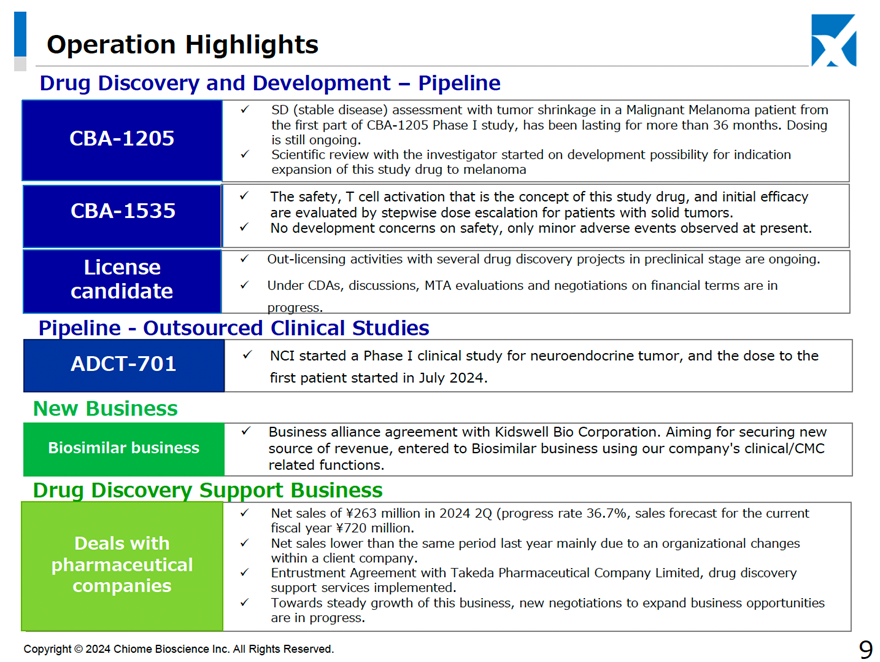

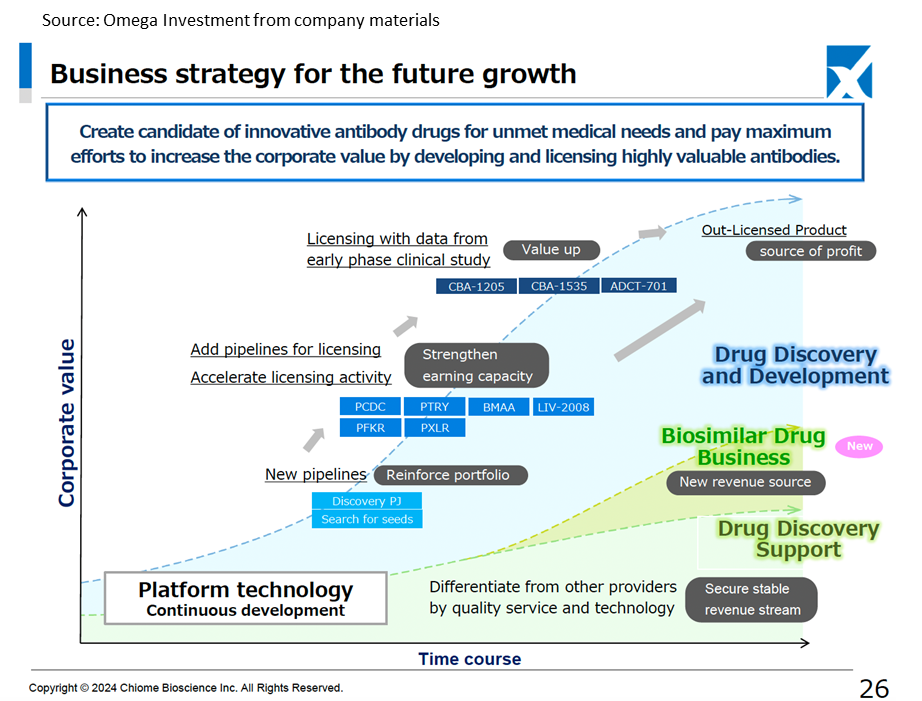

◇ Drug Discovery and Development Business is progressing smoothly

The number of projects in the drug discovery and development business pipeline is three in clinical trials (two in-house developed, one external clinical trial) and seven pre-clinical trials, which is unchanged from the information disclosed in May.

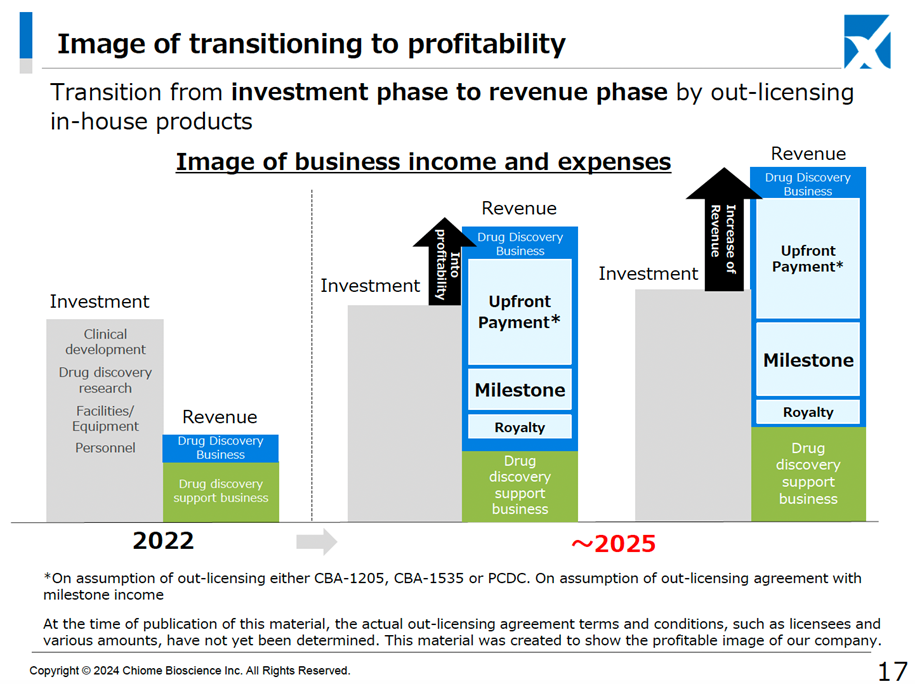

CBA-1205 (In-house developed product) is continuing to progress through the second half of Phase I clinical trials, with administration to patients with hepatocellular carcinoma progressing, and partial response (PR) has been confirmed in one case (unchanged from previous information). In addition, as the melanoma patients who received treatment in the first half of the trial continue to show stable disease (SD) with tumour shrinkage, and treatment has continued for more than 36 months, the company has begun to consider the possibility of developing the drug for melanoma in conjunction with the principal investigator (updated information). At the financial results briefing, it was confirmed that the first half of the project is expected to be presented at a conference within 2024 and that the company intends to conclude a licensing agreement by 2025, when the second half of the project is expected to be completed. Suppose multiple cases of efficacy are confirmed in hepatocellular carcinoma, and the development of melanoma progresses. In that case, the economic value is expected to increase, and the upfront payment will follow suit. This will be important in achieving profitability in a single year by 2025.

CBA-1535 (In-house developed product) is still in Phase I clinical trials, and changes in blood biomarkers that indicate T-cell activation, the concept behind the drug, are beginning to be seen. There have been no safety-related events that would raise concerns about development (as before). At the financial results briefing, it was indicated that from the second half of 2024 to the first half of 2025, the evaluation of T-cell activation and initial clinical efficacy, as well as safety, will progress and that this will be used as a basis for full-scale out-licensing negotiations.

ADCT-701 (the National Cancer Institute is the lead investigator). A phase 1 clinical trial in paediatric neuroendocrine cancer was initiated, and the first subject was administered in July 2024 (updated information).

Out-licensing activities are also continuing for multiple drug discovery projects in the pre-clinical stage.

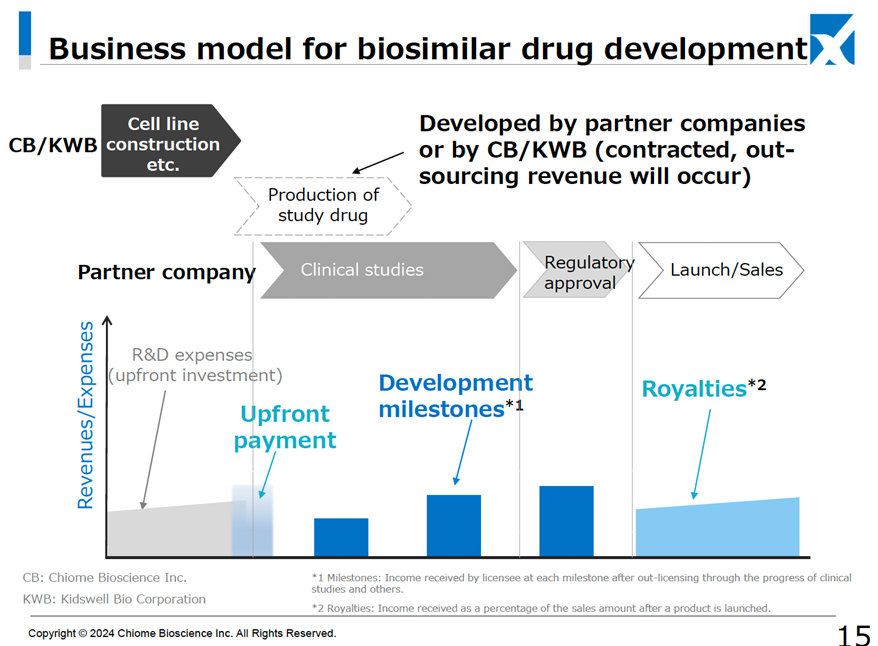

◇ Entry into the Biosimilar Business

On 18 June 2024, the company concluded a basic agreement on a business alliance with Kidswell Bio Co. (hereafter, KWB) regarding the development of biosimilar pharmaceuticals. Together with KWB, which has four approved biosimilar products in Japan, the two companies plan to share knowledge, mainly in CMC development of biopharmaceuticals, to operate the business efficiently and share costs and revenues. The biosimilar market is expected to grow as biosimilar spread is promoted as a national policy from the perspective of curbing medical expenses. It is thought to be more difficult to enter than the market for generic small-molecule drugs, so it seems likely that this will lead to the creation of a third source of revenue for the company.

The business can take various forms, including the company and KWB building their own cell lines and then licensing and transferring them to a partner company, licensing and transferring them and then undertaking development on contract from the partner company, or just undertaking development on contract. We await further information.

◇ Funding allocation progresses

On 22 July 2024, the acquisition and cancellation of all remaining 18,530 Series 20 warrants was completed. A further 101,700 Series 21 warrants (initial exercise price of 125 yen, with exercise price revision, minimum exercise price of 81 yen, exercise deadline 21 July 2026) and 11,000 Series 22 warrants ( initial exercise price of 134 yen, no exercise price revision, exercise deadline 21 July 2026) were issued. The total number of potential shares is11.27 million (approximately 20% of the shares outstanding), and the estimated amount of funds raised is approximately 1.41 billion yen, assuming the initial exercise price. In addition, the first unsecured bond of 250 million yen (with early redemption depending on the progress of the exercise of the 22nd warrant) has also been issued.

Although the impact of dilution is a concern, it is positive that the company has made progress in providing the current funds needed to promote research and development.

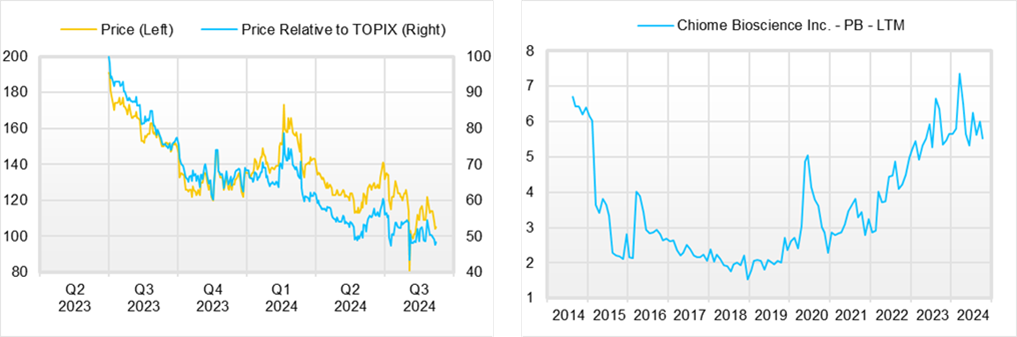

◇ Share price trend and future highlights

The company’s share price is in a gradual downtrend. From a broad perspective, this is due to the long lead time before the new drug is licensed out. During this time, the company had no choice but to raise funds for research and development by issuing new shares, typical of drug discovery bio ventures.

However, according to previous disclosures, the company is approaching a critical point when it should be looking at the possibility of a successful out-licensing of its in-house developed product, as the Phase I clinical trials are now well underway. If the company succeeds in out-licensing its in-house development product and makes a profit in a single year, and if investor expectations rise for subsequent out-licensing, the share price will more actively factor in the value of the Drug Discovery and Development Business pipeline, and the company will be on track to see its corporate value increase, reversing the dilution mentioned earlier.

The immediate focus will therefore be on the chances of successful out-licensing of in-house developed products such as CBA-1205 and CBA-1535, whether the economic conditions are sufficient, and whether the company can achieve its business target of returning to profitability in a single year by 2025, and whether it can do so ahead of schedule.

Company profile

Chiome Bioscience Inc. is a bio venture company that challenges unmet needs through antibody drug discovery and development based on its proprietary ADLib/Tribody technology. The company’s Drug Discovery and Development Business (the business of in-house or joint development of antibody drug discovery in disease areas with high unmet needs, licensing the patents and other intellectual property rights relating to the resulting antibodies to pharmaceutical companies and other parties, and earning upfront payments, milestone payments, royalties and other income) is a pillar of its growth. The company has a pipeline of around ten products, three of which are in the clinical stage. In addition, as a complementary business, it has established a track record in the Drug Discovery Support Business (a high-value-added contract research business that mainly provides major domestic pharmaceutical companies with antibody production, antibody engineering and protein preparation services utilising the antibody drug discovery technology platform). The company has also started to expand into the biosimilar business.

Key financial data

| Unit: million yen | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 | 2024/12 CE |

| Sales | 448 | 481 | 713 | 631 | 682 | NA |

| EBIT (Operating Income) | -1,402 | -1,284 | -1,334 | -1,259 | -1,205 | NA |

| Pretax Income | -1,401 | -1,291 | -1,466 | -1,238 | -1,215 | NA |

| Net Profit Attributable to Owner of Parent | -1,404 | -1,294 | -1,480 | -1,243 | -1,220 | NA |

| Cash & Short-Term Investments | 2,106 | 2,686 | 1,791 | 1,727 | 1,326 | |

| Total assets | 2,808 | 3,495 | 2,339 | 2,215 | 1,751 | |

| Total Debt | 291 | 291 | 291 | 291 | 291 | |

| Net Debt | -1,035 | -1,035 | -1,035 | -1,035 | -1,035 | |

| Total liabilities | 187 | 385 | 446 | 425 | 594 | |

| Total Shareholders’ Equity | 1,158 | 1,158 | 1,158 | 1,158 | 1,158 | |

| Net Operating Cash Flow | -1,537 | -1,360 | -1,131 | -1,191 | -1,069 | |

| Capital Expenditure | 0 | 0 | 0 | 0 | 0 | |

| Net Investing Cash Flow | -26 | -4 | -35 | 0 | 0 | |

| Net Financing Cash Flow | 1,341 | 1,944 | 271 | 1,127 | 667 | |

| ROA (%) | -49.79 | -41.06 | -50.73 | -54.57 | -61.51 | |

| ROE (%) | -52.99 | -45.15 | -59.16 | -67.48 | -82.76 | |

| EPS (Yen) | -44.6 | -36.1 | -36.7 | -28.3 | -24.6 | |

| BPS (Yen) | 78.8 | 78.7 | 46.4 | 37.0 | 22.0 | |

| Dividend per Share (Yen) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Shares Outstanding (Million shares) | 58.28 | 58.28 | 58.28 | 58.28 | 58.28 |

Source: Omega Investment from company data, rounded to the nearest whole number.

Share price

Quarterly topics

Source: Omega Investment from company materials

Source: Omega Investment from company materials

Source: Omega Investment from company materials

Source: Omega Investment from company materials

Source: Omega Investment from company materials

Source: Omega Investment from company materials

Financial data (quarterly basis)

| Unit: million yen | 2022/12 | 2023/12 | 2024/12 | ||||||

| 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | |

| (Income Statement) | |||||||||

| Sales | 150 | 155 | 197 | 169 | 189 | 165 | 158 | 130 | 134 |

| Year-on-year | 7.8% | -0.8% | 15.1% | 31.8% | 26.6% | 6.2% | -19.6% | -23.5% | -29.2% |

| Cost of Goods Sold (COGS) | 69 | 72 | 83 | 73 | 77 | 67 | 67 | 73 | 56 |

| Gross Income | 80 | 84 | 114 | 96 | 113 | 98 | 92 | 57 | 78 |

| Gross Income Margin | 53.7% | 53.9% | 57.8% | 56.6% | 59.5% | 59.6% | 57.8% | 44.0% | 58.0% |

| SG&A Expense | 373 | 344 | 333 | 322 | 546 | 344 | 391 | 379 | 337 |

| EBIT (Operating Income) | -293 | -260 | -219 | -226 | -433 | -246 | -300 | -322 | -259 |

| Year-on-year | 12.5% | -40.3% | -54.6% | -53.5% | 48.0% | -5.4% | 36.7% | 42.6% | -40.2% |

| Operating Income Margin | -195.6% | -167.3% | -111.3% | -133.4% | -228.6% | -149.0% | -189.3% | -248.5% | -193.1% |

| EBITDA | -292 | -260 | -219 | -226 | -433 | -246 | -300 | -322 | -259 |

| Pretax Income | -277 | -255 | -214 | -226 | -435 | -254 | -300 | -303 | -259 |

| Consolidated Net Income | -279 | -257 | -215 | -228 | -436 | -255 | -302 | -304 | -260 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | -279 | -257 | -215 | -228 | -436 | -255 | -302 | -304 | -260 |

| Year-on-year | 12.3% | -40.9% | -66.2% | -53.8% | 56.5% | -0.7% | 40.1% | 33.5% | -40.4% |

| Net Income Margin | -186.2% | -165.0% | -109.2% | -134.4% | -230.1% | -154.3% | -190.3% | -234.5% | -193.9% |

| (Balance Sheet) | |||||||||

| Cash & Short-Term Investments | 1,472 | 1,592 | 1,727 | 1,566 | 1,245 | 1,342 | 1,326 | 1,325 | 1,104 |

| Total assets | 1,920 | 2,081 | 2,215 | 2,086 | 1,686 | 1,753 | 1,751 | 1,754 | 1,557 |

| Total Debt | 188 | 188 | 184 | 301 | 298 | 316 | 291 | 314 | 292 |

| Net Debt | -1,284 | -1,404 | -1,543 | -1,265 | -947 | -1,026 | -1,035 | -1,012 | -812 |

| Total liabilities | 444 | 431 | 425 | 524 | 541 | 542 | 594 | 506 | 487 |

| Total Shareholders’ Equity | 1,476 | 1,650 | 1,791 | 1,562 | 1,145 | 1,211 | 1,158 | 1,248 | 1,071 |

| (Profitability %) | |||||||||

| ROA | -70.19 | -66.16 | -54.57 | -46.44 | -62.98 | -59.13 | -61.51 | -67.53 | -69.09 |

| ROE | -84.99 | -81.62 | -67.48 | -60.83 | -86.66 | -79.25 | -82.76 | -92.28 | -101.15 |

| (Per-share) Unit: JPY | |||||||||

| EPS | -6.5 | -5.8 | -4.6 | -4.7 | -9.0 | -5.2 | -5.8 | -5.6 | -4.6 |

| BPS | 34.3 | 35.9 | 37.0 | 32.3 | 23.6 | 23.9 | 22.0 | 22.4 | 19.0 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Shares Outstanding(million shares) | 42.74 | 45.23 | 48.42 | 48.42 | 48.50 | 50.01 | 52.19 | 55.40 | 56.39 |

Source: Omega Investment from company materials

Financial data (full-year basis)

| Unit: million yen | 2014/12 | 2015/12 | 2016/12 | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| (Income Statement) | ||||||||||

| Sales | 370 | 280 | 252 | 260 | 213 | 448 | 481 | 713 | 631 | 682 |

| Year-on-year | – | -24.4% | -10.0% | 3.0% | -18.1% | 110.3% | 7.4% | 48.3% | -11.5% | 8.2% |

| Cost of Goods Sold | 119 | 225 | 228 | 94 | 107 | 167 | 238 | 292 | 283 | 285 |

| Gross Income | 252 | 55 | 25 | 166 | 106 | 281 | 243 | 421 | 348 | 398 |

| Gross Income Margin | 67.9% | 19.8% | 9.7% | 64.0% | 49.6% | 62.7% | 50.5% | 59.0% | 55.1% | 58.3% |

| SG&A Expense | 1,406 | 1,325 | 1,067 | 1,054 | 1,645 | 1,683 | 1,526 | 1,755 | 1,606 | 1,603 |

| EBIT (Operating Income) | -1,154 | -1,270 | -1,042 | -888 | -1,539 | -1,402 | -1,284 | -1,334 | -1,259 | -1,205 |

| Year-on-year | – | 10.0% | -17.9% | -14.8% | 73.4% | -8.9% | -8.4% | 3.9% | -5.7% | -4.2% |

| Operating Income Margin | -311.6% | -453.4% | -413.3% | -341.6% | -723.1% | -313.2% | -266.9% | -187.2% | -199.5% | -176.6% |

| EBITDA | -1,046 | -1,168 | -929 | -877 | -1,532 | -1,397 | -1,280 | -1,331 | -1,257 | -1,204 |

| Pretax Income | -1,180 | -1,281 | -1,501 | -880 | -1,531 | -1,401 | -1,291 | -1,466 | -1,238 | -1,215 |

| Consolidated Net Income | -1,180 | -1,283 | -1,491 | -883 | -1,534 | -1,404 | -1,294 | -1,480 | -1,243 | -1,220 |

| Minority Interest | -30 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | -1,150 | -1,283 | -1,491 | -883 | -1,534 | -1,404 | -1,294 | -1,480 | -1,243 | -1,220 |

| Year-on-year | – | 11.5% | 16.3% | -40.8% | 73.8% | -8.5% | -7.8% | 14.4% | -16.0% | -1.8% |

| Net Income Margin | -310.6% | -457.9% | -591.2% | -339.6% | -720.5% | -313.6% | -269.1% | -207.6% | -197.0% | -178.8% |

| (Balance Sheet) | ||||||||||

| Cash & Short-Term Investments | 5,576 | 4,100 | 4,553 | 4,027 | 2,329 | 2,106 | 2,686 | 1,791 | 1,727 | 1,326 |

| Total assets | 6,257 | 4,919 | 4,789 | 4,419 | 2,831 | 2,808 | 3,495 | 2,339 | 2,215 | 1,751 |

| Total Debt | 0 | 100 | 54 | 4 | 0 | 0 | 180 | 183 | 184 | 291 |

| Net Debt | -5,576 | -4,000 | -4,499 | -4,023 | -2,329 | -2,106 | -2,506 | -1,608 | -1,543 | -1,035 |

| Total liabilities | 418 | 355 | 224 | 202 | 154 | 187 | 385 | 446 | 425 | 594 |

| Total Shareholders’ Equity | 5,828 | 4,564 | 4,565 | 4,218 | 2,677 | 2,622 | 3,110 | 1,893 | 1,791 | 1,158 |

| (Cash Flow) | ||||||||||

| Net Operating Cash Flow | -789 | -1,245 | -970 | -867 | -1,689 | -1,537 | -1,360 | -1,131 | -1,191 | -1,069 |

| Capital Expenditure | 119 | 168 | 11 | 5 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Investing Cash Flow | -619 | -1,780 | 1,989 | -137 | 0 | -26 | -4 | -35 | 0 | 0 |

| Net Financing Cash Flow | 2,131 | 124 | 1,434 | 479 | -10 | 1,341 | 1,944 | 271 | 1,127 | 667 |

| (Profitability %) | ||||||||||

| ROA | -30.46 | -22.95 | -30.72 | -19.17 | -42.30 | -49.79 | -41.06 | -50.73 | -54.57 | -61.51 |

| ROE | -33.51 | -24.69 | -32.67 | -20.10 | -44.49 | -52.99 | -45.15 | -59.16 | -67.48 | -82.76 |

| (Per-share) Unit: JPY | ||||||||||

| EPS | – | -58.3 | -65.9 | -33.5 | -57.3 | -44.6 | -36.1 | -36.7 | -28.3 | -24.6 |

| BPS | 265.6 | 207.0 | 179.3 | 157.5 | 99.9 | 78.8 | 78.7 | 46.4 | 37.0 | 22.0 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Shares Outstanding (million shares) | 21.93 | 22.05 | 25.31 | 26.78 | 26.78 | 33.28 | 39.51 | 40.31 | 48.42 | 52.19 |

Source: Omega Investment from company materials