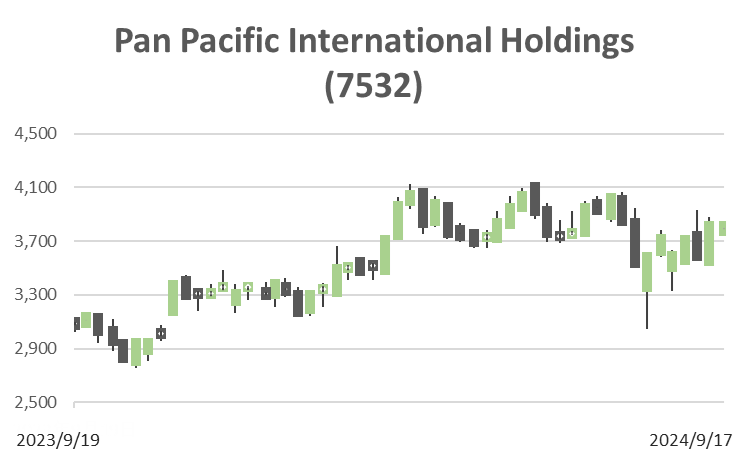

Pan Pacific International Holdings (Price Discovery)

Buy

Profile

Develops general discount shop Don Quijote. Subsidiaries include Nagasakiya and UNY. Operates 619 shops nationwide as of mid-2024. Overseas operations are concentrated in North America and Southeast Asia. The group has acquired small US supermarket chains in Hawaii and California and is also accelerating shop development in Singapore and Hong Kong. Founded by Takao Yasuda in 1980 and headquartered in Tokyo. Mr Yasuda, now 75, participates in management as a non-executive director. President Mr Yoshida, appointed in 2019, is a 59-year-old MBA, graduate of ICU and INSEAD. Sales ratio by division% (OPM%): Japan 84 (8), North America 12 (1), Asia 4 (0) [Overseas] 16 (FY6/2024)

| Securities Code |

| TYO:7532 |

| Market Capitalization |

| 2,422,634 million yen |

| Industry |

| Retail trade |

Stock Hunter’s View

The medium-term plan was achieved one year ahead of schedule. Next step: ‘Operating profit of 200 billion yen’.

Pan Pacific HD operates Don Quijote discount stores, which are popular with tourists visiting Japan. In FY6/2024, the company achieved an 8.2% increase in sales and a 33.2% increase in operating profit for the 35th consecutive year. It achieved sales of 2 trillion yen and an operating profit of 120 billion yen set out in its medium-term management plan one year ahead of schedule.

The next target is ‘operating profit of 200 billion yen by 2030’. The first target is an operating profit of 150 billion yen (+7.0% YoY) for the current financial year. In addition to opening more than 30 new shops in Japan and seven overseas, PB and OEM sales in the discount store business are to increase by 130% YoY to 320 billion yen to improve profit margins further.

The company also aims to achieve 150 billion yen in duty-free sales, which reached a full-year total of 117.3 billion yen in the previous fiscal year, well above the revised budget. The company conducts SNS marketing in collaboration with influencers and travel agencies before tourists arrive in Japan and uses nationality-based preference analysis to develop PB and OEM products. These measures are believed to have contributed to capturing inbound needs.

Note that the most recently announced August same-store sales (domestic retail business) rose 9.4% YoY for the 27th consecutive month of growth. In addition to strong sales of summer appliances, bedding and interior goods, there was a sharp increase in sales of disaster prevention-related products due to the Hyuga Sea earthquake, the Nankai Trough earthquake warning, and the impact of a large typhoon.

Investor’s View

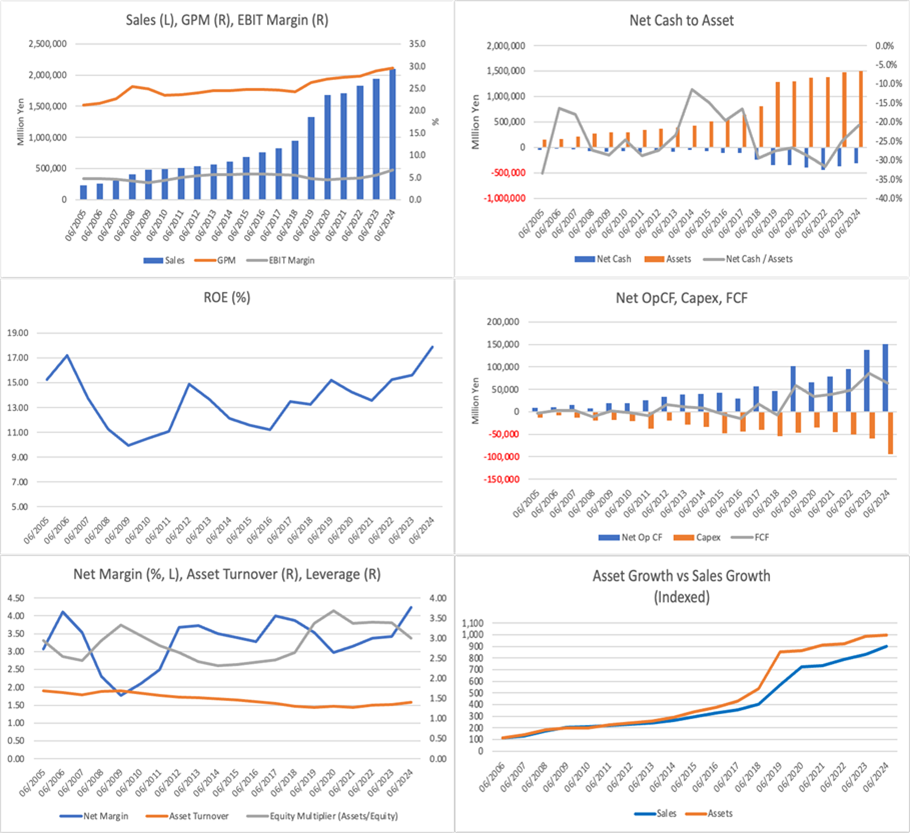

Buy. Slowing profit growth over the next five to six years could affect PER, but ROE has an upside. Solid growth in BPS and EPS should drive the share price rise at an average of around 10% per annum over the next few years.

Share Price – 20 Year

PBR – 20 Year LTM

PER – 20 Year LTM

ROE – 20 Year

BPS

EPS

As per valuations, it is noteworthy that while PER has remained at almost 25x over the past decade, PBR has increased from 2.5x to around 4x. This is thought to be a straight reflection of ROE’s expansion from around 10% to 18% over the same period, while positive expectations for EPS growth have been maintained.

Over the past five years, the share price has risen by 19% per annum, EPS by +14%, and BPS by +12%. Assuming an operating profit of 200 billion yen in 2030, the CAGR is +6%, a significant slowdown from the six-year CAGR of +18% until FY6/2024. There may, therefore, be some downside to PER. On the other hand, there is an upside to ROE as management continues to focus on PL profitability and BS efficiency.

Economic value is being created robustly. The equity yield is also reasonable at around 4%, suggesting that a PBR of 4x is not too high.

In conclusion, valuation expansion will not drive share prices, but a significant downside to share price multiples is also unlikely in the next few years. In the meantime, we expect share prices to rise at a steady rate of around 10% per annum, reflecting growth in value per share.