Shimamura (Price Discovery)

Suitable to adjust the portfolio’s beta

Profile

Japanese apparel retailer. The products sold are mainly purchased goods. Low-cost operations. The company’s main business is Fashion Center Shimamura, which operates over 1,000 stores selling products for families, mainly homemakers in their 20s to 50s. Fashion Center Shimamura focuses on low-priced private brands. The stores are located in metropolitan areas such as Tokyo and Osaka and in suburban residential areas. The company was established in 1953 and is headquartered in Saitama. Sales by business segment: Women’s clothing 32%, Men’s clothing 9%, Underwear 23%, Baby and children’s clothing 8%, Bedding and other 28% (FY2/2024)

| Securities Code |

| TYO:8227 |

| Market Capitalization |

| 574,223 million yen |

| Industry |

| Retail trade |

Stock Hunter’s View

Expectations of an upward revision to the first half results. The mark-up ratio is continuing to improve.

The financial results for the first half of the current fiscal year (from 21 February to 20 August), which Shimamura is scheduled to announce on 30 September, are attracting attention.

In the 2Q (June to August), same-store sales increased by 3.2% YoY, and the average amount spent per customer also increased by 1.6%, maintaining a positive trend. In August, the additional purchase of popular products such as T-shirts and blouses was successful, and sandals, hats and arm covers were substantial due to demand for outings. Due to the high temperatures, sales of summer innerwear for men and women and interior and bedding products were also strong.

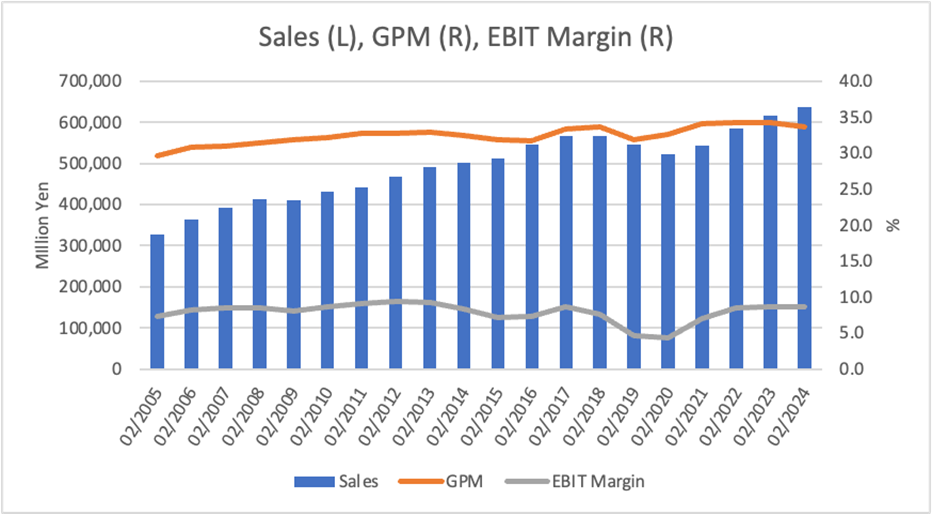

As a result of the company’s efforts to strengthen its product and sales capabilities, it recorded its highest-ever quarterly sales in Q1. From Q2 onwards, the impact of lingering inventory is expected to disappear, and the contribution of improved mark-up rates is expected, so there is a possibility that operating income for the first half of the year will exceed the company’s plan of 28.774 billion yen (down 4.6% YoY).

The company is expanding its high-end private brand (in-house developed brand) range, raising the price point of its joint brand (developed with suppliers) range, and expanding its ‘EC supplier delivery’ service, which delivers EC products directly to stores. The company’s EC business is performing well thanks to digital marketing, and various initiatives such as fairs and critical events are progressing smoothly. Continued improvements in profitability are expected.

Investor’s View

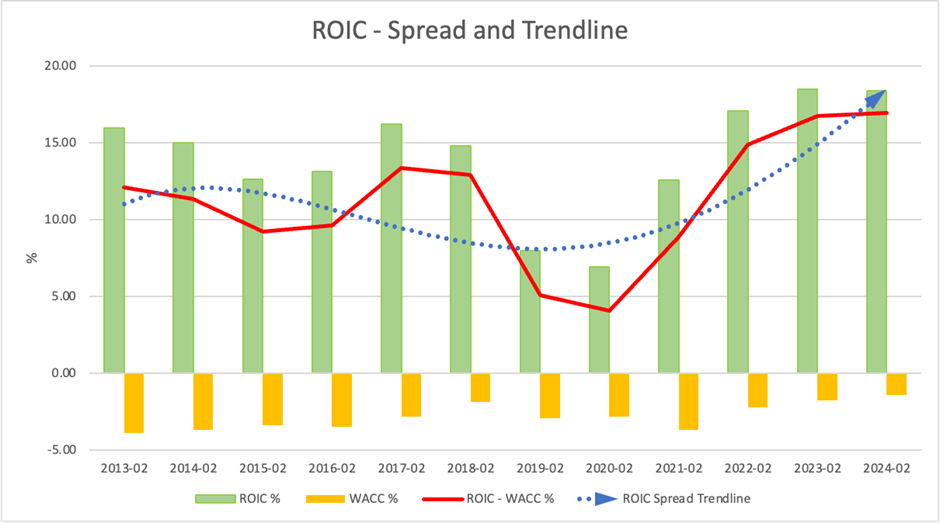

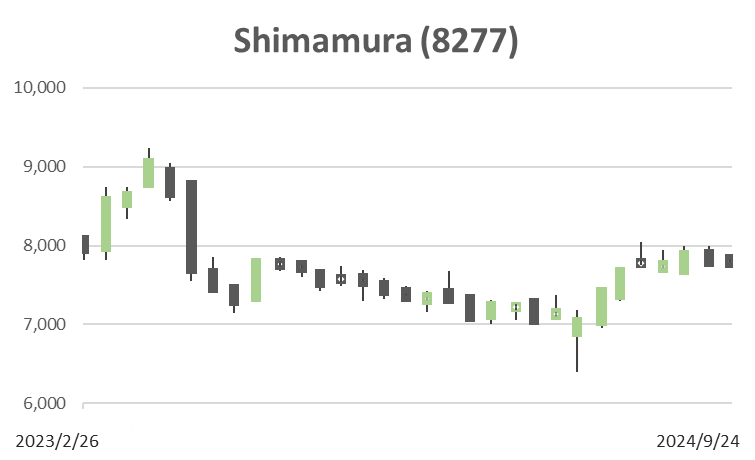

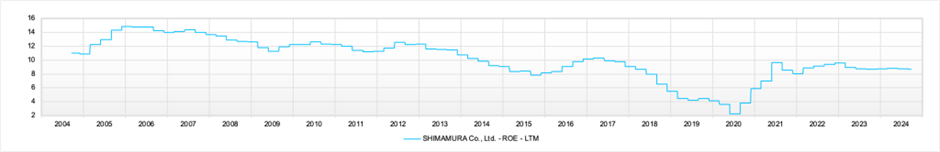

Suitable to adjust portfolio beta but is not an exciting stock pick to aim for a significant upside at the current price. Shimamura is a typical low beta (3 years 0.51) stock and has significantly underperformed TOPIX since 2023. The company has been achieving stable, low growth in its business performance for a long time and is also creating good economic value. The price-multiples are at a reasonable level.

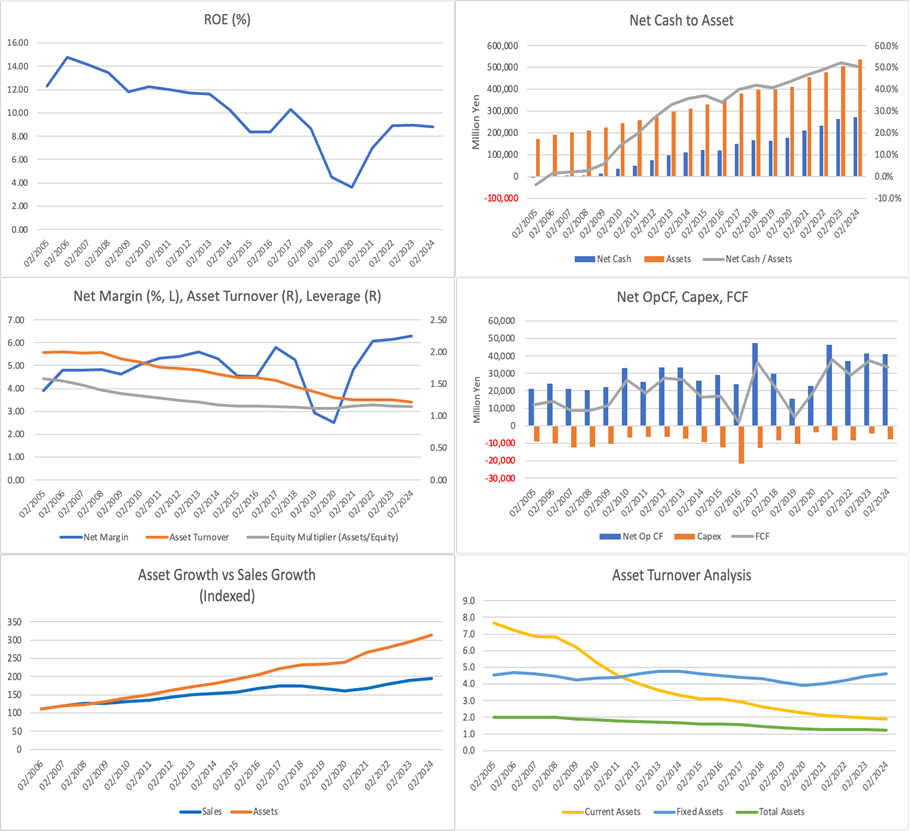

ROE has recovered sharply from 2% in 2020, but it has tended to consolidate in the 8-10% range in recent years. The reason for this is the accumulation of cash due to the company’s underinvestment. The ratio of net cash to assets has risen steadily and reached 50%. The management team disappoints by forecasting around 8% in FY2/2027 as the ROE of TOPIX has already reached 8.9%. Unless the mindset of the management team changes significantly, the downward trend in ROE over the past 20 years is likely to continue.

EPS has recovered from the significant decline that lasted for three years from 2018 and has risen from the 100 yen range of the 2010s to the 150 yen range over the past four years. However, it has been trending sideways. The management team aims to improve the PL profit margin and increase the operating income margin from 8.7% in FY2/2027 to 9.2% in FY2/2027. The impact on ROE will likely be minimal, and no significant drivers of profit momentum are visible.

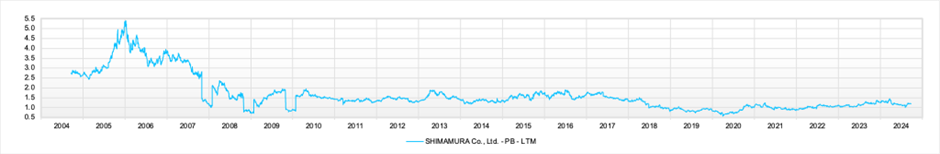

In recent years, there has been no significant change in investor valuations for stock price multiples in the range of 1-1.5x for PBR and 10-15x for PER. Dividend yields are around 1.5%, which is not particularly attractive.

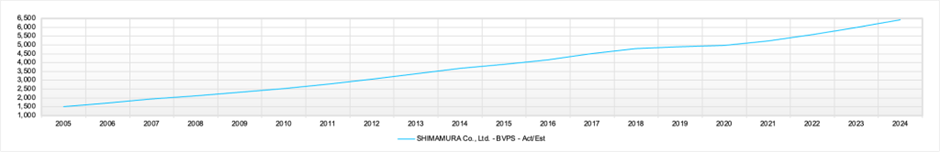

The only financial indicator related to stock investment that is consistently growing is BPS. The BPS growth rate has averaged 6% over the past five years, and future stock prices are expected to reflect this, rising by around 5-6% per year. We believe a dip in PBR will present a perfect opportunity to buy the shares for long-term investment.

Price – 20 Year

PBR (LTM) – 20 Year

PER (LTM) – 20 Year

ROE – 20 Year

EPS – 20 Year

BPS – 20 Year