Hamee (Company note – Q1 update)

| Share price (10/11) | ¥1,043 | Dividend Yield (25/4 CE) | 2.2 % |

| 52weeks high/low | ¥830/1,425 | ROE(24/4) | 11.9 % |

| Avg Vol (3 month) | 45 thou shrs | Operating margin (24/4) | 10.9 % |

| Market Cap | ¥17.0 bn | Beta (5Y Monthly) | 1.3 |

| Enterprise Value | ¥14.9 bn | Shares Outstanding | 16.3 mn shrs |

| PER (25/4 CE) | 12.2 X | Listed market | TSE Standard |

| PBR (24/4 act) | 1.7 X |

| Click here for the PDF version of this page |

| PDF version |

Net sales and operating income increased sharply in the first quarter, and the Company got off to a good start in line with its plan.

Expectations for the second half of the year are high.

◇ Q1 FY04/2025 financial highlights: Double-digit increases in net sales and operating income, as expected

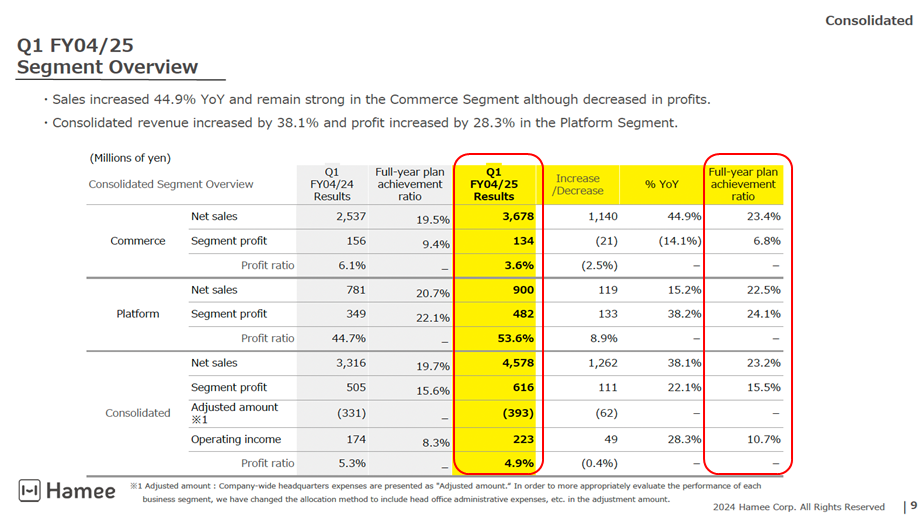

Hamee (hereafter referred to as the Company) announced its Q1 FY04/2025 results on September 13, 2024. Although ordinary income was down slightly YoY, net sales and operating income increased sharply, and quarterly net income attributable to owner of parent returned to profitability. The Company stated that the results were largely in line with its plan (however, as discussed later, they are biased toward the year’s second half).

Specifically, net sales were JPY 4.57 billion (+38% YoY), operating income was JPY 223 million (+28% YoY), ordinary income was JPY 196 million (-3% YoY), and quarterly net income attributable to owner of parent was JPY 101 million (compared to a loss of JPY 132 million in the same quarter of the previous fiscal year).

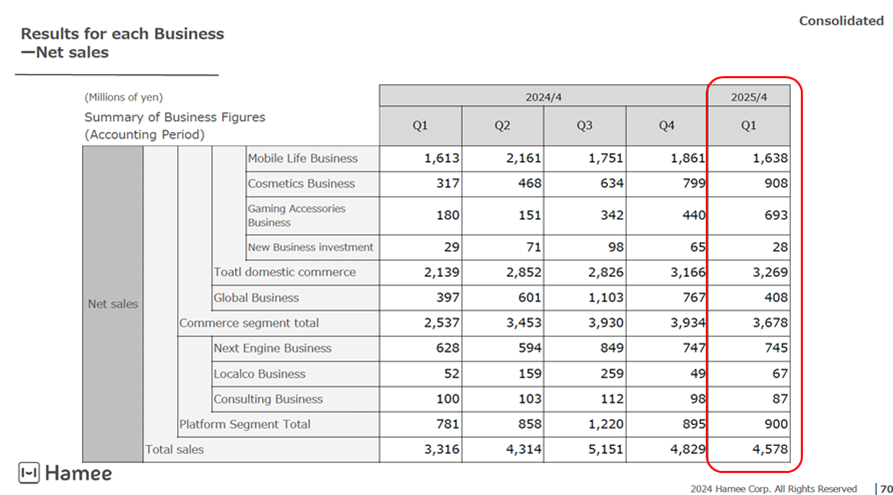

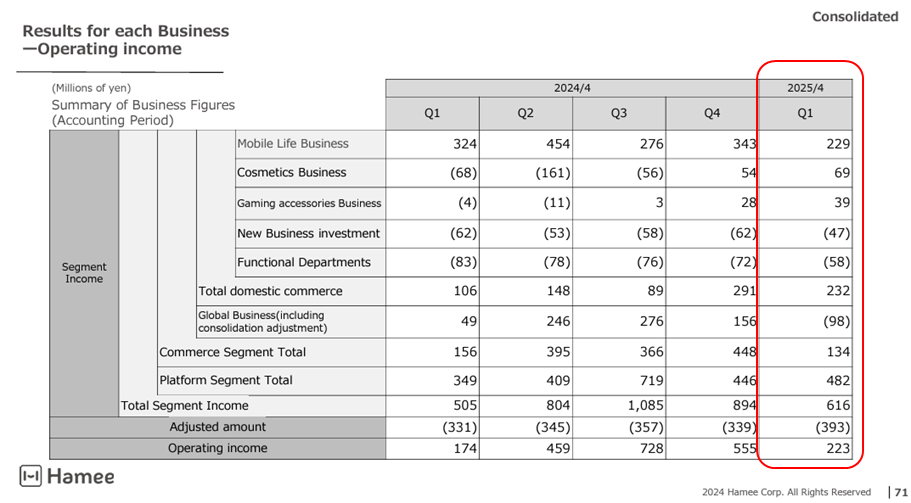

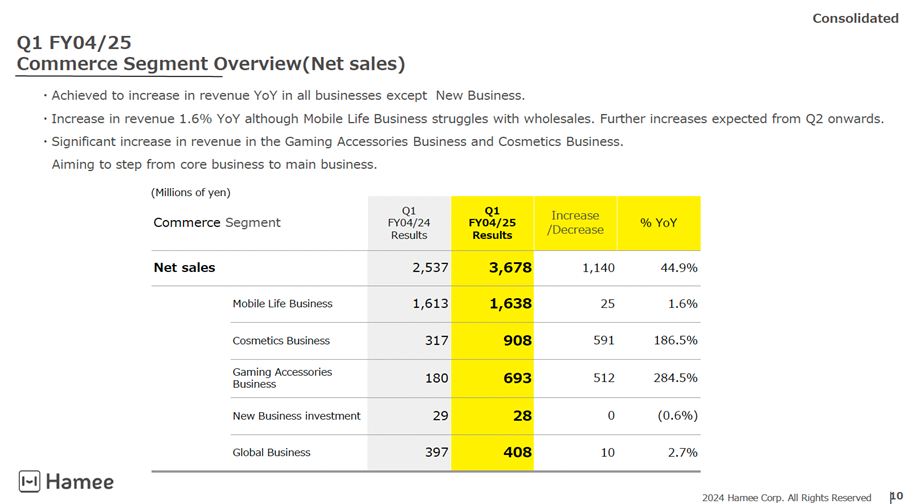

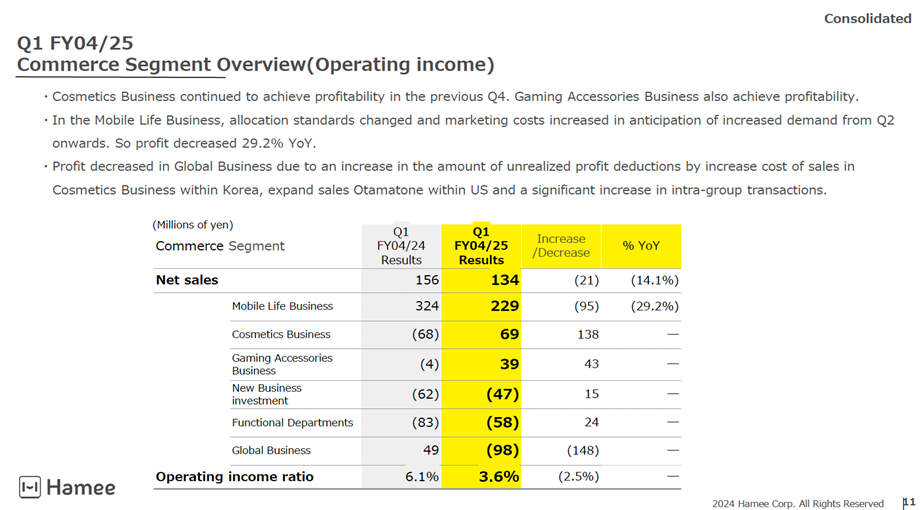

By segment, the Commerce Segment saw an increase in revenue but a decrease in profit, while the Platform Segment saw an increase in both revenue and profit. Overall, the results were positive.

In the Commerce Segment, the Cosmetics Business, which is growing rapidly, saw a significant increase in revenue, and the segment has been operating profitably for two consecutive quarters. The Gaming Accessories Business is also growing rapidly and has been operating profitably for three straight quarters. The Company has also invested in the Mobile Life Business and other areas. The big picture is that the Company is creating a structure in which multiple businesses drive the growth of the segment as a whole in a well-balanced way. Although profits decreased, overall, the content of the results is positive.

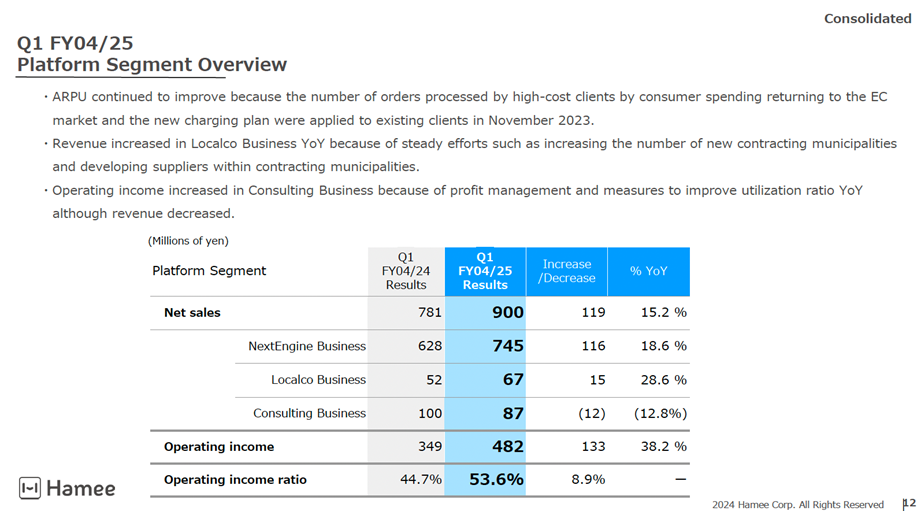

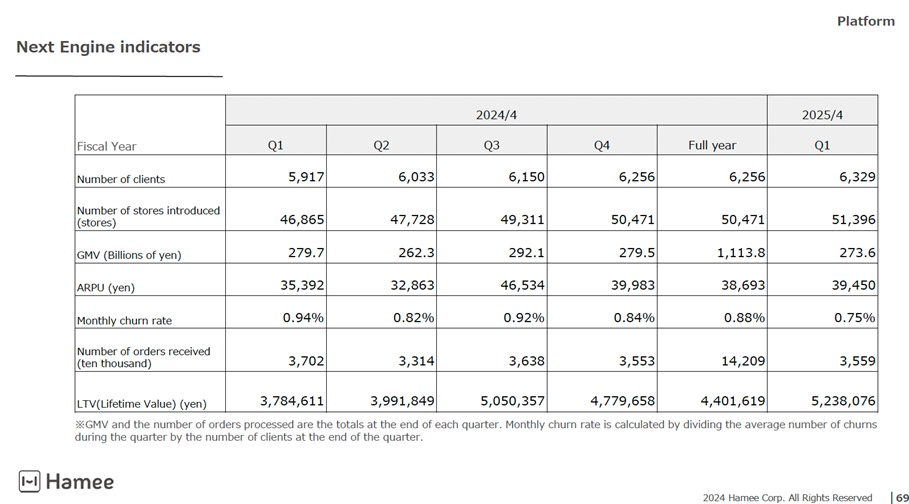

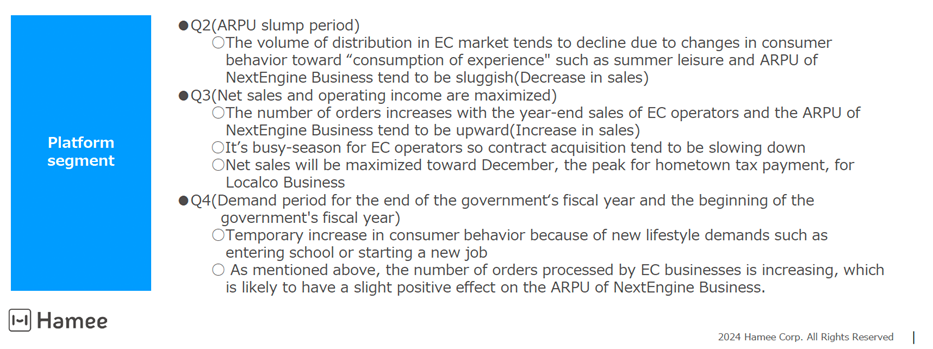

Sales increased by 15% in the Platform Business, and the operating income margin improved to 53.6%. In the mainstay NextEngine Business, the Company stated that it felt that the EC market had entered a growth trajectory again after a period of consumption of experience. The fact that the Company has continued to achieve good results due to an increase in the number of transactions handled by major clients and an increase in ARPU due to the effect of the fee revision in November last year is positive. However, although the number of clients has increased and the churn rate has fallen, there are still issues to be addressed regarding increasing the number of clients and the number of orders received.

The main reason for the decrease in ordinary income despite the increased operating income was the impact of foreign exchange losses. In addition, the main reason for the return to profitability in quarterly net income was the decrease in income taxes deferred.

On the balance sheet, merchandise (inventory) and other current assets increased by JPY 1.3 billion compared to the end of the previous fiscal year. This was covered by a JPY 1.1 billion increase in short-term loans and a decrease in cash and other equivalents.

◇ Full-year forecast: No change in the initial guidance

There are no changes to the full-year earnings forecast or dividend. Net sales of JPY 19.74 billion (+12% YoY), operating income of JPY 2.08 billion (+8% YoY), ordinary income of JPY 2.05 billion (+1% YoY), net income attributable to owners of parent of JPY 1.36 billion (+21% YoY), net profit per share of JPY 83.69, dividend per share of JPY 22.50 (unchanged YoY).

There are no changes to the plan for reorganization (a share-distribution-type spin-off of NE, which will take charge of the Platform Segment and listing of NE) by 2025.

◇ Stock Price Trends and Points to Watch in the Future

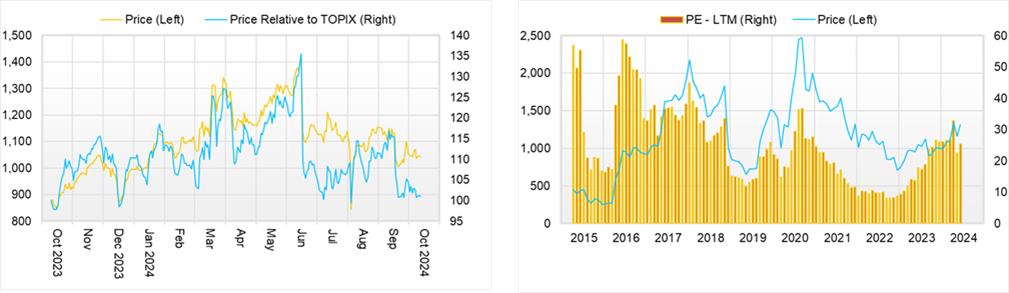

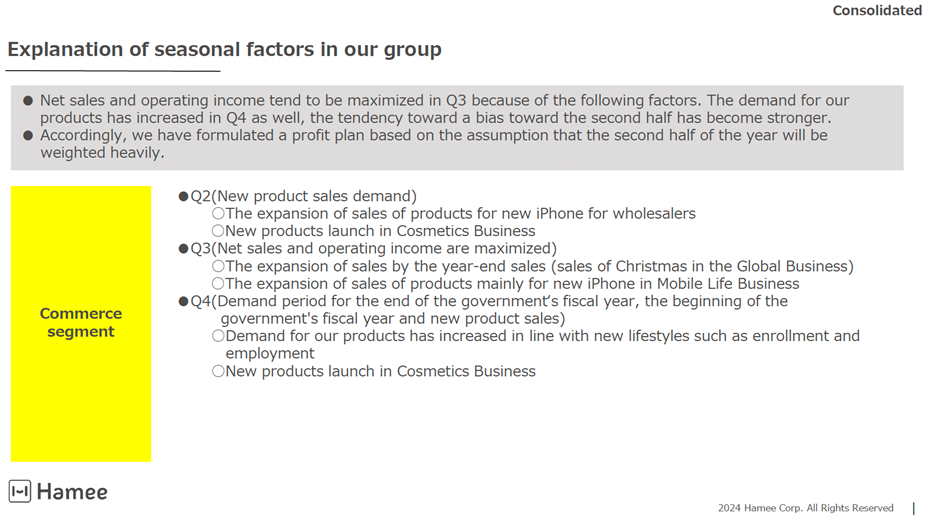

After the announcement of the full-year results in June, the share price generally remained in the JPY 1000-1200 range, except for a sharp drop in early August. However, following the announcement of the Q1 results, the share price has fallen to the JPY 1000 level. This is thought to be because the Company’s earnings are biased towards the second half in the Commerce and Platform segments. It is difficult to estimate the likelihood of achieving full-year results based on Q1 results alone (the progress ratio of Q1 results to the full-year forecast is 23% for net sales but only around 10% for operating income). It also appears to be affected by the fact that the overall sentiment of the stock market has calmed down.

On the other hand, the valuation is PER of 12 based on the Company’s forecast EPS and PBR of 1.6. As the likelihood of achieving the full-year company forecast increases and the path to a fair evaluation of the value of the two segments through the planned company reorganization becomes clear, there will likely be significant room for the share price to be re-evaluated.

The main points to watch for are (1) whether earnings will continue to grow steadily from the second quarter onwards, increasing the likelihood of achieving the full-year forecast; (2) whether the Commerce Segment will establish a structure that will enable multiple businesses to achieve stable growth for the segment as a whole, with the Mobile Life Business, the Cosmetics Business, and the Gaming Accessories Business all making steady contributions to profits; (3) In the Platform segment, with the recovery of the EC market as a tailwind, will it be possible to steadily increase the number of orders processed and APRU, strengthen the Company’s position as an EC platform provider, and maintain or further improve profitability? ; (4) whether the contribution to earnings from the Global Business and the Encer mall Business will increase, and (5) the realization of the reorganization plan.

As a precedent for the share-distribution-type spin-off of NE and the listing of NE, which the Company is promoting, Melco Holdings (TYO: 6676) is planning to conduct a share-distribution-type spin-off of its subsidiary Shimadaya and list it on October 1 (TYO: 250A). If this listing is successful, there will be renewed interest in the Company’s reorganization plans and business value.

Company profile

◇Hamee Corp. (hereafter referred to as the Company) was founded in 1997, went public on the TSE Mothers in 2015 and is currently listed on the Standard Market. The Company operates through the Spin-off of two segments. The Commerce Segment, which includes the Mobile Life Business, the Gaming Accessories Business, the Cosmetics Business, and the Global Business. The Platform Segment is mainly engaged in the provision of cloud-based (SaaS) EC Attractions “NextEngine”, which automates operations related to online shop management and enables cross-mall, multi-store order processing and centralized inventory management.

The Company is planning a reorganization by 2025. It plans to conduct a share-distribution-type spin-off of NE Inc., which is in charge of the Platform Segment, and list NE Inc. on the stock exchange. This series of reorganizations aims to avoid the conglomerate discount, efficiently operate each of the two segments, and appropriately and timely reflect the value of each business in the share price.

Key financial data

| Unit: million yen | 2020/04 | 2021/04 | 2022/04 | 2023/04 | 2024/04 | 2025/04 CE |

| Sales | 11,325 | 12,363 | 13,413 | 14,038 | 17,612 | 19,745 |

| EBIT (Operating Income) | 1,745 | 2,180 | 2,202 | 1,251 | 1,964 | |

| Pretax Income | 1,582 | 2,144 | 2,463 | 1,396 | 2,009 | 2,051 |

| Net Profit Attributable to Owner of Parent | 1,069 | 1,556 | 1,744 | 945 | 1,122 | 1,362 |

| Cash & Short-Term Investments | 3,453 | 3,355 | 4,026 | 3,536 | 4,022 | |

| Total assets | 8,097 | 8,342 | 10,524 | 12,392 | 14,885 | |

| Total Debt | 2,327 | 2,327 | 2,327 | 2,327 | 2,327 | |

| Net Debt | -1,694 | -1,694 | -1,694 | -1,694 | -1,694 | |

| Total liabilities | 3,272 | 1,814 | 2,271 | 3,431 | 4,728 | |

| Total Shareholders’ Equity | 10,157 | 10,157 | 10,157 | 10,157 | 10,157 | |

| Net Operating Cash Flow | 1,934 | 1,941 | 1,186 | 695 | 886 | |

| Capital Expenditure | 477 | 477 | 477 | 477 | 477 | |

| Net Investing Cash Flow | -1,020 | -412 | -886 | -1,507 | -877 | |

| Net Financing Cash Flow | 933 | -1,736 | 298 | 263 | 380 | |

| Free Cash Flow | 577 | 577 | 577 | 577 | 577 | |

| ROA (%) | 15.43 | 18.94 | 18.49 | 8.25 | 8.22 | |

| ROE (%) | 23.73 | 27.42 | 23.60 | 10.98 | 11.73 | |

| EPS (Yen) | 67.4 | 98.4 | 109.7 | 59.4 | 70.4 | |

| BPS (Yen) | 305.5 | 411.1 | 519.1 | 563.0 | 637.6 | |

| Dividend per Share (Yen) | 7.00 | 10.00 | 22.50 | 22.50 | 22.50 | |

| Shares Outstanding (Million Shares) | 16.10 | 16.21 | 16.27 | 16.27 | 16.28 |

Source: Omega Investment from company data, rounded to the nearest whole number.

Share price

Overview of Q1 FY04/2025

Overview of Company-wide Performance

Source: Company material

Source: Company material

Source: Company material

Overview of the Commerce Segment

Source: Company material

Source: Company material

Overview of the Platform Segment

Source: Company material

Source: Company material

Seasonal factors in business performance, which are biased toward the latter half of the fiscal year

Source: Company material

Financial data (quarterly basis)

| Unit: million yen | 2023/04 | 2024/04 | 2025/04 | ||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | |

| (Income Statement) | |||||||||

| Sales | 3,106 | 3,527 | 3,909 | 3,496 | 3,317 | 4,315 | 5,151 | 4,829 | 4,579 |

| Year-on-year | 18.7% | 5.9% | -3.0% | 1.8% | 6.8% | 22.3% | 31.8% | 38.1% | 38.1% |

| Cost of Goods Sold (COGS) | 1,208 | 1,428 | 1,410 | 1,517 | 1,279 | 1,631 | 1,858 | 1,977 | 1,841 |

| Gross Income | 1,898 | 2,100 | 2,499 | 1,979 | 2,038 | 2,684 | 3,293 | 2,852 | 2,738 |

| Gross Income Margin | 61.1% | 59.5% | 63.9% | 56.6% | 61.4% | 62.2% | 63.9% | 59.1% | 59.8% |

| SG&A Expense | 1,650 | 1,774 | 1,903 | 1,894 | 1,863 | 2,224 | 2,565 | 2,306 | 2,505 |

| EBIT (Operating Income) | 248 | 326 | 595 | 85 | 187 | 470 | 756 | 551 | 233 |

| Year-on-year | -24.3% | -59.6% | -19.5% | -74.0% | -24.8% | 44.1% | 27.0% | 545.8% | 24.7% |

| Operating Income Margin | 8.0% | 9.2% | 15.2% | 2.4% | 5.6% | 10.9% | 14.7% | 11.4% | 5.1% |

| EBITDA | 373 | 618 | 724 | 332 | 377 | 670 | 953 | 749 | 435 |

| Pretax Income | 297 | 439 | 485 | 174 | 205 | 492 | 737 | 576 | 200 |

| Consolidated Net Income | 207 | 288 | 320 | 130 | -133 | 334 | 492 | 428 | 101 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 207 | 288 | 320 | 130 | -133 | 334 | 492 | 428 | 101 |

| Year-on-year | -18.7% | -58.2% | -36.6% | -55.8% | -164.0% | 16.1% | 53.6% | 228.4% | -176.6% |

| Net Income Margin | 6.7% | 8.2% | 8.2% | 3.7% | -4.0% | 7.8% | 9.5% | 8.9% | 2.2% |

| (Balance Sheet) | |||||||||

| Cash & Short-Term Investments | 3,320 | 3,468 | 3,396 | 3,536 | 3,176 | 2,983 | 3,430 | 4,022 | 3,642 |

| Total assets | 10,457 | 11,442 | 12,374 | 12,392 | 12,350 | 13,197 | 14,210 | 14,885 | 15,295 |

| Total Debt | 532 | 1,020 | 1,008 | 1,300 | 1,700 | 1,650 | 1,928 | 2,327 | 3,232 |

| Net Debt | -2,788 | -2,448 | -2,388 | -2,236 | -1,476 | -1,333 | -1,502 | -1,694 | -410 |

| Total liabilities | 2,170 | 2,998 | 3,460 | 3,431 | 3,608 | 4,040 | 4,566 | 4,728 | 5,242 |

| Total Shareholders’ Equity | 8,288 | 8,444 | 8,914 | 8,961 | 8,742 | 9,156 | 9,644 | 10,157 | 10,053 |

| (Profitability %) | |||||||||

| ROA | 18.32 | 12.09 | 9.64 | 8.25 | 5.31 | 5.29 | 6.20 | 8.22 | 9.81 |

| ROE | 22.75 | 16.52 | 13.26 | 10.98 | 7.12 | 7.41 | 8.88 | 11.73 | 14.43 |

| (Per-share) Unit: JPY | |||||||||

| EPS | 13.0 | 18.1 | 20.1 | 8.2 | -8.3 | 21.0 | 30.9 | 26.9 | 6.4 |

| BPS | 521.3 | 530.9 | 560.4 | 563.0 | 549.2 | 575.0 | 605.6 | 637.6 | 630.7 |

| Dividend per Share | 22.50 | 22.50 | 22.50 | 22.50 | 22.50 | 22.50 | 22.50 | 22.50 | 22.50 |

| Shares Outstanding (Million Shares) |

16.27 | 16.27 | 16.27 | 16.28 | 16.28 | 16.28 | 16.28 | 16.28 | 16.29 |

Source: Omega Investment from company materials

Financial data (full-year basis)

| Unit: million yen | 2016/04 | 2017/04 | 2018/04 | 2019/04 | 2020/04 | 2021/04 | 2022/04 | 2023/04 | 2024/04 |

| (Income Statement) | |||||||||

| Sales | 6,500 | 8,503 | 9,379 | 10,300 | 11,325 | 12,363 | 13,413 | 14,038 | 17,612 |

| Year-on-year | 14.9% | 30.8% | 10.3% | 9.8% | 10.0% | 9.2% | 8.5% | 4.7% | 25.5% |

| Cost of Goods Sold | 3,816 | 4,485 | 4,618 | 5,056 | 4,894 | 4,802 | 4,892 | 5,563 | 6,745 |

| Gross Income | 2,684 | 4,018 | 4,761 | 5,244 | 6,431 | 7,562 | 8,522 | 8,476 | 10,867 |

| Gross Income Margin | 41.3% | 47.3% | 50.8% | 50.9% | 56.8% | 61.2% | 63.5% | 60.4% | 61.7% |

| SG&A Expense | 2,237 | 2,916 | 3,381 | 4,080 | 4,686 | 5,382 | 6,319 | 7,225 | 8,959 |

| EBIT (Operating Income) | 447 | 1,102 | 1,380 | 1,164 | 1,745 | 2,180 | 2,202 | 1,251 | 1,964 |

| Year-on-year | 32.8% | 146.8% | 25.2% | -15.7% | 50.0% | 24.9% | 1.0% | -43.2% | 57.0% |

| Operating Income Margin | 6.9% | 13.0% | 14.7% | 11.3% | 15.4% | 17.6% | 16.4% | 8.9% | 11.1% |

| EBITDA | 521 | 1,272 | 1,627 | 1,525 | 2,227 | 2,694 | 2,840 | 2,042 | 2,749 |

| Pretax Income | 426 | 1,010 | 1,259 | 1,179 | 1,582 | 2,144 | 2,463 | 1,396 | 2,009 |

| Consolidated Net Income | 258 | 696 | 873 | 821 | 1,069 | 1,556 | 1,744 | 945 | 1,122 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 258 | 696 | 873 | 821 | 1,069 | 1,556 | 1,744 | 945 | 1,122 |

| Year-on-year | 33.8% | 169.7% | 25.4% | -5.9% | 30.2% | 45.5% | 12.0% | -45.8% | 18.6% |

| Net Income Margin | 4.0% | 8.2% | 9.3% | 8.0% | 9.4% | 12.6% | 13.0% | 6.7% | 6.4% |

| (Balance Sheet) | |||||||||

| Cash & Short-Term Investments | 1,103 | 1,324 | 1,695 | 1,660 | 3,453 | 3,355 | 4,026 | 3,536 | 4,022 |

| Total assets | 3,016 | 4,240 | 5,042 | 5,761 | 8,097 | 8,342 | 10,524 | 12,392 | 14,885 |

| Total Debt | 383 | 468 | 298 | 500 | 1,740 | 104 | 544 | 1,300 | 2,327 |

| Net Debt | -720 | -856 | -1,397 | -1,160 | -1,713 | -3,251 | -3,482 | -2,236 | -1,694 |

| Total liabilities | 1,022 | 1,484 | 1,445 | 1,572 | 3,272 | 1,814 | 2,271 | 3,431 | 4,728 |

| Total Shareholders’ Equity | 1,994 | 2,756 | 3,597 | 4,189 | 4,824 | 6,528 | 8,253 | 8,961 | 10,157 |

| (Cash Flow) | |||||||||

| Net Operating Cash Flow | 71 | 576 | 1,246 | 651 | 1,934 | 1,941 | 1,186 | 695 | 886 |

| Capital Expenditure | 189 | 228 | 437 | 291 | 649 | 351 | 1,018 | 487 | 477 |

| Net Investing Cash Flow | -263 | -433 | -674 | -671 | -1,020 | -412 | -886 | -1,507 | -877 |

| Net Financing Cash Flow | -139 | 69 | -230 | -7 | 933 | -1,736 | 298 | 263 | 380 |

| Free Cash Flow | 52 | 464 | 960 | 526 | 1,440 | 1,760 | 362 | 405 | 577 |

| (Profitability %) | |||||||||

| ROA | 8.71 | 19.18 | 18.81 | 15.21 | 15.43 | 18.94 | 18.49 | 8.25 | 8.22 |

| ROE | 13.83 | 29.30 | 27.48 | 21.10 | 23.73 | 27.42 | 23.60 | 10.98 | 11.73 |

| Net Profit Margin | 3.97 | 8.18 | 9.31 | 7.97 | 9.44 | 12.59 | 13.00 | 6.73 | 6.37 |

| Asset Turnover | 2.19 | 2.34 | 2.02 | 1.91 | 1.63 | 1.50 | 1.42 | 1.23 | 1.29 |

| Financial Leverage | 1.59 | 1.53 | 1.46 | 1.39 | 1.54 | 1.45 | 1.28 | 1.33 | 1.43 |

| (Per-share) Unit: JPY | |||||||||

| EPS | 16.6 | 44.2 | 54.7 | 51.2 | 67.4 | 98.4 | 109.7 | 59.4 | 70.4 |

| BPS | 127.2 | 174.0 | 224.1 | 263.0 | 305.5 | 411.1 | 519.1 | 563.0 | 637.6 |

| Dividend per Share | 1.50 | 4.50 | 5.50 | 6.50 | 7.00 | 10.00 | 22.50 | 22.50 | 22.50 |

| Shares Outstanding (Million Shares) |

15.55 | 15.74 | 15.94 | 16.08 | 16.10 | 16.21 | 16.27 | 16.27 | 16.28 |

Source: Omega Investment from company materials