Strike (Price Discovery)

Buy

Profile

Strike Co., Ltd. provides M&A (mergers and acquisitions) consulting services. The main focus is on business succession cases for small and medium-sized enterprises. The company was established in 1997 by Kunihiko Arai. Sales by business segment %: M&A intermediary 100 <FY9/2024>

| Securities Code |

| TYO:6196 |

| Market Capitalization |

| 75,675 million yen |

| Industry |

| Service |

Stock Hunter’s View

The trend towards a healthier industry is a tailwind. Even after stricter regulations, growth can be expected from the “winners.”

Strike, an M&A intermediary, has strengths in business succession cases for medium-sized and small-to-medium-sized companies. The company’s president, Kunihiko Arai, is listed as the representative director of a self-regulatory organization, and he has been taking the initiative in working to improve the industry, such as by formulating self-regulatory rules in December last year and planning to launch a committee to consider a qualification system in January next year.

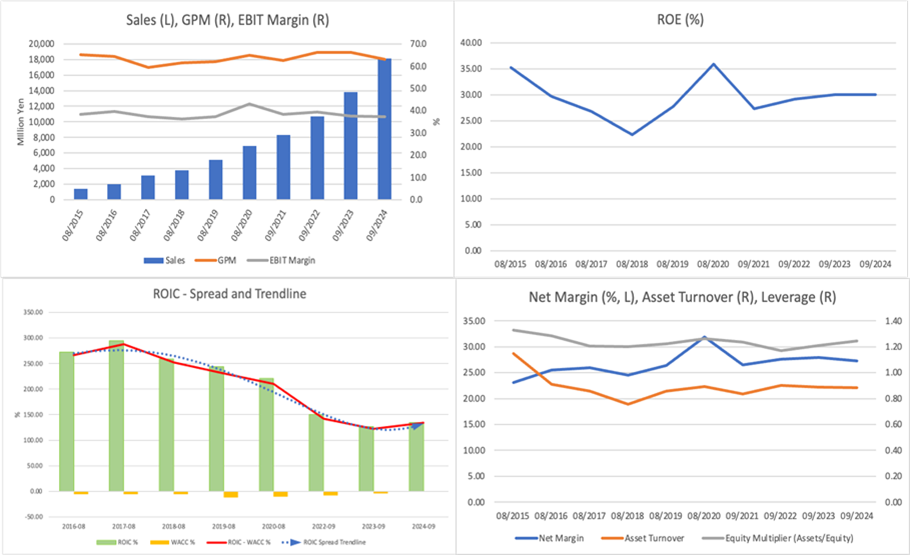

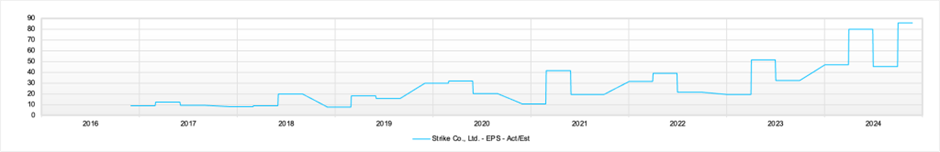

For the previous FY/^2024, the company achieved its 10th consecutive year of increased sales and profits, with sales and operating income growing by more than 30%. For the current FY9/2025, the company forecasts double-digit revenue growth, with sales of 22.3 billion yen (up 22.9% year-on-year) and operating profit of 8.47 billion yen (up 24.1% year-on-year). The company has stated that its performance forecast for the current fiscal year is a “conservative plan” based on the assumption of continued active recruitment of consultants and an increase in the period required to conclude contracts due to compliance with the M&A guidelines for small and medium-sized companies. That leaves room for an upward revision.

Furthermore, the series of measures to exclude unscrupulous buyers, such as the revision of the “Guidelines for Small and Medium-Sized M&A,” is expected to lead to a concentration of deals with healthy major companies, which will be a tailwind for related stocks. At the same time, as fee structures and the services provided become more transparent, opportunities for excess earnings will become more limited. However, the company has been working to strengthen its partnerships with financial institutions and accounting firms and increase the number of consultants. It is expected that the number of new contracts will continue to grow, and stable growth is expected to continue.

Investor’s View

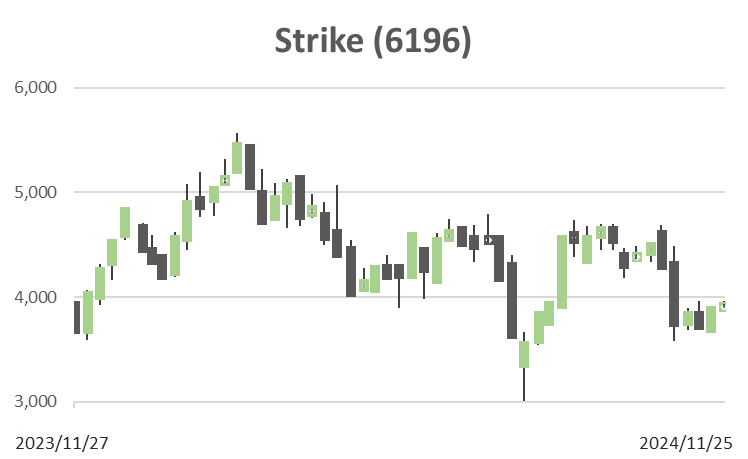

BUY. The stock price is undervalued due to the excessive drop in valuation since the IPO. The net-cash-neutral basis PER is just over 9 times.

Price

PBR

PER

ROE

EPS

BPS

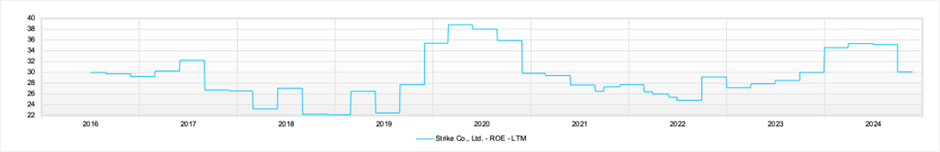

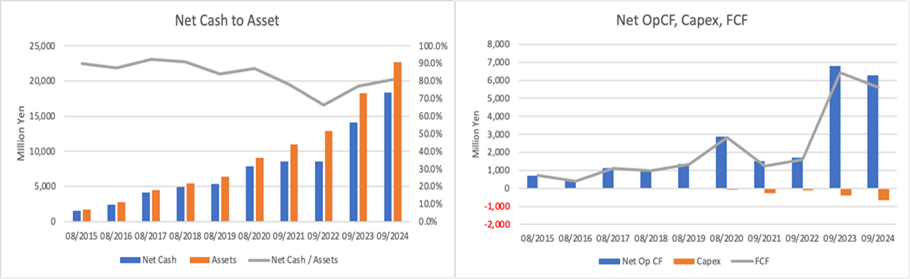

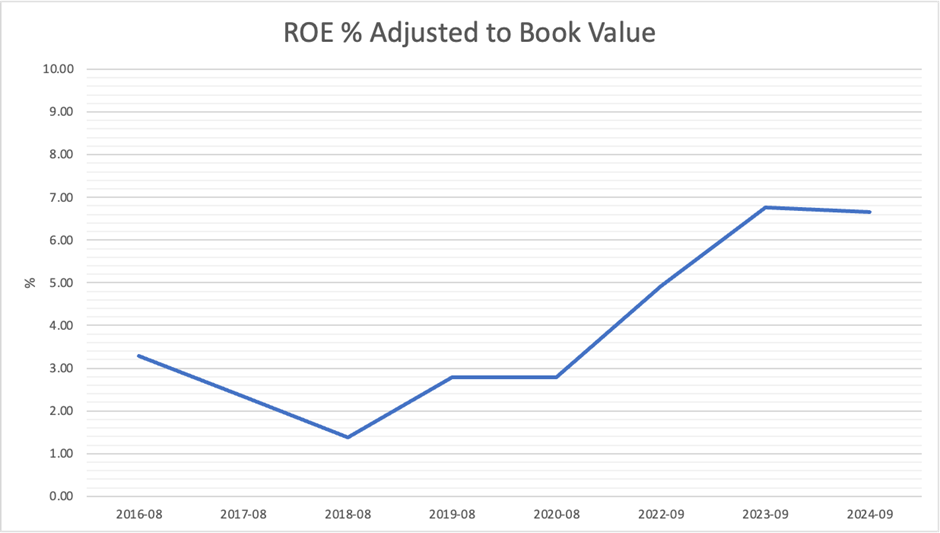

The company’s net cash amounted to 18.3 billion yen at the end of September 2024. This accounts for 81% of the company’s assets and 25% of its market capitalization of 73 billion yen. The company’s current net income is 5-6 billion yen. The forecast PER of 12-13x translates into just over 9x on a net-cash-neutral basis, which is very cheap. The return on equity of the stock, measured by ROE after PBR adjustment, is just under 7%, which is fine enough.

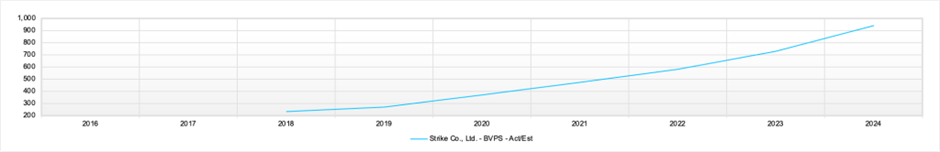

The company’s shares were valued at a PER of 100 and a PBR of over 20 immediately after its IPO in July 2016. Since then, the excessive popularity of the company’s shares has continued to cool, and the long-term performance of its stock price has been lackluster. The current share price is undervalued after the excessive valuation has been stripped away. Since the IPO, the PER and PBR have continued to fall, and the excessive expectations have been stripped away. In the meantime, the company’s earnings have been steadily growing, and both EPS and BPS have grown impressively. It is difficult to predict the company’s earnings, but there is no doubt that the business Arai established in 1997 has gained a solid foothold in the industry.

The BS for consulting business, excluding financial assets, is overwhelmingly slim, and the PL profit margin is extremely high. The company’s ROE is around 30%, and its ROIC is also overwhelmingly high, creating an astonishing economic value.