Hibiya Engineering (Price Discovery)

Buy

Profile

A company that mainly installs air conditioning systems. Highly dependent on the NTT Group. Approximately 30% of the construction work carried over from the previous fiscal year was ordered by the NTT Group. The company has strengths in air conditioning systems for data centers and other information and communications equipment. Established in 1966. Sales by business segment % (OPM%): Facility Construction 86 (6) Equipment 9 (6) Equipment Manufacturing 5 (13) <FY3/2024>

| Securities Code |

| TYO:1982 |

| Market Capitalization |

| 94,431 million yen |

| Industry |

| Construction industry |

Stock Hunter’s View

Inquiries increased due to accelerated DC investment. Operating profit margin improved, and 1H operating profit increased 3.3 times.

Hibiya Engineering’s core business is in four fields: air conditioning, water supply and drainage, electrical, and information and communications. For many years, the company has been involved in equipment-related work for the NTT Group, and in recent years it has been applying the cooling technology it has developed through NTT construction work to meet the demand for data centres (DCs).

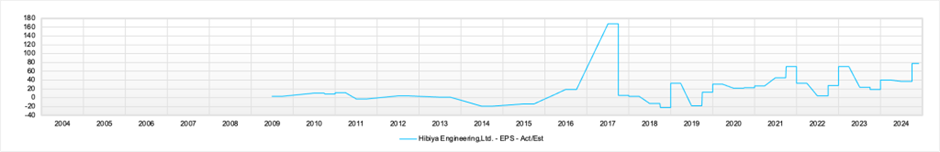

The company’s financial results for the second quarter (April to September) of the current fiscal year, announced on 14 November, showed sales of 37.66 billion yen (up 14.1% YoY) and operating profit of 3.238 billion yen (up 3.3 times YoY). In addition to an improvement in earnings at the time of order receipt, the profit margin improved due to an increase in the profitability of construction completed in the 1H, leading to a significant increase in profits.

The company is receiving many inquiries, particularly for DCs, and expects to receive more orders, particularly for large DCs, in 2H. Meanwhile, it has maintained its full-year forecasts of sales of 91 billion yen (up 8.6% YoY) and operating profit of 5.9 billion yen (up 2.8% YoY), and there is a possibility that these forecasts will be revised.

The company plans to continue focusing on DC projects, which are expected to grow. Recently, it has been working with NTT Data to verify next-generation cooling technology, and it has also set up a facility to promote open innovation and collaboration in the DC field. The facility is designed to enable users to better understand the characteristics and performance limits of cooling equipment by using actual equipment.

Investor’s View

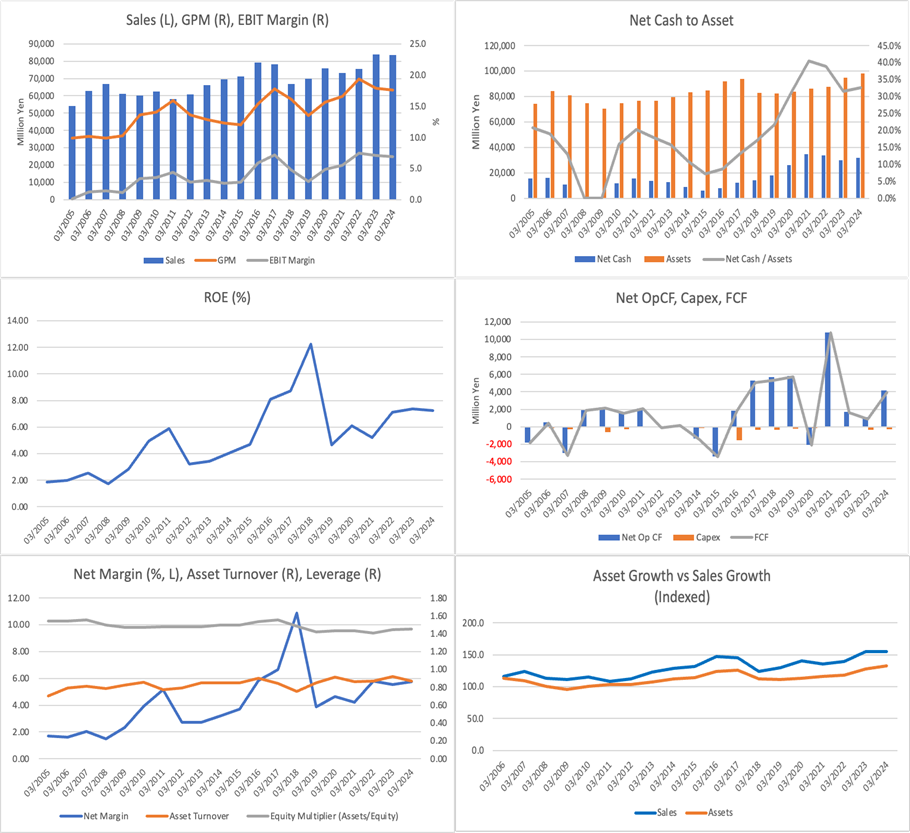

The company holds 20 billion yen in securities. Considering this, the company’s net cash at the end of FY3/2024 will reach 65% of its market capitalisation. The PER after adjusting for net cash is 5 to 6 times, so the share price is significantly undervalued. It may be worth waiting for a dip, but buy the shares for a long-term account if that opportunity doesn’t come in the short run.

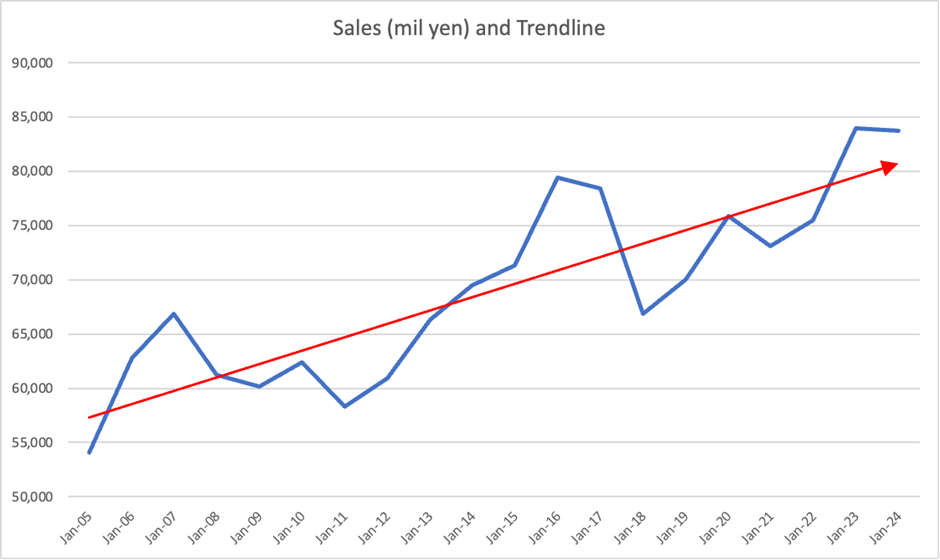

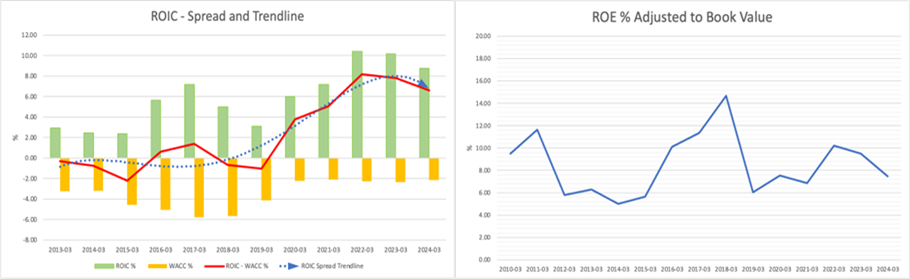

The company’s business is centred on data centre construction, which accounts for around 50% of sales, with NTT, a major client, accounting for around 40% of sales. Air conditioning accounts for around 50% of sales by type of facility. The first thing that catches the eye is the clear upward trend in sales over the past 20 years. However, the CAGR is only 2.3%, so while the company has sustained long-term growth, it has been low growth. More noteworthy is the solid resilience of the company’s top-line revenue.

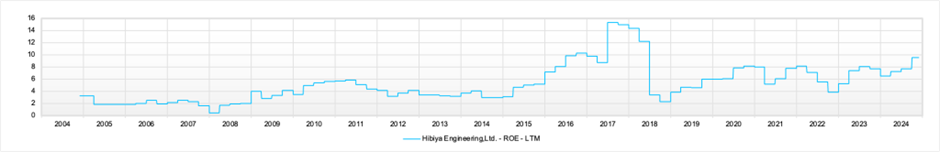

The business content and management strategy could be more appealing. The management team has stated that they will increase the ROE, currently around 7%, to over 7% within the next three years, up to FY3/2026; this is so boring. The company’s fundamentals are stable over the long term, its financial status is sound, and the fact that NTT is its largest customer are all positive points. The president and vice president are both from NTT.

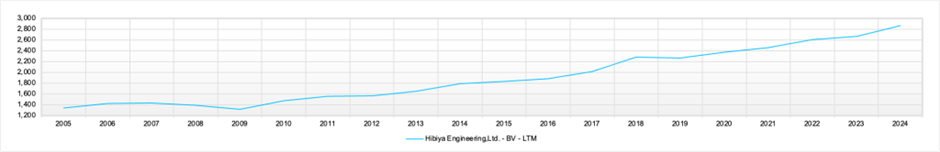

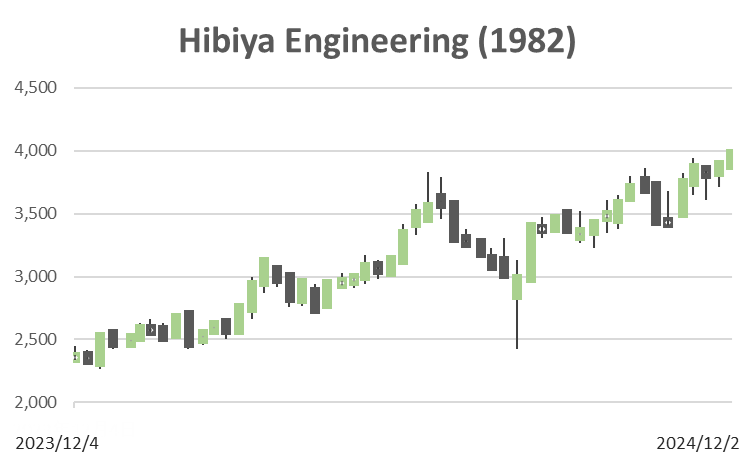

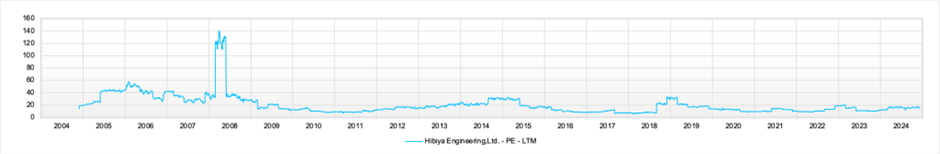

Historically, the stock price premium has been small, and the PBR has been below 1 for nearly 30 years, but it has now jumped to 1.3x. This is because the stock price has risen by almost 60% YTD, incorporating expectations of an increase in DC due to the AI boom. However, the company’s cash-neutral valuation is low, and its equity yield is around 8%, which is fine. The company is creating economic value without any problems. The share price has soared, but one should not wait too long for a dip.

Price

PBR

PER

ROE

EPS

BPS