Chiome Bioscience (Company note – 3Q update)

| Share price (12/4) | ¥179 | Dividend Yield (24/12 CE) | – % |

| 52weeks high/low | ¥75/304 | ROE(23/12 act) | -83.6 % |

| Avg Vol (3 month) | 7,058.1 thou shrs | Operating margin (TTM) | -176.6 % |

| Market Cap | ¥11.2 bn | Beta (5Y Monthly) | 0.7 |

| Enterprise Value | ¥10.7 bn | Shares Outstanding | 62.441 mn shrs |

| PER (24/12 CE) | – X | Listed market | TSE Growth |

| PBR (23/12 act) | 9.13 X |

| Click here for the PDF version of this page |

| PDF Version |

The same level of deficit as the previous year. The clinical trial plan was revised to out-license two in-house developed products. An exclusive licensing agreement was concluded with Asahi Kasei Pharma for PFKR (pre-clinical).

◇ 3Q of FY12/2024: Highlights of Financial Results: A decrease in revenue but the same level of deficit as the previous year

In the third quarter results of FY12/2024, announced by Chiome Bioscience (hereafter, the Company) on November 12, 2024, Although sales decreased YoY, the deficit was about the same as the previous year. On a cumulative basis, sales were 420 million yen (down 19% YoY), operating loss was 920 million yen (900 million yen loss), ordinary loss was 910 million yen (910 million yen loss), and net loss was 910 million yen (910 million yen loss). There were no significant surprises in the financial results.

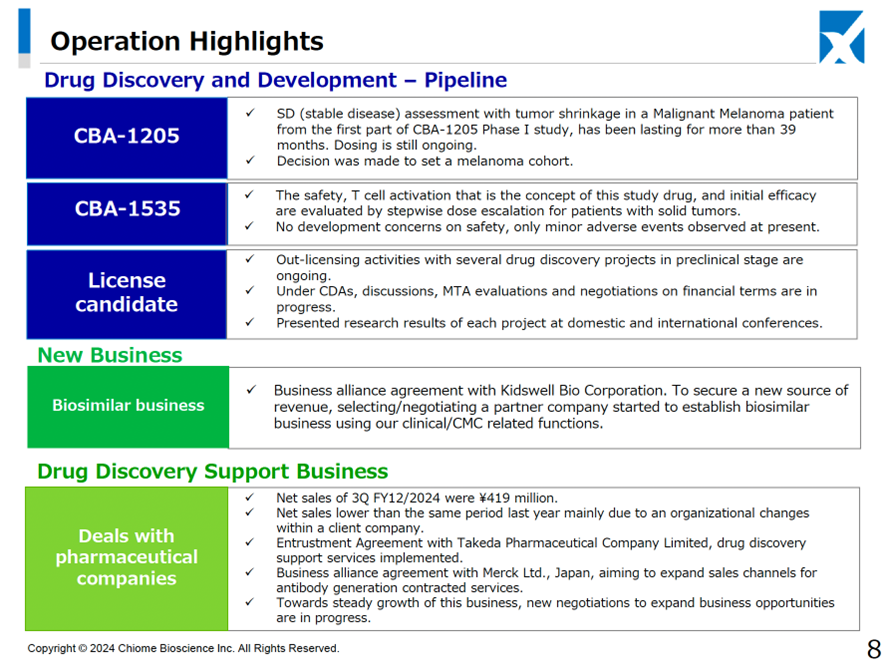

In the Drug Discovery and Development Business, the Company recorded 2.9 million yen in revenue from Material Transfer Agreements (MTAs) with potential out-licensing partners in the July-September period while recording 740 million yen in R&D expenses due to progress in clinical development, resulting in a segment loss of 740 million yen (a 60 million yen decrease in the loss compared to the same period previous year).

In the Drug Discovery Support Business, the Company is contracted by companies such as Ono Pharmaceutical and Chugai Pharmaceutical to carry out antibody generation, affinity improvement, and protein adjustment work, utilizing its antibody generation technology platform centered on its proprietary ADLib® system for antibody generation. During the period under review, the Company concluded a basic agreement on outsourcing with Takeda Pharmaceutical Company Limited and a business alliance agreement with Merck Ltd., Japan to expand sales channels for the Company’s services. However, although there was progress in orders received from new customers, the impact of organizational changes on existing customers continued, and sales were 410 million yen (down 100 million yen YoY), and segment profit was 210 million yen (down 90 million yen YoY).

As per the balance sheet, cash and deposits decreased by 80 million yen YoY (balance of 1.32 billion yen), liabilities decreased by 110 million yen due to a decrease in accounts payable due to the payment of additional manufacturing costs for CBA-1205 investigational new drug, etc. Net assets increased by 50 million yen due to the exercise of stock acquisition rights.

The above summarize the financial results, which are typical of bio-ventures where drug discovery and development costs come first. Hence, the impact on the share price is thought to be limited.

◇ FY12/2024 full-year earnings forecast: The full-year sales forecast for the Drug Discovery Support Business has been revised to 600 million yen.

The Company has only disclosed its full-year sales forecast for its Drug Discovery Support Business. The company has revised this forecast from 720 million yen to 600 million yen (down 80 million yen YoY). However, the Company states that it sees signs of a recovery in transactions with existing customers.

As mentioned below, a license agreement related to the out-licensing was concluded on November 20, and the receipt of a one-time contract payment of 200 million yen is scheduled. However, the factors for the full-year settlement of accounts have not yet been disclosed.

◇Drug Discovery and Development Business is progressing smoothly

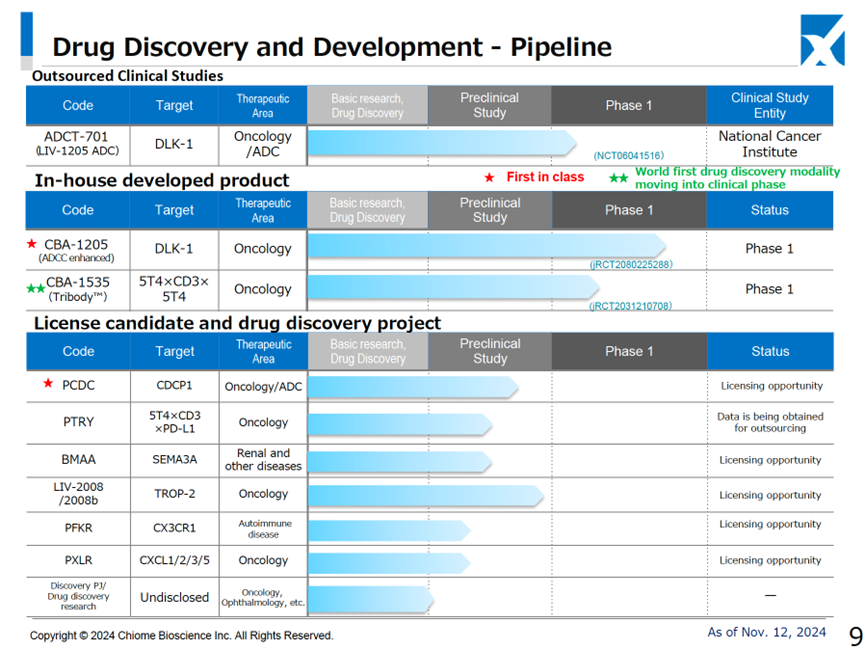

The number of projects in the drug discovery and development business pipeline is three in clinical trials (two in-house developed, one external clinical trial) and seven pre-clinical trials, which is unchanged from the information disclosed in August.

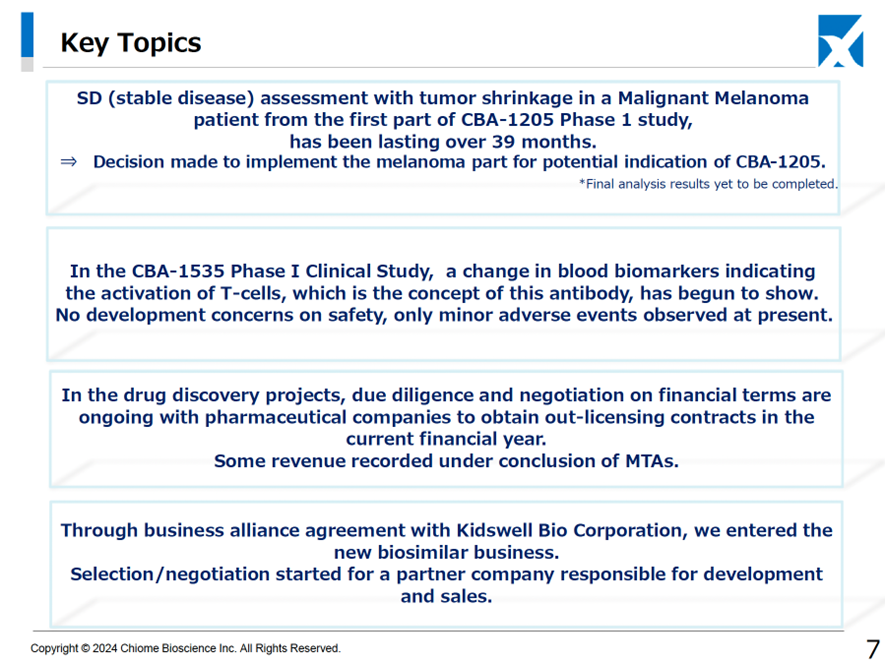

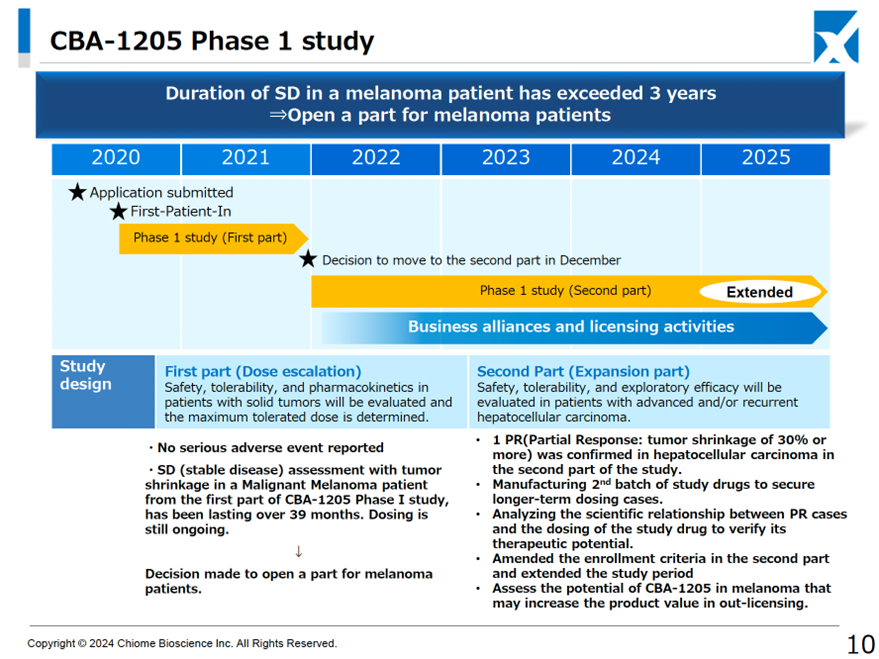

CBA-1205 (in-house development): In the second half of the Phase I clinical trials, it was decided to add melanoma to the list of indications for this drug on top of hepatocellular carcinoma. The aim is to maximize the product’s value.

The drug is still in the second half of the Phase I clinical trial, and it is being administered to patients with hepatocellular carcinoma. A partial response (PR) was confirmed in one case. For this reason, the selection criteria for patients registered in the clinical trial have been tightened, and the clinical trial period has been extended to analyze the scientific relationship between the PR cases and the administration of this drug. (As before).

On the other hand, in the first half of the study, the melanoma patients who received the treatment continued to show stable disease (SD) with tumor shrinkage, and the treatment was continued for more than 39 months. Therefore, the possibility of developing a drug for melanoma was discussed with the principal investigator, and a development part for melanoma patients was added to the second half of the study. (information updated this time).

As a result of these developments, the completion of the second half of the Phase I clinical trial has been extended to between the middle and end of 2025. Although the completion date has been pushed back by around six months, we view this positively as it can potentially increase the product value at the time of licensing out.

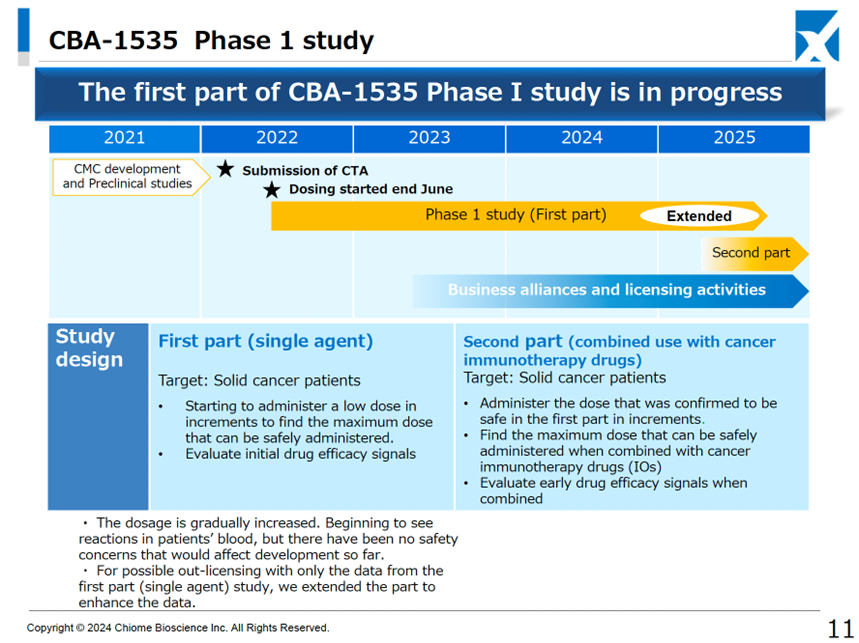

CBA-1535 (In-house developed product): The first half of the Phase I clinical trial (monotherapy part) is currently underway. The decision has been made to extend the first half of the trial with a view to the possibility of out-licensing the monotherapy part only.

Phase I clinical trials are ongoing for single-agent administration in patients with solid tumors. The Company is starting to see a response in the parameters that indicate T-cell activation in the concept of the drug, and there have been no safety issues that would cause concern for development (as before). Therefore, the Company has decided to extend the first half of the trial to expand the data, with the possibility of out-licensing the single-agent part only. if the second half of the trial, which will be conducted in combination with cancer immunotherapy, is conducted in-house, the start of the trial will be postponed from the previously expected 2024 to 2025. We would like to view this decision positively as one that will maximize the product’s potential and an early out-licensing.

ADCT-701 (the National Cancer Institute is the lead investigator): Phase I clinical trials are ongoing

A phase 1 clinical trial in pediatric neuroendocrine cancer was initiated, and the first subject was administered in July 2024. There was no update in this earnings announcement.

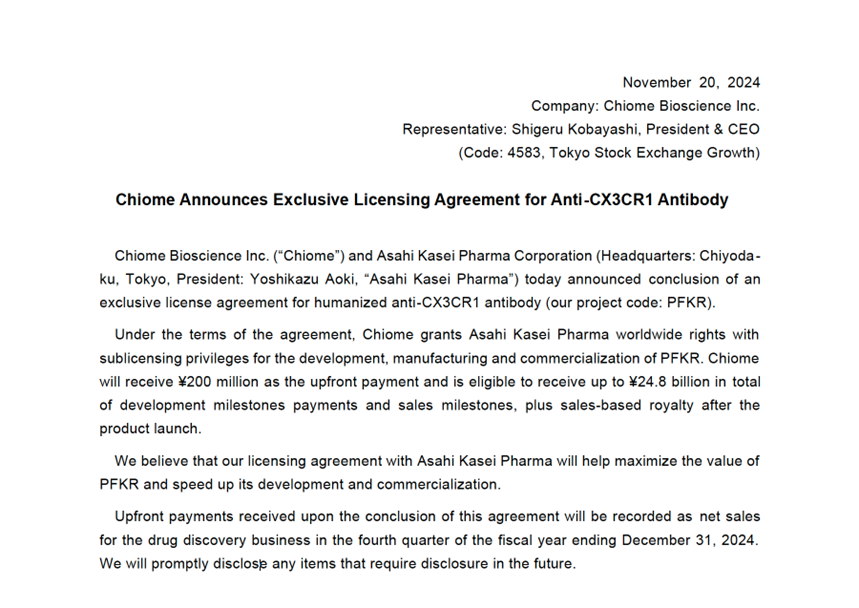

Multiple drug discovery projects in the preclinical stage: PFKR licensed to Asahi Kasei Pharma. Other licensing activities are ongoing.

On November 20, 2024, the Company announced that it had entered into an exclusive license agreement with Asahi Kasei Pharma Corporation for one of its preclinical drug discovery projects, a humanized anti-CX3CR1 antibody (the Company’s project code: PFKR). Under the terms of the license agreement, the Company has granted Asahi Kasei Pharma exclusive worldwide rights to develop, manufacture, and sell PFKR, with the right to sublicense. The Company will receive an upfront payment of 2 million yen and milestone payments of up to approximately 24.8 billion yen, depending on future development and sales progress. After the product is launched, it will receive royalties based on product sales. This is a long-awaited licensing decision.

In addition, DD and economic condition negotiations with pharmaceutical companies are underway in other projects. As mentioned above, revenue from the conclusion of MTAs has already been recorded.

◇ the Biosimilar Business

On June 18, 2024, the Company concluded a basic agreement on a business alliance with Kidswell Bio (hereafter, KWB) regarding the development of biosimilar pharmaceuticals, etc., but it has begun selecting and negotiating with a third partner company to take charge of development and sales.

◇Exercise of stock acquisition rights is progressing

The number of shares issued by the Company was 52,640,200 (including 6,149 treasury shares) at the end of December 2023, 61,243,400 shares as of the end of September 2024 (including 6 149 shares), 62,441,500 shares as of the end of October 2024 (including 6,149 treasury shares), and 64,010,400 shares as of November 21, 2024.

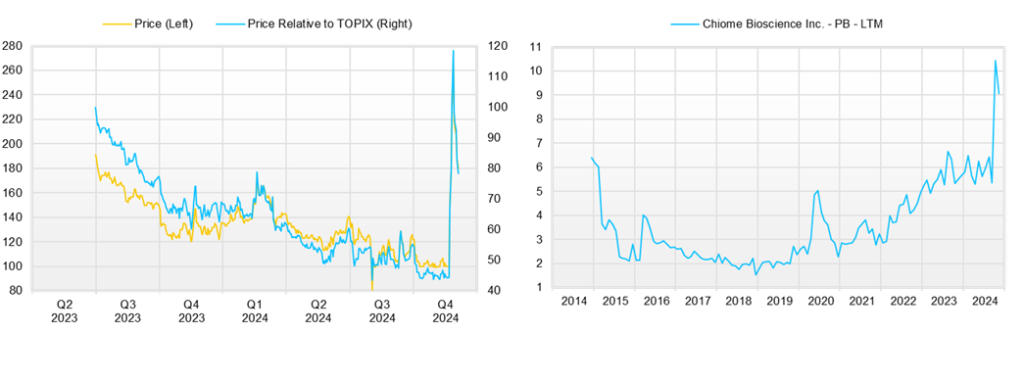

◇Share price trend and future highlights

The Company’s share price had been in a gentle downward trend, but following the news of the aforementioned out-licensing of PFKR, it has soared, accompanied by a rise in trading volume.

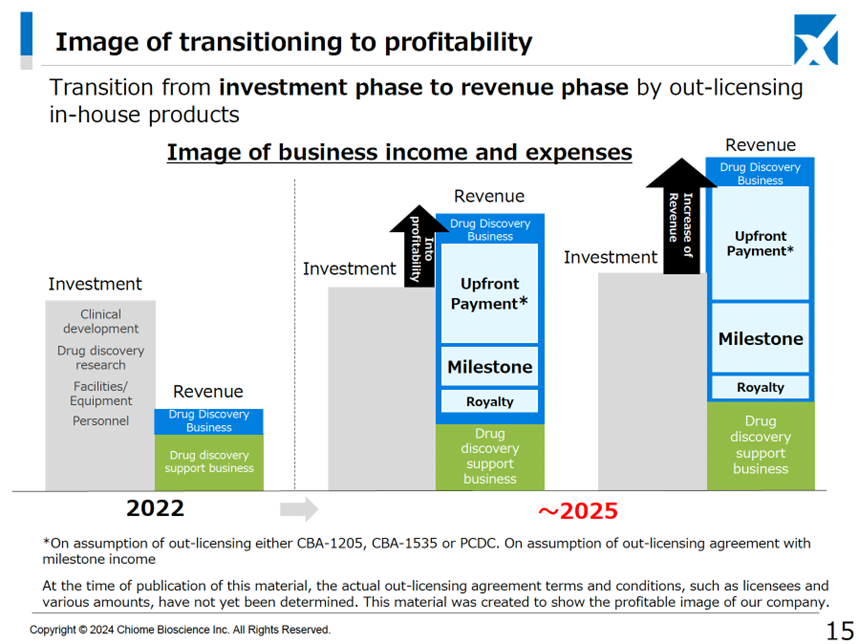

This is expected to lead to the exercise of new share subscription rights, but it is also thought that the Company is beginning to re-evaluate the potential of its entire pipeline in a positive light, taking the opportunity of the PFKR license agreement. In other words, the stock market will look at the Company becoming profitable in a single year due to the one-off payment from the agreement and then moving into a phase of business expansion that does not overly rely on new share subscription rights.

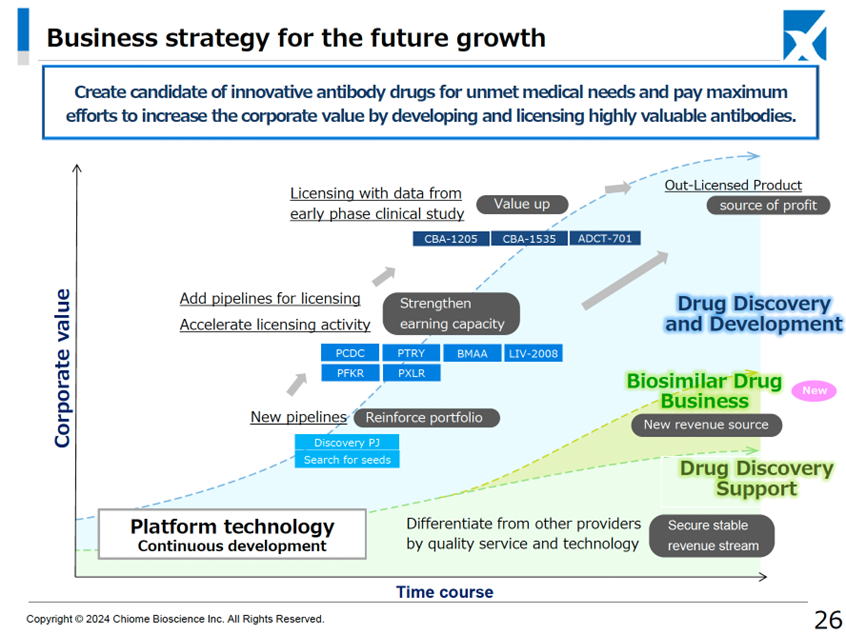

The main points to watch for in the near future are (1) whether the Company will be successful in licensing out its in-house developed products such as CBA-1205 and CBA-1535, and whether the economic terms of the licensing agreements will be satisfactory, (2) whether the Company will be able to achieve its business target of turning a profit in a single year by fiscal 2025, and whether it will be possible to bring this forward, and (3) how the Drug Discovery Support Business and the Biosimilar Business will boost earnings.

Company profile

Chiome Bioscience Inc. is a bio venture company that challenges unmet needs through antibody drug discovery and development based on its proprietary ADLib/Tribody technology. The Company has positioned its Drug Discovery and Development Business as a pillar of growth. (This business involves the in-house or joint development of antibody drugs for diseases with high unmet medical needs and the licensing of intellectual property rights such as patents for the resulting antibodies to pharmaceutical companies, etc., to generate income from one-time contract fees, milestone payments, and royalties, etc.) The Company has a pipeline of around 10 products, three of which are in clinical trials, and in November 2024, it licensed out one preclinical program. In addition, the Company has built up a track record in its Drug Discovery Support Business (a high-value-added contract research business that provides antibody generation, antibody engineering, and protein preparation services using the Company’s antibody drug discovery technology platform, mainly to major domestic pharmaceutical companies). It has also started to expand into the biosimilar business.

Key financial data

| Unit: million yen | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 | 2024/12 CE |

| Sales | 448 | 481 | 713 | 631 | 682 | NA |

| EBIT (Operating Income) | -1,402 | -1,284 | -1,334 | -1,259 | -1,205 | NA |

| Pretax Income | -1,401 | -1,291 | -1,466 | -1,238 | -1,215 | NA |

| Net Profit Attributable to Owner of Parent | -1,404 | -1,294 | -1,480 | -1,243 | -1,220 | NA |

| Cash & Short-Term Investments | 2,106 | 2,686 | 1,791 | 1,727 | 1,326 | |

| Total assets | 2,808 | 3,495 | 2,339 | 2,215 | 1,751 | |

| Total Debt | 291 | 291 | 291 | 291 | 291 | |

| Net Debt | -1,035 | -1,035 | -1,035 | -1,035 | -1,035 | |

| Total liabilities | 187 | 385 | 446 | 425 | 594 | |

| Total Shareholders’ Equity | 1,158 | 1,158 | 1,158 | 1,158 | 1,158 | |

| Net Operating Cash Flow | -1,537 | -1,360 | -1,131 | -1,191 | -1,069 | |

| Capital Expenditure | 0 | 0 | 0 | 0 | 0 | |

| Net Investing Cash Flow | -26 | -4 | -35 | 0 | 0 | |

| Net Financing Cash Flow | 1,341 | 1,944 | 271 | 1,127 | 667 | |

| ROA (%) | -49.79 | -41.06 | -50.73 | -54.57 | -61.51 | |

| ROE (%) | -52.99 | -45.15 | -59.16 | -67.48 | -82.76 | |

| EPS (Yen) | -44.6 | -36.1 | -36.7 | -28.3 | -24.6 | |

| BPS (Yen) | 78.8 | 78.7 | 46.4 | 37.0 | 22.0 | |

| Dividend per Share (Yen) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Shares Outstanding (Million shares) | 58.28 | 58.28 | 58.28 | 58.28 | 58.28 |

Source: Omega Investment from company data, rounded to the nearest whole number.

Share price

Quarterly topics

Source: company materials

Source: company materials

Source: company materials

Source: company materials

Source: company materials

Source: company materials

Source: company materials

Source: company materials

Financial data (quarterly basis)

| Unit: million yen | 2022/12 | 2023/12 | 2024/12 | ||||||

| 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | |

| (Income Statement) | |||||||||

| Sales | 155 | 197 | 169 | 189 | 165 | 158 | 130 | 134 | 159 |

| Year-on-year | -0.8% | 15.1% | 31.8% | 26.6% | 6.2% | -19.6% | -23.5% | -29.2% | -3.8% |

| Cost of Goods Sold (COGS) | 72 | 83 | 73 | 77 | 67 | 67 | 73 | 56 | 74 |

| Gross Income | 84 | 114 | 96 | 113 | 98 | 92 | 57 | 78 | 85 |

| Gross Income Margin | 53.9% | 57.8% | 56.6% | 59.5% | 59.6% | 57.8% | 44.0% | 58.0% | 53.4% |

| SG&A Expense | 344 | 333 | 322 | 546 | 344 | 391 | 379 | 337 | 425 |

| EBIT (Operating Income) | -260 | -219 | -226 | -433 | -246 | -300 | -322 | -259 | -340 |

| Year-on-year | -40.3% | -54.6% | -53.5% | 48.0% | -5.4% | 36.7% | 42.6% | -40.2% | 38.1% |

| Operating Income Margin | -167.3% | -111.3% | -133.4% | -228.6% | -149.0% | -189.3% | -248.5% | -193.1% | -213.9% |

| EBITDA | -260 | -219 | -226 | -433 | -246 | -300 | -322 | -259 | -340 |

| Pretax Income | -255 | -214 | -226 | -435 | -254 | -300 | -303 | -259 | -351 |

| Consolidated Net Income | -257 | -215 | -228 | -436 | -255 | -302 | -304 | -260 | -352 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | -257 | -215 | -228 | -436 | -255 | -302 | -304 | -260 | -352 |

| Year-on-year | -40.9% | -66.2% | -53.8% | 56.5% | -0.7% | 40.1% | 33.5% | -40.4% | 38.0% |

| Net Income Margin | -165.0% | -109.2% | -134.4% | -230.1% | -154.3% | -190.3% | -234.5% | -193.9% | -221.2% |

| (Balance Sheet) | |||||||||

| Cash & Short-Term Investments | 1,592 | 1,727 | 1,566 | 1,245 | 1,342 | 1,326 | 1,325 | 1,104 | 1,241 |

| Total assets | 2,081 | 2,215 | 2,086 | 1,686 | 1,753 | 1,751 | 1,754 | 1,557 | 1,694 |

| Total Debt | 188 | 184 | 301 | 298 | 316 | 291 | 314 | 292 | 303 |

| Net Debt | -1,404 | -1,543 | -1,265 | -947 | -1,026 | -1,035 | -1,012 | -812 | -938 |

| Total liabilities | 431 | 425 | 524 | 541 | 542 | 594 | 506 | 487 | 478 |

| Total Shareholders’ Equity | 1,650 | 1,791 | 1,562 | 1,145 | 1,211 | 1,158 | 1,248 | 1,071 | 1,216 |

| (Profitability %) | |||||||||

| ROA | -66.16 | -54.57 | -46.44 | -62.98 | -59.13 | -61.51 | -67.53 | -69.09 | -70.61 |

| ROE | -81.62 | -67.48 | -60.83 | -86.66 | -79.25 | -82.76 | -92.28 | -101.15 | -100.30 |

| (Per-share) Unit: JPY | |||||||||

| EPS | -5.8 | -4.6 | -4.7 | -9.0 | -5.2 | -5.8 | -5.6 | -4.6 | -6.1 |

| BPS | 35.9 | 37.0 | 32.3 | 23.6 | 23.9 | 22.0 | 22.4 | 19.0 | 19.9 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Shares Outstanding(million shares) | 45.23 | 48.42 | 48.42 | 48.50 | 50.01 | 52.19 | 55.40 | 56.39 | 61.24 |

Source: Omega Investment from company materials

Financial data (full-year basis)

| Unit: million yen | 2014/12 | 2015/12 | 2016/12 | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| (Income Statement) | ||||||||||

| Sales | 370 | 280 | 252 | 260 | 213 | 448 | 481 | 713 | 631 | 682 |

| Year-on-year | – | -24.4% | -10.0% | 3.0% | -18.1% | 110.3% | 7.4% | 48.3% | -11.5% | 8.2% |

| Cost of Goods Sold | 119 | 225 | 228 | 94 | 107 | 167 | 238 | 292 | 283 | 285 |

| Gross Income | 252 | 55 | 25 | 166 | 106 | 281 | 243 | 421 | 348 | 398 |

| Gross Income Margin | 67.9% | 19.8% | 9.7% | 64.0% | 49.6% | 62.7% | 50.5% | 59.0% | 55.1% | 58.3% |

| SG&A Expense | 1,406 | 1,325 | 1,067 | 1,054 | 1,645 | 1,683 | 1,526 | 1,755 | 1,606 | 1,603 |

| EBIT (Operating Income) | -1,154 | -1,270 | -1,042 | -888 | -1,539 | -1,402 | -1,284 | -1,334 | -1,259 | -1,205 |

| Year-on-year | – | 10.0% | -17.9% | -14.8% | 73.4% | -8.9% | -8.4% | 3.9% | -5.7% | -4.2% |

| Operating Income Margin | -311.6% | -453.4% | -413.3% | -341.6% | -723.1% | -313.2% | -266.9% | -187.2% | -199.5% | -176.6% |

| EBITDA | -1,046 | -1,168 | -929 | -877 | -1,532 | -1,397 | -1,280 | -1,331 | -1,257 | -1,204 |

| Pretax Income | -1,180 | -1,281 | -1,501 | -880 | -1,531 | -1,401 | -1,291 | -1,466 | -1,238 | -1,215 |

| Consolidated Net Income | -1,180 | -1,283 | -1,491 | -883 | -1,534 | -1,404 | -1,294 | -1,480 | -1,243 | -1,220 |

| Minority Interest | -30 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | -1,150 | -1,283 | -1,491 | -883 | -1,534 | -1,404 | -1,294 | -1,480 | -1,243 | -1,220 |

| Year-on-year | – | 11.5% | 16.3% | -40.8% | 73.8% | -8.5% | -7.8% | 14.4% | -16.0% | -1.8% |

| Net Income Margin | -310.6% | -457.9% | -591.2% | -339.6% | -720.5% | -313.6% | -269.1% | -207.6% | -197.0% | -178.8% |

| (Balance Sheet) | ||||||||||

| Cash & Short-Term Investments | 5,576 | 4,100 | 4,553 | 4,027 | 2,329 | 2,106 | 2,686 | 1,791 | 1,727 | 1,326 |

| Total assets | 6,257 | 4,919 | 4,789 | 4,419 | 2,831 | 2,808 | 3,495 | 2,339 | 2,215 | 1,751 |

| Total Debt | 0 | 100 | 54 | 4 | 0 | 0 | 180 | 183 | 184 | 291 |

| Net Debt | -5,576 | -4,000 | -4,499 | -4,023 | -2,329 | -2,106 | -2,506 | -1,608 | -1,543 | -1,035 |

| Total liabilities | 418 | 355 | 224 | 202 | 154 | 187 | 385 | 446 | 425 | 594 |

| Total Shareholders’ Equity | 5,828 | 4,564 | 4,565 | 4,218 | 2,677 | 2,622 | 3,110 | 1,893 | 1,791 | 1,158 |

| (Cash Flow) | ||||||||||

| Net Operating Cash Flow | -789 | -1,245 | -970 | -867 | -1,689 | -1,537 | -1,360 | -1,131 | -1,191 | -1,069 |

| Capital Expenditure | 119 | 168 | 11 | 5 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Investing Cash Flow | -619 | -1,780 | 1,989 | -137 | 0 | -26 | -4 | -35 | 0 | 0 |

| Net Financing Cash Flow | 2,131 | 124 | 1,434 | 479 | -10 | 1,341 | 1,944 | 271 | 1,127 | 667 |

| (Profitability %) | ||||||||||

| ROA | -30.46 | -22.95 | -30.72 | -19.17 | -42.30 | -49.79 | -41.06 | -50.73 | -54.57 | -61.51 |

| ROE | -33.51 | -24.69 | -32.67 | -20.10 | -44.49 | -52.99 | -45.15 | -59.16 | -67.48 | -82.76 |

| (Per-share) Unit: JPY | ||||||||||

| EPS | – | -58.3 | -65.9 | -33.5 | -57.3 | -44.6 | -36.1 | -36.7 | -28.3 | -24.6 |

| BPS | 265.6 | 207.0 | 179.3 | 157.5 | 99.9 | 78.8 | 78.7 | 46.4 | 37.0 | 22.0 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Shares Outstanding (million shares) | 21.93 | 22.05 | 25.31 | 26.78 | 26.78 | 33.28 | 39.51 | 40.31 | 48.42 | 52.19 |

Source: Omega Investment from company materials