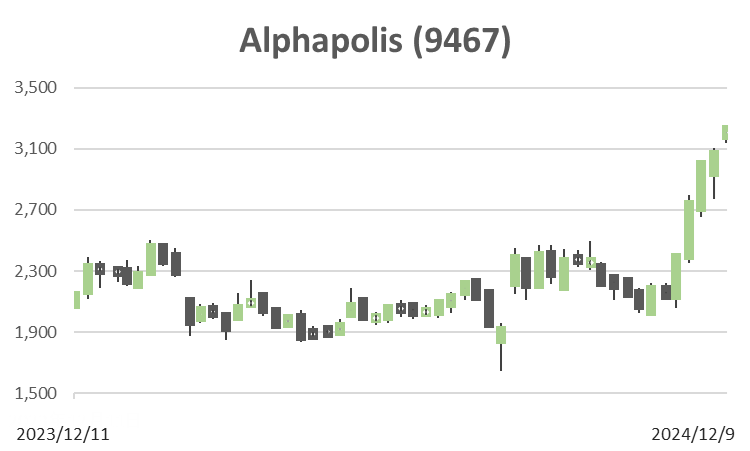

Alphapolis (Price Discovery)

Buy

Profile

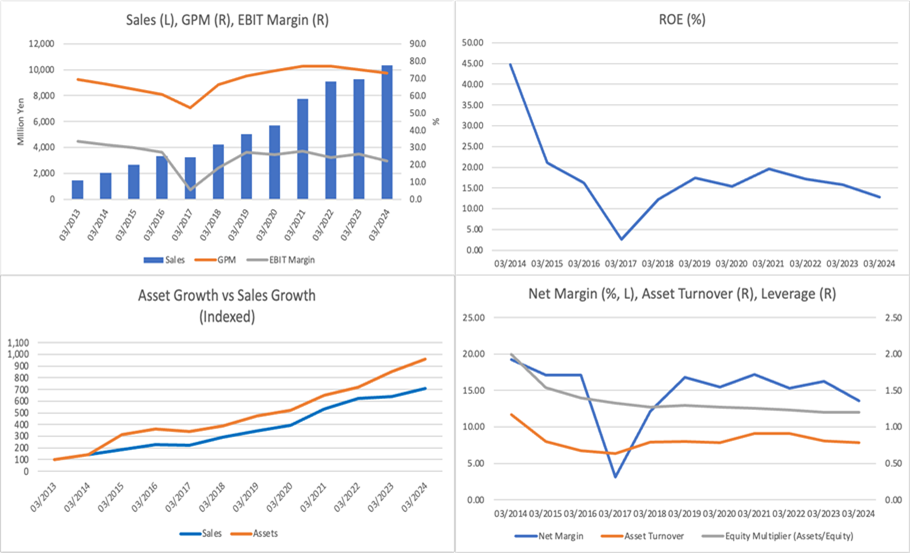

Alphapolis Inc. operates the website “Alphapolis.” (https://www.alphapolis.co.jp/). It selects popular works from light novels posted on the website, a unique approach that has set it apart in the industry. Established by Yusuke Kajimoto in 2000, the company’s primary source of income is manga. Sales by business segment %: Light novels 24, Manga 74, Paperbacks 2 < FY3/2024>

| Securities Code |

| TYO:9467 |

| Market Capitalization |

| 31,242 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

The year’s second half will also see a rush of anime adaptations. Digital manga is doing well, and thanks to the impact of the tax hike, business performance is expected to exceed forecasts.

Alphapolis is expected to see further growth in its business performance, given the expansion of the content and intellectual property (IP) markets.

The company publishes books based on novels and manga posted on its websites and sells them in bookstores and electronic stores nationwide. In the July to September period, in addition to the effect of price revisions, the popularity of anime adaptations and popular series contributed to the company’s record-high quarterly sales and profits. The fact that competitor KADOKAWA was affected by a large-scale cyber attack on its publishing business had a positive effect.

There are also plans to continue to adapt in-house works into anime in the second half and beyond. In the first half, popular works were adapted into anime, and not only manga but also light novels grew well. The number of monthly unique users is on a recovery trend, and the profit margin is improving even as costs increase due to factors such as strengthened promotions. The operating profit for the first half of the year secured a 62% progress rate against the full-year forecast, and there are high expectations for an upward swing in business performance.

In addition, the company is promoting its medium-term priority strategy of ‘expanding overseas sales’ and has recently started selling e-books of manga translated into French. The company aims to achieve an overseas ratio of 30% of profits related to e-manga in FY3/2030.

Investor’s View

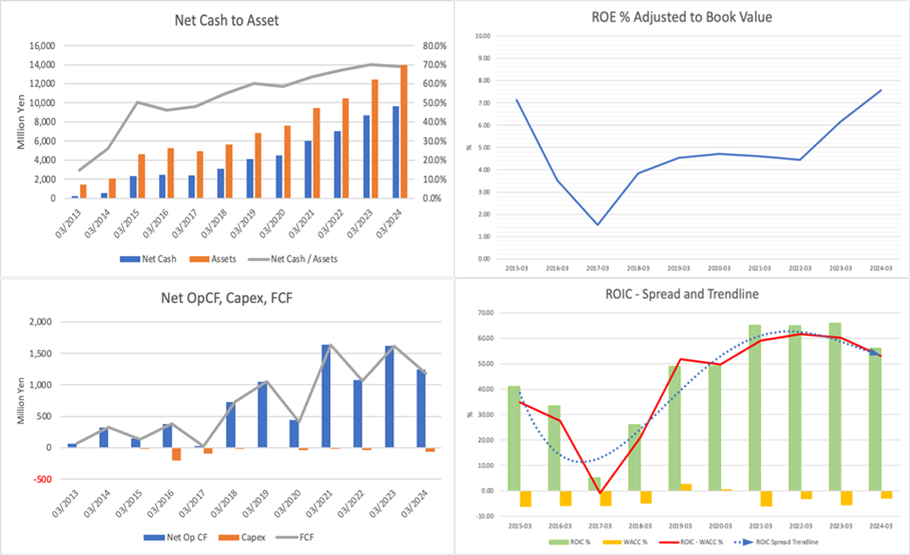

Buy. While earnings are difficult to forecast, the company’s low PER after adjusting for net cash and its robust cash-generating ability are highly attractive. The accumulated cash is a strong indicator of the company’s financial stability and will eventually be used for shareholders or as a catalyst for the advent of corporate buyers.

Alphapolis offers a unique platform where one can submit original novels and manga and also read other people’s work. This business idea has never been seen before and is difficult to forecast.

However, what is notable is the 38% net-cash to market cap ratio and the rich cash flow being generated. PER adjusting for net cash is low at 9-11x. In addition, the fair value based on a DCF model that assumes a 10% growth rate in FCF and discounts it by 7% is 3,530 yen, which is 20% above the share price. The equity yield is over 7%, which means a PBR of 2.3x is reasonably low. Economic value is also being steadily created.

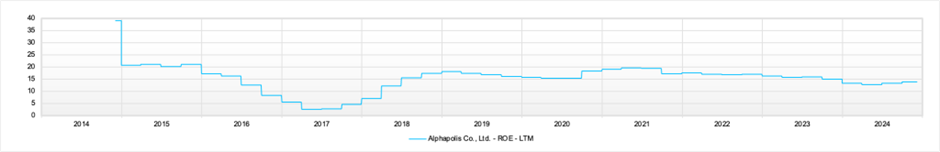

In contrast, the downward trend in the EBIT margin is a concern. The negative trend line for ROE is also primarily due to this. According to the result presentation materials, personnel and advertising expenses are increasing to drive business scale-up. In the foreseeable future, the management will likely continue to aim for business expansion at the expense of profit margins. If the ROE of a small-cap stock with a market capitalisation of less than 30 billion yen converges to a level below 10%, it will be disappointing, and the stock’s attraction will be lost. The lacklustre stock price performance from 2022 to 2023 may have reflected these grim observations.

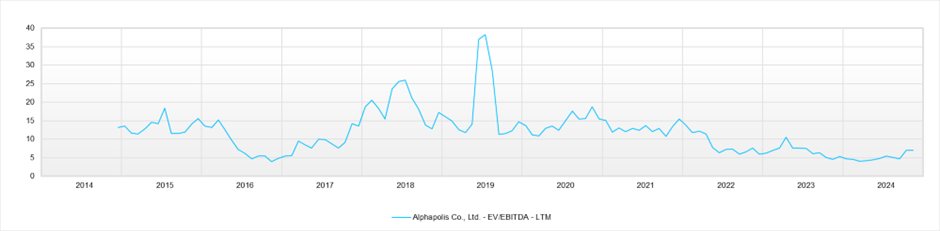

The gradual decline in the asset turnover ratio due to cash accumulation is also not good. However, given the environment surrounding the Japanese stock market, there will probably be pressure to use the cash for active investment or shareholder returns sooner or later. In addition, an EV/EBITDA of around 7 times should be fine for corporate acquirers. The BS is simple and seems clean.

EV/EBITDA (LTM)

Price

PBR

PER

ROE

EPS

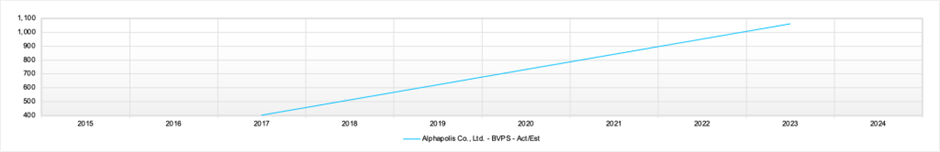

BPS