Tokyotokeiba (Price Discovery)

Buy

Profile

Tokyotokeiba Co., Ltd. is involved in gambling, mainly related to horse racing. The current president is a former deputy governor of Tokyo. The Tokyo Metropolitan Government is the largest shareholder, with a 27.7% stake. The company runs four business segments: public competition, amusement park, warehouse lease, and services. The company operates horse and bicycle racing tracks in the public competition segment. The amusement park segment operates Tokyo Summerland. The company leases logistics warehouses in the warehouse lease segment, and in the services segment, it leases commercial facilities. The majority of the company’s revenue is generated in Japan. Established in 1949. Sales by business segment (OPM%): Public competition 73 (39), Amusement park 8 (14), Warehouse lease 14 (63), Service 5 (11) <FY12/2023>

| Securities Code |

| TYO:9672 |

| Market Capitalization |

| 124,696 million yen |

| Industry |

| Service |

Stock Hunter’s View

A turnaround from the forecast of a decrease in profits, with an increase in profits expected. Earnings related to SPAT4 are also expected to improve in the next fiscal year.

Tokyotokeiba’s primary business is public racing, which includes leasing and operating the Ohi Racecourse and the home-based betting system. The company’s primary source of income is the commission it receives from SPAT4, a service that allows people to buy tickets for all races at local racecourses nationwide online, and the recent upsurge in popularity of local horse racing has been a tailwind for the company.

Although the company is expecting an increase in sales, a decrease in profits for the current FY12/2024, with sales of 40,047 million yen (up 6.7% YoY) and operating income of 12,349 million yen (down 7.6% YoY), the company’s performance for the first three quarters of the year was an 8.1% increase in sales and a 3.6% increase in operating income, raising expectations of an upward swing for the full year. In addition to the increase in rental income from the SPAT4 system due to the rise in betting ticket sales, the opening of a new warehouse rental business and the effect of the new pool ‘Monster Stream’ at Tokyo Summerland also contributed to the increase in revenue. The ‘Tokyo Mega Illumi’ event, which has been attracting attention for its spectacular illuminations, has opened at the Ohi Racecourse (2 November 2024 – 12 January 2025), and the effect on attracting customers during the winter months is also attracting attention.

The company has set a medium-term target of 15 billion yen in operating profit for the next fiscal year, but further profit improvement is expected in the next fiscal year when the burden of system upgrades for SPAT4 will have run its course, and there is a possibility that this target will also be exceeded.

Investor’s View

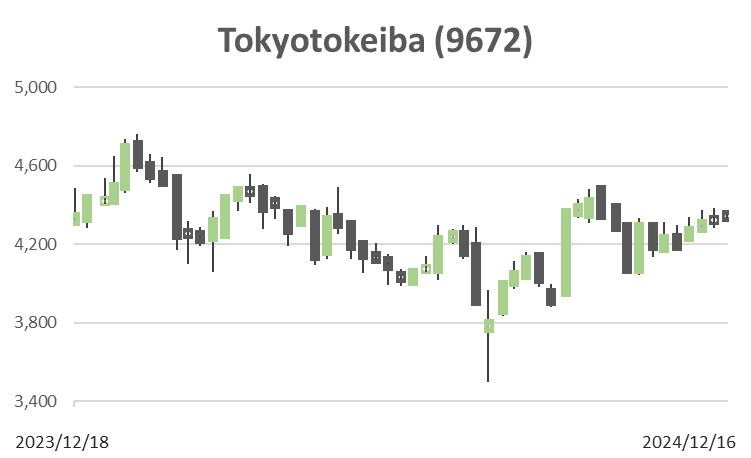

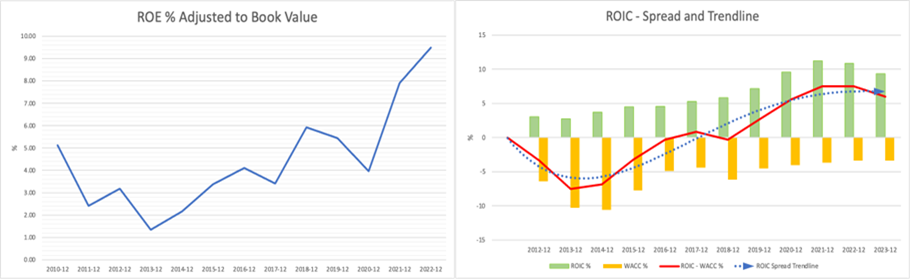

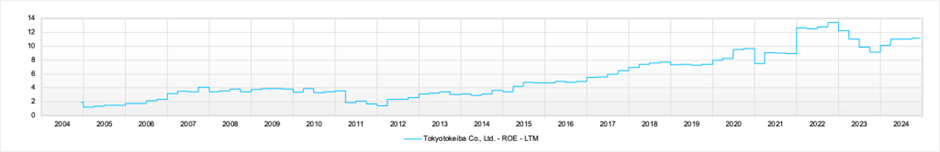

BUY. Since 2023, Oasis has been a major shareholder, holding 8.3% of the company’s shares. The spread of SPAT4, a driver of profits, may be running its course. However, horse racing popularity should continue, and the company will continue to generate CF steadily. Investors pessimistically view the long-term public gambling in Japan, and the stock price premium has not moved. PER is around 12x, and PBR is around 1.3x, with no movement for a long time. On the other hand, the company’s ROE is good, and economic value creation is steady. The equity yield is also supportive. The lacklustre share price performance since 2021 does not reflect these, and it is a good time for the entry.

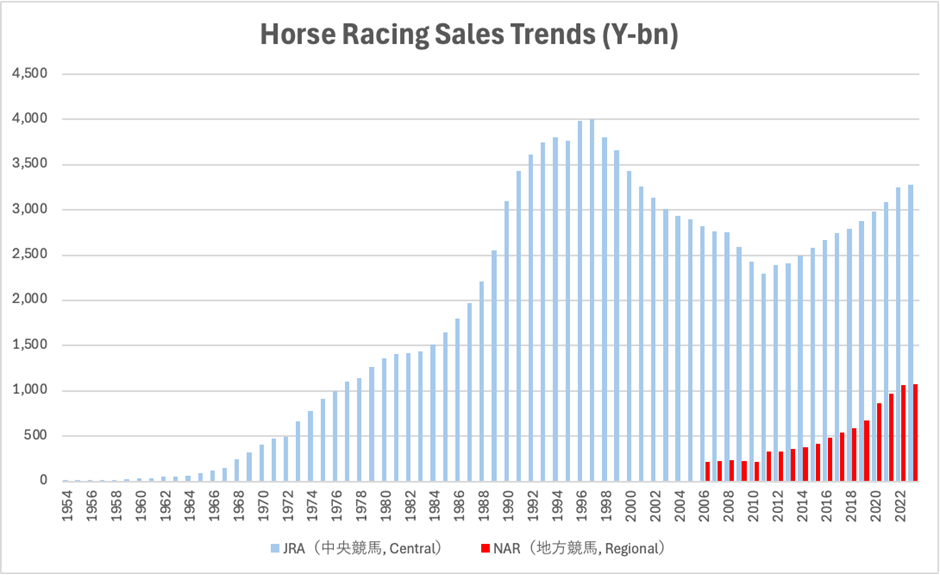

The popularity of easy online voting has grown due to the COVID-19 pandemic, and horse racing has achieved unexpected growth in public gambling. Tokyotokeiba, which leases voting systems to local horse racing organisers, is also doing well.

The central government oversees public gambling, which includes horse racing, bicycle racing, boat racing, motorbike racing, and sports lotteries. JRA (Japan Racing Association) is the largest horse racing company, a state-run business with the Japanese government as its sole shareholder.

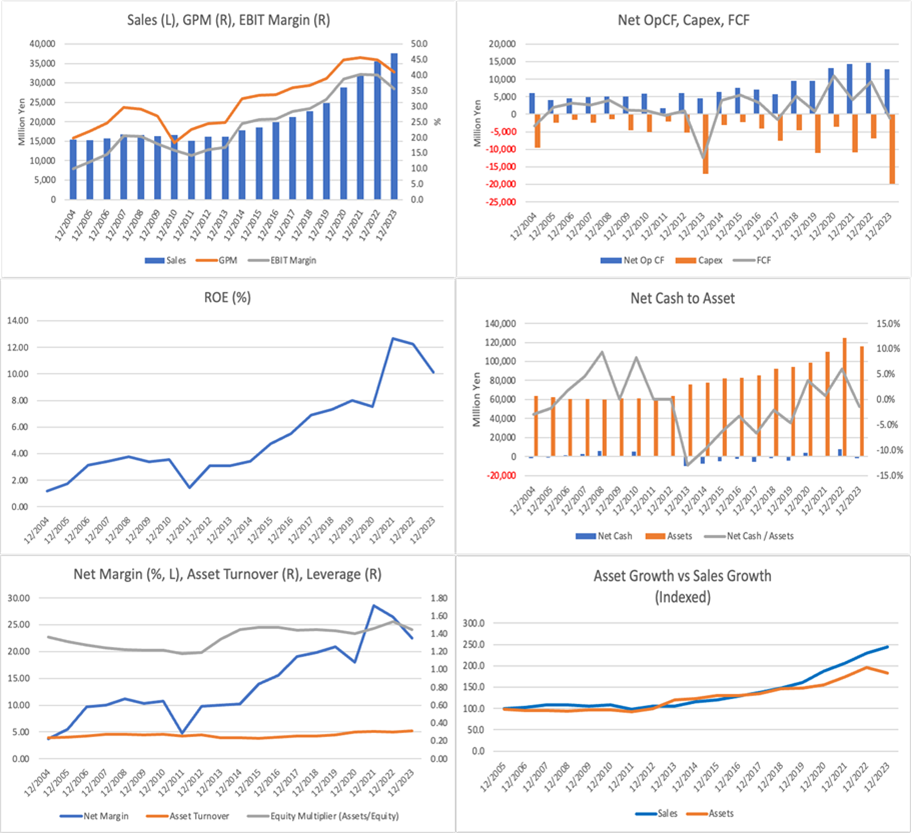

Tokyhotokeiba is 27.7% owned by the Tokyo Metropolitan Government, and the president is a former deputy governor of Tokyo, so it has a strong public sector flavour. Nonetheless, it is a private company that leases facilities and systems, not the event’s host. The rapid spread of the internet voting system (SPAT4) has improved profit margins, and the company’s earnings in recent years have been good, with ROE also rising. The warehouse leasing business has a high-profit margin and generates stable revenue.

In the public racing segment, the main businesses are commission-based income from the rental of SPAT4 (an online local horse race betting system) to local horse race organisers, rental of the Ohi Racecourse and Isesaki Auto Race Track to race organisers, and rental of off-track betting facilities, but SPAT4 rental income accounts for 60% of consolidated sales (85% of segment sales), making it critically important. In recent years, one of the main items in capital investment has been the renewal of SPAT4-related systems, but this business excels in terms of return on capital.

The number of SPAT4 subscribers has already exceeded 1 million, and there are signs that the growth of betting ticket sales is peaking out. In contrast, the number of online and telephone betting members of the JRA, which has a sales scale three times that of local horse racing, is around 6 million, so there may still be room for growth in the number of SPAT4 subscribers.

SPAT4 horse race betting turnover (not the turnover of Tokyotokeiba)

(FY2024 3Q Company Financial Results Presentation Materials)

The management team announced the ‘Long-term Management Vision 2035’ at the beginning of the year, but it is not interesting. The numerical targets of the new medium-term plan are to be announced separately, although they say they will be higher than those of the previous medium-term plan. The current medium-term plan calls for an ROE of at least 10%, an ROIC of at least 8.5%, a dividend payout ratio of 30%, and share buybacks while calling for at least 60% of equity ratio and a net debt-equity ratio of 0.4 times or less. It is a list of targets that lacks focus and consistency. The company’s asset turnover is 0.3x, which is as low as that of a utility company, and there is a possibility that, at some stage before long, the activist shareholders will become the core of a shareholder revolt.

Price

PBR

PER

ROE

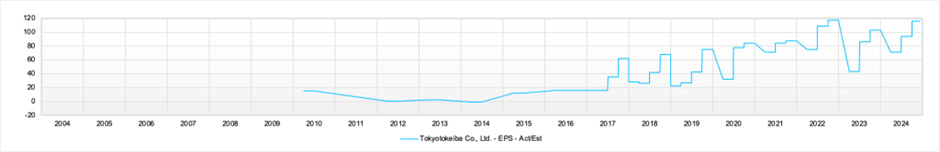

EPS