Colan Totte (Price Discovery)

Poor visibility

Profile

A manufacturer and seller of magnetic medical devices. Magnetic necklaces account for 89% of sales. Many contract athletes. Sales channels are 60% wholesale, 10% retail, and 30% EC. The company’s products include Colan Totte, Colan Totte RESNO, and Colan Totte Safety System. Founded by Katsumi Komatsu in 1997 and headquartered in Osaka. Sales by business segment % (OPM%): Necklaces 89, Loops 4, Supporters 1, Wear 6 <FY9/2024>

| Securities Code |

| TYO:7792 |

| Market Capitalization |

| 9,712 million yen |

| Industry |

| Other products |

Stock Hunter’s View

The success of the company’s contracted athletes contributes to its business expansion. The company’s recognition will grow further, and its production will expand.

Colan Totte manufactures and sells medical devices and healthcare products, focusing on magnetic necklaces. Their magnetic therapy devices, which have permanent magnets arranged in an alternating N-S pattern, are certified as medical devices, and they are popular with many famous athletes, not only because of their efficacy and effectiveness but also because of their excellent design. They have many contracted athletes, including volleyball player Yuki Ishikawa, table tennis player Mima Ito, and ski jumper Noriaki Kasai.

For FY9/2024, sales and profits exceeded forecasts and reached record highs. In particular, retail sales grew by more than 30%. The number of customers visiting the stores increased due to the effects of TV commercials, measures to capture gift demand at Christmas and other times, an increase in inbound tourism, the success of contracted athletes at the Paris Olympics, and the average sales price also increased.

The company is forecasting sales of 6.5 billion yen (up 9.3% YoY) and operating income of 1.65 billion yen (up 9.9% YoY) for the current term. In addition to its campaign measures, the company plans to expand its lineup of high-end models, make inroads into the Paris Collection, and open its first directly managed store in the Chugoku region of Japan. It also plans to build a ‘Research and Development Centre (tentative name)’ to strengthen its production system further.

Investor’s View

Valuations are interesting, but the visibility of medium- to long-term earnings is poor.

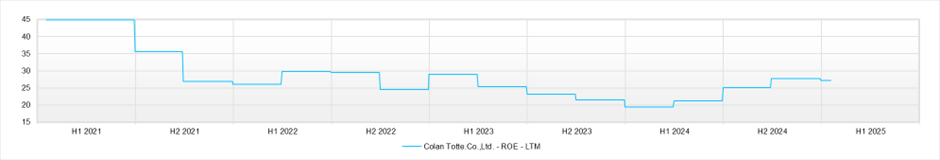

The company’s magnetic necklaces have been successful, but long-term growth forecasts will be difficult. ROE is close to 30%, which is excellent capital efficiency. Economic value creation is also good. The equity yield is an attractive 12%.

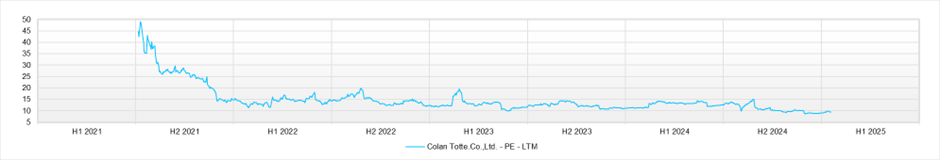

However, PER is 9 times, and investors do not expect the company to grow. Investors are sensibly cautious about the strong sales of consumer goods, which are similar to luxury items and have many competitors. They are unsure when these strong sales will end.

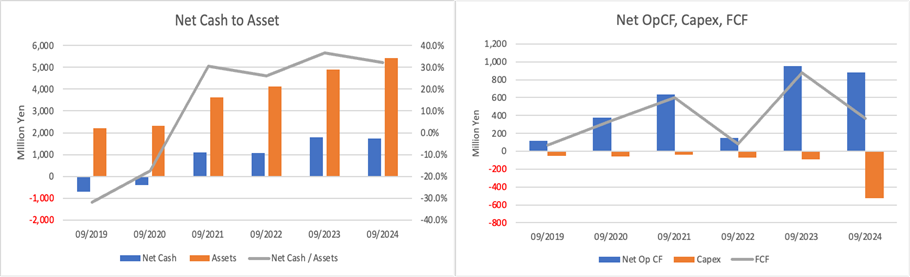

Currently, cash flow is generated steadily, and net cash accounts for 32% of assets and 18% of market capitalisation. After adjusting for net cash, the forecast PER is just over 7 times. In FY9/2024, nearly 600 million yen was invested, which is thought to have been used to construct a research and development centre. Still, the company’s business requires minimal investment.

The share price is undervalued, but something big will be needed to bet on the growth of magnetic necklaces. A significant strengthening of shareholder returns, such as dividends, could also be a catalyst. Valuations are interesting but do not make us want to consider buying the shares.

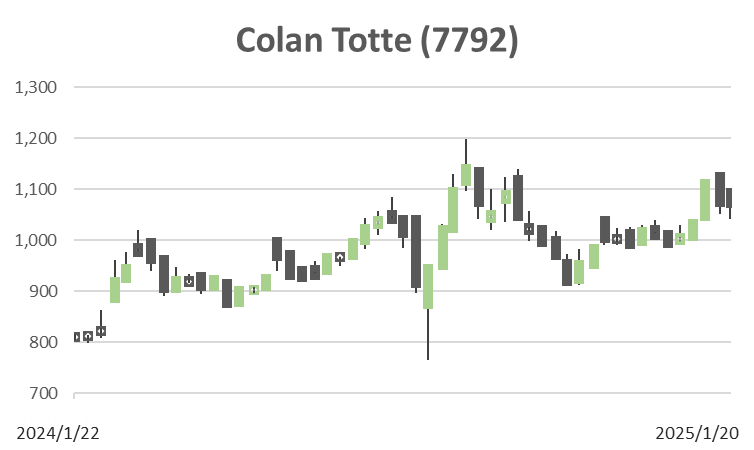

Price

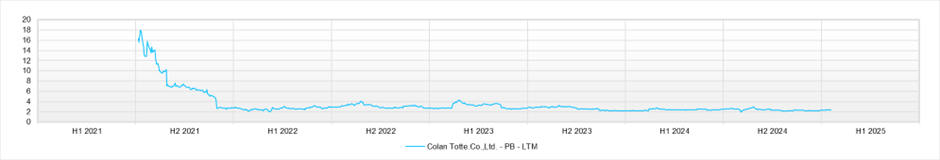

PBR

PER

ROE

EPS