Amiya Corp. (Price Discovery)

Buy on Weakness

Profile

Amiya Corporation is engaged in the audit solution business and the IT infrastructure solution business. It was established in 1996 by Seiichi Ito and is headquartered in Tokyo.

Sales by business segment % (OPM%): Data Security 36 (45), Network Security 64 (23) <FY12/2023>

| Securities Code |

| TYO:4258 |

| Market Capitalization |

| 14,475 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

The overwhelming market share in security log management. Revenue is set to double with the shift to a subscription model.

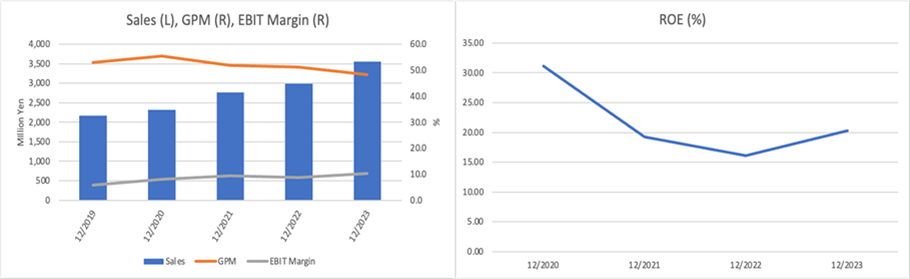

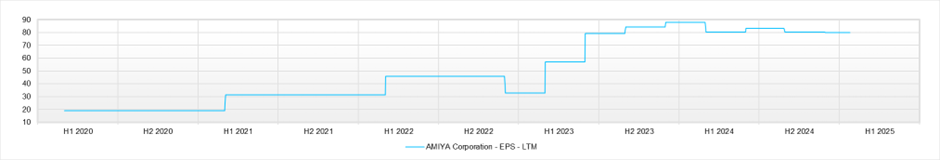

Amiya develops and sells the “Alog series” of products, which manage all security-related logs. It also operates a network security business. The mainstay “Alog” product was discontinued in March last year. The transition to a high-profit subscription model was completed, and the “profit doubling plan” set out in the medium-term management plan is progressing smoothly.

The company plans to exceed its previous forecast for the fiscal year ending December 2023. With the switch to the new subscription system almost complete in the second and third quarters, the ARR has been a small accumulation of maintenance fees up to now, but from now on, the structure will be such that almost all sales will be accumulated in the ARR. In addition, although “Alog” boasts an overwhelming share of the domestic security log management industry, it is also scheduled to begin full-scale overseas expansion in 2025. It has established a network of 14 distributors in 9 countries and regions.

In addition, the company has announced that starting on April 1st, it will change the pricing and add new products to its “Network All Cloud” product lineup. It says it will strengthen its cloud service provision system to meet customer needs.

Investor’s View

The company is growing well amid the industry boom. However, the shares look overpriced.

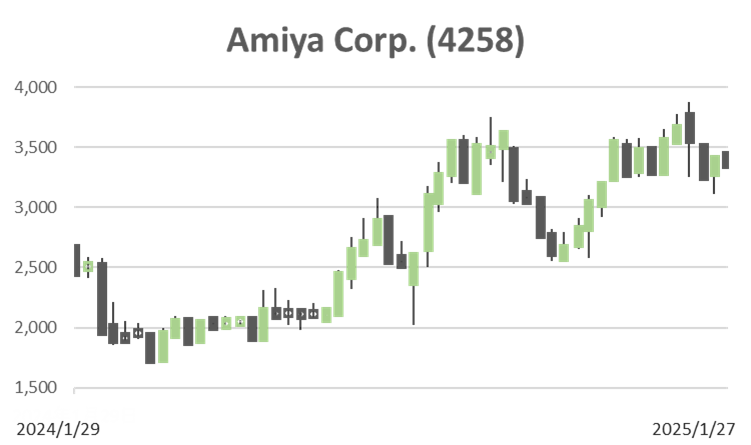

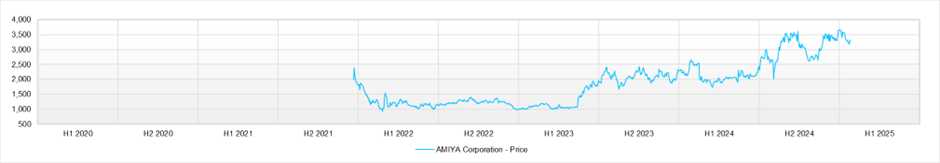

The company is just a tiny niche in the vast network and cloud services industry, making long-term earnings forecasts difficult. In the domestic public cloud market, which is expected to exceed 3 trillion yen and reach over 7 trillion yen by 2028, the company’s management team is forecasting sales of just 4.7 billion yen for the fiscal year ending December 2024. Nevertheless, the industry is in the midst of a boom, and there is no doubt that the company is growing within it. Top-line sales growth is accelerating, and the share price performance since the second half of 2023 has been good.

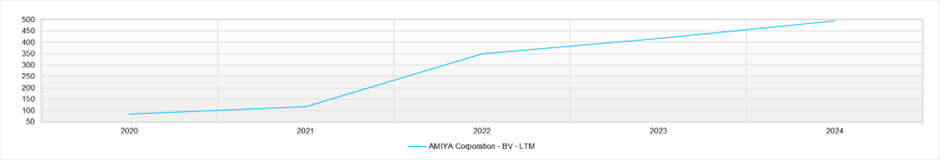

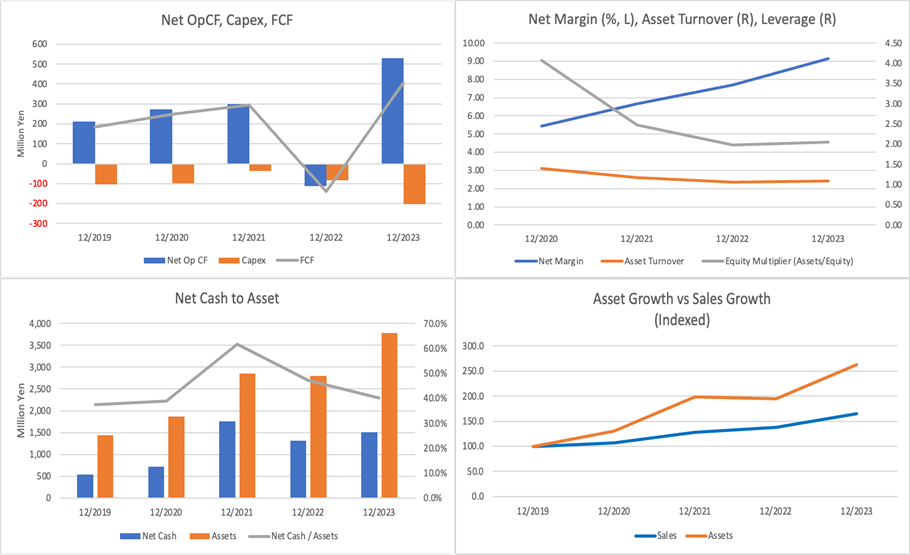

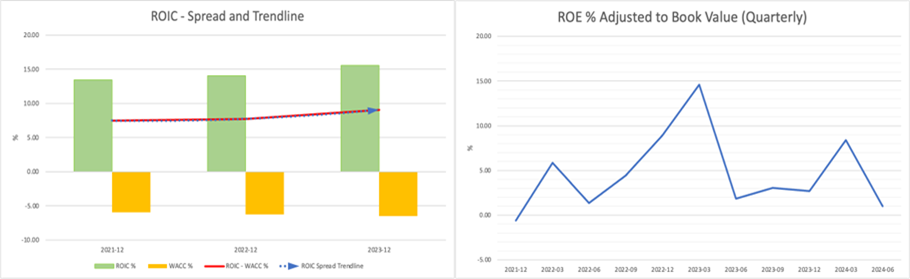

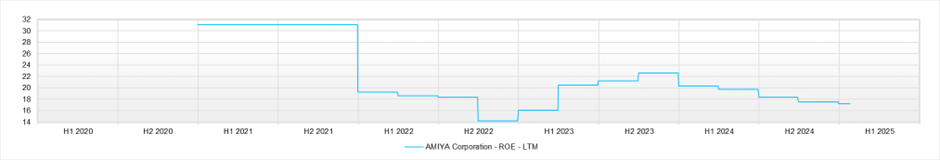

GPM has been around 50% so far, but the company being at a turning point to all-subscriptions should rise with the shift to subscriptions. As a result, the bottom-line profit margin is expected to improve. Accordingly, the upward momentum of ROE, which is bottoming out, should increase. The current ROE is around 20%, and ROIC is also high, with plenty of room for economic value creation. In recent years, the financial focus has been on whether the accumulating cash will be used for shareholder-beneficial purposes. At present, management has not answered this question.

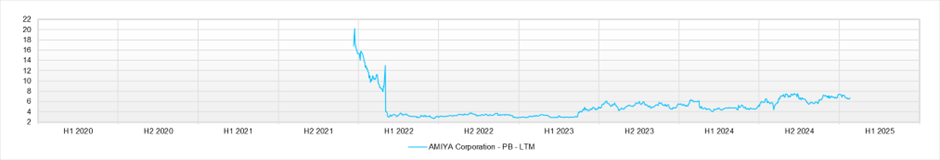

While the appropriateness of the liquidity of the stock depends on the individual investor, another vital point to consider is that the valuation is expensive. PER and PBR are 40% and 70% higher than the industry average, respectively, and the equity yield (ROE adjusted for PBR) is only a few percent. Assuming 10-year EPS growth of +20% p.a., the stock price is 15% more expensive than the fair value of our DCF model, which is discounted at 9%. While the appropriateness of the liquidity of the stock depends on the individual investor, another vital point to consider is that the valuation is expensive. PER and PBR are 40% and 70% higher than the industry average, respectively, and the return on equity (ROE) after PBR adjustment is only a few percent. Assuming 10-year EPS growth of +20%, the share price is 15% more expensive than the fair value of our DCF model, which is discounted at 9%. Of course, this fair value is an unreliable figure because earnings are not very predictable. The share price has fallen moderately since the beginning of the year. We want to wait for it to fall more significantly.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

BPS (LTM)