CNS (Company note – 2Q update)

1H FY25/5 results in-line with internal plan

Strategic increase in salaries and reinforcing new Consulting Business

| Click here for the PDF version of this page |

| PDF Version |

SUMMARY

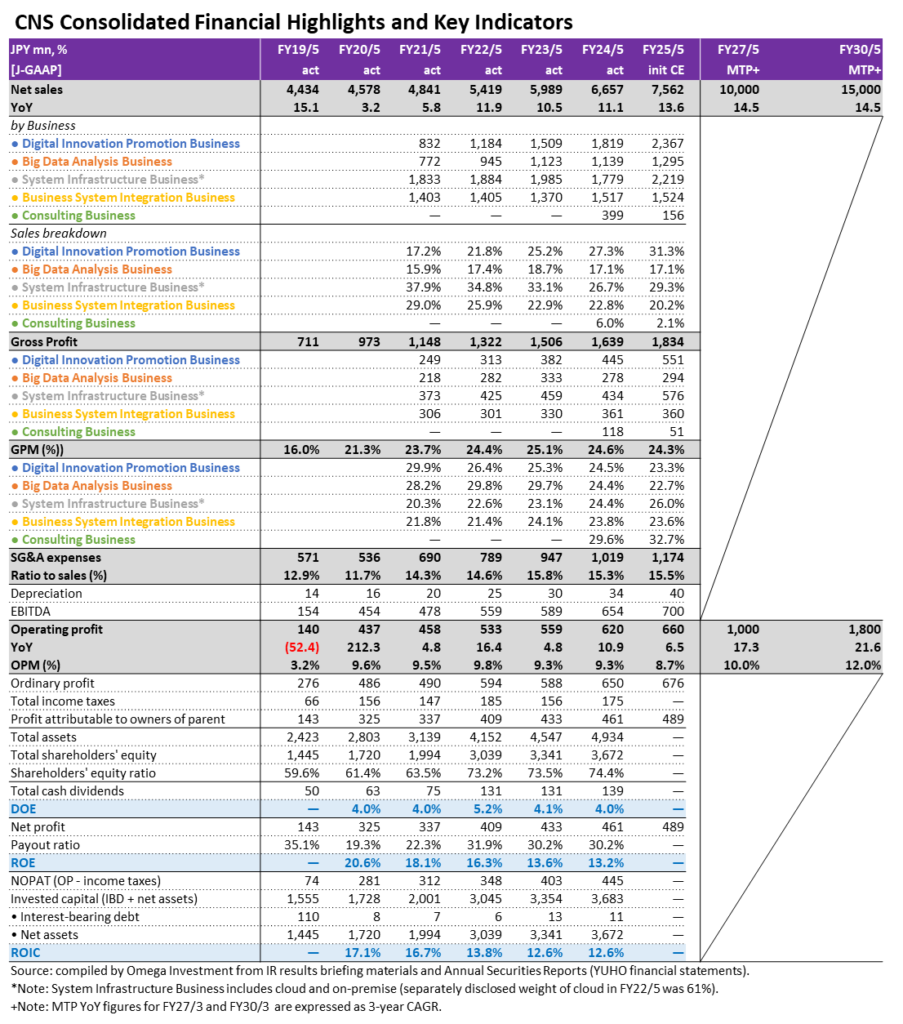

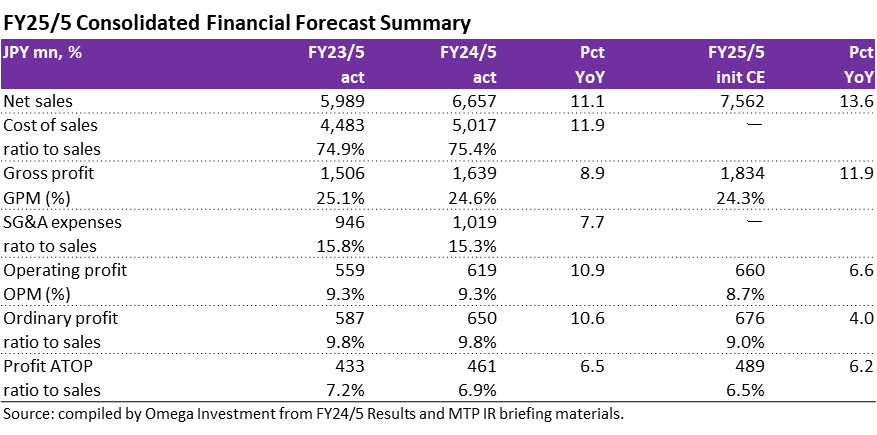

- CNS announced 1H FY25/5 (Jun-Nov) results at 15:00 on January 10. Topline numbers were net sales +2.0% YoY, operating profit -30.0%, ordinary profit -28.7% and profit attributable to owners of parent -26.4%. 2Q-only (Sep-Nov) results were net sales +4.2% YoY (1Q -0.1%) and operating profit -19.5% (1Q -43.6%), showing sequential improvement from the 1Q. Relative to the 4-year average 1H achievement ratios (progress toward full-term results) of net sales 48.3% and OP 50.9%, 1H FY25/5 net sales was 44.5% and 1H OP was 34.3%. This is attributed to the downsizing of the new Consulting business (1Q net sales -81.6% YoY) with a view toward reconfiguration this term, and depressed 1Q OPM mainly as a result of implementation of the strategic salary increase of roughly 11% from the beginning of the FY for profits.

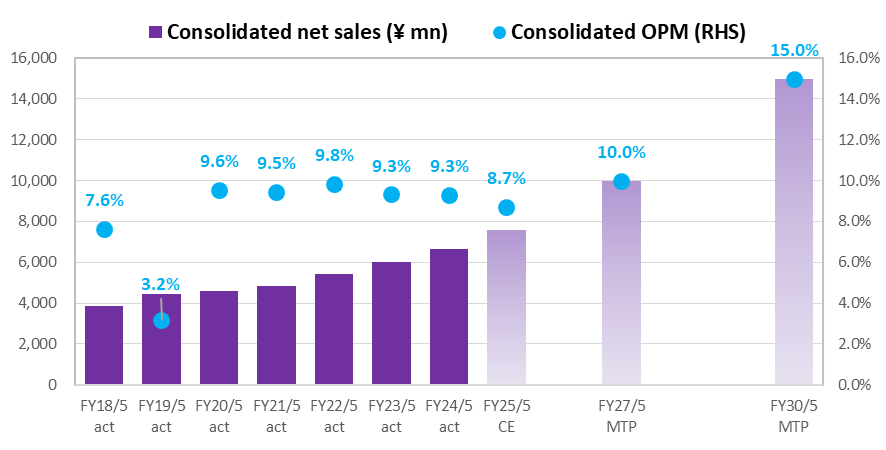

- CNS is confident that it can achieve the initial full-term FY25/5 forecasts through implementation of initiatives for each business, noting that the initial internal budget is weighted toward the 2H. In this report we summarize progress on future initiatives in each of the 5 business areas. We believe the CNS investment opportunity lies in management taking steps to ensure a steady transition from the current DX-driven high market growth to sustainable growth regardless of underlying market conditions, including transforming the profit structure to higher margins not dependent on contract-based orders, and compelling valuations that do not reflect that upside.

Financial Indicators

| Share price (1/31) | 1,445 | 25.5 P/E (CE) | 8.6x |

| YH (24/4/18) | 2,111 | 25.5 EV/EBITDA (CE) | 1.0x |

| YL (24/8/5) | 1,300 | 24.5 ROE (act) | 13.2% |

| 10YH (21/8/20) | 3,035 | 24.5 ROIC (act) | 12.6% |

| 10YL (23/1/17) | 1,270 | 24.8 P/B (act) | 1.14x |

| Shrs out. (mn shrs) | 2.906 | 25.5 DY (CE) | 3.39% |

| Mkt cap (¥ bn) | 4.199 | | |

| EV (¥ bn) | 0.826 | | |

| Equity ratio (11/30) | 73.8% | | |

1H RESULTS SUMMARY AND PROGRESS ON FUTURE GROWTH INITIATIVES BY BUSINESS

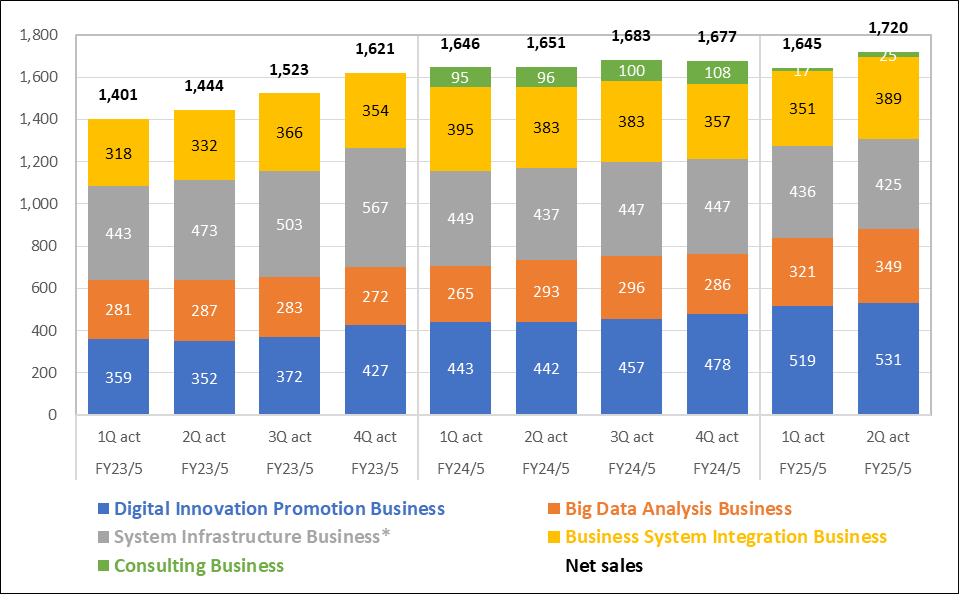

- 1H RESULTS SUMMARY: CNS 1H FY25/5 net sales increased +2.0% YoY, driven by ongoing high growth in Digital Innovation Promotion Business and a recovery in Big Data Analysis Business, which can be clearly seen in the graph on the next page. GP declined -1.9% (GPM 24.8% → 23.9%) due to the planned 10.8% increase in labor cost from base and regular salary increases. OP declined -30.0% (OPM 9.8% → 6.7%), in addition to the decrease in GP, due to SG&A expense increasing +16.4% (ratio to sales 15.0% → 17.2%) due to the +17.0% increase in personnel expense from wage increases and increased managerial staff, increased training and recruitment expenses, and increased compensation paid for back-office outsourcing expenses. However, 1H results were largely in line with the internal plan.

- Digital Innovation Promotion Business: 1H net sales increased +18.6% YoY, and GP increased +28.4% (GPM 23.0% → 24.9%), due to the expansion of the structure for new customer projects related to ServiceNow, cashless payment service projects, and generative AI-related projects (mainly for NTT DATA) won in the previous fiscal year. Future initiatives include: 1) further increase orders for generative AI projects mainly for NTT DATA and existing customers, 2) expand the ServiceNow project structure through increasing sales staff and strengthening the development structure, and 3) expand the structure for acquiring mainly cashless payment projects.

- Big Data Analysis Business: 1H net sales recovered +20.2% YoY with GP decreasing -2.0% (GPM 26.6% → 21.7%), in addition to maintaining a structure to expand existing projects related to major clients, aggressive sales activities resulted in the acquisition of several new nclients, while GP dipped slightly due to increased staff for existing projects for a major telecom carrier and software vendors, acquiring several new clients including a major consulting firm and financial institutions. Future initiatives include: 1) proactive proposals to win new projects, focusing on selection and concentration of projects (shift to high unit price projects), continuing to expand track record for U-Way Migration to SAS Viya and developing new large-scale projects by leveraging the capabilities of multiple companies, sharing customers and technology toward acquiring new customers.

Quarterly Trend of Net Sales by Business (JPY million)

Source: compiled by Omega Investment from TANSHIN Quarterly Financial Results Summaries.

*System Infrastructure Business includes cloud + on-premise.

- System Infrastructure Business: 1H net sales decreased -2.7% YoY, and GP decreased -2.9% (GPM flat at 24.4%). While inquiries for “U-Way Oracle Cloud VMware Solution migration and implementation support service” increased, and a new government cloud project was launched in the 2Q, net sales declined slightly due to the termination of projects at existing clients and the freezing or postponement of projects for client reasons. Factors for failure to achieve the target included new project starts postponed due to revised plans at major existing clients, and new client acquisition was limited to small projects. Expectations for an expanded structure are due to the scheduled start of the Government Cloud project, a policy measure of the Digital Agency. Future initiatives include: 1) acquisition of new end-users and implementation of measures to increase the number of existing projects, focusing on promoting proposal activities to increase the number of existing projects, and aiming to acquire end users with U-Way Oracle Cloud VMware Solution Migration and Implementation Support Service as a starting point, incorporating previous VMware know-how + know-how with Oracle Cloud Infrastructure and Oracle products, providing support from system planning to operation according to customer requirements toward acquiring new customers.

- Business System Integration Business: 1H net sales decreased -4.9% and GP decreased -2.2% (GPM 24.8% → 25.5%). The number of personnel increased due to the expansion of projects related to economic security (System for Ensuring Stable Provision of Specified Essential Infrastructure Services under the Economic Security Promotion Act – Cabinet Office) won in the previous FY and system construction projects for securities companies, however this could not offset the impact of the significant downsizing of the operation and maintenance systems of some existing clients. Despite the decline in net sales, CNS managed to improve GPM, focusing on expansion of economic security and existing projects, including NS Solutions and Mizuho Information & Research Institute (IT consulting). Future initiatives include: 1) target expansion of the scale of projects related to economic security, focusing on expanding the scale of large near-shore IT projects for existing clients and support for the development of advanced key technologies, and 2) building a track record with Oracle ERP, focusing on continuing to build a track record as well as expanding project scale.

- Consulting Business: 1H net sales decreased sharply by -77.6% YoY, and GP posted a loss due to the significant downsizing aiming for reconfiguration during the current FY. Focusing on turning around the business this term by increasing the number of consultants through increasing and strengthening new consultants as well as deploying a cost increase for upfront investment in promoting DX. Future initiatives include: 1) turn around the business through increasing staff on existing projects, including PMO projects and business strategy development support projects, 2) reinforce the business structure through recruitment centered on recruitment of mid-career consultants and 3) expand business transactions with new end-users. End-users acquired during the 1H include electrical equipment/ electronics manufacturers and transportation equipment manufacturers, focusing on providing high quality service to new end-users through reinforcing the structure aiming to expand business transactions.

- For reference, delayed startup of Consulting Business in FY24/5 resulted in a 14.5% shortfall of profits from the initial full-term forecast. Newly launched Consulting Business started off with a shortage of consultants, and the business was commenced with existing engineers. Efforts were also focused on building a track record in business transformation design projects, but the inability to hire consultants as planned had a negative impact due to a lack of securing new consulting projects. Consulting Business net sales and gross profit recorded 20% and 30% shortfalls, respectively. The initial forecast for FY25/5 Consulting Business is net sales -61.0% YoY and GP -56.6%. n

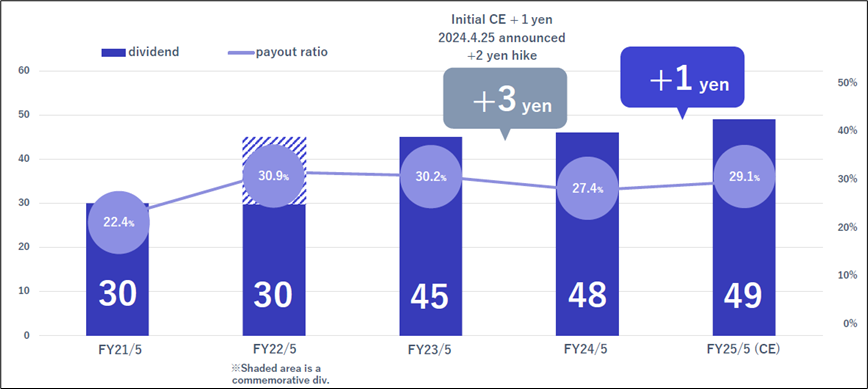

- The CNS Group will celebrate its 40th Anniversary since founding during FY25/5. The main reason for the slowdown in profit growth relative to accelerating top line growth is factoring in implementation of a uniform 8% base increase and regular salary increases of approximately 11%, which are aimed at improving work ethic and attracting and retaining talented employees, as well as the anticipation of a certain level of expenses due to planned leading investments in innovation creation. The initial dividend indication is for a +1yen hike to ¥49 per share under the new progressive dividend policy (see details on P6).

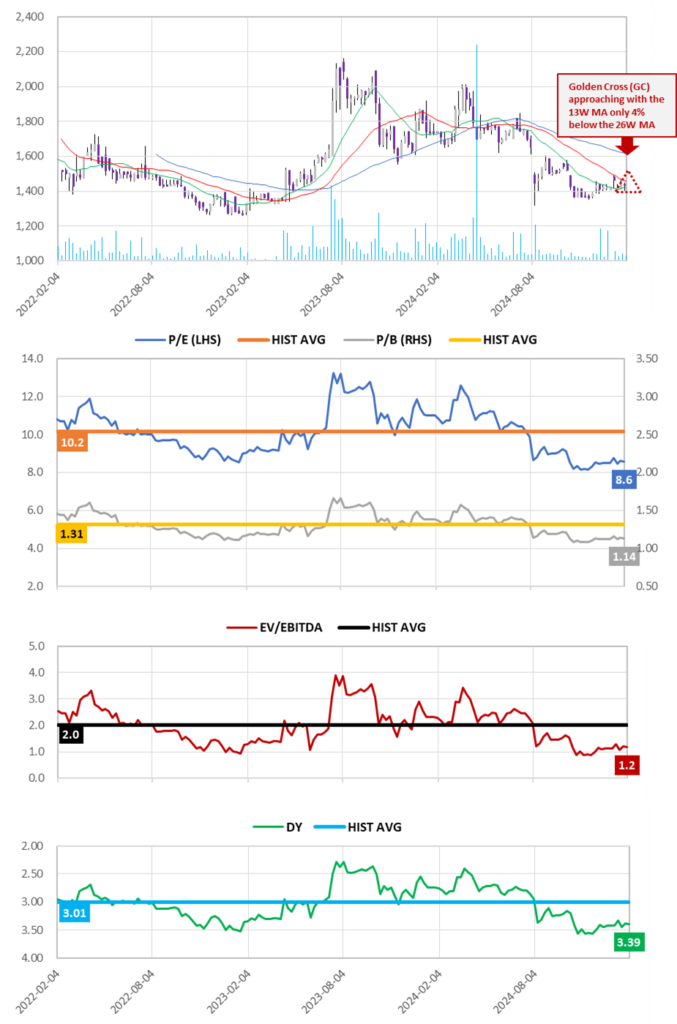

SHARE PRICE AND VALUATIONS

3-Year Weekly Share Price Chart, 13W/26W/52W MA, Volume and Valuation Trends

Source: compiled by Omega Investment from historical price data. Forecast values based on current Company estimates.

Key takeaways:

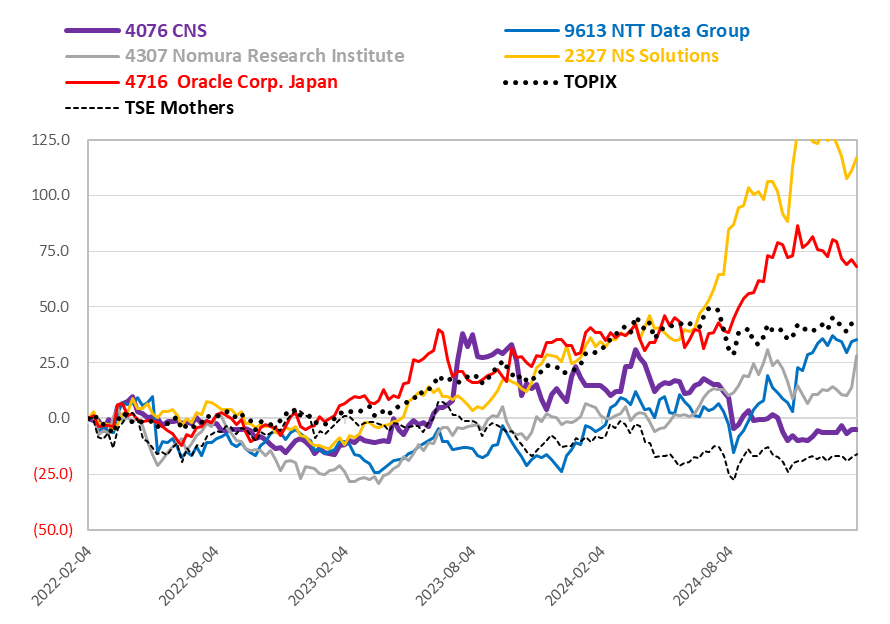

❶ The P/E and P/B ratios are trading 15% and 13% below their respective historical averages.

❷ EV/EBITDA on 1.2x is one of the lowest in the industry by far, and it is trading 41% below its historical average.

❸ The DY at 3.39% is one of the highest among peers, and some have yet to pay a dividend, trading 13% above its historical average.

➡ Even adjusting for the lower liquidity of the TSE Growth Market shown on the following page using the TSE Mothers index, CNS valuations are all trading at the bottom of their listing ranges, presenting a contradiction with the underlying strong earnings, and prospects for double-digit growth to continue for the next 4-5 years. Apparent weak 1Q results on the surface present an opportunity to buy on weakness.

3-Year Relative Share Price Performance versus Major Customers and Partners

Shareholder return policy

Expanding business by quickly identifying changes in the ICT industry and being proactive in taking on challenges in new fields, based on the trust and track record with major system integrators and ongoing relationships with them → these business characteristics enable CNS to secure stable revenues. In order to achieve sustainable growth together with share-holders, continuation of the progressive dividend policy to increase dividends in line with profit growth, with a target payout ratio of 30% or more.

Omega Investment’s case for CNS as an attractive opportunity

Omega Investment believes that CNS is one of those rare hidden gems among small cap growth companies waiting to be discovered. First, as an investor, it is reassuring that the Chairman and President are major shareholders, so their financial interests are directly aligned with shareholders. More importantly, management is taking steps to ensure a steady transition from the current DX-driven high market growth to sustainable growth regardless of underlying market conditions, including transforming the profit structure to higher margins not dependent on contract-based orders.