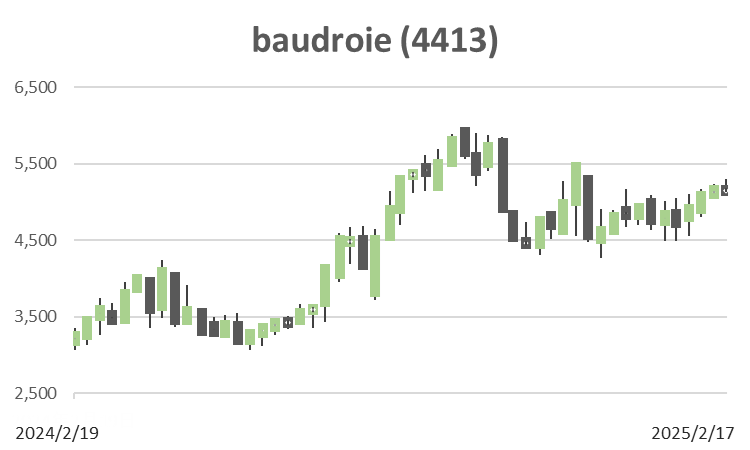

baudroie (Price Discovery)

Buy on Weakness

Profile

Specialises in IT infrastructure construction. More than half of its sales are from monthly subscription income from system maintenance and operation. Provides services from consulting to maintenance and operation. Supports the design, verification, and construction of systems such as server construction, virtualisation, and security, both on-premise and in the cloud. Established in 2007, IPO in 2021. Sales by business segment %: IT Infrastructure 100 <FY2/2024>

| Securities Code |

| TYO:4413 |

| Market Capitalization |

| 82,358 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

High growth in advanced technology fields. Medium-term plan to be revised soon.

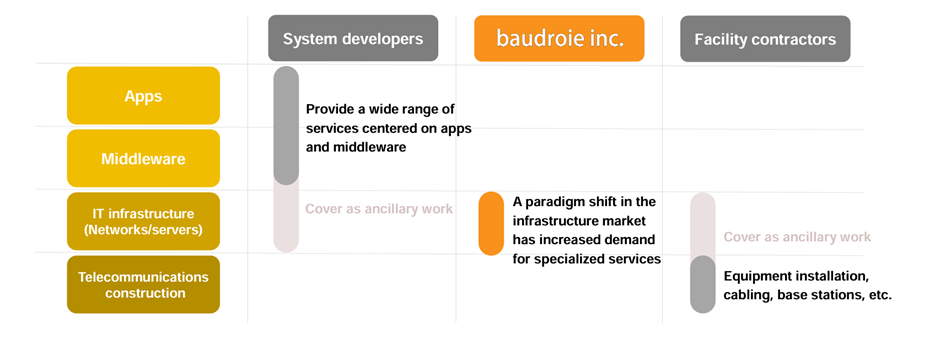

baudroie is a specialist provider of IT infrastructure (network and server) services. It does not provide applications, middleware, or telecommunications work but specialises in the IT infrastructure field, where demand is increasing due to a paradigm shift in the infrastructure market. Its particular strength is its focus on the cutting-edge technology field, which is rapidly growing.

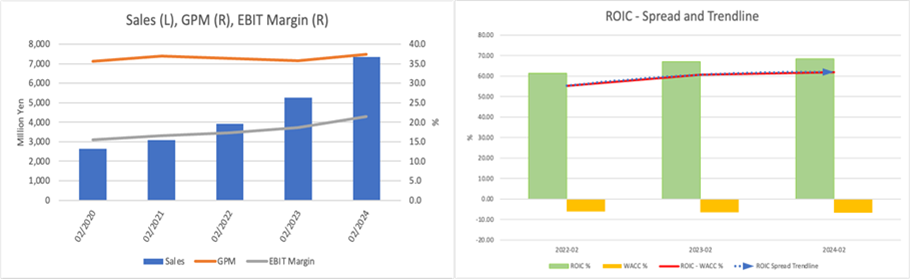

While the company is receiving many inquiries due to its highly competitive services, it is also receiving more selective orders, and the average sales per enterprise customer is on an upward trend. As in previous years, the company expects the second half of the current fiscal year (FY2/2025) to be stronger than the first half, and the results for the third quarter (March to November) announced on 14 January show sales revenue of 8,425 million yen (up 56.2% year-on-year) and operating profit of 1,737 million yen (up 52.1% year-on-year). The operating profit to full-year forecast ratio was 75%, which is also reasonable compared to the revised full-year forecast, and the company has stated that it aims to achieve results that exceed the full-year forecast.

In addition, the company’s performance is already exceeding the targets of the medium-term management plan that was updated in April last year, and the plan is scheduled to be updated when the full-year financial results are announced (scheduled for mid-April 2013).

Investor’s View

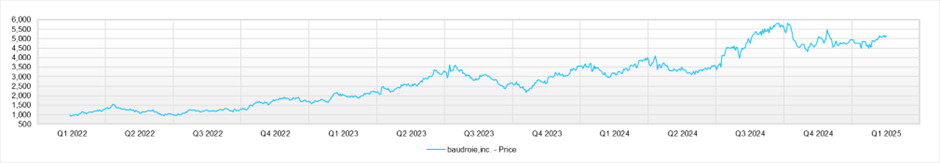

The management’s strategy of chasing the business scale and focusing on the share price is quite sensible. The valuation is not cheap, but we would want to pick up the shares on any weakness.

IT infrastructure is a niche that is not likely to draw the attention of investors. Institutional investors own 6.6% of the company, of which 80% are Japanese. According to the company, IR contact with overseas investors is increasing. It will not take long for the strength the company has cultivated by consistently specialising in niche fields to be recognised by smart investors. The company’s market capitalisation is not too large or too small, and the shares of the company, which generate ample economic value, are of an investable size for a wide range of investors. In anticipation of a broader range of investors, the management team aims for early inclusion in the TOPIX and improved stock liquidity. This timely measure represents the management’s consciousness of the share price and is rated highly.

Company’s position in the IT industry

(Source) Company material

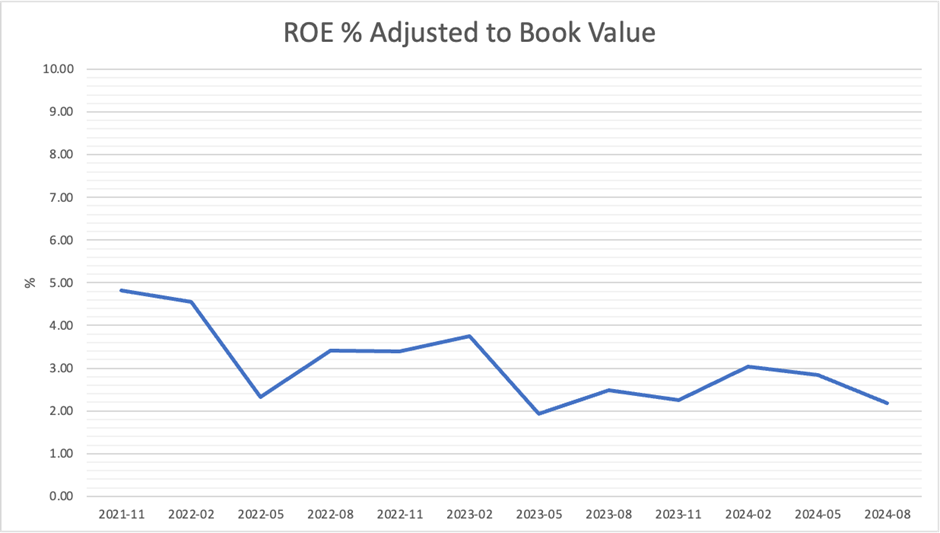

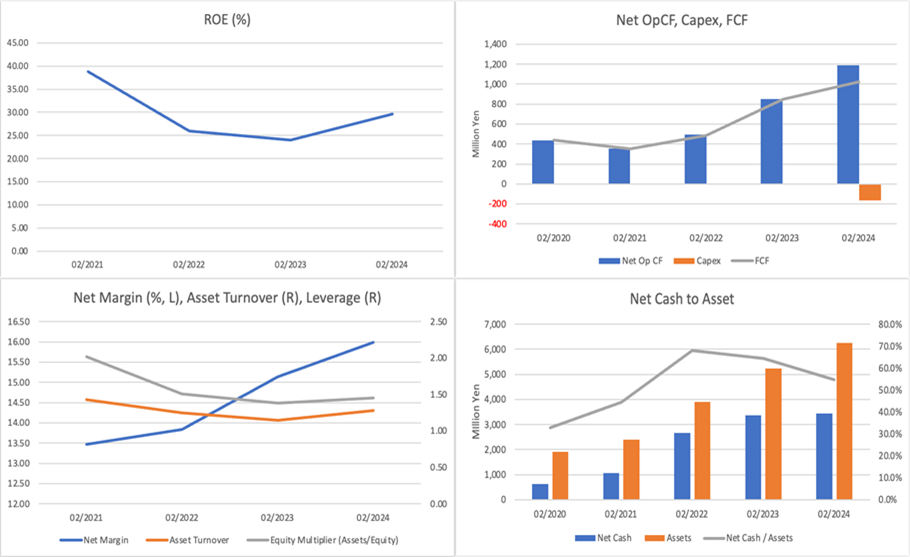

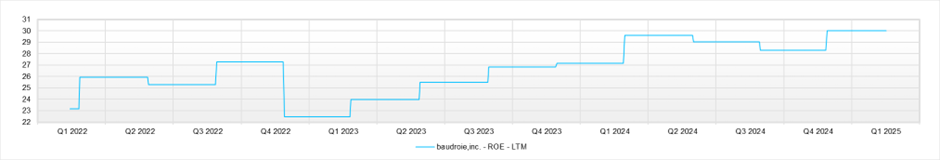

The company’s shares are priced at very high valuations. The equity yield of the stock, adjusted for ROE and PBR, is less than 3% and is not very attractive. The ratio of net cash to market capitalisation is not particularly high, and the forecast PER after adjusting for net cash is just over 40 times. Moreover, it is difficult to forecast the company’s long-term.

Nevertheless, the company has succeeded in the IT boom, and it is hard to imagine that its growth will soon reach saturation. The company’s cash is rapidly increasing, and investors are naturally very interested in how the company will balance expansion and return on capital. In response, the management team has chosen to expand, which is encouraging.

The adoption of IFRS during this period has led to the lump-sum recording of goodwill, and assets have increased significantly. Nevertheless, the company’s current net cash equals 38% of its assets, which weighs on its ROE. The company is likely to continue accumulating cash by generating superior cash flows. On the other hand, its ROIC still far exceeds its WACC. The management team is at a crossroads in balancing top-line growth and return on capital, and while they say they will likely increase retained earnings in the short term, it is likely to invest its cash in growth and take proactive measures.

From an investor’s perspective, the IT industry is in the midst of a boom. Still, competition is so fierce that pursuing the speed of top-line growth while sacrificing some of the high asset profit margins is a desirable strategy for expanding market capitalization and maintaining high valuations. The management team remains keen on M&A, having carried out four since 2022. The company is making significant progress in acquiring highly specialised human resources. Concerning profit margins, it is estimated that the expansion of enterprise and advanced technology customers has a positive effect. We recommend that investors include this stock in portfolio when the share price dips.

Price

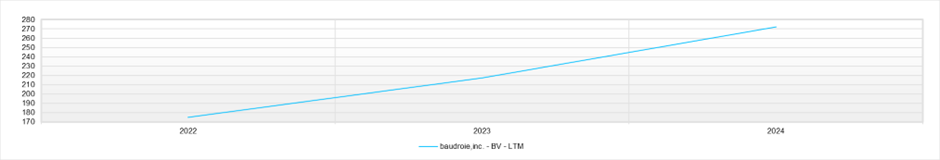

PBR (LTM)

PER (LTM)

ROE (LTM)

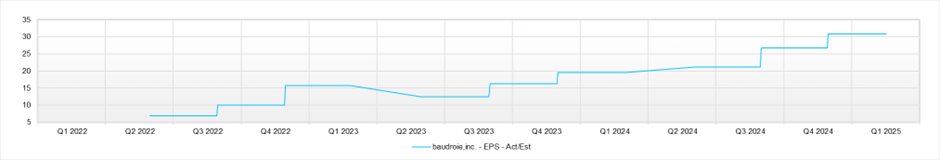

EPS (LTM)

BPS (LTM)