Sinfonia Technology (Price Discovery)

Cautious Trading Buy

Profile

Sinfonia Technology Co., Ltd. is a comprehensive machinery manufacturer founded in 1917. The company operates in four business segments: Motion Equipment, Power Electronics Equipment, Clean Transport Systems, and Engineering & Services. It provides products and services across various industries, including industrial machinery, energy, semiconductors, and aerospace, demonstrating strong competitiveness, particularly in clean transport systems, semiconductor transportation, aerospace, and control equipment. The company also engages in solar panel installation, equipment construction, mechanical equipment construction, and engineering services for electrical machinery and in-hospital transport systems. Formerly part of the Kobe Steel Group, Sinfonia is now independent.

Sales by business segment % (OPM%): Motion Equipment 36 (9), Power Electronics Equipment 23 (6), Clean Transport Systems 21 (15), Engineering & Services 20 (8) [Overseas] 27 <FY3/2024>

| Securities Code |

| TYO:6507 |

| Market Capitalization |

| 188,267 million yen |

| Industry |

| Electronic equipment |

Stock Hunter’s View

Benefiting from increased defence spending. The semiconductor-related business is showing signs of recovery.

Sinfonia Technology leverages its proprietary motion and energy control technologies to offer products across various industries. In the aerospace sector, it is the only domestic power system manufacturer capable of providing a full suite of electrical components from power generation to distribution. The company is also the market leader in Japan’s electrical equipment for defense aircraft. Recently, it has gained attention as a “hidden defense-related” stock.

For FY3/2025, Sinfonia is expected to achieve record-high results, with sales of 116 billion yen (up 13.0% YoY) and an operating profit of 14.5 billion yen (up 44.8%). The latest 3Q (April to December) financial results show an operating profit of 8.725 billion yen, an impressive 88.3% YoY increase, demonstrating steady earnings progress.

Among its business segments, the aerospace-related equipment division stands out, with order volume surging by 77% YoY, driven by increased demand for electrical components for the Ministry of Defense. This growth momentum is expected to continue, supported by the expanding defense budget. Additionally, the Clean Transport Systems business saw a 35.9% increase in orders, as demand for semiconductor manufacturing equipment gradually recovers. While the company anticipates a full recovery by 2026, the robust demand from the generative AI sector suggests that recovery might arrive earlier than expected.

Investor’s View

Playing the space, defence, and semiconductor sectors, Sinfonia Technology enjoys steady earnings and attracts market attention. However, considering the sharp rise in its stock price, a cautious approach to trading is recommended.

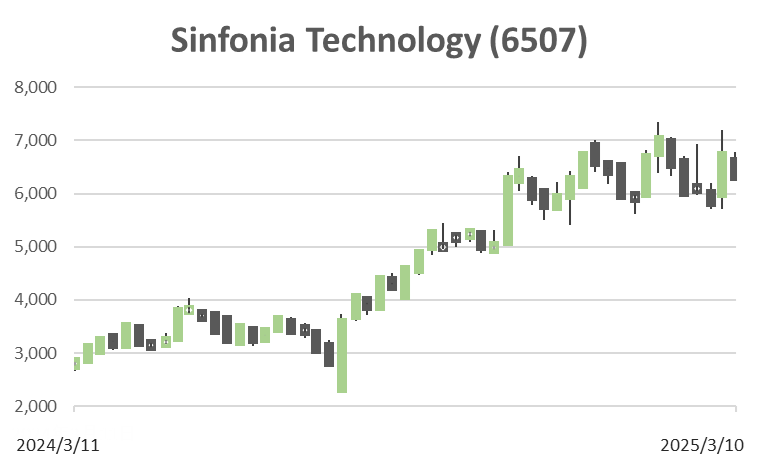

Since the end of 2023, Sinfonia Technology’s share price has surged more than threefold. The primary drivers behind this remarkable rally include the upward revision of its earnings forecast in November 2023, the announcement of a management policy focused on capital cost and share price awareness, and the company’s strong performance across the thematic space, defence, and semiconductor sectors. These factors combined to attract market attention, leading to a significant uplift in the share price. At the end of 2023, the share’s earnings yield was reassuring at 15-20%, offering an attractive entry for investors.

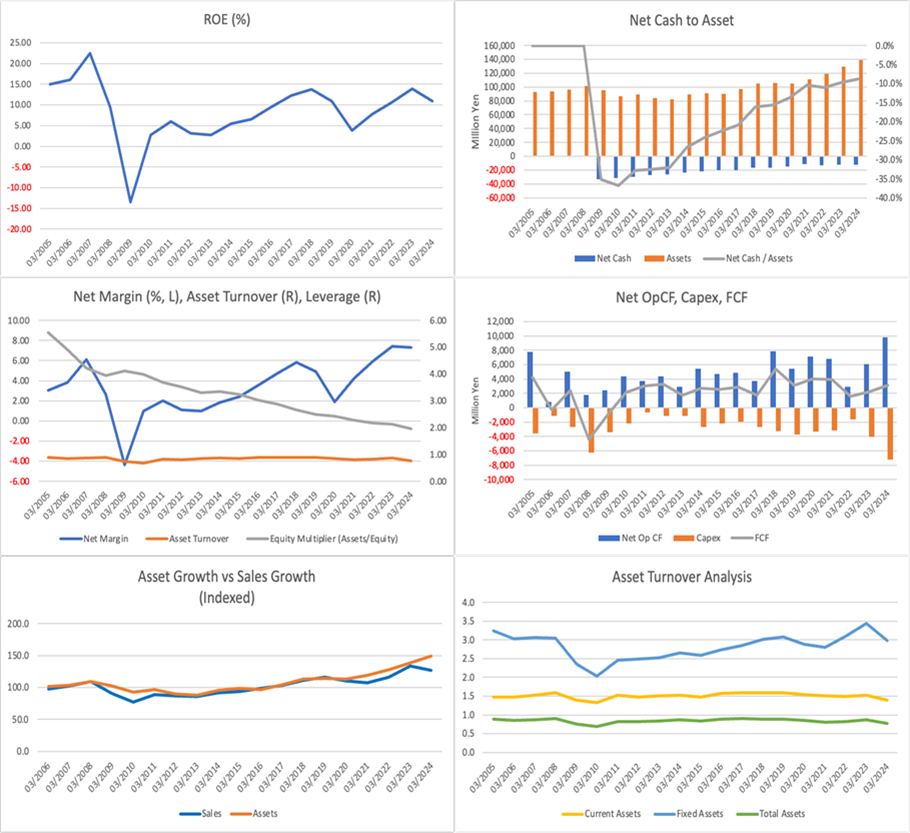

The management team has laid out a comprehensive strategy to enhance corporate value through a range of initiatives. These include stabilising ROE, improving profit margins, pursuing aggressive expansion investments and operational efficiencies, generating cash flow for shareholder returns, strengthening investor relations (IR), and revising and concretising long-term goals towards 2030. While these initiatives are broad and well-thought-out, they are not particularly groundbreaking in the current Japanese equity market. The announcement essentially marks the starting point, merely signalling the management’s intent rather than delivering tangible results. How these initiatives translate into the share price depends on the management’s future efforts and actual outcomes. There is no specific expectation on this front, reflecting a wait-and-see approach.

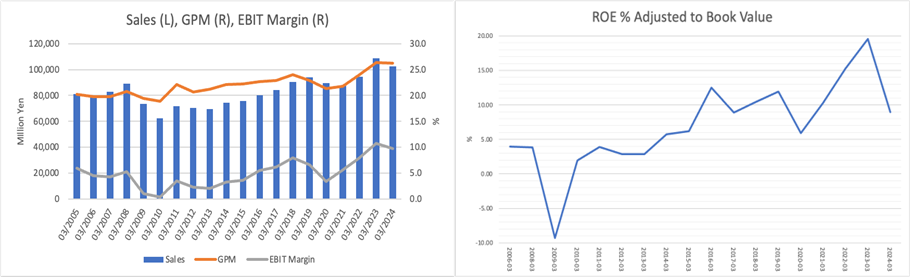

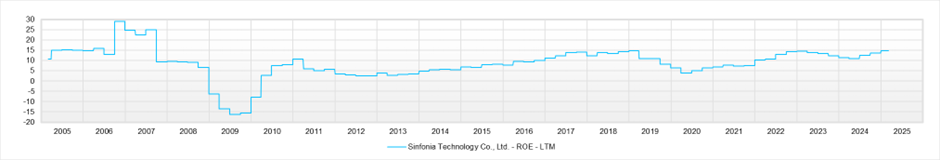

From long-term performance records, the company’s business appears reasonably good; however, the predictability of medium- to long-term earnings remains low. ROE has fluctuated within a range of 5-15% over the past 15 years, primarily driven by changes in net profit margins. The business model seems to rely heavily on individual projects, making its sales and profits difficult for outsiders to forecast accurately.

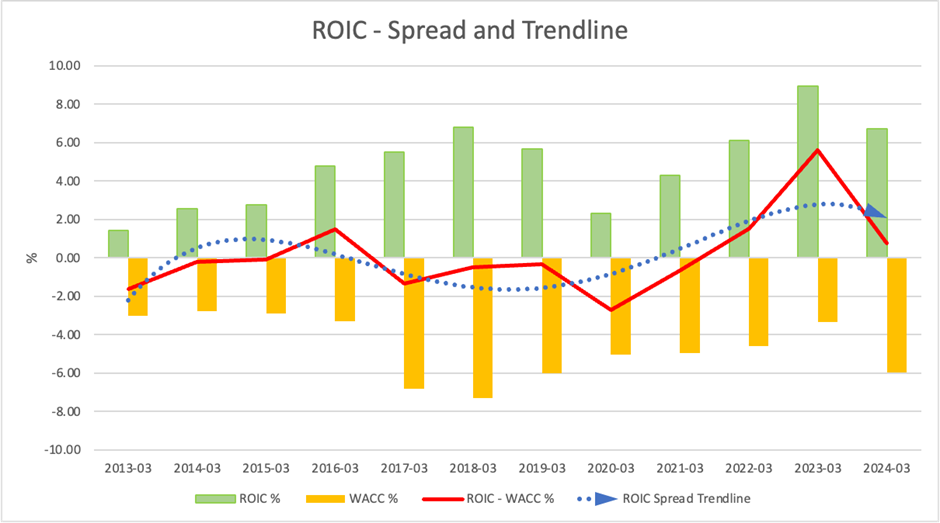

With renewed interest in defence-related stocks, there may still be room for Sinfonia Technology’s shares to attract short-term buying, particularly given the strong momentum in its recent earnings. However, a cautious approach to short-term trading is recommended, considering the previous sharp rise in its share price, the earnings yield below 10%, and the relatively insufficient ROIC to generate solid economic value.

It should also be noted that analysts have recognised Sinfonia Technology as a defence-related stock since last year. Contrary to Stock Hunter’s assertion, it is not a “hidden” defence stock.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)