Prestige International Inc. (Price Discovery)

Buy

Profile

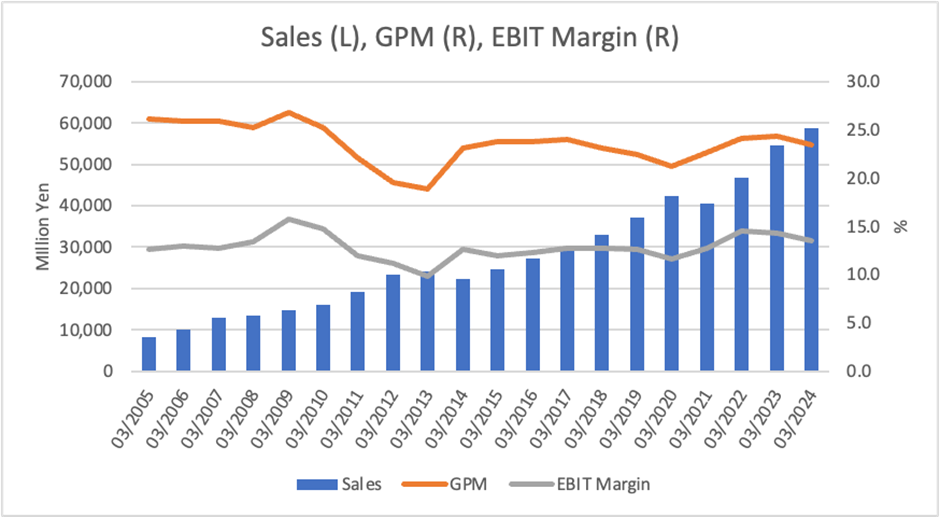

Prestige International, Inc. is a business process outsourcing (BPO) company specialising in call centre-based services, with particular strength in the automotive and property management sectors. Its core Automotive Assistance business provides roadside assistance and accident response services, while its Property Assistance division supports real estate management. The company also operates Global BPO services, Customer Support, Financial Guarantee, and IT & Social Services. Leveraging its 24-hour operational infrastructure and industry expertise, Prestige International enhances corporate efficiency and customer service capabilities for clients worldwide. Revenue composition by segment (%): Automotive 43, Property 12, Global 14, Customer 14, Financial Guarantee 15, IT 1, Social 1 [Overseas] 7 <FY3/2024>

| Securities Code |

| TYO:4290 |

| Market Capitalization |

| 89,301 million yen |

| Industry |

| Service |

Stock Hunter’s View

The near-term negative stock price catalysts are out, and a return to double-digit profit growth is anticipated.

Prestige International, Inc. is expected to achieve a double-digit profit growth trajectory from FY3/2026. The company provides business process outsourcing (BPO) services across seven segments: Automotive, Property, Global, Customer, Financial Guarantee, IT, and Social. Its one-stop service model integrates contact centre operations with on-site support and is a key differentiator from competitors.

For FY3/2025, profit growth is expected to be temporarily subdued due to higher costs associated with wage structure revisions, including base salary increases, improvements in the compensation system, and the winding down of vaccine-related operations. The full-year operating profit is projected to remain flat, increasing by just 1% YoY. However, for the third quarter (April–December), excluding vaccine-related operations, revenue grew by 12.3% and operating profit by 15.2%, indicating strong performance across key business segments.

In the Automotive segment, profitability has been sustained through fee structure revisions and cost control measures, such as curbing outsourcing expenses, which offset rising costs from workforce expansion and training investments. Meanwhile, in the Financial Guarantee segment, subsidiary Entrust Inc. (TSE: 7191) has seen strong performance in its rental debt guarantee business, driven by **steady growth in new contracts and renewals.

Investor’s View

BUY. Despite operating an outstanding business, the company’s share price issue is its misaligned balance sheet. The management team is committed to implementing fundamental reforms in this area, which is expected to impact the stock price over the medium to long term.

The company has successfully built a business portfolio that captures market demand well, demonstrating sustained revenue growth over an extended period. This consistency is highly commendable. Additionally, its net profit margin remains high and stable.

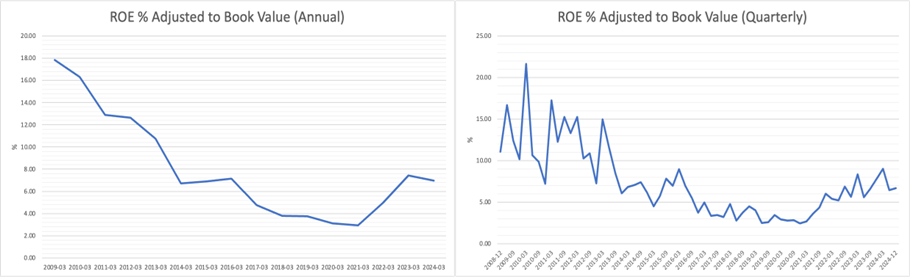

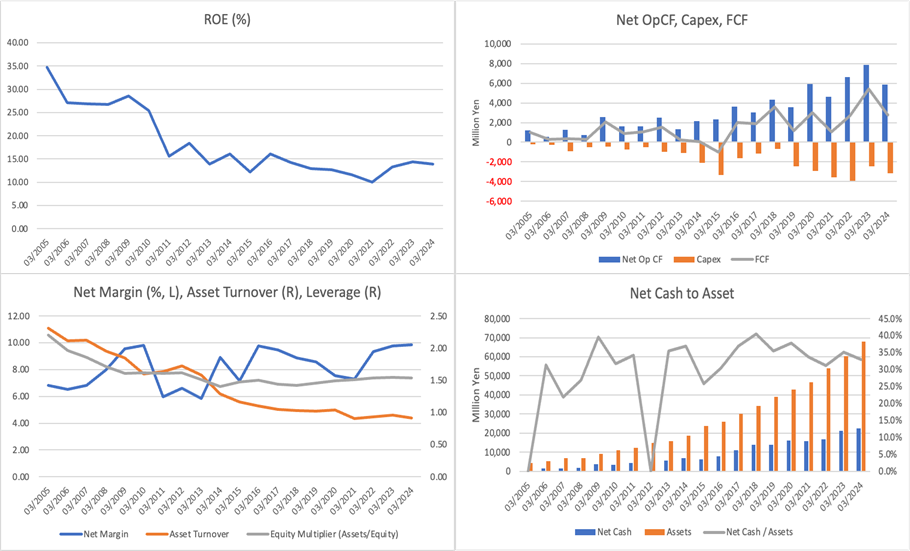

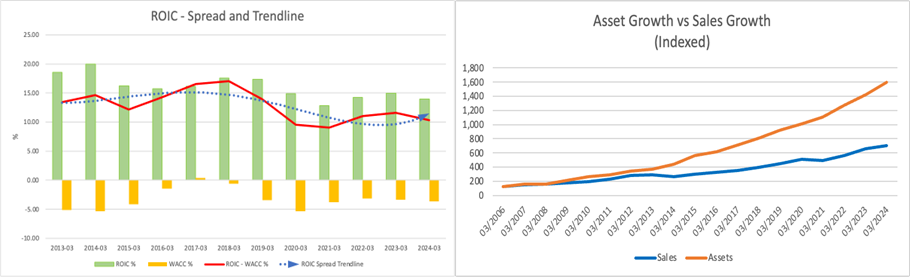

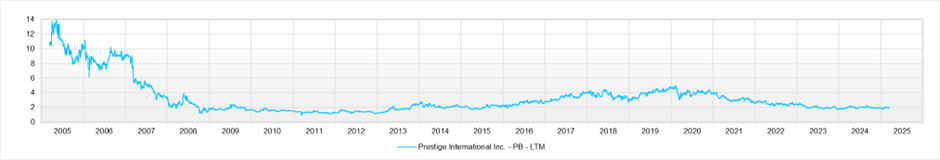

Following a period of market enthusiasm between 2017 and 2021, the stock’s valuation premium has adjusted. Over the past few years, its valuation has stabilised around 15 times in PER and approximately 2 times in PBR. This implies that the market perceives the company’s underlying ROE as around 13%. Meanwhile, the current equity yield has rebounded to over 6%.

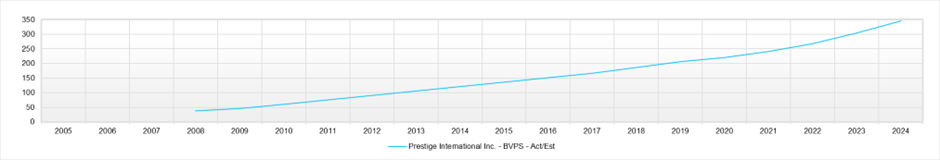

A breakdown of ROE reveals that the net profit margin remains stable within the 8-10% range, and financial leverage has gradually improved. However, the decline in asset turnover has had a significant impact, suggesting a somewhat negative momentum for ROE in its current state. Cash accumulation is the primary driver behind the decline in asset turnover, leading to an equity ratio of 65%, which is excessive from an equity investor’s perspective.

In response, management has identified a fundamental restructuring of the financial framework as a key initiative in its medium-term plan. The execution of this plan is likely to drive the share price. The proposed measures are well within the company’s capabilities, making us want to rate the shares favourably. While the ROE target may appear somewhat conservative, the anticipated improvement in momentum and the increase in economic value creation are expected to contribute positively to the share price over the medium to long term. Furthermore, with a beta of 0.57, the company benefits from a low WACC, providing an advantage in terms of economic value creation.

The key initiatives are summarised as follows:

1. Enhancing Capital Efficiency

The company aims to optimise the balance between equity and interest-bearing debt by reducing its equity ratio from 64.9% to the 50% range, thereby implementing a more capital-cost-conscious management approach. It has set targets of 15.0% for return on invested capital (ROIC) and 13.9% for ROE while maintaining a WACC of 5.1% to ensure an optimal allocation of capital. Over the next three years, it plans to invest approximately JPY 12 billion, targeting JPY 75 billion in revenue and JPY 10 billion in operating profit. The company will prioritise free cash flow generation, balancing growth investments with shareholder returns.

2. Strengthening Shareholder Returns

The company will revise its dividend policy, increasing the dividend payout ratio from approximately 30% to around 60% by the second year, with an ultimate goal of achieving a total shareholder return ratio of over 70% by the final year. It intends to raise dividend payments in line with earnings growth incrementally. In addition, considering market conditions, it will conduct share buybacks with an upper limit of JPY 3 billion. Combining dividends and share repurchases, the company will execute a total shareholder return programme worth JPY 13 billion. Increasing the amount of shareholder returns will prevent excessive capital accumulation, promote efficient capital utilisation, and maximise shareholder value.

3. Enhancing Stock Value

The company seeks to improve ROE by increasing profit through business expansion and enhancing capital efficiency. It will constrain excessive capital accumulation while increasing shareholder returns to optimise capital structure and drive corporate value growth. Furthermore, by maintaining a capital-cost-conscious approach to management, the company aims to improve investor perception, ensuring that its strengthened shareholder return strategy and growth initiatives contribute to sustained long-term stock value appreciation.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

BPS (LTM)