SBI Sumishin Net Bank (Price Discovery)

Buy

Profile

SBI Sumishin Net Bank is a leading Internet-only bank that began operations in 2007. Its core business is mortgage lending, but in recent years, it has also expanded into investment property loans and Banking-as-a-Service (BaaS). The bank offers advanced services through mobile applications, artificial intelligence, and biometric authentication technologies. It has formed strategic partnerships with major corporations such as Japan Airlines and Yamada Holdings. Its principal shareholders are Sumitomo Mitsui Trust Bank and SBI Holdings.

| Securities Code |

| TYO:7163 |

| Market Capitalization |

| 459,921 million yen |

| Industry |

| Banking |

Stock Hunter’s View

The mortgage business is thriving. Higher interest rates provide further tailwinds.

SBI Sumishin Net Bank was established in 2006 as a joint venture between Sumitomo Mitsui Trust Bank and SBI Holdings. It ranks among Japan’s most prominent Internet banks in terms of deposit volume and loan balance. It is also a pioneer of the BaaS (Banking-as-a-Service) model, which provides banking infrastructure to corporate partners.

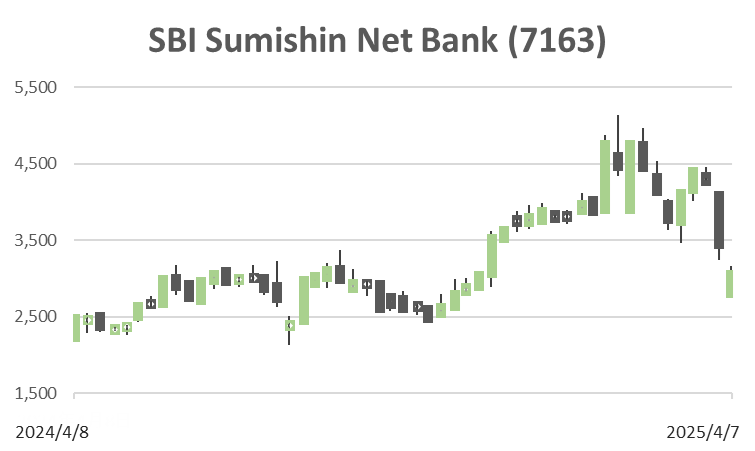

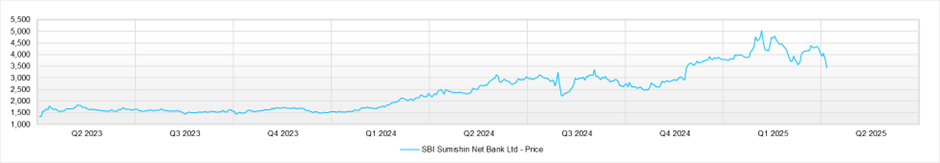

Following its IPO in March 2023—the first by a Japanese internet bank—the company has garnered notable market recognition, supported by its solid earnings trajectory. The current share price is trading more than three times its listing price.

In its most recent earnings announcement for the third quarter of FY March 2025 (April–December 2024), the company reported ordinary revenue of 103.598 billion yen (+21.4% YoY) and ordinary profit of 26.725 billion yen (+6.5% YoY), reflecting strong top- and bottom-line growth. Deposit balances, including yen savings and SBI Hybrid Deposits, have steadily increased, surpassing the 10 trillion yen mark for the first time since the bank’s inception.

The rapidly expanding NEOBANK BaaS platform has played a central role in driving growth, and mortgage execution volumes are steadily progressing toward the 2 trillion yen milestone. In the fourth quarter, the uplift from higher lending rates on existing mortgage assets (+0.25%) is expected to contribute to earnings, and further interest rate hikes could drive additional profit growth. Some observers anticipate the Bank of Japan’s next rate hike may occur on 1 May.

Investor’s View

Amidst a sharp risk-off shift and a steep drop in interest rates, the company’s share price has experienced a notable pullback. Nevertheless, its earnings remain robust, and its growth narrative is well-defined. The current share price could represent an excellent buying opportunity for those optimistic that recession fears will abate.

SBI Sumishin Net Bank continues to achieve high growth, with mortgages and BaaS functioning as its twin engines. As a digital bank, it differentiates itself by integrating AI and biometric authentication technologies. Its leadership in digital banking and the BaaS model is commendable, and it continues to expand earnings steadily. Further growth in mortgage lending, asset-building loans, and new revenue streams via the NEOBANK platform is anticipated, suggesting strong medium- to long-term prospects.

Business Overview

The company is an internet-only bank jointly owned by Sumitomo Mitsui Trust Bank and SBI Holdings. It launched operations in 2007 and offers financial services primarily through non-face-to-face channels such as mobile applications. Its primary revenue sources are mortgage loans and the corporate-facing BaaS segment.

Its three core businesses are:

- Digital Bank Business: Provides online services, including mortgage loans, cards, payments, and deposits.

- BaaS Business: Offers banking functions (accounts, lending, payments) to corporate partners, including Japan Airlines, under the NEOBANK brand.

- THEMIX Business: Expands into non-financial domains such as financial data utilisation, digital transformation in forestry, and carbon credit support.

Financial Performance

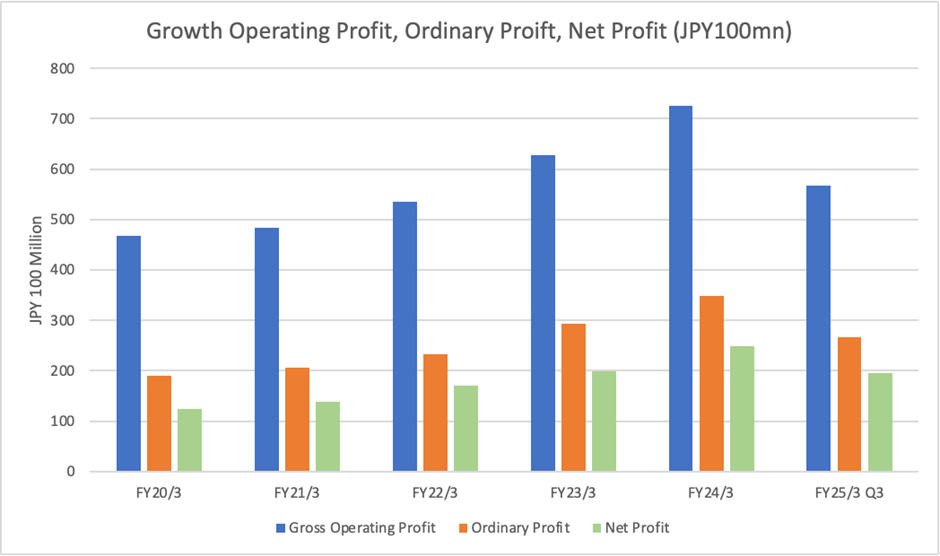

Over the past five years, total assets have grown from 6.3737 trillion yen (FY3/2000) to 11.5631 trillion yen (December 2024). Both loans and deposits have more than doubled, and the mortgage portfolio has reached 7.7088 trillion yen. Net profit has risen from 12.5 billion yen (FY3/2000) to 24.8 billion yen (FY3/2024), demonstrating consistent expansion.

Latest Earnings

In the nine months ended December 2024 (FY3/2025 Q3), the company achieved ordinary revenue of 103.5 billion yen (+21.4% YoY), ordinary profit of 26.7 billion yen (+6.5%), and net profit of 19.5 billion yen (+7.0%), all representing year-on-year growth. The BaaS business saw a sharp rise in gross operating profit, up +48.3% YoY to 9.2 billion yen, driven by the NEOBANK platform.

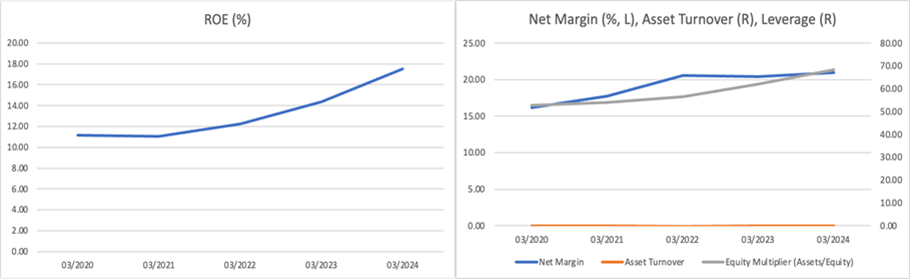

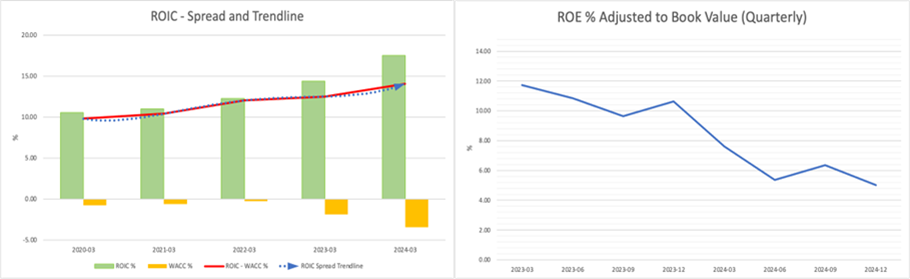

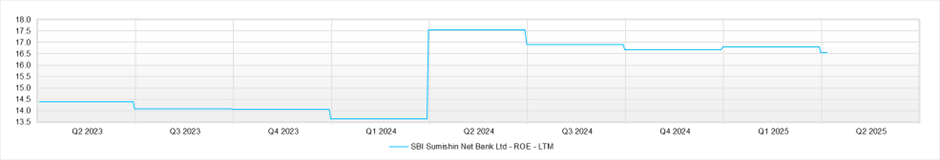

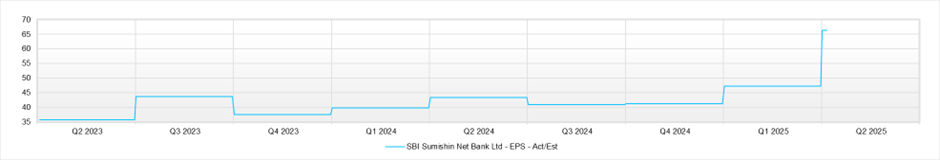

For the full year, net profit attributable to owner of parent is forecast at 28.0 billion yen (+12.7% YoY), with a progress rate exceeding 70%. Growth in mortgage and asset-building loans, coupled with BaaS expansion, suggests the company is on track to meet this forecast. ROE remains high with a positive trend.

Growth Strategy and Risks

Key growth drivers include:

- Mortgage Loans: Supported by rapid expansion via NEOBANK channels (+145.2% YoY).

- BaaS Business: Partner count has increased to 21, with revenues growing approximately 2.4x YoY.

- Asset-Building Loans: Cumulative execution volume has reached 139.4 billion yen, establishing a new revenue pillar.

Under its mid-term management plan, the company targets an ordinary profit of over 40 billion yen, a net profit of over 28 billion yen, and more than 9 million accounts for FY3/2025. It aims to execute 2 trillion yen in mortgage loans and expand its BaaS partner base to over 20 firms.

Naturally, attention must be paid to risks such as rising funding costs in a higher interest rate environment, intensifying competition, and counterparty credit risks among BaaS partners.

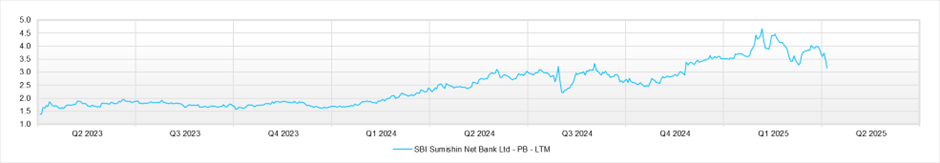

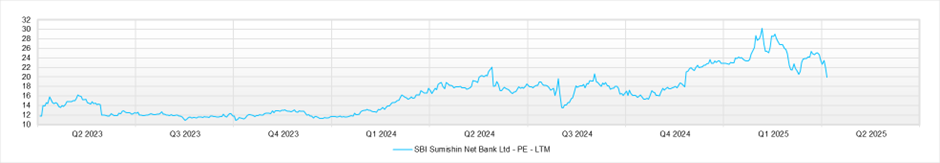

Valuation and Share Price

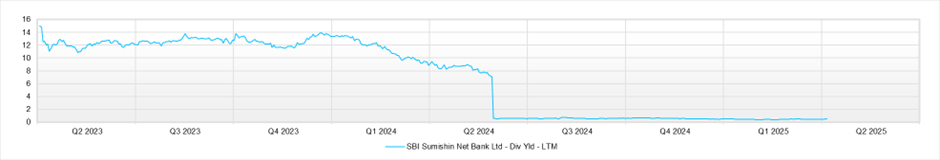

Valuation had been on an upward trend, driven by steady earnings growth and the appeal of the company’s unique business model. However, since early February this year, it has gradually declined, easing the sense of overheating. The recent share price drop has further compressed valuations. Nevertheless, ROIC remains high, enabling the company to generate substantial economic value.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)