JSB (Price Discovery)

Buy

Profile

JSB operates a nationwide real estate rental management business centred on student housing, supported by a stable revenue model based on master lease arrangements.

JSB Co., Ltd. is a real estate rental management company engaged in the planning, development, and operation of rental apartments primarily for students. Under its leading brand “UniLife,” the company operates in major cities across Japan, with a particular strength in supplying properties tailored to demand in areas surrounding universities.

Its property management model comprises three formats: (1) master lease, (2) property management on commission, and (3) company-owned properties. As of FY10/2024, the respective composition ratios were 57.0% for master lease, 36.4% for commissioned management, and 6.6% for company-owned properties. Notably, the master lease model is based on long-term contracts in which the company leases entire buildings from owners and subleases them to tenants, primarily students, under rent-guaranteed agreements—a stable business model.

In FY10/2024, 98% of consolidated revenue was derived from the real estate rental management business, with the remaining 2% from other operations, indicating the company’s clear strategic focus.

| Securities Code |

| TYO:3480 |

| Market Capitalization |

| 85,087 million yen |

| Industry |

| Real Estate |

Stock Hunter’s View

JSB operates a nationwide real estate rental management business centred on student housing, supported by a stable revenue model based on master lease arrangements.

JSB Co., Ltd. is a real estate rental management company engaged in the planning, development, and operation of rental apartments primarily for students. Under its leading brand “UniLife,” the company operates in major cities across Japan, with a particular strength in supplying properties tailored to demand in areas surrounding universities.

Its property management model comprises three formats: (1) master lease, (2) property management on commission, and (3) company-owned properties. As of FY10/2024, the respective composition ratios were 57.0% for master lease, 36.4% for commissioned management, and 6.6% for company-owned properties. Notably, the master lease model is based on long-term contracts in which the company leases entire buildings from owners and subleases them to tenants, primarily students, under rent-guaranteed agreements—a stable business model.

In FY10/2024, 98% of consolidated revenue was derived from the real estate rental management business, with the remaining 2% from other operations, indicating the company’s clear strategic focus.

Investor’s View

High growth in student housing. Robust earnings underpinned by steady expansion in managed units and near-full occupancy.

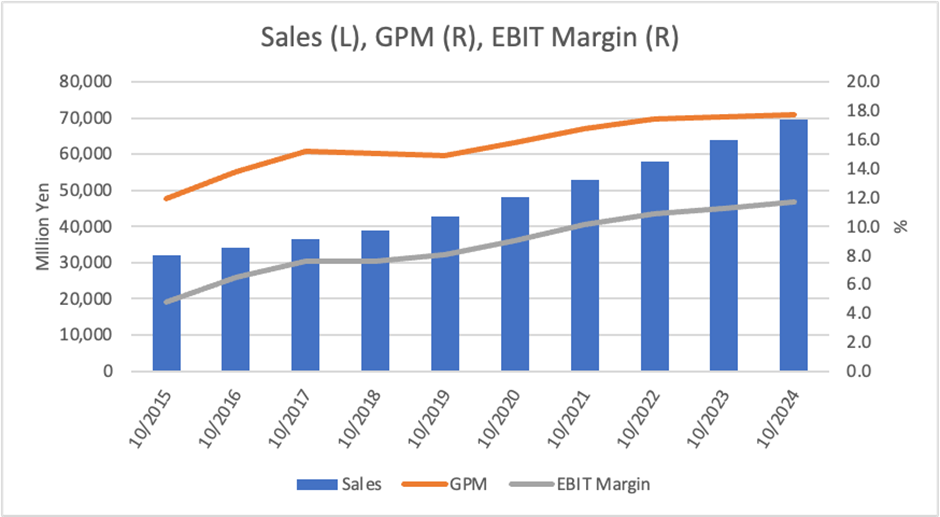

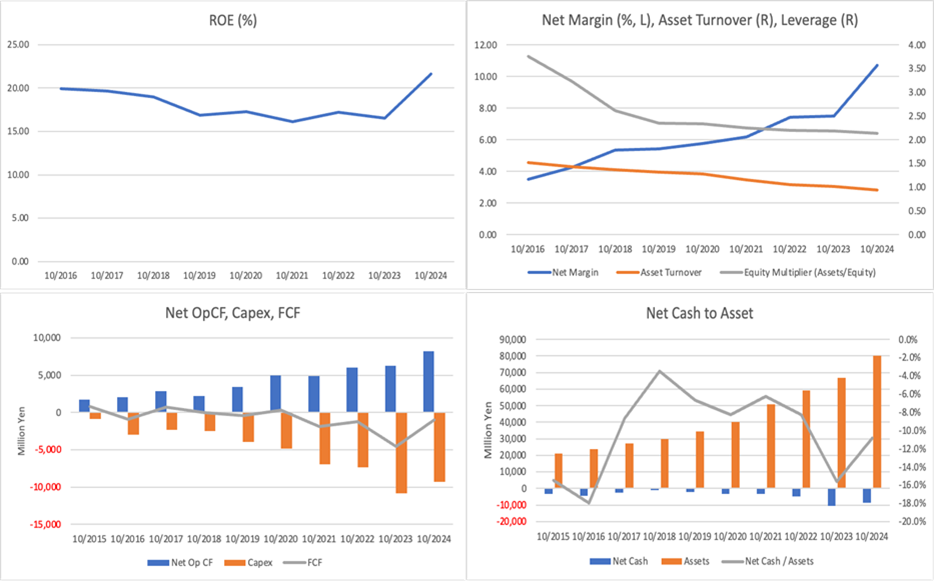

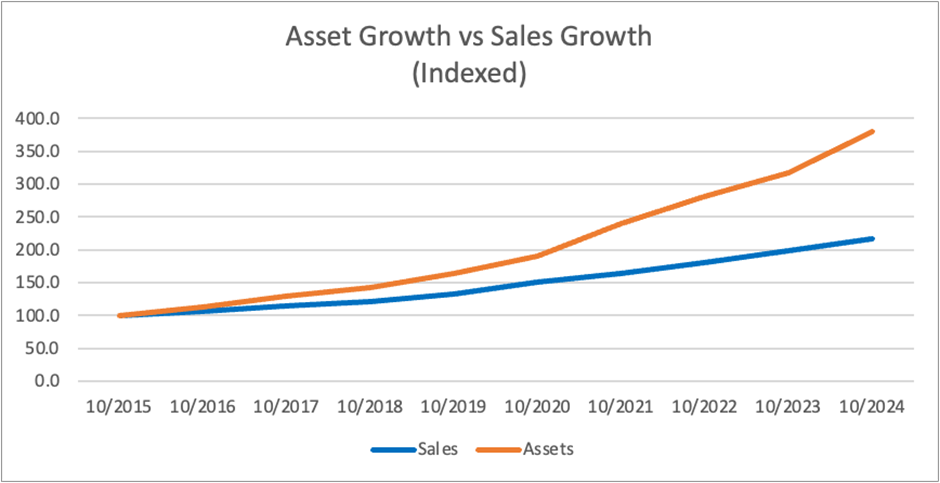

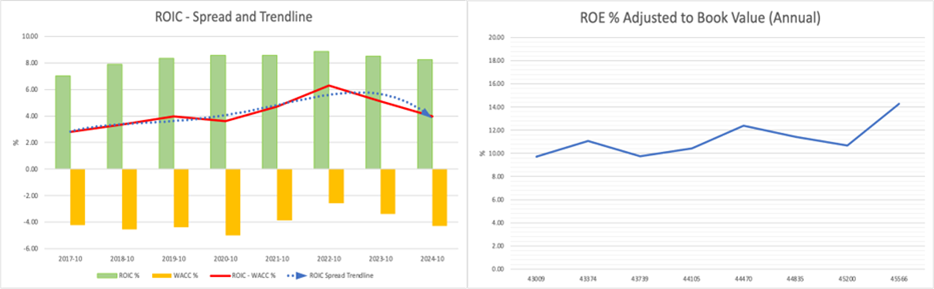

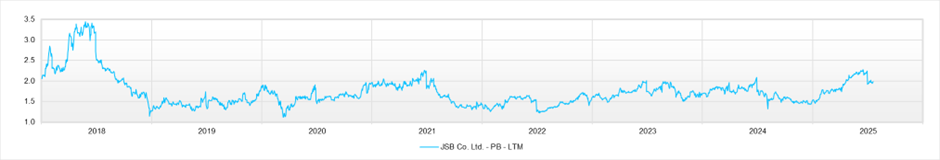

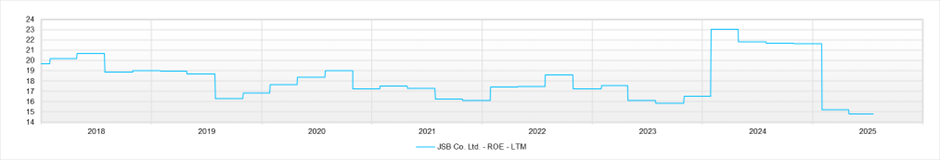

JSB is a company that has steadily achieved both topline growth and high capital efficiency. Notably, the company’s return on equity (ROE) has remained strong, primarily driven by a structural improvement in profit margins. Although business expansion has led to an increase in the size of the balance sheet and a gradual decline in financial leverage, the improvement in profit margins has more than offset these effects, enabling the company to sustain a high ROE.

Its business targets the student apartment market, a niche segment characterised by high customer stickiness. High occupancy rates, long-term lease contracts, and continued growth in the number of managed units have together underpinned a robust cash flow. Furthermore, nearly all of this cash flow is reinvested in development, resulting in a capital cycle that is favourable from a shareholder perspective.

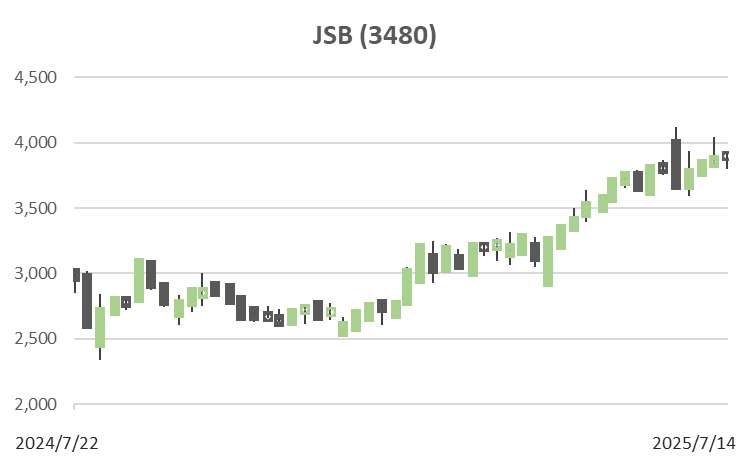

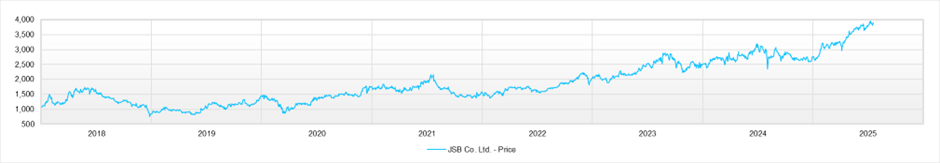

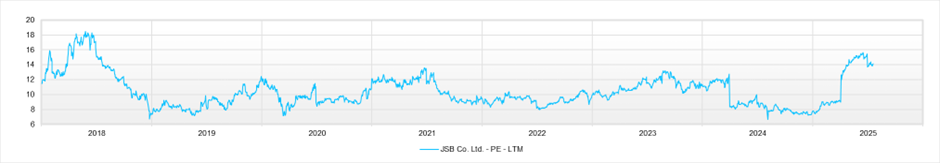

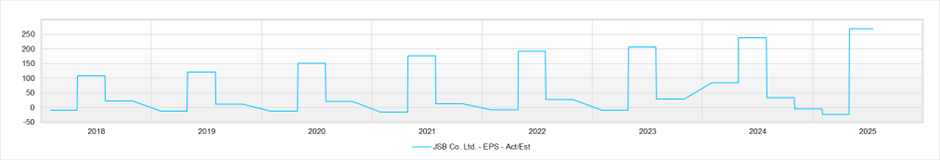

The forecast ROE for FY10/2025 is approximately 15%. Based on this, the implied earnings growth rate embedded in the current share price is estimated to be around 4–5% annually. However, the company has achieved a compound annual growth rate (CAGR) of +26% in net profit over the past five years. Considering this historical performance and the currently favourable operating results, the market’s valuation appears to be somewhat overly cautious.

Business Performance and Earnings Structure

Supported by stable growth in the number of managed units and a high occupancy rate, topline performance remained solid, while profit levels were maintained despite absorbing one-off costs.

In the second quarter of FY10/2025 (first half), JSB recorded consolidated revenue of 42.3 billion yen (+10.0% YoY) and operating profit of 7.93 billion yen (+11.4% YoY), achieving steady growth in both revenue and earnings. The company’s core student apartment business is subject to seasonal demand, with a peak period concentrated in March and April. Against this backdrop, the number of managed units increased by 4,322 year-on-year, reaching 99,300 units, with occupancy for master-leased and company-owned properties remaining exceptionally high at 99.9%.

The increase in revenue was primarily driven by growth in rental income and associated service revenue, exceeding the initial forecasts. On the cost side, expenses rose due to increased guaranteed rent payments associated with a greater number of master-leased properties, as well as higher property taxes and depreciation related to company-owned assets. In addition, rising personnel and food costs to ensure recruitment and retention impacted cost levels. Furthermore, one-off expenses such as bonuses aimed at boosting employee morale and costs related to special investigations were also recorded during the period.

Despite these cost pressures, both operating and ordinary profit exceeded the previous year’s levels, demonstrating the business’s stability and resilient profitability. However, net income attributable to owners of the parent decreased to 5.17 billion yen (–24.0% YoY), primarily due to the absence of the extraordinary gain from the sale of the subsidiary Gran Unilife Care Service that was recorded in the same period of the previous year.

On the financial side, total assets increased to 89.78 billion yen (+12.3% from the previous fiscal year-end), and net assets rose to 41.49 billion yen (+9.5%), maintaining an equity ratio of 46.2%. Operating cash flow remained strong at 7.09 billion yen. Despite active capital investments of 6.82 billion yen, the company secured end-of-period cash and equivalents of 18.92 billion yen, maintaining ample liquidity.

Although the company’s earnings are seasonally concentrated in the second quarter, progress thus far is proceeding at a favourable pace relative to the full-year earnings forecast of 75.5 billion yen in revenue, 8.51 billion yen in operating profit, and 5.48 billion yen in net income.

Progress and Assessment of the Medium-Term Management Plan “GT02”

Now in its second year, the medium-term plan, which balances “deepening” and “exploration,” has been revised upward in terms of its profit target. Steady progress is also being made in human capital, DX, and ESG initiatives.

Under its long-term vision “Grow Together 2030,” JSB is executing a three-year medium-term management plan titled “GT02 (Grow Together 02)” starting in 2023. The plan is built on two strategic pillars: “deepening,” which aims to enhance the competitiveness of existing businesses, and “exploration,” which focuses on creating new value. The strategy emphasises both revenue growth and capital efficiency.

As numerical targets, the company recorded an operating profit of 8.1 billion yen in FY10/2024 and has set a forecast of 8.51 billion yen for FY10/2025. This reflects the steady accumulation of managed units and solid profit generation supported by a high occupancy rate. The plan also highlights a commitment to continuously improving ROIC (Return on Invested Capital) and clearly states the company’s intention to prioritise investments that exceed its cost of capital.

On the non-financial front, the company is making proactive efforts in the areas of human capital management, digital transformation (DX), and Environmental, Social, and Governance (ESG) considerations. In terms of human capital, institutional reforms have been introduced to support employee development, including initiatives to strengthen recruitment and improve retention, the establishment of reskilling programmes in collaboration with universities, and the adoption of a job-based personnel system.

In its DX strategy, JSB is working to integrate legacy systems and automate property management operations to enhance efficiency. The company is also improving customer interfaces through the expansion of its UniLife app and the implementation of AI-powered chatbots. In the ESG domain, JSB is advancing its energy initiatives through the development of ZEB-compliant (Net Zero Energy Building) properties and the adoption of solar power generation and storage systems.

Overall, the company’s medium-term plan goes beyond mere scale expansion and includes reforms that contribute to the long-term enhancement of corporate value. Its execution capabilities and steady progress have been positively received. These initiatives also serve as a source of reassurance for investors, reinforcing confidence in the company’s ability to sustain mid-term ROE levels and growth potential.

Shareholder Structure

As of July 2025, the shareholder structure is characterised by stability, with a majority held by the founder’s family and related parties, and a gradual increase in foreign institutional ownership.

The largest shareholder is Ms. Yasuko Oka, a member of the founding family, who holds a 37.99% stake. Together with the executive team and related parties, these insider shareholders collectively control a majority stake in the company. Additionally, the company holds 3.32% of its shares as treasury shares, which further contributes to the stability of the shareholder base.

The second-largest shareholder is HIKARI TSUSHIN, INC., which holds 17.30% and has been steadily increasing its shareholding. Among foreign institutional investors, notable holders include Neuberger Berman East Asia Ltd. (5.24%), Norges Bank (2.23%), and The Vanguard Group (1.82%), reflecting growing attention from the global capital market.

Among domestic institutional investors, stakes are dispersed among firms such as Sumitomo Mitsui DS Asset Management (1.70%), Nomura Asset Management (1.35%), and Daiwa Asset Management (0.88%), though each holds only 1–2%, implying limited influence.

JSB directors and the company’s employee stock ownership plan also appear on the shareholder register, indicating a degree of alignment between management, employees, and shareholders in terms of incentives.

Overall, while the free float remains low and supply-demand conditions for the stock are somewhat tight, the shareholder base is structured around medium- to long-term holders, forming a stable foundation that supports the neutrality and sustainability of the company’s management.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

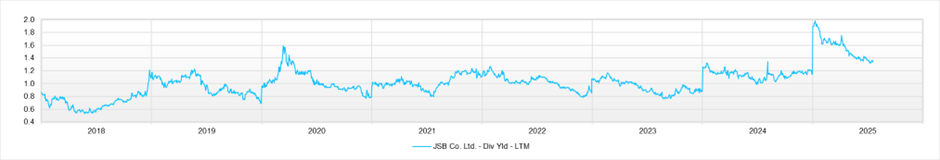

Dividend Yield (LTM)