Fujimi Incorporated (Price Discovery)

Cautious Watch

Conclusion

Fujimi Incorporated is a niche leader in advanced semiconductor-related products, with a world-leading share in FEOL CMP slurry, and benefits from the rising importance of planarisation processes in the era of 2nm-generation and beyond. In FY3/2026, record-high results for the full year are coming into view. On the other hand, as the company has entered a phase of large-scale investment, such as new plant construction, uncertainty has increased around the trends in ROIC and free cash flow. The medium- to long-term growth expectations inferred from valuation indicators are also almost flat, indicating that the market is shifting towards a cautious assessment of the company as a “high-quality but cyclical semiconductor peripheral materials” name. The current valuation is not sufficiently low to be definitively described as undervalued. For the time being, this is a phase in which it is necessary to observe whether the results of growth investments, alongside the start-up of mass production and facilities for 2nm and beyond, will be confirmed as a sustained improvement in capital efficiency and cash flow; we would therefore adopt a Cautious Watch investment stance.

Profile

A precision abrasive manufacturer with a world-leading share in polishing materials for semiconductor silicon wafers and CMP slurry for advanced semiconductor manufacturing.

Fujimi Incorporated is a dedicated abrasives manufacturer established in 1953 and headquartered in Kiyosu City, Aichi Prefecture. From slicing and lapping of silicon ingots to polishing of silicon wafers, CMP (chemical mechanical polishing) in semiconductor device manufacturing processes, polishing for hard disks, functional materials, and thermal spray materials, the company supplies powders and slurries for a wide range of precision polishing and surface-treatment applications. In FY3/2025, the composition of consolidated net sales was wafer lapping 13%, wafer polishing 22%, CMP 52%, hard disk 4%, other in-house products 9%, and the overseas sales ratio 78%, giving the company a business portfolio with a high dependence on semiconductor-related and overseas demand.

On the technology side, based on “filtration, classification and purification technologies”, “powder technologies” and “chemical technologies”, the company’s strength lies in its ability to control particle-size distribution, surface characteristics and slurry composition at the nano level. It has established a world-leading position in silicon wafer polishing materials and FEOL CMP slurry. Production and development bases are deployed globally, not only in Japan but also in the United States, Taiwan, Malaysia, China, and Europe. Through joint development with advanced logic and memory manufacturers, including TSMC, the company is working to expand its line-up of high-value-added products that respond to miniaturisation and 3D-structure needs in the 2nm generation and beyond. The company is listed on the Tokyo Stock Exchange Prime Market and the Nagoya Stock Exchange Premier Market, and maintaining a conservative financial base characterised by a high equity ratio and net cash is also a key element of the company’s profile.

| Securities Code |

| TYO:5384 |

| Market Capitalization |

| 195,200 million yen |

| Industry |

| Glass, clay, and stone products |

Stock Hunter’s View

Undervalued semiconductor-related name, the importance of polishing liquid increases with miniaturisation.

Fujimi Incorporated’s main products are polishing liquids called “CMP slurry”, which are used to planarize the surface of wafers in semiconductor manufacturing processes. Its market share in 2024 is around 15% overall, but it holds nearly 60% in transistor device formation (FEOL: the first process in the front-end). Its largest customer is TSMC (16% of net sales).

In the first half of FY3/2026, net sales were 33.4 billion yen (up 9% year on year) and operating profit was 6.4 billion yen (up 13% year on year), with net sales reaching a new record high for a half year. Although expenses increased due to growth investments such as higher headcount, double-digit profit growth was achieved thanks to higher sales of CMP products for advanced semiconductors and polishing materials for silicon wafers. At the same time as announcing first-half results, the company revised up its full-year forecast, raising operating profit from 12.1 billion yen to 13.0 billion yen (up 10.1% year on year), approaching the record-high profit of 13.2 billion yen in FY3/2023.

From 2026 to 2028, 2nm semiconductor plants will begin operations in succession. In semiconductor manufacturing at 2nm and beyond, the importance of planarisation processes is expected to increase, while the company’s CMP slurry growth pace is likely to accelerate. Although it is semiconductor-related, its current PER is in the 18x range, its PBR is around 2x, and its valuation is considered relatively cheap.

Investor’s View

Cautious Watch: While the company can be evaluated highly in terms of business quality and financial base as a niche leader in advanced semiconductor abrasives, uncertainty around the trends in ROIC and free cash flow has increased as it has entered a large-scale investment phase, and at present, it is difficult to recommend an aggressive buy. Until it is confirmed that the results of growth investments are leading to sustained improvement in capital efficiency and cash flow, a cautious stance toward the company, with a medium- to long-term perspective, is considered appropriate.

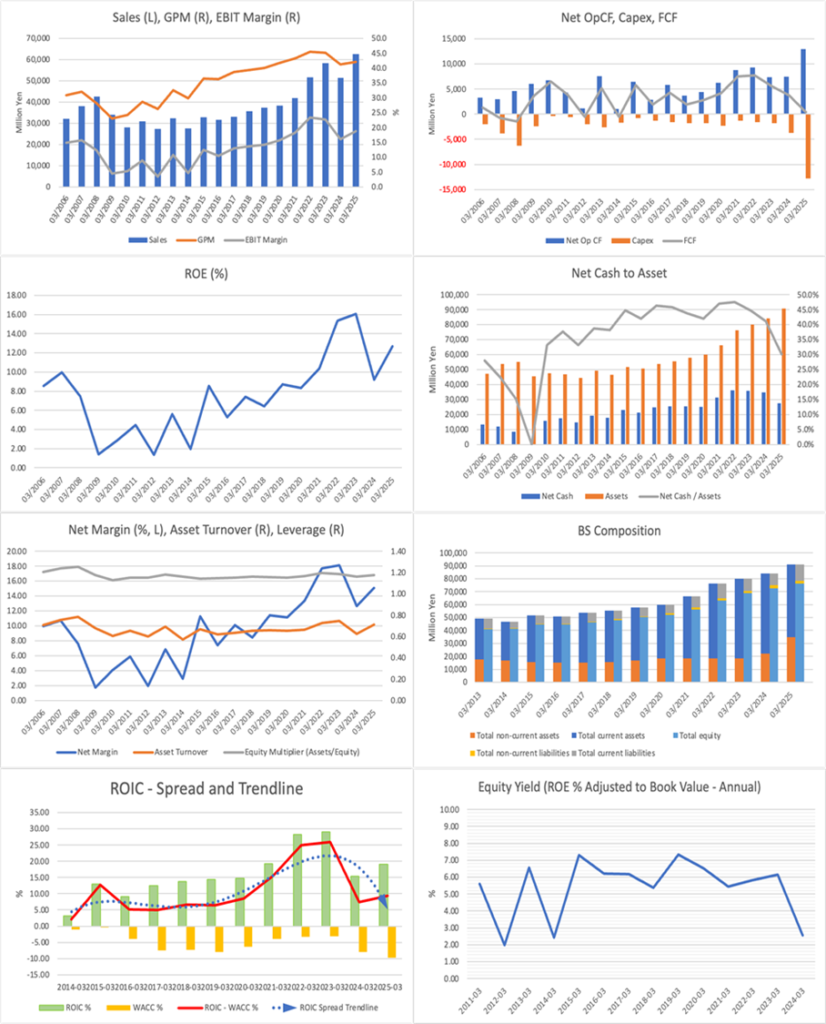

The company holds a world-leading share of the FEOL CMP slurry market. It is well-positioned to benefit from a structural tailwind, as the importance of planarisation processes increases as miniaturisation and 3D structuring advance in the 2nm generation and beyond. From the long-term trends in net sales and profit margins, it can be read that, against the backdrop of global economic growth and expanding semiconductor demand, the company has maintained high EBIT margins and double-digit ROE by leveraging economies of scale and technological superiority, and taking into account its relationships with advanced logic customers including TSMC, the quality of the business can be evaluated as being at a high level.

On the other hand, ROIC and margins had already reached high levels around 2023. At present, a sense that these indicators are peaking and that large-scale capital investments, such as new plant construction and capacity expansion, are beginning to materialize is causing free cash flow to swing deeply down. The net cash ratio that had been built up is also declining, and the mode is shifting from a defensive balance sheet backed by abundant net cash to a phase of waiting for investment recovery. Although the equity ratio remains high and financial risk is limited, investor focus is shifting from maintaining high profitability to securing ROIC and FCF under the burden of investment.

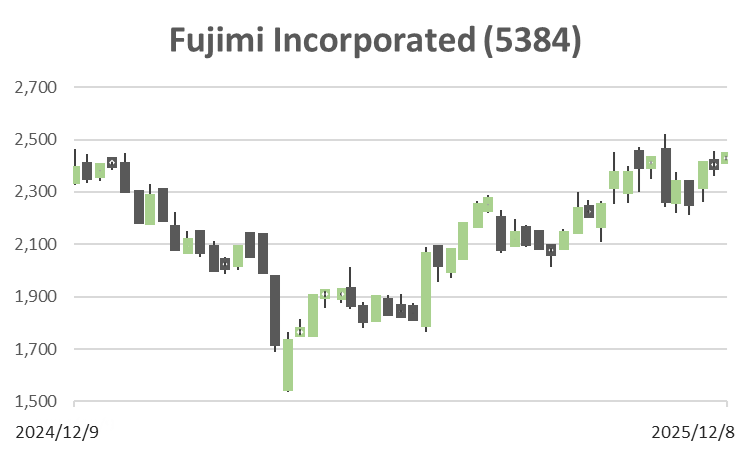

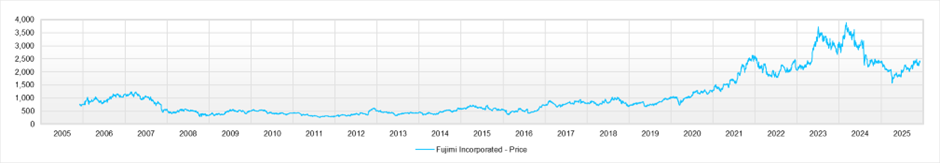

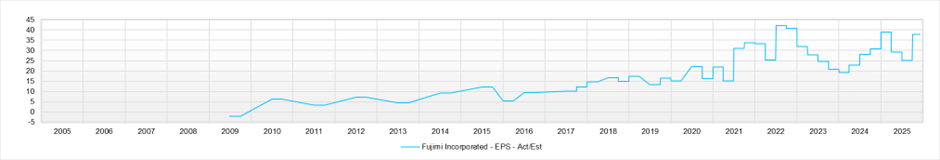

The growth expectations factored into the valuation indicators also reflect this mode shift. While the sustainably achievable EPS growth rate implied from the assumptions of a forecast PER of 20.5x, an actual PBR of 2.25x, a forecast ROE of 11.6%, a forecast EPS of 73.3 yen, and a forecast dividend of 74 yen is almost flat at +0.5% per year, the EPS CAGR over the past five years is +17%. Presumably, investors interpret the high growth of the past several years as a one-off with a significant cyclical drive and as beginning to reclassify the company not as a high-growth stock but as a semiconductor-related name that is high-quality but has a strong cyclical nature. The fact that the share price rose sharply in 2023, then entered a correction phase in 2024, and is underperforming TOPIX YTD can be explained by this revision in growth expectations and the derating that occurred as it entered an investment phase.

As for capital policy, in addition to its conservative financial structure with an equity ratio of over 70% and net cash, the company does not pursue a style of actively using leverage to push up ROE, so the drivers of ROE and EPS growth depend entirely on the development of the business itself and the maintenance and improvement of margins. This structure means that, while the risk to the business’s continuation is relatively small, it is also challenging to expect rapid shareholder value creation or a valuation re-rating using capital policy as a lever. Therefore, this is not a stock whose price should be chased at high levels to seek short-term capital gains; at present it should be placed on a watch list as a medium- to long-term candidate name, and this is a phase in which to assess whether the start of mass production at 2nm and beyond, the full-scale start-up of new plants and the expansion of CMP slurry share will lead to a renewed improvement in ROIC and free cash flow.

In light of the above, the current valuation has not reached a level that would warrant an undervalued rating, and it is also hard to say that growth expectations have been sufficiently revised. As an investment stance, until it is confirmed that the results of growth investments are leading to a sustained expansion of economic value creation, it is considered appropriate not to recommend buying and to maintain a Cautious Watch, carefully following trends in results, investment plans, ROIC, and free cash flow.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (Actual)

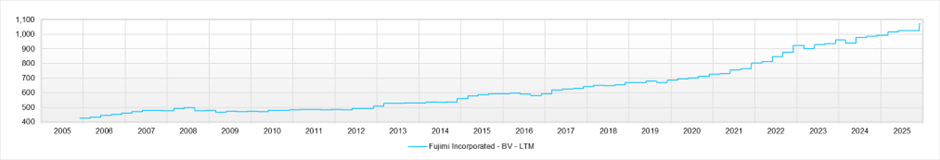

BPS (LTM)